-

The altcoin market cap rebounded to $920 billion, breaking out of a 9-month downtrend.

Analysts predicted continued growth, with SEI and other altcoins showing promising signs of further upside.

As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed numerous bull and bear cycles, and I must admit, this altcoin recovery has piqued my interest. The parallels between the current market conditions and those seen in 2016 are undeniable, and if history repeats itself, we could be on the brink of another altcoin rally.

Over the last several weeks, the altcoin market has shown remarkable strength by recovering after a substantial drop that occurred earlier in the month.

The total value of all altcoins (excluding Bitcoin) has rebounded after dipping below $800 billion, currently standing at approximately $920 billion as the latest figures show.

The bounce back in the market is fueling hope among investors, as numerous analysts express positive views about the prospect of altcoins moving forward.

Altcoins to mirror 2017 rally?

As a seasoned cryptocurrency investor, I can’t help but draw parallels between the current market climate and the one we experienced back in 2016, as pointed out by the esteemed analyst Moustache, who has a knack for deciphering trends on platforms like X (previously Twitter).

Moustache emphasized the Relative Strength Index (RSI) as a crucial sign, explaining that when the RSI line drops, it usually bounces back upward in due time.

He expressed confidence that altcoins could repeat the massive rallies seen in 2016 and 2017, albeit over a longer timeframe.

Later on, Moustache underscored the fact that altcoins have just burst free from a nine-month descending triangle, which is typically considered a positive sign indicating more upward momentum to come.

Moustache was not alone in his positive outlook. Another well-known analyst, Michael Van De Poppe, also shared his thoughts on the altcoin market’s potential.

According to Van De Poppe, several alternative coins (altcoins) saw an initial surge in the last week. He anticipates a short phase of stabilization before the upward trend continues again.

He thought that the latter part of 2024 would prove advantageous for altcoins, since they were successfully breaching significant resistance thresholds.

SEI as a case study

Van De Poppe used SEI, a lesser-known altcoin, as a case study to illustrate his point.

Despite a recent 5.1% decline in SEI’s price, the asset has managed to hold above the critical support levels of $0.31 to $0.32, which Van De Poppe identified as essential for its continued upward movement.

He proposed that should SEI continue with its current support, it might aim for a price around $0.46 in the upcoming period.

SEI’s market activity further supported this bullish outlook.

