- Altcoin funding rate has hit a 9-month high, making the recent 3-month pump leverage-driven

- In the current market context, long liquidations could be triggered, keeping investors on the edge

As an experienced crypto investor who has weathered numerous market cycles and learned from my fair share of mistakes, I can’t help but feel a mix of excitement and trepidation as I watch the recent altcoin rally unfold. On one hand, it’s thrilling to see promising projects like Hedera (HBAR) surge by over 500%, signaling potential for massive returns. However, I can’t shake off the nagging feeling that we might be in for a correction soon.

Over the last 30 days, a select pool of altcoins have significantly outperformed Bitcoin, with Hedera (HBAR) alone posting an impressive 500%+ surge. While the current altcoin rally is significant, caution is necessary.

Due to the significant increase in monthly funding rates for perpetual futures (now at 4%-6%), it suggests that a higher level of leveraging is being employed.

As an analyst, I find it crucial to highlight that past trends indicate swift price escalations and increasing funding rates typically pave the way for market corrections. To clarify, following a comparable spike in January, we experienced a 15% correction.

Currently, while a chain reaction of forced liquidations isn’t imminent, market turbulence is predicted to continue. It’s crucial for the market to handle high amounts of borrowed capital with caution.

It’s wise for investors to stay vigilant since corrections might happen, particularly when the overall market situation or investor attitudes change.

The high altcoin funding rates could cost millions

Over a period of 30 days, the cost for maintaining leveraged positions in perpetual futures significantly increased, as shown by CoinGlass data, with investors in a bullish market having to pay between 4% and 6% each month.

Source : Coinglass

During robust market upswings, these expenses might seem manageable. However, should the prices remain stable or drop, they have the potential to significantly diminish profits over time. Such costs can even test the patience of seasoned traders, as they may find it challenging to sustain these high fees indefinitely.

It’s becoming apparent that altcoins are increasingly being recognized as a distinct investment category, leading to continued movement in low-capitalization alternatives even during market downturns. This segregation seems logical, considering their affordability and the allure of greater potential returns associated with higher risk.

It’s worth mentioning that in the last month, two well-known altcoins, XRP and Cardano [ADA], have experienced substantial growth, jumping approximately 300% each and returning above the $1 mark. However, this rise makes them more susceptible to abrupt fluctuations.

Upon examining the enclosed graph, it appears that while the funding rates for ADA and XRP currently surpass levels seen over the past six months, they haven’t yet reached their 12-month peaks. Given historical trends, this could indicate that there might still be potential for these altcoins to experience more growth fueled by speculative activity.

Indeed, it’s been unveiled that an altcoin rally is underway, as approximately 40 altcoins have shown better performance than Bitcoin in the latest findings.

With their funding rates taken into account, some might choose to retreat, while others could see it as a chance to profit from the continuing upward trend in the market.

Tight liquidity could present a major challenge

In active or fluid markets, there’s an abundant availability of a specific asset, along with a strong interest from both buyers and sellers. This makes it simpler to connect those looking to buy with those ready to sell.

Under the present market circumstances, there’s a general trend for liquidity to be concentrated in Bitcoin as investors adjust their forecasts and seek to pinpoint its upcoming resistance level.

For altcoins, it’s tough to establish a strong user community, which can be exploited by bears through the use of high-leverage strategies to instigate a ‘short squeeze’.

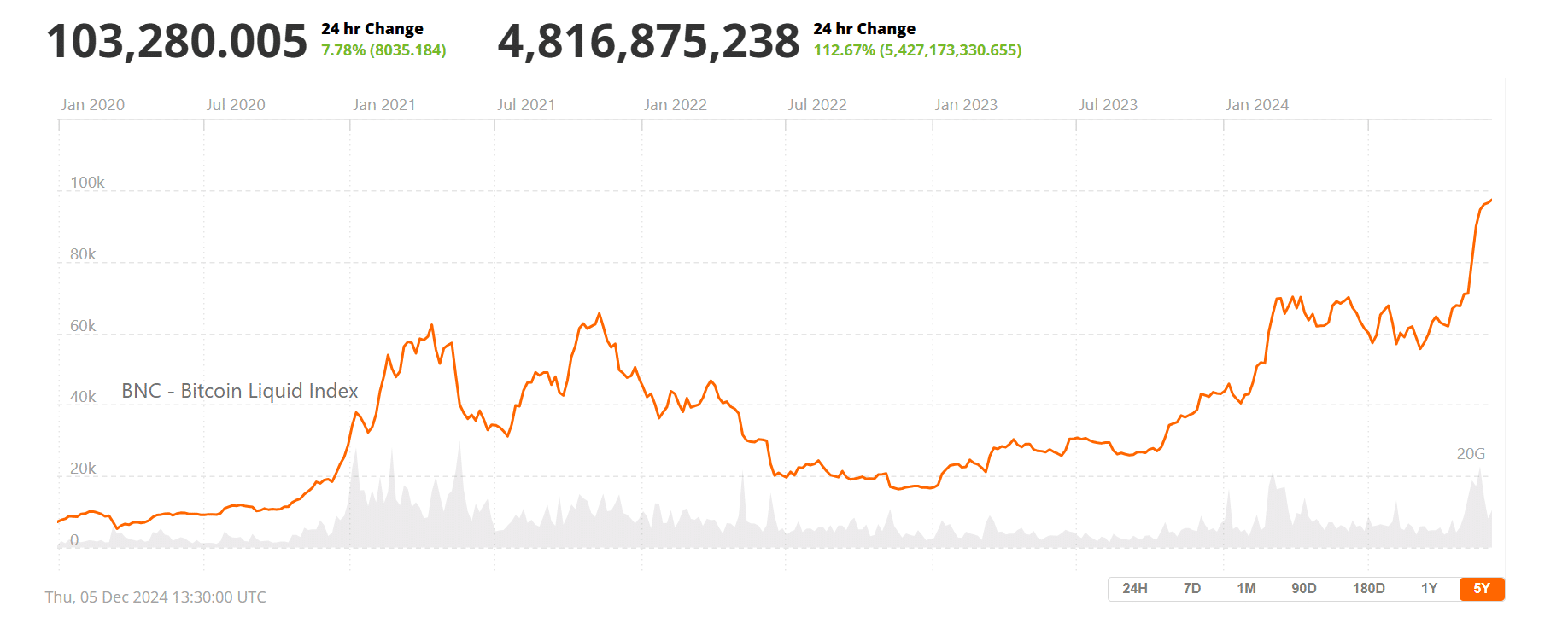

Source : BraveNew.Com

From the graph provided, it’s clear that Bitcoin’s Liquidity Index attained its highest point in five years when it surpassed $100k. This remarkable increase was followed by a 8% surge within a single day.

Read Ripple’s [XRP] Price Prediction 2024-2025

In simpler terms, it appears that many investors have been moving their money into Bitcoin instead of other cryptocurrencies like XRP during this time frame, which has resulted in a decrease of around 6% for XRP. This shift in investment could indicate that liquidity, or easily accessible funds, is being directed more towards Bitcoin.

In other words, it’s important to exercise caution as this trend continues, because prolonged high funding rates might lead to a chain reaction of liquidations, known as a long-liquidation cascade. This could be especially problematic if short-sellers control the derivatives market.

Read More

2024-12-06 12:08