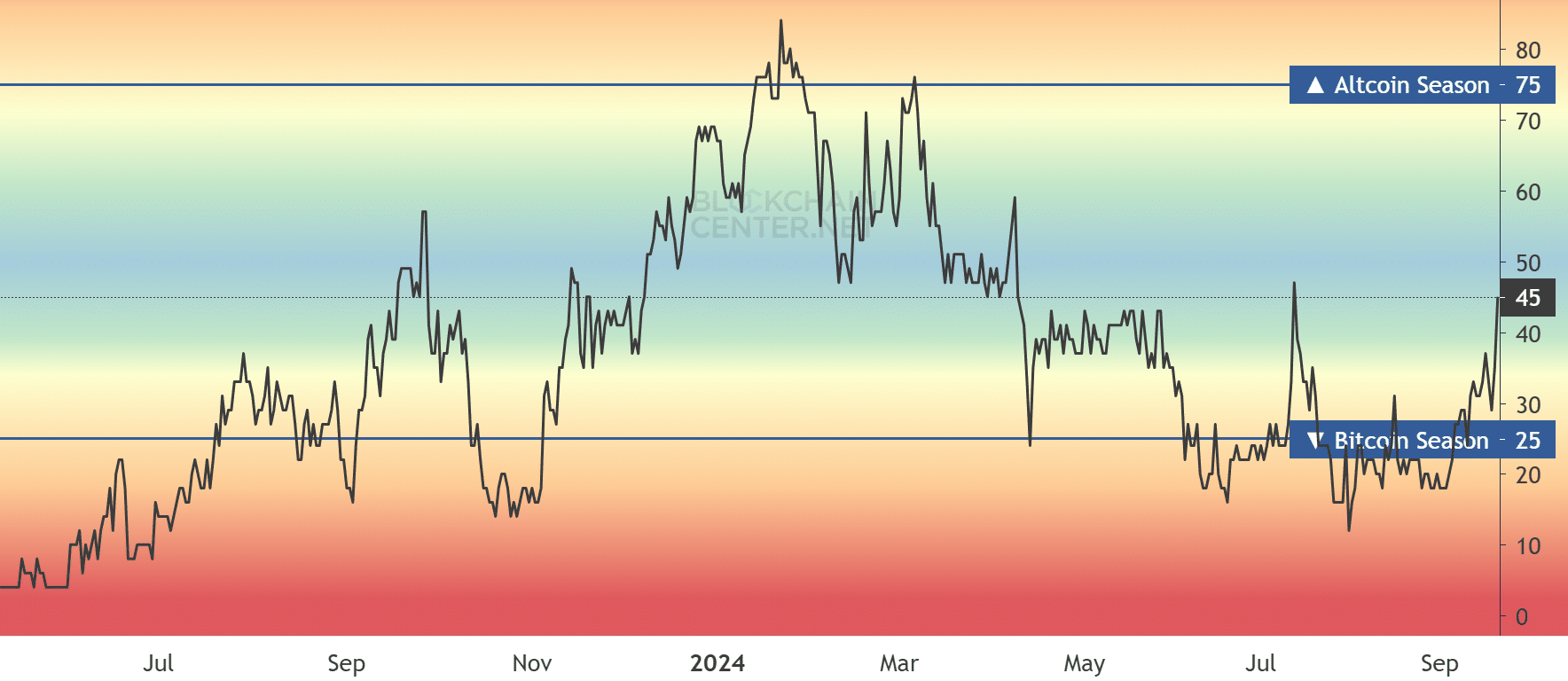

- The Altcoin Season Index has reached a two-month high above 45 suggesting altcoins are rallying

- However, this metric needs to hit 75 to confirm an altseason

As a seasoned crypto investor with a decade of experience navigating these digital seas, I find myself intrigued by the recent surge in altcoins and the Altcoin Season Index reaching a two-month high. While it’s a promising sign, I remind myself that we need to see the index hit 75 for a confirmed altcoin season.

As a researcher, I’ve noticed an impressive spike in the value of altcoins this past week, mirroring the growth experienced by Bitcoin [BTC]. This upward trend has led to a significant increase in the Altcoin Season Index, reaching a two-month peak of 45, as observed on Blockchain Center.

