Key Takeaways

As a seasoned observer of the ever-evolving world of cryptocurrencies and blockchain technology, I find myself both captivated and intrigued by the trends and predictions outlined in this comprehensive analysis. With over two decades of experience in the tech industry under my belt, I’ve witnessed countless transformations – but none quite as rapid and groundbreaking as the rise of digital assets.

Listed below are the key takeaways for the month of December 2024:

Bitcoin Breaks $100K Barrier: A Historic Milestone

- Bitcoin reached an all-time high of $106,496 in December 2024, fueled by institutional inflows totaling $5.5 billion and supportive U.S. regulatory developments.

- Macroeconomic uncertainty and the adoption of the Lightning Network enhanced Bitcoin’s appeal as both a hedge and a utility-driven asset.

Global Regulations Reshape Crypto’s Future

- Proposals for a U.S. national Bitcoin reserve and the appointment of pro-crypto regulators signaled strong governmental support for digital assets.

- Europe’s MiCA rollout set a framework for stablecoins and crypto funds, while Hong Kong expanded its exchange licensing to strengthen compliance.

Institutions vs. Retail: Who’s Leading the Crypto Market?

- AMBCrypto’s survey revealed 57.5% of respondents believe institutions are driving the market, with only 13.6% crediting retail investors.

- While institutional players boosted market trust, 56.4% of respondents raised concerns about crypto becoming too centralized and similar to traditional finance.

Ethereum’s December Highlights: Growth and Preparation for 2025

- Ethereum’s price ranged between $3,500 and $4,000, while staking activity surged to over 34.7 million ETH.

- The upcoming Pectra upgrade promises to enhance scalability, reduce gas fees, and position Ethereum as a leader in DeFi and NFTs.

XRP’s Standout Month: From Stablecoin Launch to Market Volatility

- Ripple’s RLUSD stablecoin launch on December 17 positioned XRP as a leader in compliant digital payments.

- Despite price volatility, XRP’s market activity and institutional adoption highlighted its growing influence in December 2024.

Top Crypto Sectors of December: The Movers and Shakers

- Memecoins: Speculative fervor around Fartcoin and social media hype drove a resurgence in memecoin activity.

- Tokenized Real-World Assets: Institutional adoption propelled RWA tokenization, with on-chain values surpassing $13 billion.

- CBDCs: Global initiatives, including the UK’s and Philippines’ pilots, underscored their role in modernizing financial systems.

NFT Market Rebounds with Record Sales and Trends

- December 2024 saw a sales volume of $757.57 million, led by Pudgy Penguins’ $110.43 million in transactions.

- Blur emerged as the top marketplace, facilitating $589.74 million in trades, while the highest single sale—Uncategorized Ordinals #8760—fetched $7.51 million.

Crypto in 2025: Key Predictions

- Scaling the Future: Layer-2 solutions and multi-chain ecosystems will drive efficiency and scalability across the crypto landscape.

- Real-World Use Cases: DeFi expansion and NFT utility in gaming and metaverse applications will redefine adoption.

- Green Blockchain Initiatives: Energy-efficient blockchains and tokenized carbon credits will gain traction.

- AI and Blockchain Synergy: Projects like Fetch.ai and SingularityNET will drive intelligent, decentralized applications.

Bitcoin Breaches $100K: Ushering in a New Era for Crypto

“December 2024 will likely be known for Bitcoin breaking the significant $100,000 mark, reaching an all-time high of $106,496 on December 16. This achievement underscored Bitcoin’s role as a crucial financial asset, with its growth fueled by institutional interest, economic factors, and favorable regulation.

