- Bitcoin dominance likely needs to reach between 62% and 70% for an altcoin season to commence.

- However, additional issues across various metrics also require serious consideration.

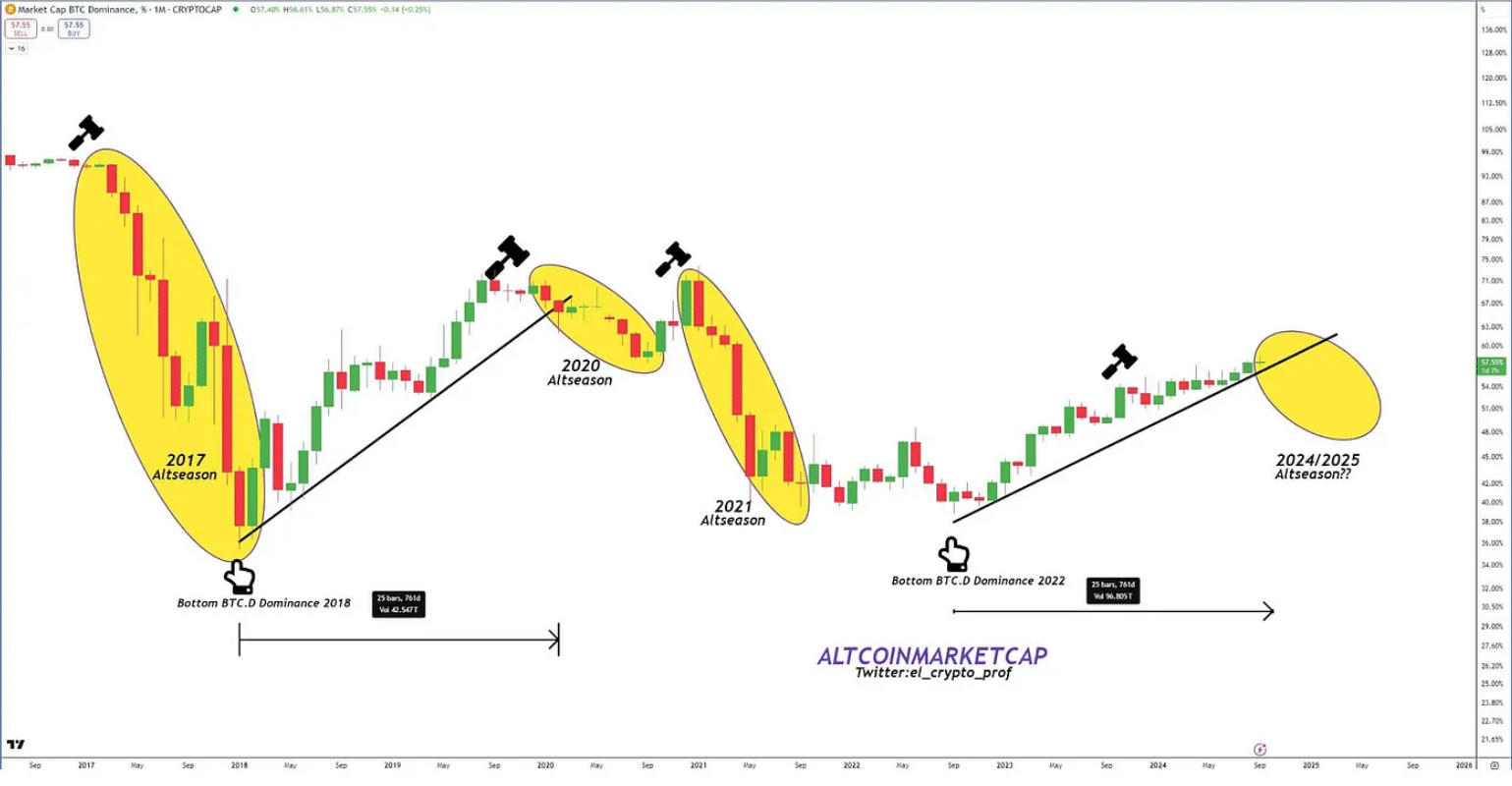

As a seasoned crypto investor with a knack for deciphering market trends and patterns, I’ve learned that predicting market movements can be as unpredictable as the weather. However, based on historical data and current market dynamics, it seems we might be on the cusp of an altcoin season.

In the third quarter, there was a predominantly pessimistic outlook towards altcoins, as Bitcoin’s [BTC] dominance increased to approximately 57%, reaching an all-time peak. The Altcoin Season Index stands at 35 now, having dipped to its lowest level in mid-August.

Generally speaking, altcoins tend to thrive when the dominance of Bitcoin reaches its peak. When Bitcoin controls a large portion of the market early in a cycle, funds frequently move towards altcoins as Bitcoin’s dominance starts to decrease. This pattern is advantageous for altcoins because investors look for assets with higher risk and potentially greater returns during this period.

To trigger an “altcoin season” statistically, Bitcoin’s total market capitalization would approximately need to increase by about $280 billion, placing it within the range of 62%-70%. This significant growth is expected when Bitcoin reaches around $80,000, alongside other key indicators.

High Bitcoin dominance is crucial

Initially, Bitcoin held a massive 90% share in the cryptocurrency market back in 2013, but as alternative coins started gaining popularity, its dominance has steadily decreased, hitting an all-time low of 39% by 2021.

Source : X

Significantly, every period of growth for altcoins has been fueled by distinct triggers, including the introduction of new digital currencies, groundbreaking technologies such as ERC-20 tokens, and wider movements such as Decentralized Finance (DeFi) and Non-Fungible Tokens (NFTs).