As a researcher examining altcoin trends, I’ve noticed that a key indicator for an ‘altcoin season’ is when the index reaches 75. Currently, we’re not there yet, but I’m observing a steady upward trend. At the beginning of this month, the metric was at 18, so it’s definitely moving in the right direction.

This data shows that sentiment towards altcoins is turning positive, but for this index to push above 75, altcoins need to extend their gains.

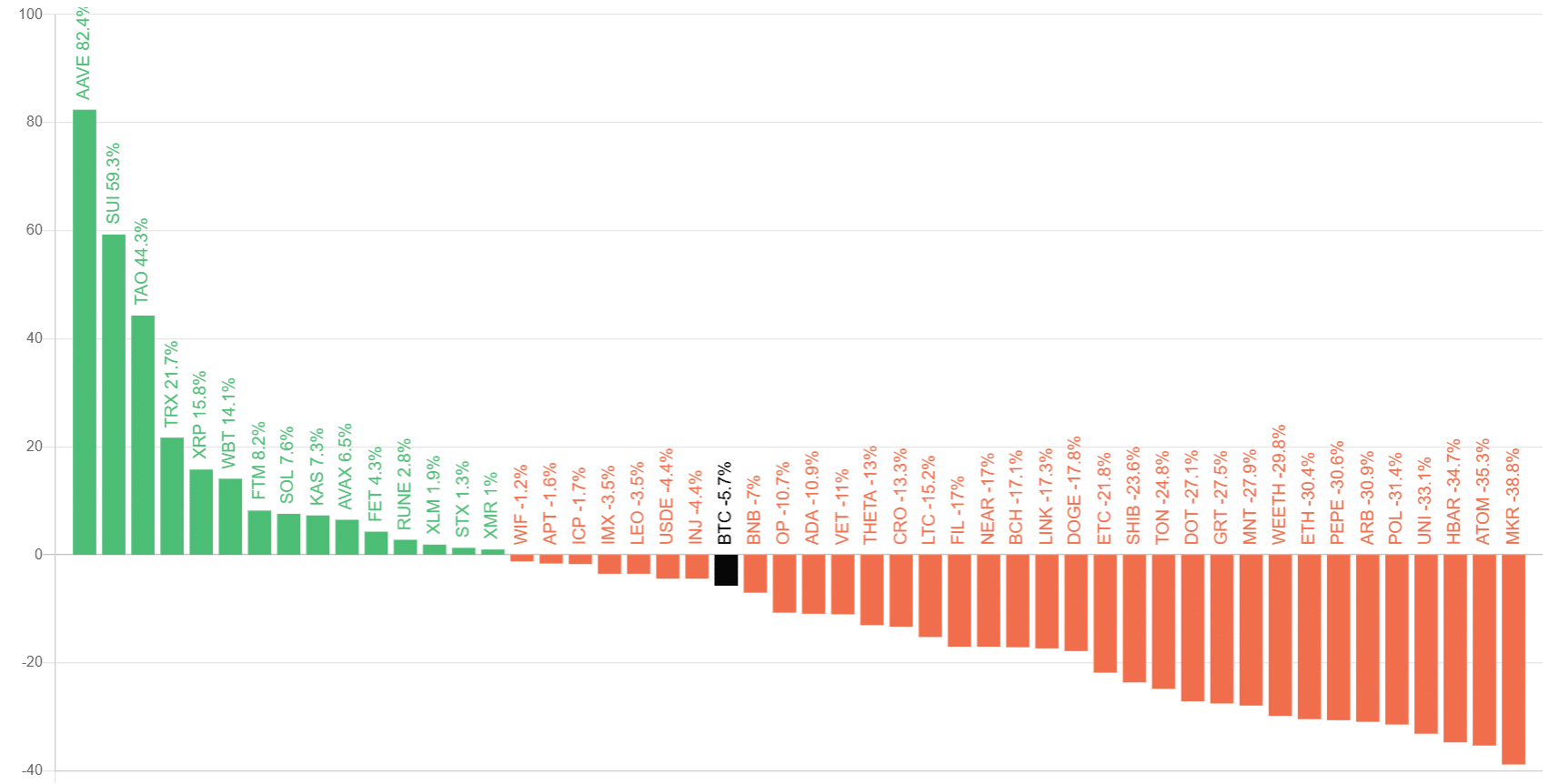

Altcoin performance against Bitcoin

In simpler terms, compared to Bitcoin, Ethereum (ETH), the biggest alternative cryptocurrency, isn’t doing as well lately. The value of one Ethereum in terms of Bitcoins (ETH/BTC ratio) has reached its lowest point since early 2021.

