- The altcoin sector sell-off pushed the funding rates to healthy levels for a rebound.

- But BTC dominance strengthening was a risk factor for the continued rally.

As a seasoned analyst with years of observing and navigating the volatile cryptocurrency market, I find myself cautiously optimistic about the current state of altcoins. The recent sell-off and liquidation have pushed funding rates to healthy levels for a potential rebound, which is indeed encouraging. However, it’s essential to keep an eye on Bitcoin dominance (BTC.D), as its strengthening could pose a risk factor for the continued altcoin rally.

After a remarkable rally, the altcoin sector saw its first major shake-out since the US elections.

Given the significant sales over the last two days, concerned investors are pondering important queries such as whether the upward trend for alternative cryptocurrencies can be maintained.

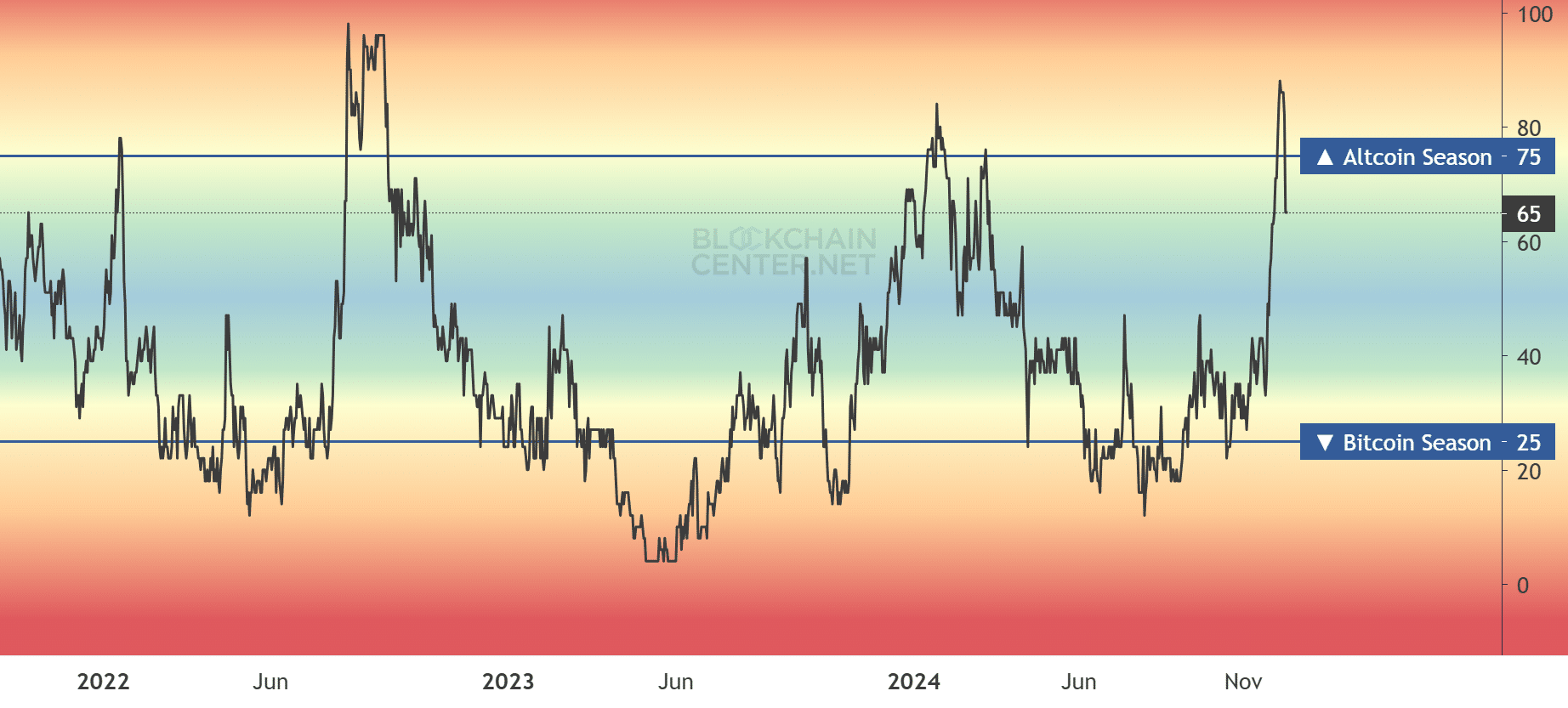

During that timeframe, the Altcoin Season Index dropped from 88 to 65, suggesting a decrease in the pace of the altcoin season’s growth.

What’s next for altcoins?