Key Drivers of Bitcoin’s Rally

Institutional Inflows

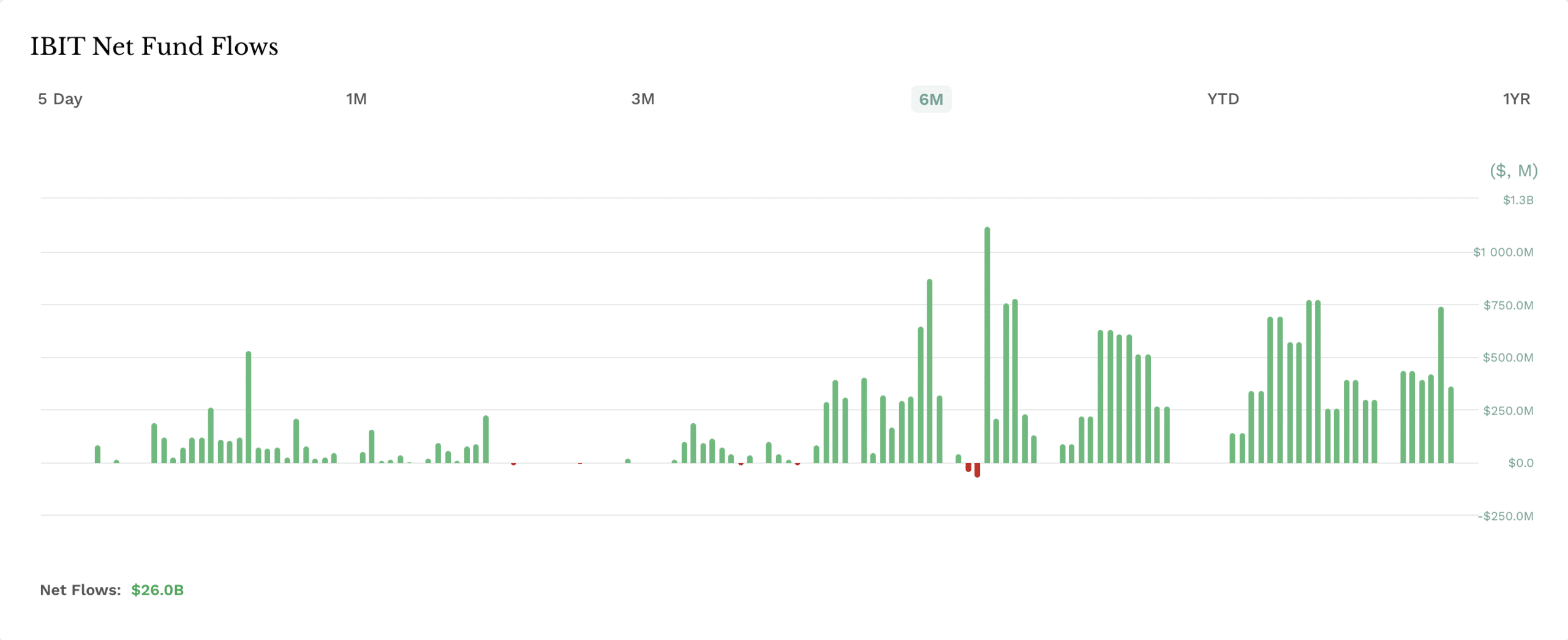

- In the first half of December 2024, Bitcoin ETFs attracted approximately $5.5 billion in inflows, reflecting heightened institutional interest as Bitcoin reached new all-time highs.

- BlackRock’s iShares Bitcoin Trust (IBIT) led these inflows, securing nearly $4.6 billion through mid-December, underscoring its dominance in the market.

Regulatory Support

- The U.S. government’s plans to establish a national Bitcoin reserve and appoint crypto-friendly officials under President Trump created a favorable environment for adoption.

- Globally, jurisdictions like Hong Kong approved new exchange licenses, further legitimizing Bitcoin as a global asset.

Macroeconomic Factors

- Inflationary pressures and geopolitical instability, particularly in Eastern Europe and the Middle East, drove some investors to view Bitcoin as a hedge against uncertainty.

- Gold also reaching record highs reinforced its status as the traditional safe-haven asset, while Bitcoin’s role as a “digital gold” alternative resonated strongly with risk-tolerant investors seeking diversification.

- Distinctive factors, such as Bitcoin’s volatility and unique market behavior, continue to set it apart from gold, limiting its role as a direct hedge against macroeconomic risks.

Technological Advancements

- Adoption of the Lightning Network for scalability and microtransactions enhanced Bitcoin’s long-term utility beyond its store-of-value narrative.

