- The altcoin season index showed investors need to bide their time.

- Participants will need to be more picky in their altcoin bets this cycle due to the inundation of new tokens.

As a researcher with extensive experience in cryptocurrencies, I believe that the current market conditions indicate that investors should exercise patience when it comes to altcoins. The altcoin season index has shown that investors need to bide their time before making significant bets on altcoins, as the market is currently inundated with new tokens and the capital inflows necessary for sustained rallies are not yet present.

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin‘s [BTC] price stood at approximately $61,500 at the time of my investigation, representing a slight 3% increase from its range low of $59,700. This significant support level was established during the initial half of May. Bullish sentiments had driven the price upward to reach $72,000, but unfortunately, the bulls failed to sustain this momentum and maintain control over the market.

Revisiting this crucial support point indicates that the consolidation stage is ongoing for Bitcoin, implying that an uptrend has not fully materialized yet. A liquidity pool beneath $60k may draw prices down towards it, causing a more significant correction than many anticipate.

As a crypto market analyst, I can explain it this way: After the crypto king’s (Bitcoin’s) halving event, its struggle to initiate an uptrend is understandable. Consequently, most alternative coins (altcoins) experience downward pressure due to the absence of significant capital inflows required for their rallies.

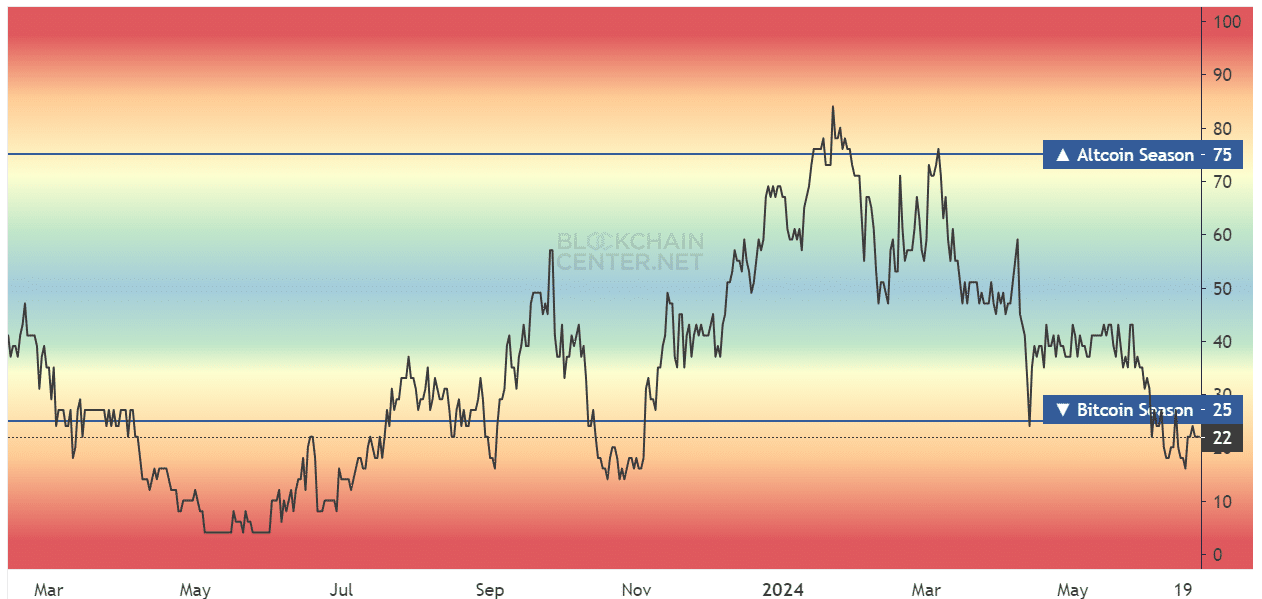

Investigating the altcoin season index- the readings are not hopeful

The Altcoin Season Index aims to gauge market sentiment and determine if the altcoin or Bitcoin sector is outperforming. If approximately three-quarters of the top 50 altcoins exhibit superior performance compared to Bitcoin over a 90-day timeframe, it is referred to as an “altcoin season.”

A scenario like that is still quite distant. The reason being, the market currently doesn’t have sufficient capital injections or heightened investor enthusiasm for altcoins to experience a boom.

Historically, after Bitcoin experiences a significant price surge, it typically enters a period of consolidation. During this phase, Bitcoin investors often shift some of their funds into altcoins. They make this move with the hope of earning greater returns from riskier assets, based on their analysis of the underlying fundamentals, tokenomics, and prevailing market sentiments.

To experience a bull run or altseason, Bitcoin must first record significant price increases, similar to the ones observed between October 2023 and January 2024.

