- Ethereum’s breakout could lead to a $5,000 target as altcoin season looms.

- Technical indicators suggest Ethereum’s dominance is fueling a potential market shift.

As a seasoned researcher with over two decades of experience navigating the volatile world of cryptocurrencies, I find myself captivated by Ethereum’s (ETH) recent surge and its potential to breach the $5,000 mark. I’ve seen my fair share of bull markets and bear markets, but ETH’s momentum is truly something to behold.

Currently, the value of Ethereum (ETH) is soaring, having reached $3,898 at this moment, and financial experts are anticipating it could surge beyond $5,000, possibly even reaching greater heights.

The surge in Ethereum is reigniting curiosity about other digital currencies. As some analysts predict significant price increases for ETH, such as a possible $7,000, the cryptocurrency sector is keenly observing whether Ethereum’s growth could impact broader market patterns and possibly initiate an “altcoin boom.

Ethereum approaches key breakout levels

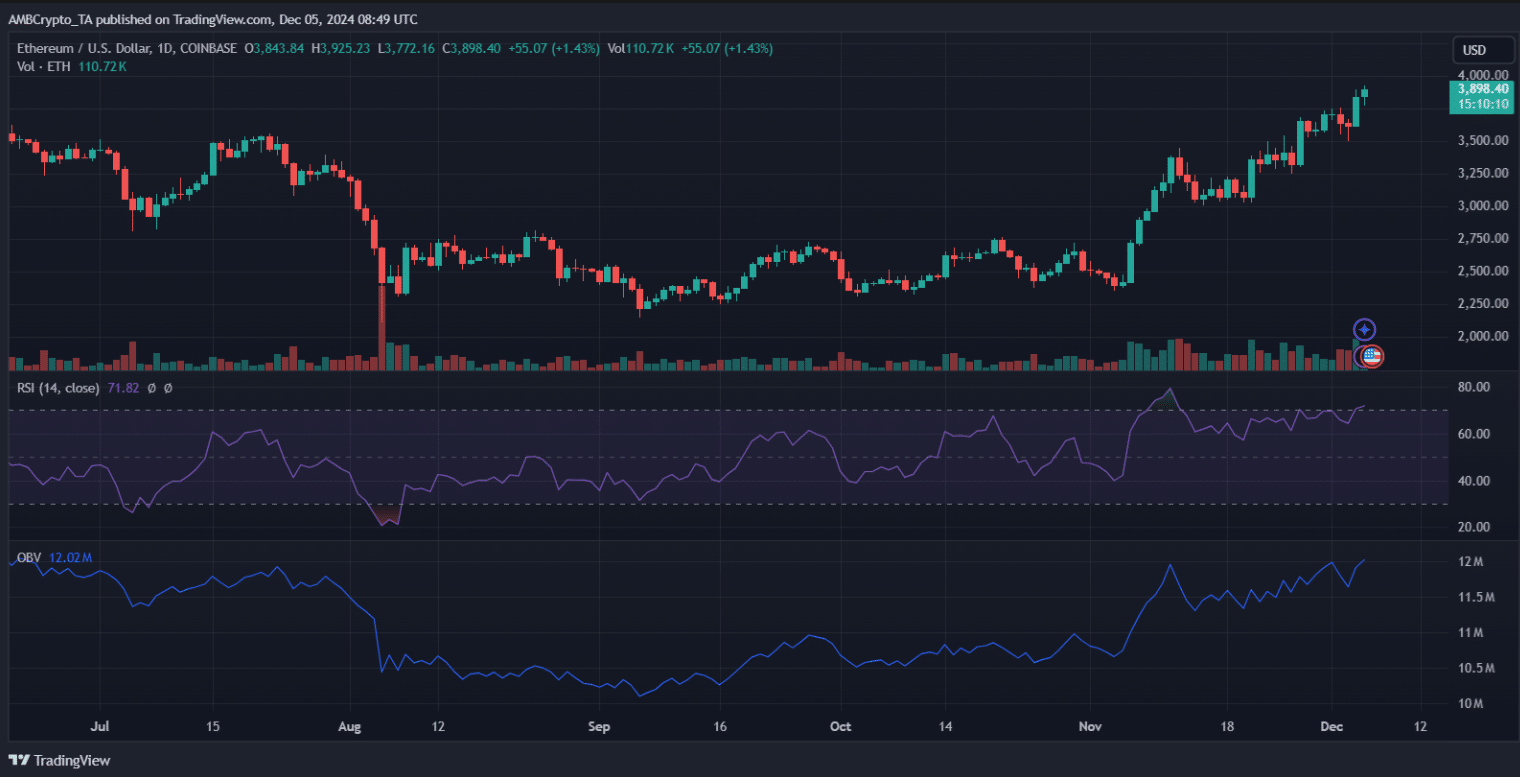

Currently, Ethereum is moving close to a significant turning point following its recent surge, surpassing the price level of $3,850. The Relative Strength Index (RSI) exceeding 70 implies that it’s overbought, yet this condition also signifies robust bullish energy, possibly indicating further progression towards $4,000 and potentially even higher values.

As OBV indicates a growing buildup, it suggests robust demand since institutional investments are bolstering the upward trend.

Important opposition is found around $4,200, a crucial point that could signal the route towards $5,000. On the other hand, $3,650 functions as the nearest defense line.

In the past few weeks, Ethereum’s performance relative to Bitcoin suggests a shift of investments towards alternative coins, stirring anticipation for an imminent boom in altcoins.

Investors and traders are keeping a close eye on Ethereum’s (ETH) price movements because its direction may influence the overall market mood, particularly when it leads to technical breaks in related assets.

ETH to $5,000: Analyst insights on the path forward

The momentum towards Ethereum reaching $5,000 is growing stronger as analysts point out significant technical indicators. Notably, prominent trader Jelle underlined a crucial resistance-to-support flip above $3,800, which might act as the catalyst propelling Ethereum to surpass the symbolic $5,000 barrier.

