-

The strong Bitcoin ETF inflows could spark the next upward price move.

Altcoins could follow BTC gains, but might struggle to outperform the king anytime soon.

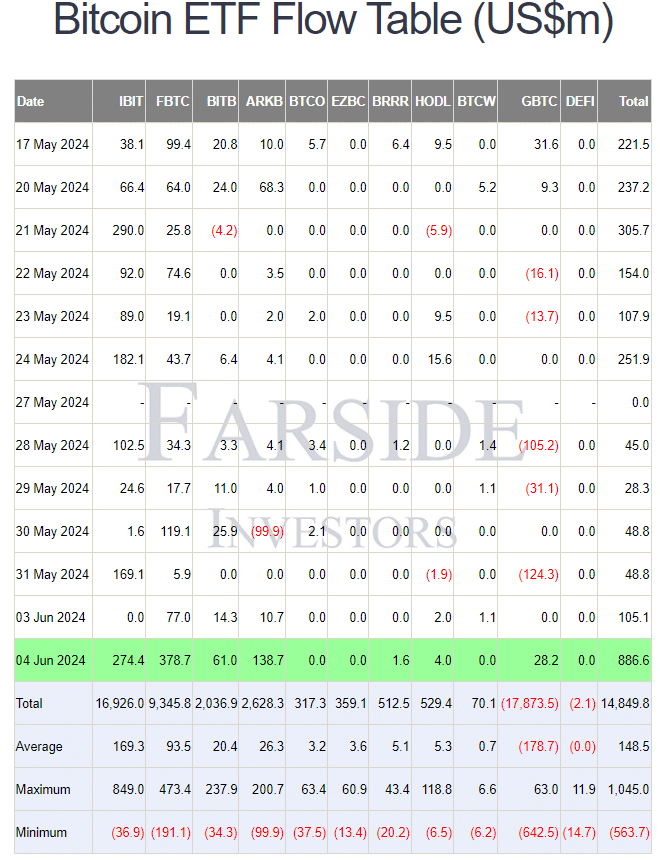

As an experienced analyst, I believe that the strong inflows into Bitcoin ETFs could indeed be the catalyst for the next upward price move. The data from Farside Investors showing a substantial $886 million inflow on Tuesday is a clear sign of increased buying and interest in Bitcoin. This trend could potentially spark a change in sentiment and attract more speculators and investors to the market.

As an analyst, I’ve noticed that Bitcoin [BTC] has been showing signs of potential awakening from its current slumber. Last week, the price hovered around $67.7k, and the scant trading volume along with muted speculative interest indicated a weak market. However, subtle shifts in market sentiment and emerging trends might prompt BTC to surge past these levels soon.

Over the last 24 hours, there’s been a noticeable change. According to Farside Investors’ data, Bitcoin ETFs experienced an influx of approximately $886 million on June 4th.

This level of buying could spark a change and stir speculators and investors into action.

As an analyst, I’ve been closely monitoring the cryptocurrency market and specifically focusing on the relationship between Bitcoin’s price movements and those of altcoins. The attention Bitcoin has been receiving lately has led some to speculate that we may be on the brink of an altcoin season, where altcoins experience significant price increases relative to Bitcoin.

How close are we to the altcoin season?