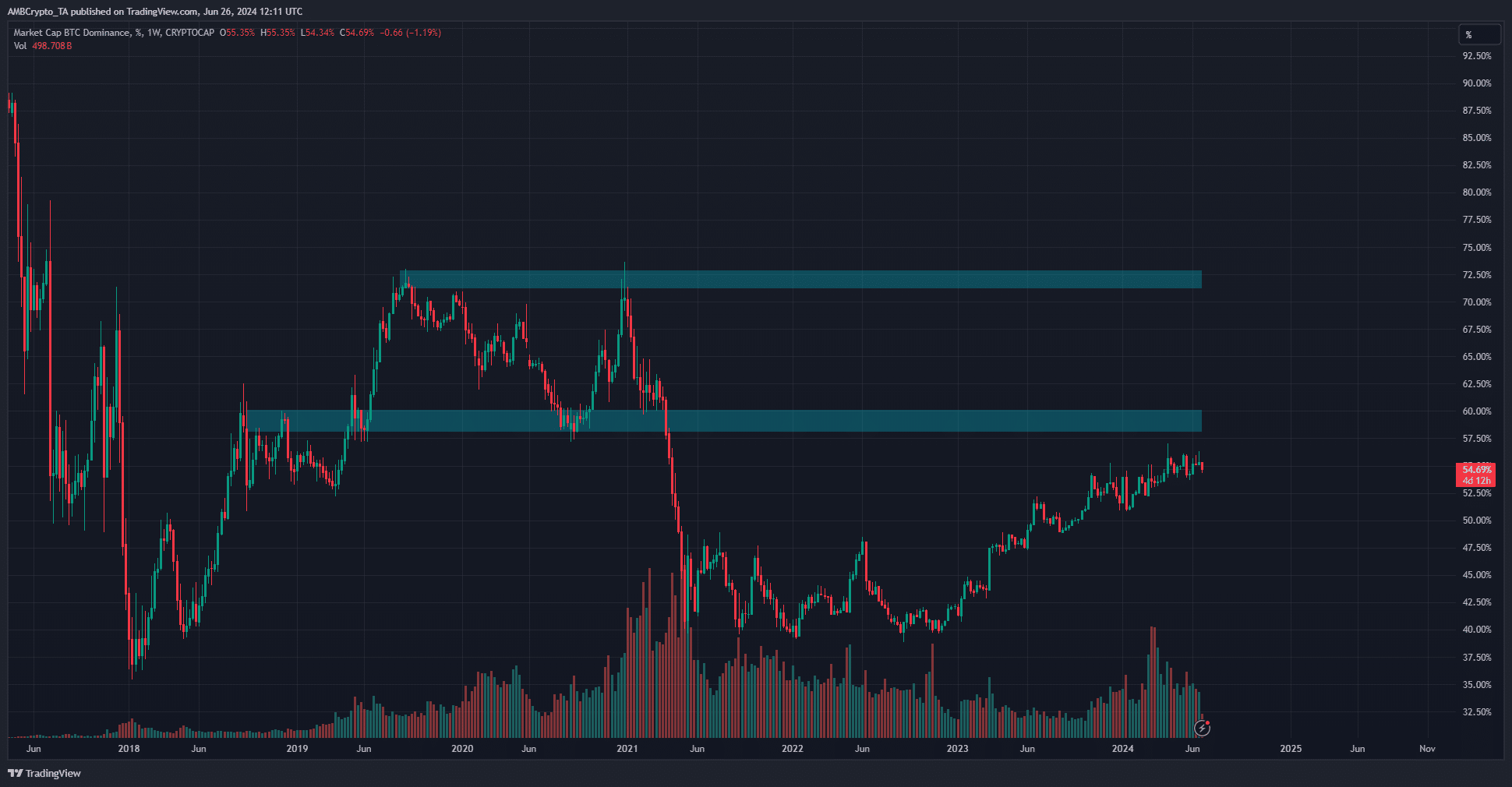

The long-term implications from the dominance chart

From March to June 2021, the altcoin rally of 2021, as indicated by the altcoin season index, unfolded. Yet, let’s examine the Bitcoin Dominance chart above. In the early part of 2021, Bitcoin’s dominance started declining, followed by a recovery in the latter half of the year.

A significant drop in BTC.D’s value serves as a major signal for altcoin rallies. It underscores the expanding dominance of the altcoin market relative to Bitcoin.

starting from March, the altcoin market has shown a downward trend, contrary to the overall positive trajectory observed in longer timeframes. The recent correction has been particularly harsh.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a researcher studying the altcoin market, I’ve observed that the continual dilution of the altcoin pool and the consistent unlocking of tokens from ongoing projects have led to a significant increase in demand. This surge in demand is necessary just to keep pace with the inflationary altcoin market.

This turn of events could result in larger-than-usual profits being accrued by a smaller number of alternative assets during this cycle, compared to 2021 or 2017. Additionally, the potential returns might be less significant than in past cycles due to the fact that participants are no longer considered early adopters.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-06-27 06:17