Darling, if you’ve been keeping one eye on the crypto markets while sipping your martini, you’ll have noticed the rather dramatic tumble on Friday. Selling pressure, my dear, was as relentless as a society hostess at a cocktail party. Bitcoin, that grande dame of the digital realm, plummeted nearly 9%, flirting briefly with the $65,000 mark, while Ethereum, poor thing, slipped below $2,000. The ripple effect, as inevitable as gossip at a soiree, sent several large-cap and mid-cap altcoins into double-digit despair.

This altcoin crash, my loves, was no gradual affair. Oh no, it was more like a dramatic exit from a dull dinner party. Once those intraday supports failed, liquidations cascaded across derivatives markets like champagne spilling on a white carpet. Liquidity vanished faster than a scandalous rumor, bids retreated, and volatility expanded in a manner one might expect during the final act of a tragic opera rather than the opening scene of a new bearish drama. With sentiment as sour as a poorly mixed cocktail and leverage fleeing the scene, the question on everyone’s lips is: Are we witnessing the exhaustion of this selloff, or merely another act in this financial farce?

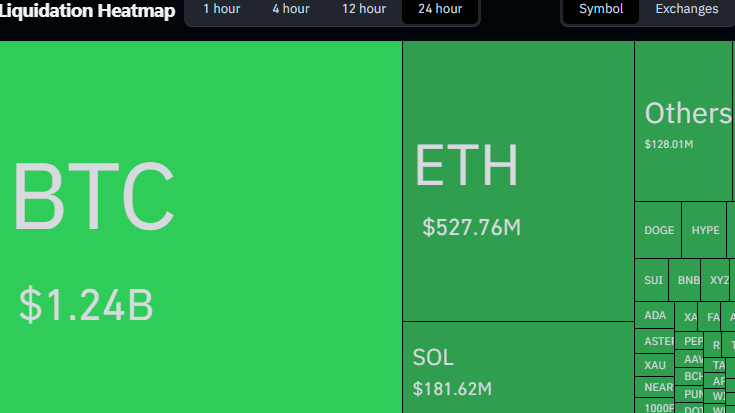

Liquidations, Darling, Are the Talk of the Town

The scale of forced selling, my dears, is as staggering as a socialite’s shopping bill. According to derivatives data, total liquidations surpassed $2.59 billion in the past 24 hours-one of the most spectacular single-day wipeouts in recent memory. Bitcoin, ever the diva, led the charge with $1.34 billion in liquidations, triggered once the price dipped below the $67,000 zone. Ethereum followed suit with $562 million, while altcoins collectively absorbed over $1.1 billion in liquidations. Solana, poor darling, saw nearly $187 million, with the remainder scattered across high-beta Layer-1s, DeFi tokens, and speculative mid-caps. This distribution, my friends, is as telling as a raised eyebrow at a dinner party. In past corrections, Bitcoin typically bore the brunt of leverage risk. This time, the speculative frenzy had spread far and wide, like a rumor at a garden party.

Once prices turned, leverage exited with the speed of a guest avoiding an awkward conversation. Historically, liquidation-heavy sessions of this magnitude tend to reset market structure by flushing out excess risk rather than heralding prolonged downturns. It’s all rather dramatic, isn’t it?

Extreme Fear, Darling, Is All the Rage

Market sentiment, my darlings, is as dire as a raincloud at a garden party. The Crypto Fear & Greed Index has plummeted to 5, firmly planting sentiment in “Extreme Fear” territory. Readings below 10, I must tell you, have appeared only a handful of times across past cycles-2018, March 2020, and late 2022. In each instance, such levels reflected emotional capitulation rather than early-stage bearish conviction. While prices did not reverse immediately in every case, downside momentum typically slowed as panic peaked. It’s all rather predictable, really.

