- Altcoin season has captured market attention as Bitcoin breaks past $64K.

- However, for this season to fully materialize, several conditions must align.

As a researcher with over a decade of experience in the cryptocurrency market, I have witnessed numerous bull runs and bear markets, and I can confidently say that patience is a virtue when it comes to altcoin seasons. While Bitcoin’s recent surge above $64K has sparked excitement about an impending altcoin season, I believe we may need to exercise some restraint and wait for more signs before jumping in.

When Bitcoin nears its market peak, several alternative cryptocurrencies (altcoins) tend to increase significantly. This rise is mainly fueled by investors who aim to spread their investments across multiple assets in order to reduce risk.

Due to this development, there’s a lot of excitement in the cryptocurrency world about the potential upcoming altcoin rally. Many coins are expected to leverage the current trend and often surpass Bitcoin’s performance.

Altcoin season may have to wait a little longer

In theory, the altcoin season starts when approximately 37 out of the top 50 alternative cryptocurrencies show better performance than Bitcoin over a 90-day period.

At present, the graph indicates that 17 out of the top 50 alternative cryptocurrencies are performing better than Bitcoin, with SUI taking the lead by soaring an impressive 155%. Normally, these altcoins follow Bitcoin’s trend, peaking at local highs when the overall sentiment towards Bitcoin is optimistic.

Investor confidence in Bitcoin frequently impacts the market for alternative cryptocurrencies, leading many traders to pursue potentially higher yields by investing in these non-mainstream assets.

Source : Bitcoin Magazine Pro

Previously, periods when the number of years since Bitcoin’s creation was halved have often signaled the start of a phase of accumulation, which is usually preceded by a peak or bubble in its value.

Nevertheless, a substantial buildup has yet to occur, which is crucial for predicting an altcoin boom period. Consequently, if Bitcoin does not retest its All-Time High (ATH), altcoins might only experience temporary profits.

A lot hinges on Bitcoin

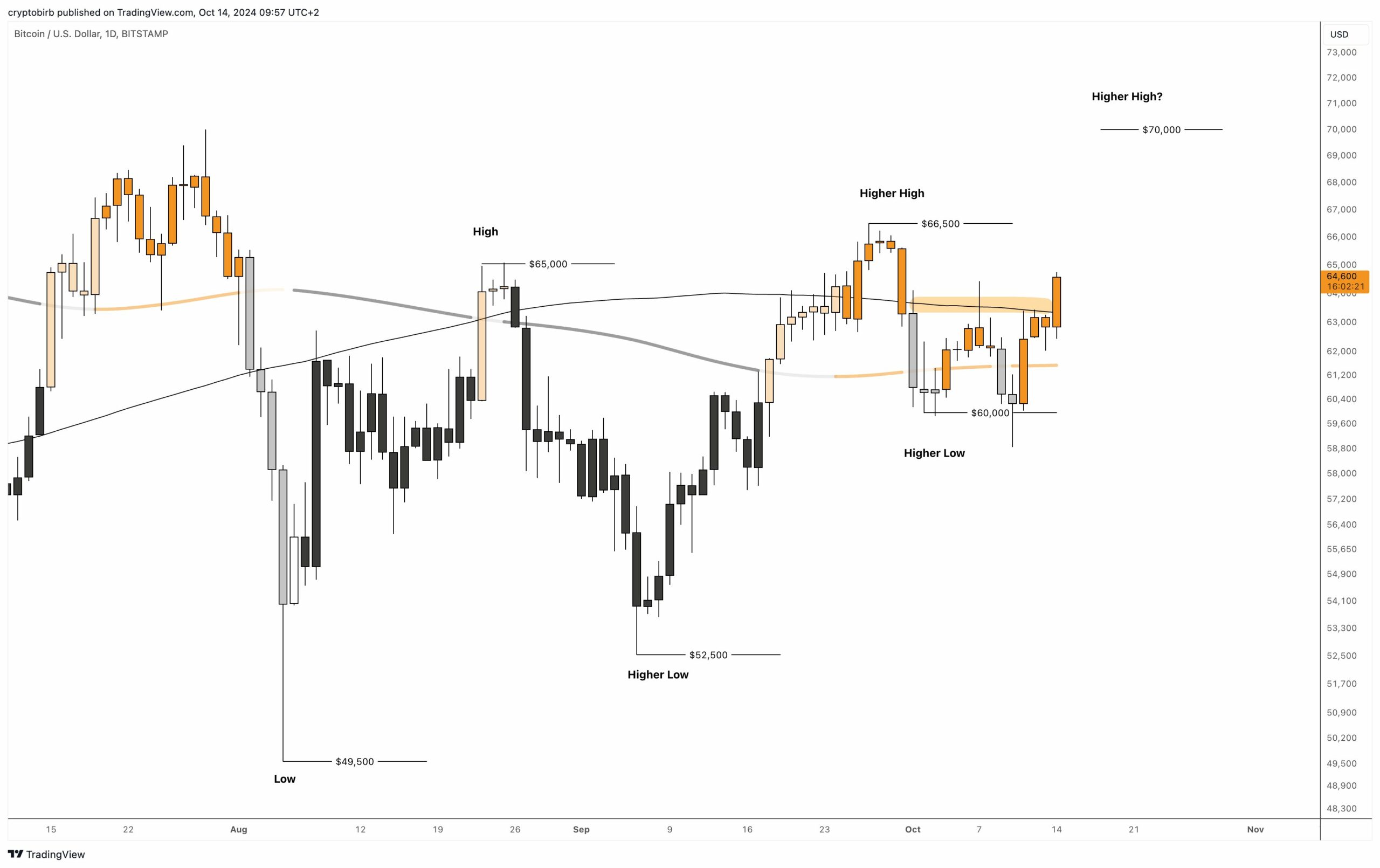

Instead of the common assumption, AMBCrypto proposes that Bitcoin could experience a drop in price, potentially falling under $64K, if this level doesn’t transform into a supportive base instead.

This adjustment could mark the fourth possible retreat since Bitcoin last hit the $66K peak. It is only when we break past this level that the opportunity to reach a new record high becomes more likely.

Source : TradingView

To summarize, the conditions that lead to an altcoin surge are often influenced by Bitcoin’s initial price trend. When Bitcoin starts picking up speed in its price movement, altcoins tend to follow a similar pattern.

In contrast, it’s common for many alternative cryptocurrencies (altcoins) to record greater daily increases relative to Bitcoin by mid-cycle. If this trend continues and multiple altcoins maintain their strength during the expected Bitcoin adjustment, it could mark the onset of an altcoin rally.

In other words, keeping a close eye on altcoins is essential during this possible downturn since they might experience substantial growth alongside Bitcoin. This could potentially signal the approach of another altcoin boom by the end of the upcoming cycle.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

2024-10-15 09:11