Technical Analysis: Breaking New Ground

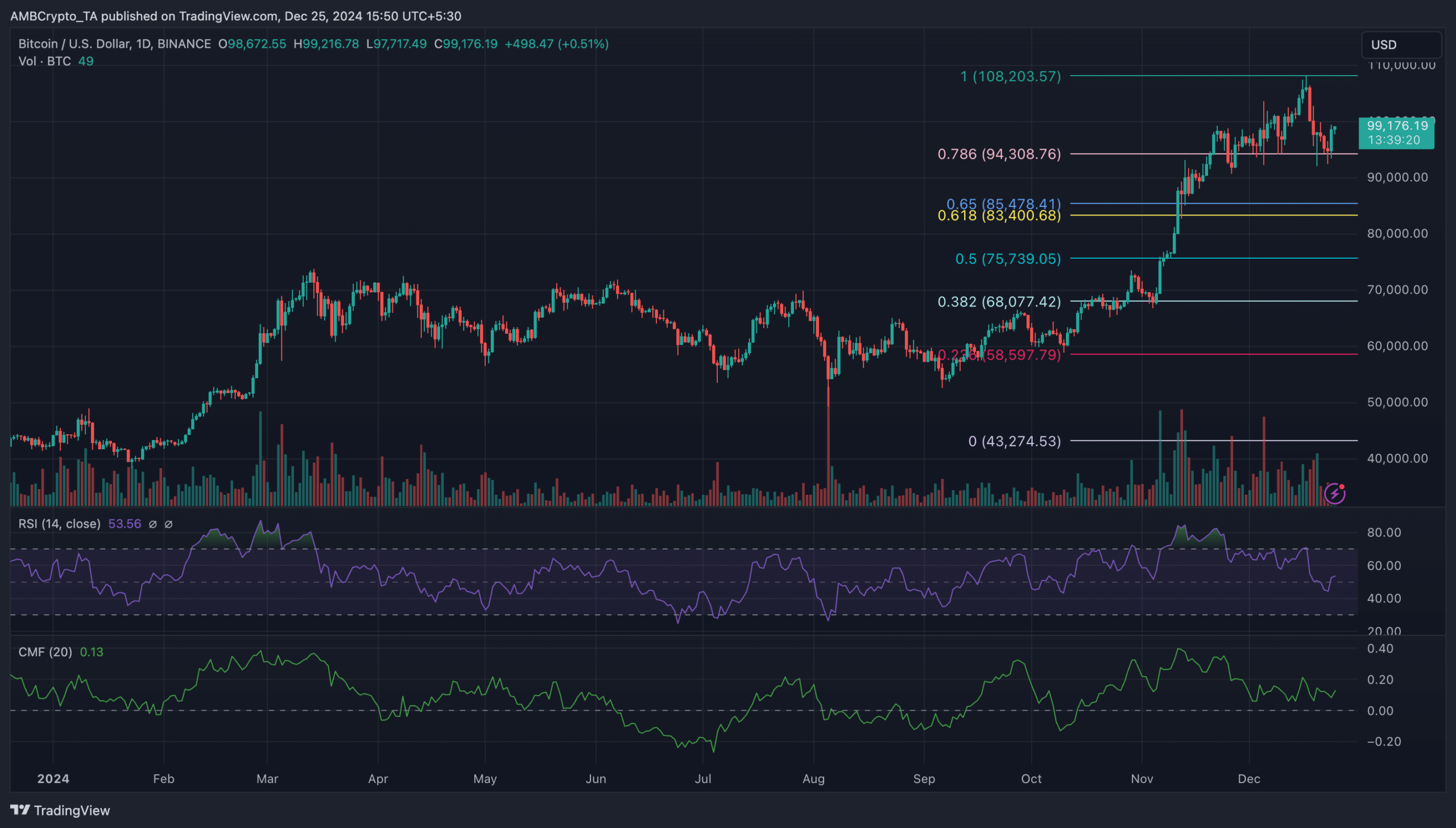

Bullish Breakout

- Bitcoin broke past its $98,000 resistance level in early December, signaling a strong continuation of its bull cycle. Analysts identified $92,000 as a key support level for potential pullbacks.

- A flagpole pattern on Bitcoin’s weekly chart suggests further upside, with short-term targets set between $110,000 and $115,000.

Key Metrics

- Whale Activity: Wallets holding over 10,000 BTC exhibited increased profit-taking behavior above the $100,000 mark.