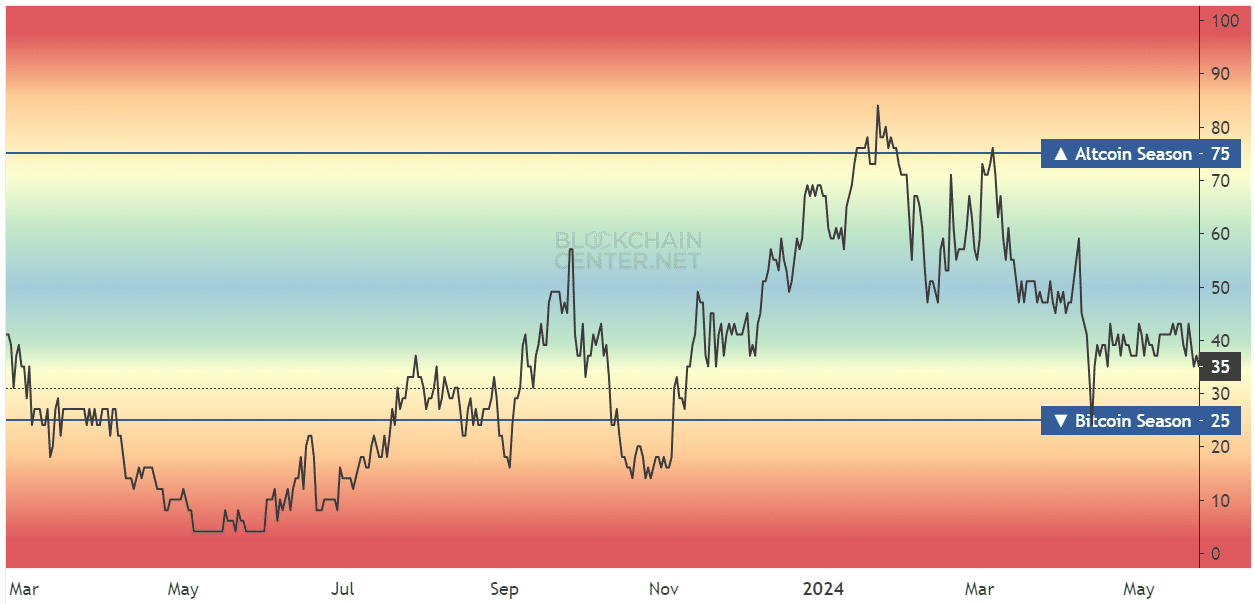

According to BlockchainCenter’s data, the altcoin season index registered a score of 31. Over the past six months, this index has decreased significantly from a high of 80.

A year ago, the index showed strong BTC season.

During the bear market’s depths, I observed Bitcoin trading at around $25k while alternative cryptocurrencies were either in a prolonged downtrend or consolidating their prices.

As an analyst, I would express it this way: At the current moment, some alternative cryptocurrencies (alts) could potentially yield impressive returns thanks to Bitcoin’s ongoing bullish trend. However, only a limited number of altcoins are likely to surpass the gains made by Bitcoin itself.

If the altcoin season indicator reaches a level above 75, this could indicate robust bullish sentiment among altcoins as a whole.

As an analyst, I would interpret this situation by saying that with a greater number of alternative cryptocurrencies (alts) available in comparison to past market cycles, it’s likely that significant price gains during an altseason may be confined to specific subsets or clusters of alts rather than resulting in market-wide rallies for all altcoins.