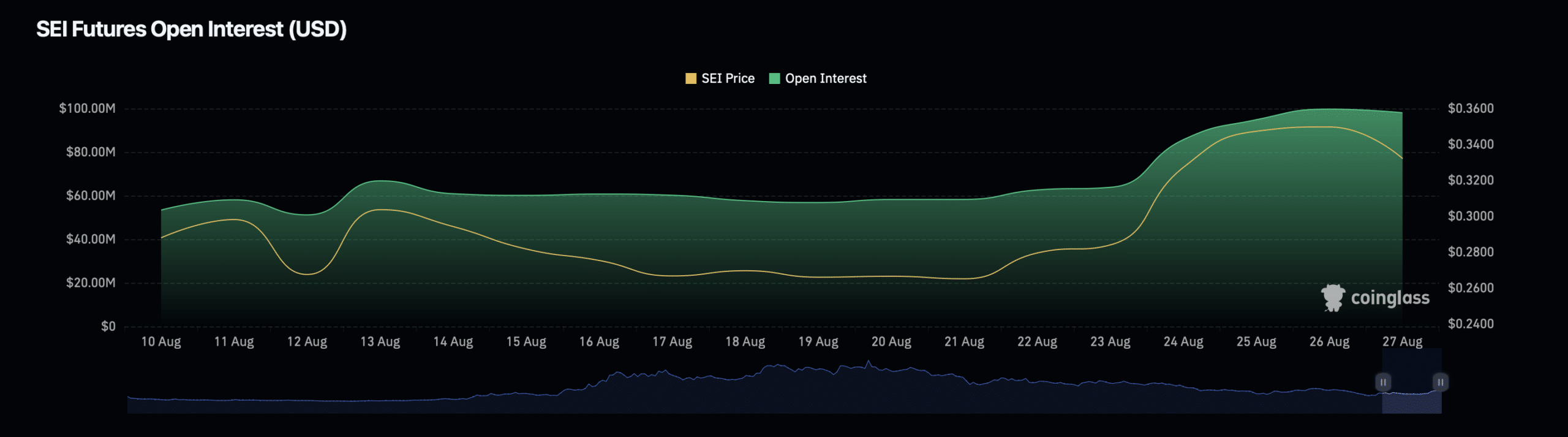

As an analyst, I’ve observed a noteworthy development in SEI‘s derivative market. The total number of outstanding contracts, or Open Interest, has seen a decrease of approximately 4.14% over the past day, settling at $96.55 million. However, quite surprisingly, the volume of these trades, or Open Interest Volume, has significantly increased by around 44%, reaching a total of $313.13 million. This intriguing contrast warrants further investigation to understand the underlying factors driving this shift in market dynamics.

The rise in Open Interest implies that even though there was a temporary dip, there’s a strong curiosity about how the price of SEI might change in the future.

This suggests an accumulation of positions, which might trigger a price surge if the bullish trend persists.

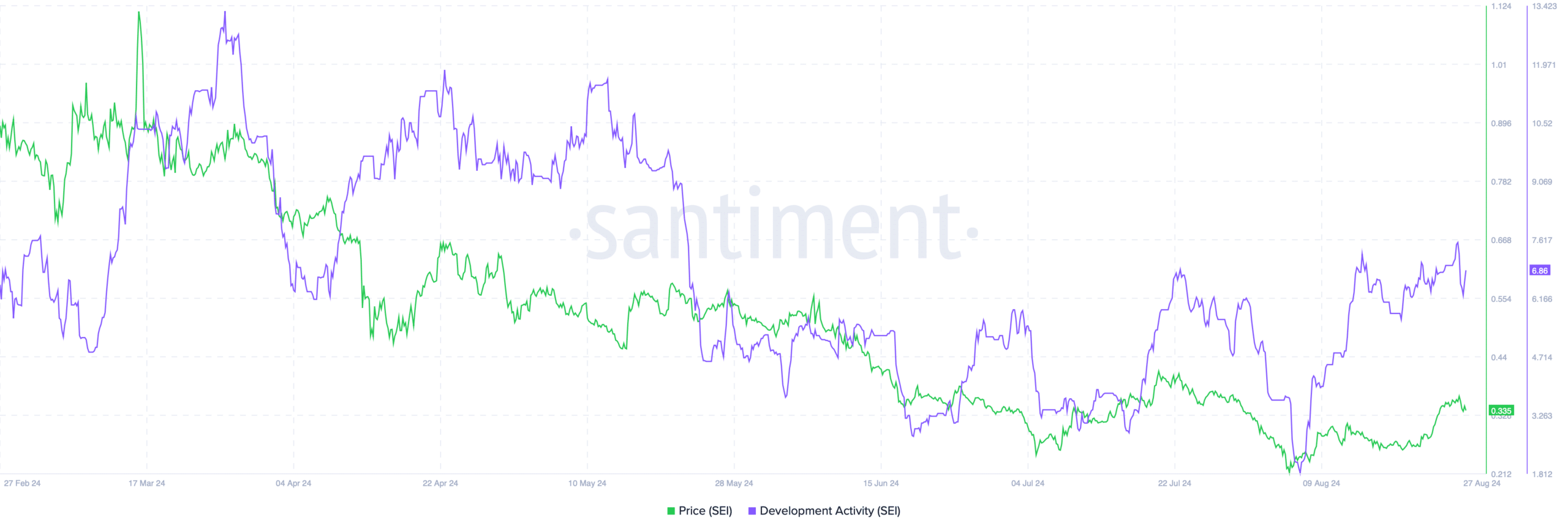

Furthermore, data provided by Santiment shows a significant surge in SEI‘s development activity. The metric, which was at a minimum of 1.8 earlier this month, has now climbed above 6.

Read Sei’s [SEI] Price Prediction 2024 – 2025

Frequent advancements in a project, typically due to continuous work or upgrades, tend to boost investor trust and potentially lead to increased asset value over time.

For SEI, this surge in development indicates that the project is currently advancing actively. Such progress could potentially boost its market performance in the future.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-08-27 23:04