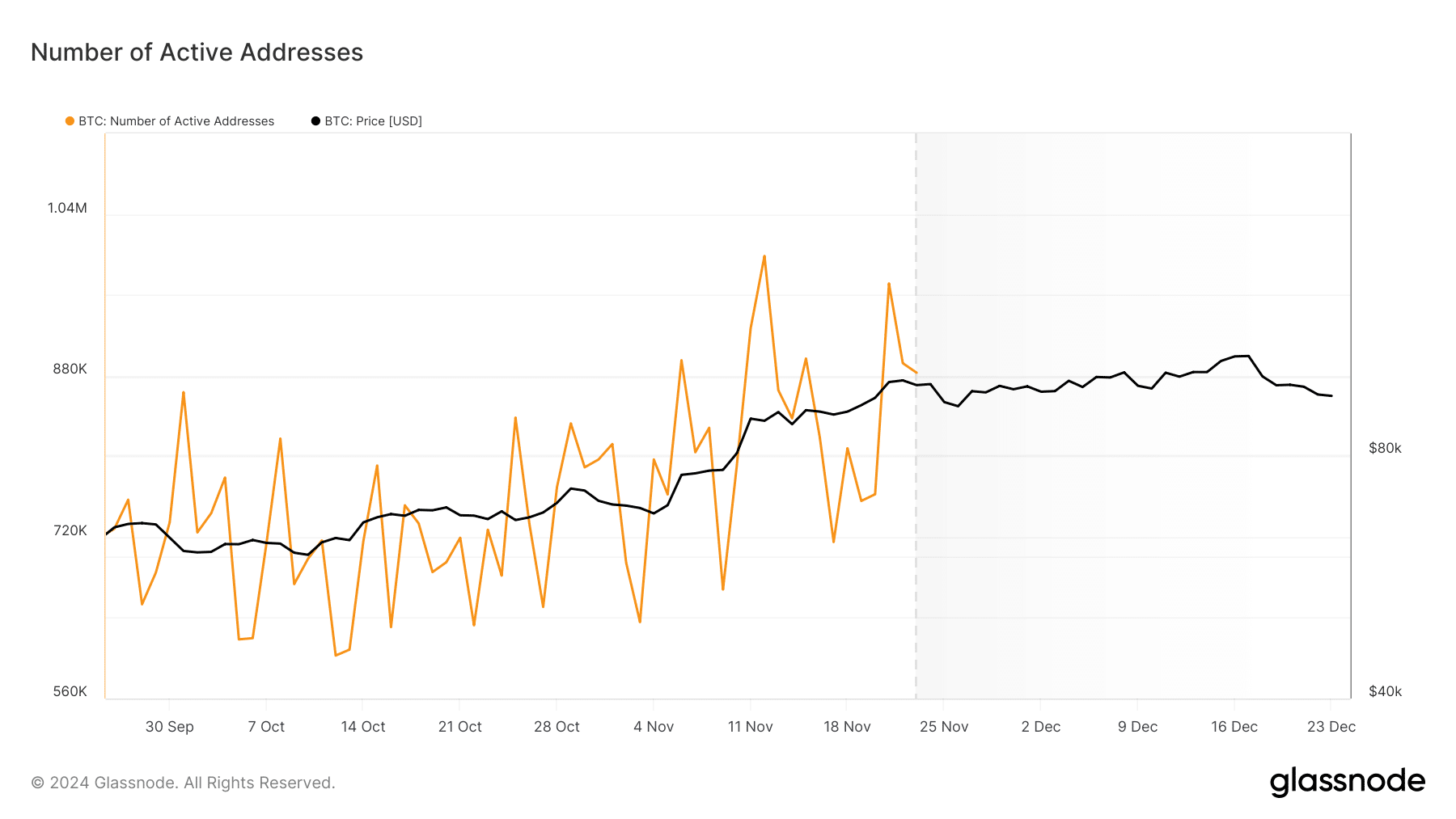

- Active Addresses: The number of active Bitcoin addresses in December 2024 fluctuated between 700K and 1M daily, reflecting stabilized activity levels after the upward trend observed in November.

Volume Trends

- Trading volumes on major exchanges like Binance and Coinbase increased significantly compared to November, reflecting heightened activity among retail and institutional players.

Market Sentiment: Balancing Optimism and Caution

Investor feelings became optimistic in December, showing a clear tilt towards “exuberance” as Bitcoin surpassed $100,000. Yet, a note of caution surfaced as:

- Protective put options surged, indicating that some institutional players were hedging against potential corrections.

- Perpetual funding rates on major exchanges remained positive, signaling continued optimism among traders despite short-term risks.