It implies that not only Bitcoin’s dominance but also significant inputs from alternative cryptocurrencies (altcoins) will be pivotal in igniting another wave of growth for altcoins.

At the moment, altcoins don’t have enough independence to stand alone in terms of driving their own seasons, as their fluctuations tend to follow Bitcoin’s price movements for balance. In order to see a change, Bitcoin might first need to experience an upward trend.

The upward trend implies that for Bitcoin’s market dominance to surpass 65%, its price might have to reach over $80,000. This could potentially lead to a significant increase in investment towards alternative cryptocurrencies.

Need for high risk appetite

According to a latest analysis by AMBCrypto, there’s a significant change happening in the altcoin market, urging Ethereum creators to take proactive steps to deal with increasing rivalry.

Inside, it calls for a thorough evaluation, whereas outside, the attractiveness of Bitcoin is being eroded by an increasing gap in risks, unintentionally hindering other cryptocurrencies from gaining the necessary traction.

Source : xe.com

With gold prices soaring due to reduced interest rates and heightened geopolitical concerns, Bitcoin’s lackluster growth suggests investors are cautious about crypto investments. Historically, a rise in the Bitcoin-to-gold ratio has often coincided with an altcoin boom. Consequently, the current low appetite for risk could dampen altcoins, implying that an increasing BTC/Gold ratio might signal more favorable conditions on the horizon.

Simply put, when Bitcoin experiences a downturn, the falling Bitcoin-to-Gold ratio indicates that investors are moving towards safer investments. This trend weakens Bitcoin’s reputation as a reliable long-term asset for storing value.

This migration underlines the importance of market confidence in BTC’s role as a “digital gold” to support a broader altcoin rally – a rally likely to stabilize once BTC approaches the $80K mark.

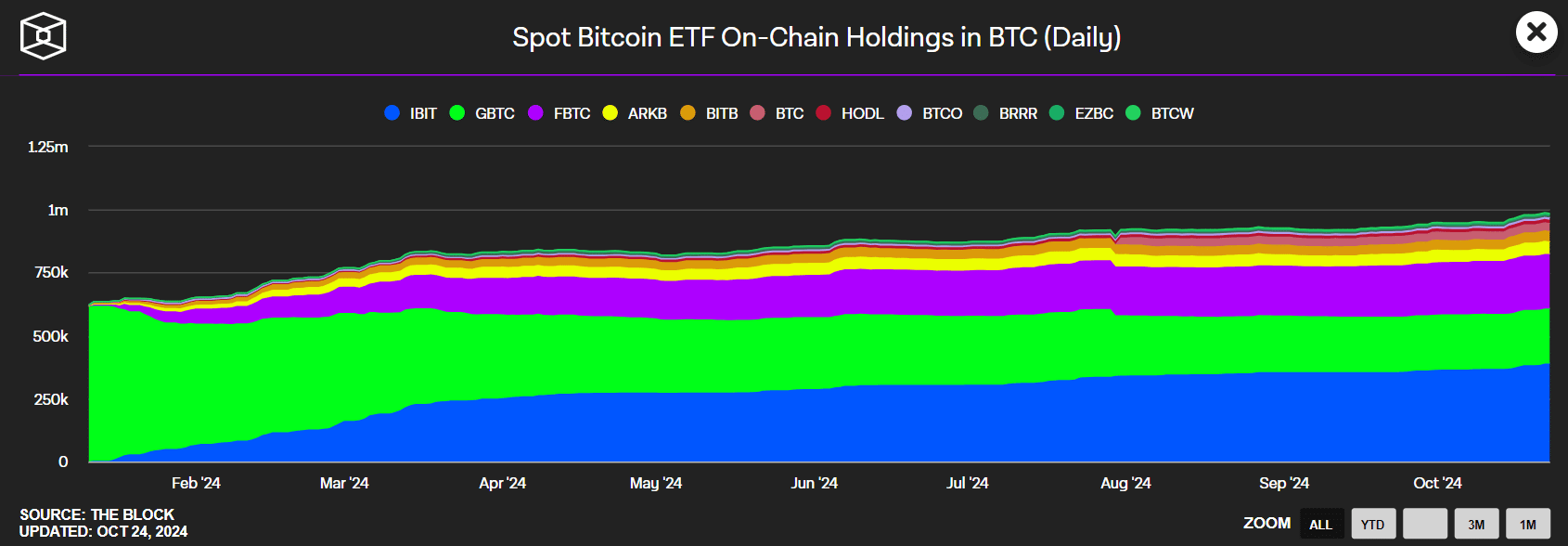

Less ETF driven momentum

As a researcher, I’ve been exploring the connection between Bitcoin’s price fluctuations and Exchange-Traded Funds (ETFs). While ETF-fueled surges typically signal a positive trend, their influence on alternative cryptocurrencies can be unpredictable. The ETF market has witnessed remarkable growth in the year 2024.

Source : The Block

In contrast, when Exchange Traded Funds (ETFs) follow the market’s momentum, they typically stay invested in Bitcoin or Ether instead of shifting into alternative coins, due to the fact that many mainstream investors lack direct access to these altcoins. Instead, it is more probable that funds will be directed towards stocks associated with cryptocurrencies.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Due to both internal and external elements, the arrival of altcoin season is consistently being delayed, as it’s heavily dependent on Bitcoin’s price fluctuations.

If Bitcoin manages to exceed $80,000, it could signal the arrival of altcoin season, but considering the present trends, achieving this milestone before the end of Q4 might prove difficult.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2024-10-25 23:04