At the moment of reporting, this ratio surpassed 0.04, indicating a minimal increase in ETH‘s value compared to Bitcoin. Yet, it continues to hover near its lowest point for the year.

Among the top ten cryptocurrencies, Solana (SOL) is the unique one that has surpassed Bitcoin (BTC) in the past week. It’s seen a rise of 12%, setting it apart from other coins within the same group.

Examining the leading 50 performances over the past 90 days reveals that most altcoins remain in negative territory. However, notable exceptions include AAVE [AAVE] and SUI [SUI], which have seen gains exceeding 50%.

This suggests that altcoins need to extend their gains for the market to enter an altcoin season.

Will DeFi and NFT boom usher in altcoin season?

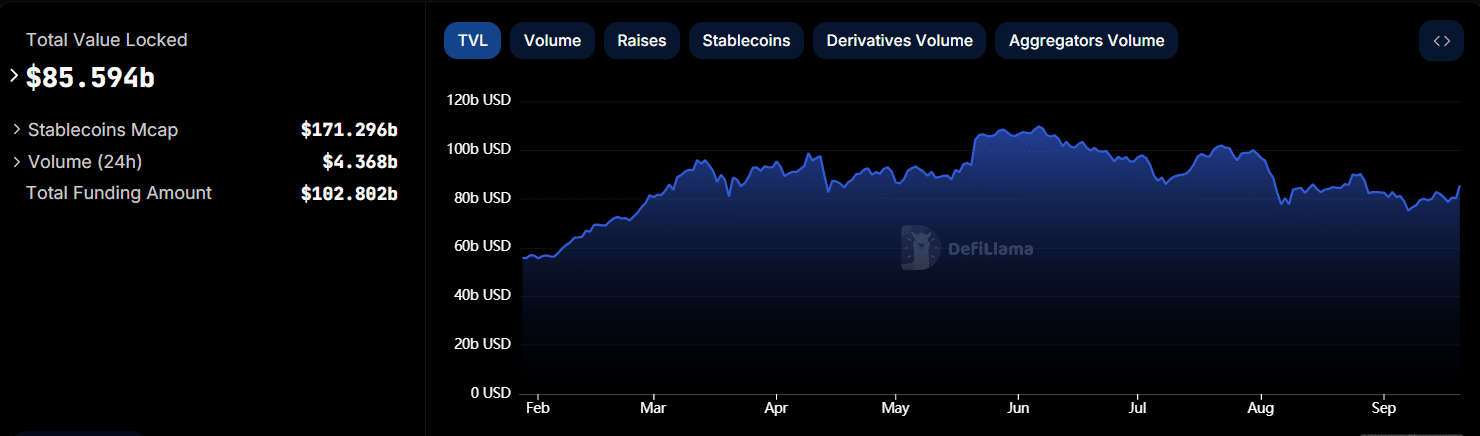

It’s worth noting that the expansion of Decentralized Finance (DeFi) and Non-Fungible Tokens (NFT) sectors can impact the behavior of alternative coins (altcoins). Both of these sectors have experienced remarkable growth over the past week.

According to DeFi Llama’s latest data, the total value locked within the Decentralized Finance (DeFi) sector has surged past $10 billion over the last fortnight, reaching approximately $85 billion as of the current reporting.

However, there is still room for growth as DeFi activity remains below this year’s highs above $100 billion.

In the world of NFTs, there’s been a significant surge. At this moment, the sales volume for NFTs has risen by over 40%, according to CryptoSlam’s latest report.

Despite indications pointing towards a period of increased popularity for alternative cryptocurrencies (altcoins), Bitcoin’s influence in the market remains substantial, with Bitcoin accounting for about 54% of the entire cryptocurrency market share, according to Coinstats.

It seems that Bitcoin’s growing influence might be due to Ether’s lackluster performance. In fact, Ether’s dominance has decreased significantly, dropping from 18% at the start of 2024 to 14% as we speak now.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-21 13:43