Comparative Analysis: Bitcoin vs. Traditional Assets

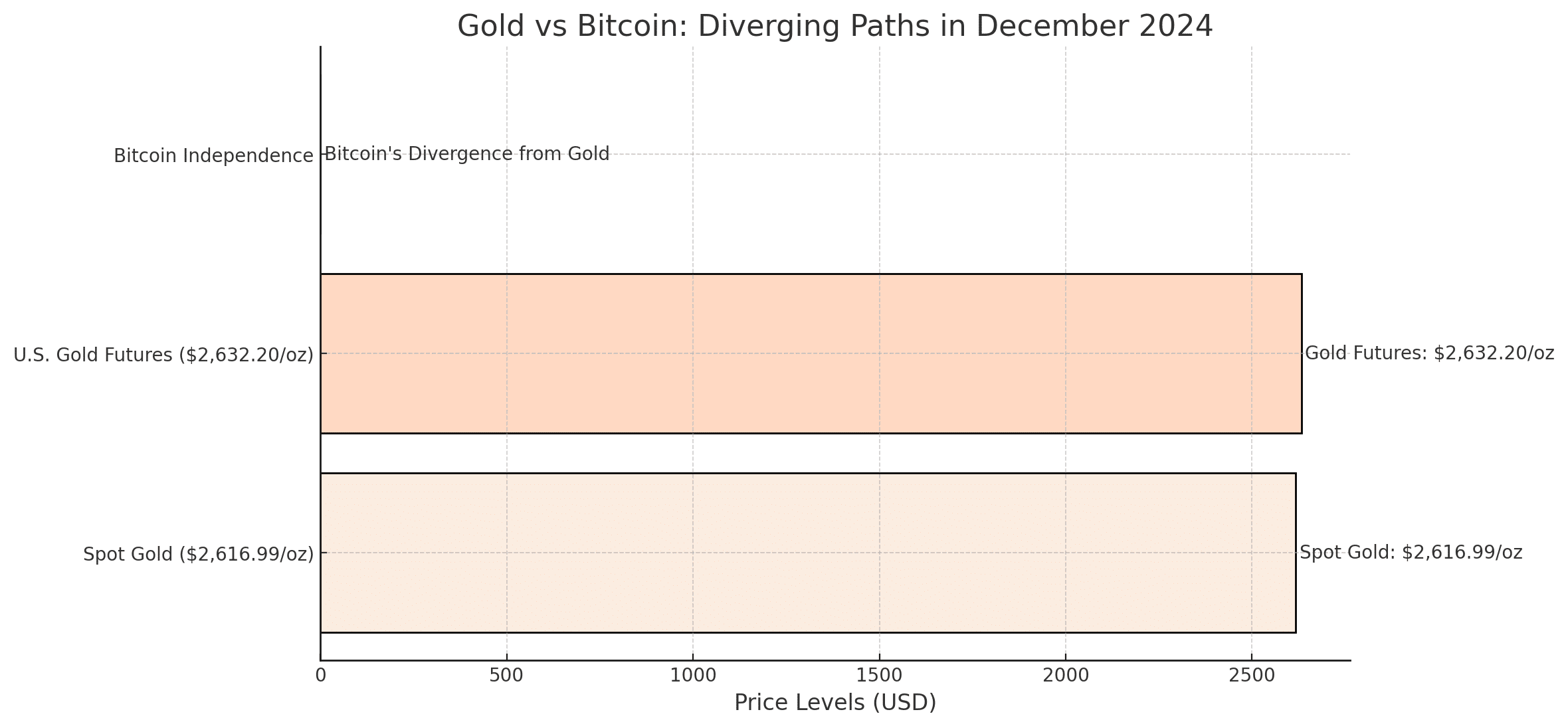

- Gold: Bitcoin’s December movements coincided with spot gold reaching $2,616.99 per ounce and U.S. gold futures climbing to $2,632.20, nearing record highs. Despite these parallel gains, their correlation weakened further, underscoring Bitcoin’s growing independence as a distinct asset class, diverging from traditional safe-haven assets like gold.

Gold vs Bitcoin

- S&P 500: S&P 500: Bitcoin’s 6% decline in December contrasted with the S&P 500’s 0.17% rise, reflecting its inherent volatility despite its reputation as a high-growth asset over the long term.