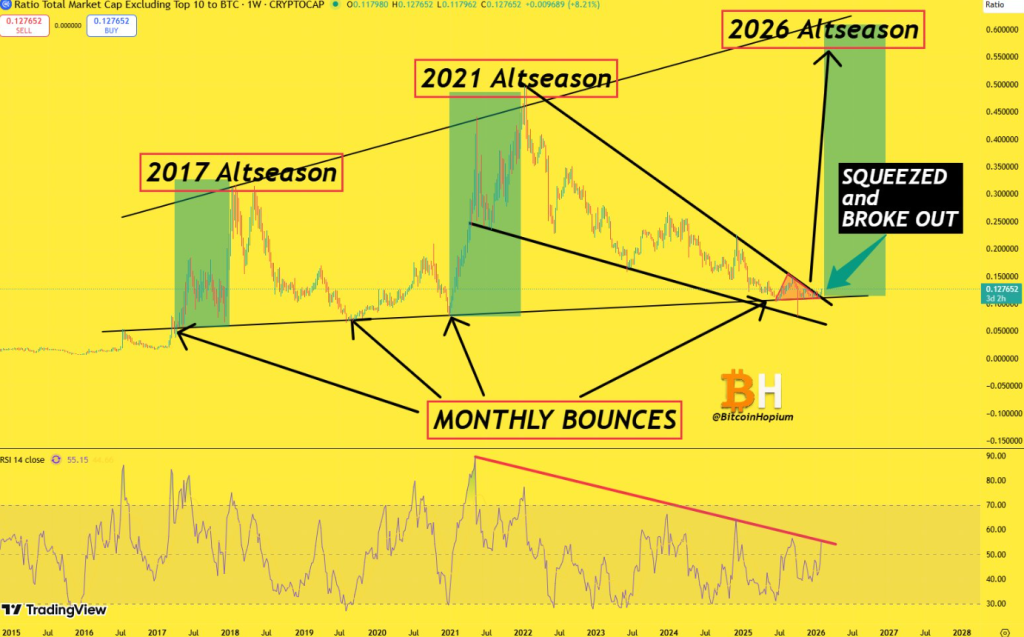

Altcoin Crash: A Historical Encore

Despite the severity of the ongoing altcoin crash, long-term structure paints a more nuanced picture. Historical market-cap trends show that altcoin cycles often experience deep compression phases before meaningful rotation begins. In 2017, 2021, and following the 2022 bear market, altcoins endured extended periods of underperformance marked by repeated breakdown fears, declining relative strength, and sharp monthly selloffs. These phases typically preceded strong upside expansions once capital rotation resumed.

Current charts reflect a similar pattern. Altcoin market capitalization remains locked in a long-term consolidation range, with downside moves repeatedly attracting demand near historical support zones. While this does not confirm an immediate altcoin season, it suggests the present altcoin crash resembles structural compression rather than outright collapse. Notably, these transitions have historically occurred during periods of extreme fear conditions that closely mirror the current environment.

Final Musings

The altcoin crash, my dears, appears driven more by liquidation pressure than fresh selling. With sentiment near extreme fear and leverage largely flushed, downside momentum may be slowing. Volatility can persist, but the data suggests the market is closer to stabilization than collapse. Caution remains key, yet conditions for a gradual base may be forming.

FAQs

Why is the crypto market crashing today?

Crypto prices fell as key supports broke, triggering mass liquidations. High leverage, thin liquidity, and panic selling accelerated losses across coins.

Is this crypto crash a sign of a new bear market?

Not necessarily. Data suggests forced liquidations drove the drop, which often marks late-stage selloffs rather than the start of long bear markets.

What do high crypto liquidations mean for prices?

Large liquidations usually flush excess leverage. This can reduce selling pressure and help prices stabilize once panic-driven trades are cleared.

Should investors buy altcoins during a crash?

Crashes can create long-term opportunities, but timing is risky. Many investors wait for volatility to cool and price action to stabilize.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Werewolf Movies (October 2025)

- These Are the 10 Best Stephen King Movies of All Time

- 10 Movies That Were Secretly Sequels

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- USD JPY PREDICTION

2026-02-06 16:32