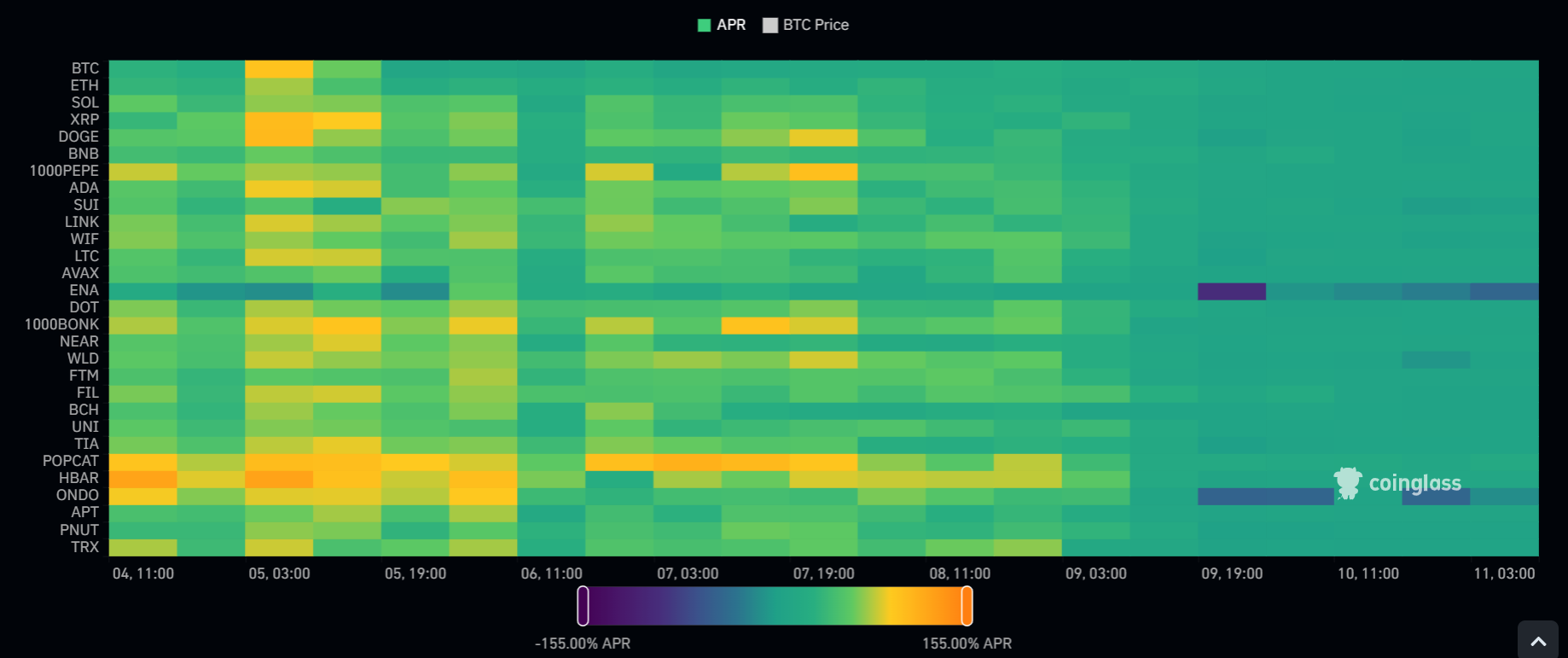

Given the unusually heated market conditions of the previous week, I wasn’t taken aback by the subsequent selling off and liquidation events. In fact, the skyrocketing funding rates, reaching their highest point in nearly nine months, had hinted at this potential outcome.

However, the process had caused altcoin funding rates to be recalculated; an event that analysts considered favorable for a possible upswing in their value.

In contrast to the escalated funding rates I observed last week, surging to double-digit levels, the rate has dipped below 10% over the past two days. This downward shift suggests a reduction in leveraged positions for betting on altcoins, a common characteristic of a bullish market setup.

Although an increase in funding rates might stimulate Bitcoin dominance (BTC.D), it could also potentially hinder the growth of altcoins.

In my recent investigation, I’ve noticed that the surge in altcoins we’ve witnessed can be attributed, in part, to a significant drop in BTC Dominance (BTC.D) from more than 60% down to less than 55%. This decrease in BTC’s dominance has opened up opportunities for other cryptocurrencies to gain traction.

Currently, BTC.D (Bitcoin Dominance Index) stands at over 55%, indicating that investors are favoring Bitcoin over altcoins in the recent significant altcoin selling wave.

According to analyst Benjamin Cowen, altcoins are generally stable as long as Bitcoin Dominance Index (BTC.D) doesn’t regain its compression range. To put it simply, if Bitcoin’s dominance continues to grow, it might halt the upward trend of altcoins.

Speaking as an analyst, I’ve observed that despite some market fluctuations, Ethereum [ETH] has managed to hold its ground at the $3.5K support. This resilience leaves me optimistic that a robust rebound might be imminent. If this happens, it could signal a fresh surge in the altcoin season, potentially revitalizing its momentum.

Read Ethereum [ETH] Price Prediction 2024-2024

For now, notable leaders within various industries, including Hedera (HBAR) and Ripple (XRP), have experienced a drop of more than ten percent in their weekly performance graphs.

In the realm of cryptocurrencies, I witnessed a significant dip in my portfolio today. HBAR fell by 13%, landing at $0.28. XRP followed suit, losing 12% and momentarily dropping beneath the $2 mark. However, it was TRX that took the heaviest blow, plummeting a staggering 30% over the same duration.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Quick Guide: Finding Garlic in Oblivion Remastered

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Shundos in Pokemon Go Explained (And Why Players Want Them)

2024-12-11 19:03