Looking Ahead: Sustainability of the Rally

Opportunities

- Continued ETF inflows and corporate adoption are driving demand. Some analysts predict Bitcoin could challenge $115,000 in early 2025, contingent on macroeconomic conditions.

- Advancements like the Lightning Network and expanding payment integrations are enhancing Bitcoin’s scalability and utility.

Risks

- Profit-taking by whales and elevated open interest levels in Bitcoin futures may heighten short-term volatility.

- Regulatory scrutiny, particularly in U.S. and European markets, could influence adoption and investor sentiment.

Reaching over $100,000 for Bitcoin signifies its transformation from a risky investment into an established financial tool. The surge in value demonstrates increasing acceptance and institutional attention. However, its longevity depends on finding equilibrium among regulatory changes, technological advancements, and market fluctuations. As we move closer to 2025, Bitcoin’s impact on the global financial system is set to expand even more.

Shaping the Rules: Key Global Crypto Regulatory Updates

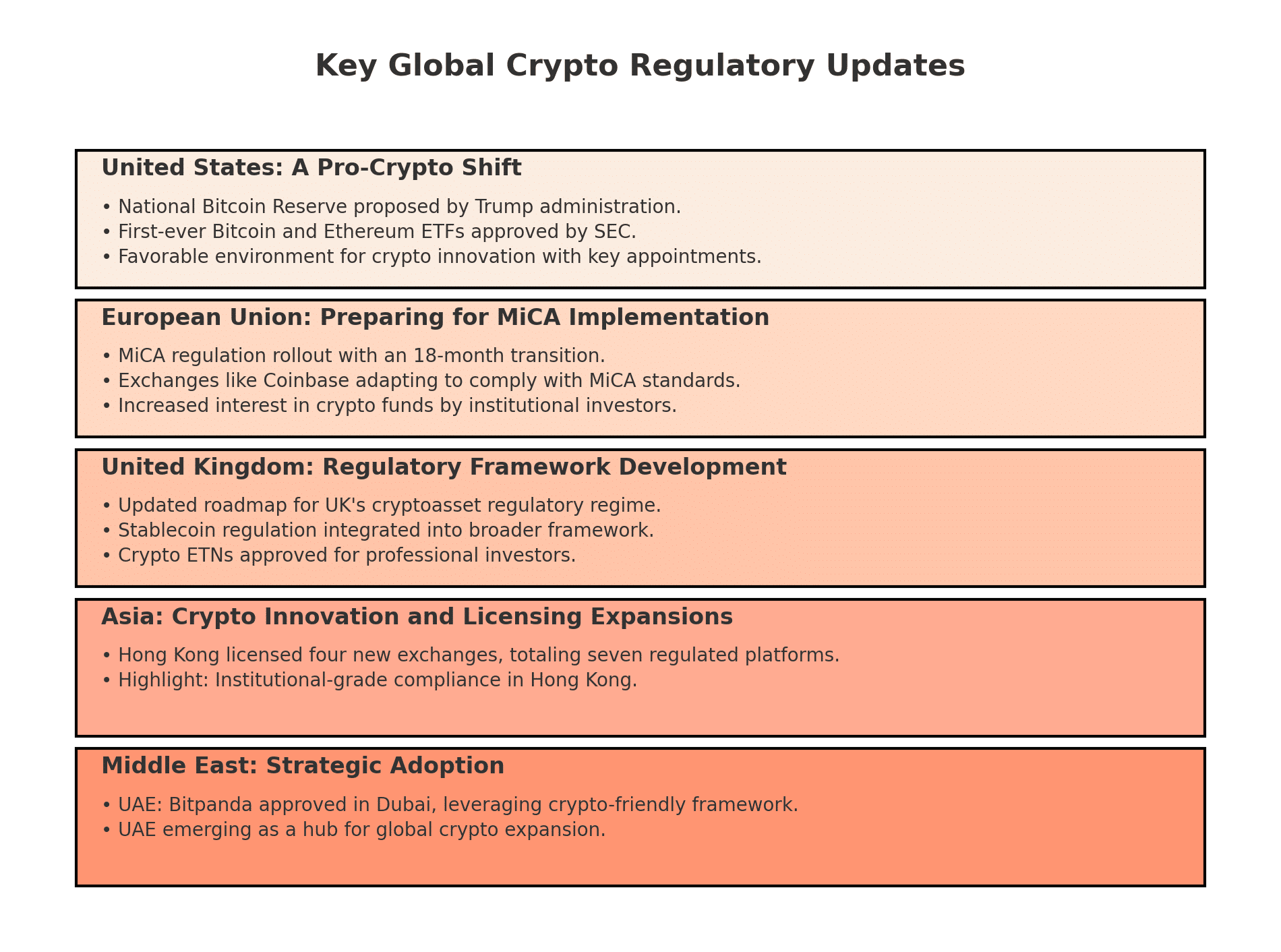

Key global crypto regulatory updates

In December 2024, the global regulatory environment for cryptocurrencies took substantial steps forward, characterized by favorable crypto policies, crucial court decisions, and rising institutional investment. These advancements not only boosted investor trust but also underscored the growing recognition of digital currencies as a standard financial sector.

United States: A Pro-Crypto Shift

National Bitcoin Reserve Announcement

- President Trump’s administration has proposed the creation of a national Bitcoin reserve, signaling potential government support for Bitcoin as a strategic asset.

- The administration is considering appointing crypto-friendly officials to key regulatory positions, fostering a favorable environment for innovation.

ETF Approvals and Performance

- The U.S. Securities and Exchange Commission (SEC) approved the first-ever Bitcoin and Ethereum ETFs in December, marking a significant milestone in crypto adoption.

- These approvals are expected to attract substantial inflows, as investors seek regulated exposure to Bitcoin and Ethereum.

European Union: Preparing for MiCA Implementation

MiCA’s Impending Rollout

- The EU’s Markets in Crypto-Assets (MiCA) regulation is set to be adopted in December 2024, with an 18-month transitional period ending in July 2026.

- Major exchanges like Coinbase have announced plans to delist certain stablecoins in the European Economic Area (EEA) by the end of the year to comply with MiCA’s stringent standards related to transparency, liquidity, and consumer protection.

