-

The prospect for an altcoin season continues to drop as the TOTAL2 market cap remained elusive of BTC.

Though some analysts see a buying opportunity, market trend suggest that it is way off.

As an experienced analyst, I’ve closely followed the cryptocurrency market trends for quite some time. Based on my observations and analysis of the current market conditions, I believe that the prospects for an altcoin season are increasingly uncertain.

Analysts have been voicing their opinions for several months now that the altcoin season is imminent. However, these forecasts have yet to materialize. Once more, there are renewed discussions about this following Bitcoin‘s [BTC] recent price decrease to a two-month low.

As a researcher studying the cryptocurrency market, I’ve come across the term “altcoin season,” which is when other digital currencies, or altcoins, outperform Bitcoin (BTC). To confirm this market phase, at least three-quarters of the top 50 altcoins based on market capitalization must perform better than Bitcoin.

During this current market cycle, Bitcoin has often outpaced other cryptocurrencies in terms of price movements. As a result, the performance of many altcoins has been secondary to Bitcoin’s leadership in both upward trends and downward corrections.

Will alts later catch Bitcoin?

One method to interpret the market trend related to seasons using a technical indicator is by examining the TOTAL2 chart. This graph represents the aggregate market capitalization of all cryptocurrencies present in the market aside from Bitcoin.

When this indicator leaps, it lends support to the idea that an altcoin season may be approaching. However, a significant drop indicates the opposite.

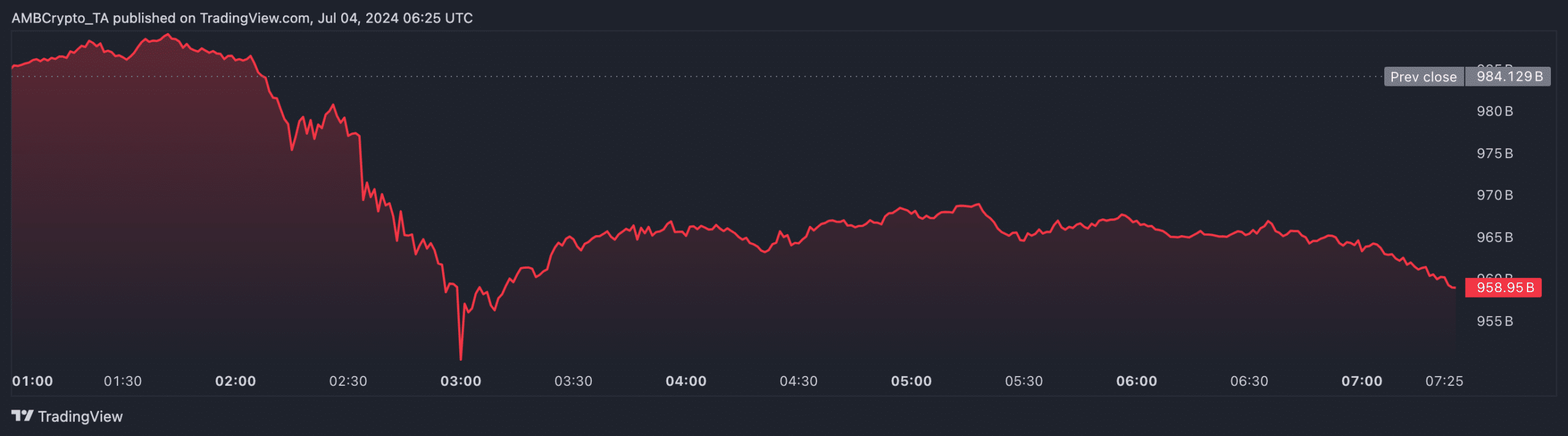

As an analyst, I’ve examined the data from AMBCrypto and found that the TOTAL2 market capitalization stood at a staggering $960.23 billion when I checked the latest figures. This represents a significant increase of 25.63% compared to six months ago. However, the last month has been quite challenging for this market. The past 30 days have shown a downward trend that continued into the previous 24 hours.

Over the past month, the value of this asset has decreased by 15.08%. Additionally, within the last week, there’s been a drop of 4.13%. Given these recent trends, it seems plausible that altcoins may not find relief in the near future.

As a researcher studying this market, I can share that if the value continues to climb and approaches the $1 trillion market capitalization, there’s an increased likelihood that comprehensive price rises could ensue.

Memes are the ones to lead, some analysts say

Currently, various analysts have weighed in on the potential performance of these cryptocurrencies. For instance, Murad, a crypto analyst at X, expressed his viewpoint that memecoins could spearhead the rally during the altcoin season if it occurs.

In his post, Murad noted that,

As a researcher studying the cryptocurrency market trends, I have observed that during an altcoin season, when the prices of alternative coins rise significantly against Bitcoin, meme coins tend to perform exceptionally well. On the other hand, if an altcoin season does not materialize, the meme coins’ performance may still outshine that of other altcoins due to their unique appeal and social media hype.

As a crypto investor, I can’t help but acknowledge the validity of certain opinions in light of this year’s cryptocurrency market performance. The meme coins such as PEPE, BONK, and FLOKI have surprised many, including myself, by outperforming numerous other altcoins.

As an analyst, I would say: If the market recovers and Murad’s current investment position holds, then the validity of his strategy will be confirmed. Concerning Mister Crypto, he kept his preference undisclosed in the discussion.

On the 1st of July, I noticed a significant drop in crypto prices. This downturn presented an uncommon chance for me to add more coins to my portfolio at lower costs.

“In all sincerity, numerous Altcoins present attractive buying opportunities at the moment. Many are predicted to increase by thirty times their current value.”

