- Bitcoin dominance has remained above 50%.

- The altcoin season has yet to kickstart despite recent moves in the market.

As an experienced analyst, I’ve closely monitored the cryptocurrency market trends for quite some time. Bitcoin’s impressive price gains since the beginning of the year and Ethereum’s recent upward movements have raised questions about the potential onset of an altcoin season.

Since the new year began, Bitcoin [BTC] has exhibited striking price growth, while Ethereum [ETH] has more recently displayed notable increases as well.

The recent surge in Ethereum’s price and the rising values of numerous other cryptocurrencies have sparked debate over the possibility of an altcoin market upswing.

Altcoin season not underway

When Ethereum begins to experience a strong upward trend, it often indicates the approach of altcoin season. Nevertheless, for this phenomenon to reach its peak, additional indicators must display noticeable shifts as well.

Currently, the Altcoin Season Index on blockchaincenter.net reads 35. An ‘altcoin season’ is signaled when 75% of the top 50 cryptocurrencies surpass the performance of Bitcoin.

Bitcoin dominance holding back the altcoin season

Reducing Bitcoin’s market influence can trigger the arrival of altcoin rallies. Traders seek diversity by investing in various cryptocurrencies, thus reallocating the total crypto market value from Bitcoin.

At present, the total value of all cryptocurrencies is approximately $2.55 trillion based on data from CoinMarketCap. Bitcoin (BTC) represents more than half (over 52%) of this market cap, while altcoins make up the remaining less than 50%. Among these alternatives, Ethereum accounts for around 18.2% of the market share.

After a notable increase or decrease in the value of Bitcoin (BTC), its price often becomes more steady. This predictability may encourage investors focusing on quick profits to offload their Bitcoin holdings and shift to alternative cryptocurrencies.

New traders might find the high cost of Bitcoin prohibitive, leading them to consider investing in less expensive altcoins. This trend could result in a significant transfer of market value from Bitcoin to altcoins.

How Ethereum and other top altcoins have performed

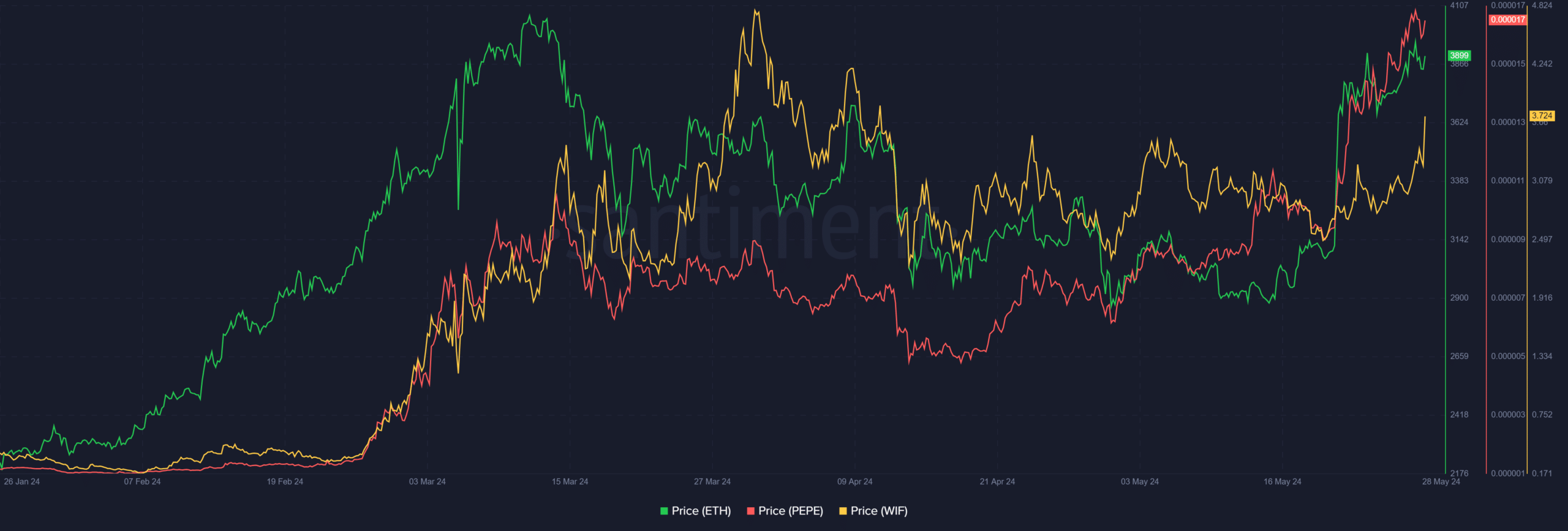

Despite the persistent growth of the Bitcoin market, Ethereum and certain alternative coins such as PEPE and WIF have experienced significant price increases in recent times. Reports indicate that PEPE’s value has surged over 1,000% more than Bitcoin during the past three months.

The chart shows numerous new peak records each day, along with a robust upward momentum for this asset, as evidenced by its Relative Strength Indicator (RSI) results.

In the same timeframe, WIF experienced a remarkable surge of over 800%, maintaining a robust upward trajectory. Currently, its value hovers near the $3.70 mark, registering approximately a 9% price rise.

The Ethereum market is showing signs of a robust bullish movement within the oversold territory, based on its Relative Strength Index (RSI). Currently, Ethereum is priced around $3,890, registering a minor gain of under 1%.

The actions indicate that although Bitcoin holds the leading position, there is growing energy in the altcoin sector.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-05-29 01:11