Currently, Michael van de Poppe highlights a bullish discrepancy in the Ethereum vs Bitcoin (ETH/BTC) Relative Strength Index (RSI), particularly on charts that span three days. This pattern suggests an increase in Ethereum’s influence within the cryptocurrency market.

With Bitcoin’s surge subsiding, the growth of Ethereum suggests that the market spotlight is shifting, as traders predict sustained bullish trends driven by institutional investment, advancements within the ecosystem, and mounting excitement for a potential upcoming altcoin boom.

Is $7,000 a plausible target for ETH?

The general feeling or expectation towards Ethereum is largely positive, as more analysts are beginning to predict a potential surge towards $7,000.

According to Venturefounder’s analysis, the “cup and handle” pattern they see indicates a potential breakthrough above $5,000 might pave the way for Ethereum (ETH) to potentially rise even higher towards $7,000.

The increase in social activity shows growing excitement among retail investors for shopping, whereas the rise in institutional investments highlights a wider trust in Ethereum’s usefulness and its staking infrastructure.

Nevertheless, critics might caution about potential challenges in the broader economy (macroeconomic headwinds) and the possibility of selling actions at significant price points (profit-taking risks).

To hit $7,000, Ethereum (ETH) needs persistent growth in the Decentralized Finance (DeFi) and Non-Fungible Token (NFT) markets, along with Bitcoin’s dominance lessening, which will help establish the right environment for such a significant price increase.

Is this the official start of altcoin season?

The surge in the value of Ethereum, along with Bitcoin’s decreasing pace, could suggest an upcoming trend where alternative cryptocurrencies (altcoins) might take the lead.

Realistic or not, here’s ETH market cap in BTC’s terms

historically, the period for altcoins arises when investment shifts from Bitcoin towards other digital currencies, such as Ethereum’s superior performance and increased attention on coins like XRP and TRX.

Experts observe that Ethereum’s (ETH) influence often serves as an early signal for large-scale surges in the altcoin market. If ETH manages to exceed $4,200 and maintain its upward trend, it may set off a chain reaction, pushing other altcoins towards substantial price increases.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-12-05 17:12