ETH’s role has not come into play

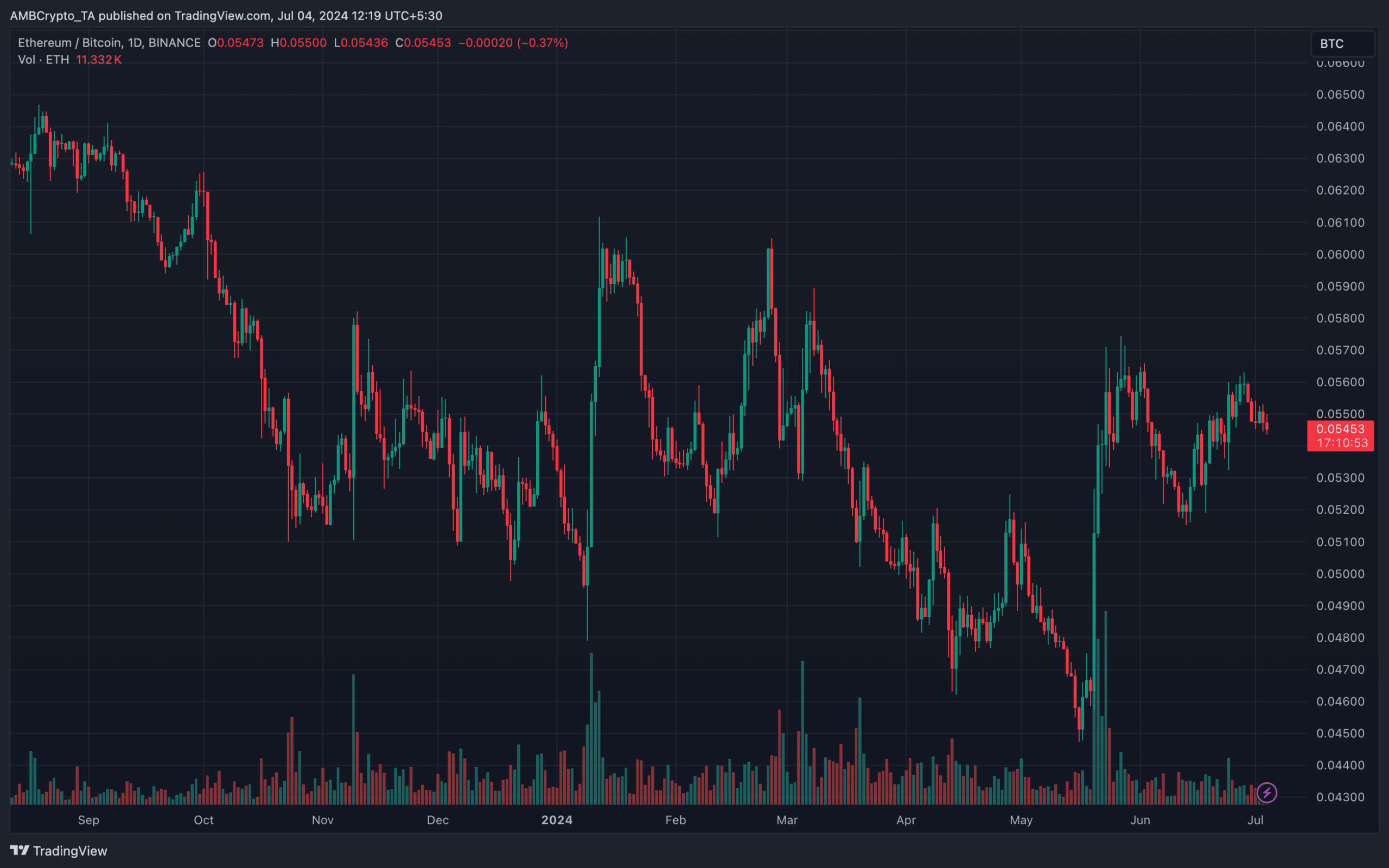

Although these forecasts are contingent upon market fluctuations, some investors examined the Ethereum-Bitcoin (ETH/BTC) chart to validate their perspectives. This graph indicates whether Bitcoin is surpassing Ethereum in performance or if Ethereum is leading the way.

In historical terms, when Ethereum outperforms Bitcoin, it often creates favorable conditions for altcoins to surpass Bitcoin’s gains. Conversely, if Bitcoin dominates, altcoin seasons tend to be less frequent or less pronounced.

As an analyst, I’ve noticed at the current moment that the Ethereum-to-Bitcoin (ETH/BTC) chart has dipped to a level of 0.054. This represents a 1.62% decrease over the past week. Previously, the price hovered around 0.056.

As an analyst, I would interpret the current exchange rate between Ethereum (ETH) and Bitcoin (BTC) as meaning that one ETH is equivalent to purchasing just 0.054 BTC. Should this ratio improve in the future, we might then be entering a period favorable for altcoins. Conversely, if this trend fails to reverse, the onset of the market’s next phase could potentially be postponed.

During this period, the larger cryptocurrency market might hold off on making significant moves until spot Ethereum Exchange-Traded Funds (ETFs) become available for trading, potentially signaling the start of an altcoin rally.

Realistic or not, here’s ETH’s market cap in BTC terms

As a researcher, I’ve noticed a shift in the anticipated starting date for the event. While it was previously believed that it would begin on the 2nd of July, there are now stronger indications suggesting that it will commence around the 8th instead.

Should Ethereum mimic Bitcoin’s trajectory following its approval in January, the outcome could bode well for the altcoin market. Conversely, if Ethereum fails to follow suit, the anticipated altcoin rally may still be on hold.

Read More

2024-07-05 02:16