The range-bound Bitcoin Dominance and parallels from the past

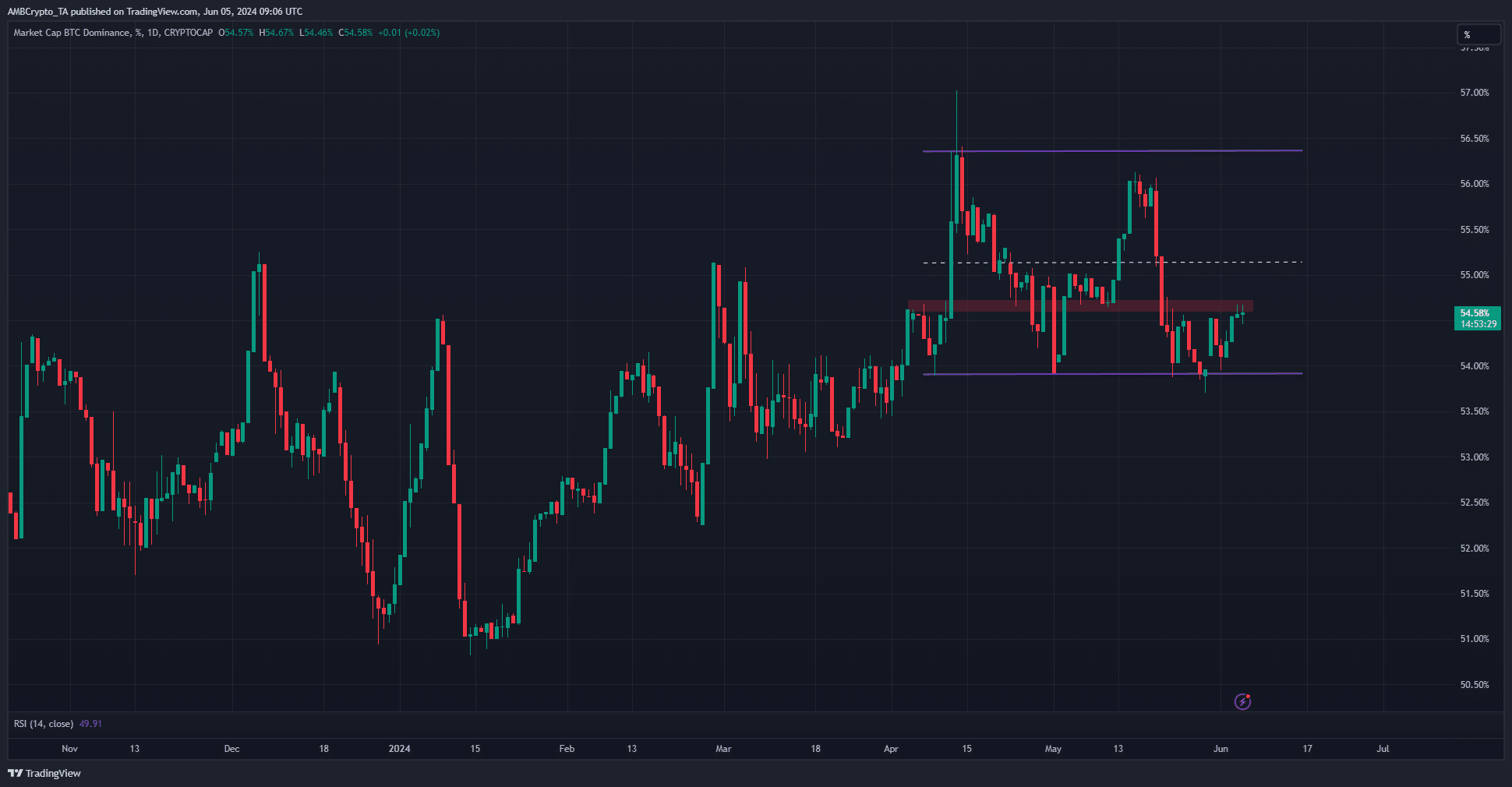

The Bitcoin Market Share graph illustrates the proportion of Bitcoin’s total market value in relation to the entire cryptocurrency market capitalization, which has remained within a range of 53.9% to 56.3% since April.

At the current moment, Bitcoin (BTC) was bouncing back from its price range bottoms. The rising BTC dominance index (BTC.D) implied that Bitcoin was gaining ground over other cryptocurrencies, including Ethereum (ETH), at an accelerated pace.

Is your portfolio green? Check the Bitcoin Profit Calculator

As an analyst in 2021, I observed that Bitcoin’s dominance dropped significantly from holding around 72% of the total cryptocurrency market capitalization in January to only 40.4% by June. Simultaneously, the market capitalization for all altcoins, excluding Ethereum, experienced a substantial surge, expanding from approximately $122 billion at the beginning of the year to an impressive $934 billion within the first half.

For a genuine altcoin rally to take place, a significant downward trend in the Bitcoin Dominance (BTC.D) chart is required.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-06-06 06:15