Institutional Adoption

- European asset managers have reported increased interest in crypto funds, driven by growing clarity around MiCA’s operational framework.

United Kingdom: Regulatory Framework Development

Cryptoasset Regulatory Regime

- The UK government and the Financial Conduct Authority (FCA) have updated their roadmap for the UK’s new cryptoasset regulatory regime, with plans to implement the proposals in full.

- Stablecoin regulation will be introduced alongside the broader regulatory regime for cryptoassets, rather than in a two-stage process.

Crypto ETNs

- The FCA has approved professional investor access to crypto Exchange Traded Notes (ETNs), with exchanges like Cboe UK accepting applications for crypto ETNs.

Asia: Crypto Innovation and Licensing Expansions

Hong Kong’s Crypto Licensing Boom:

- Hong Kong’s Securities and Futures Commission approved four more cryptocurrency exchanges in December, bringing the total number of regulated virtual asset trading platforms in the city to seven.

- The newly licensed exchanges include Accumulus GBA Technology, DFX Labs Company, Hong Kong Digital Asset EX, and Thousand Whales Technology, emphasizing institutional-grade compliance.

Middle East: Strategic Adoption

UAE’s Crypto Adoption Initiative:

- European crypto exchange Bitpanda secured in-principle approval in Dubai, choosing the UAE’s forward-thinking regulatory framework as a launchpad for global expansion.

Looking Ahead: Regulatory Prospects for 2025

- As MiCA and U.S. crypto legislation take shape, global players are expected to recalibrate their strategies to ensure compliance and capitalize on institutional opportunities.

- The rising trend of licensing and crypto-friendly frameworks in Asia and the Middle East positions these regions as key hubs for innovation and adoption.

AMBCrypto Survey Reveals: Who’s Driving the Crypto Market – Institutions or Retail Investors?

In the world of cryptocurrencies, large institutional players maintain a strong grip, leaving retail investors struggling to adapt to an ever-changing environment. An intriguing study conducted by AMBCrypto, involving 4,432 participants, offers valuable insights into the complex interactions between these two significant groups and their combined influence on the market in the year 2024.

In the year 2024, institutional investors solidified their leading position within the crypto market, as they were identified by a majority (57.5%) of survey participants as the primary influencers. Retail investors trailed substantially with only 13.6% of the influence, while a significant number (28.9%) thought both investor groups had an equal impact in shaping crypto market trends.

Trust in the Crypto Market: A Confidence Boost

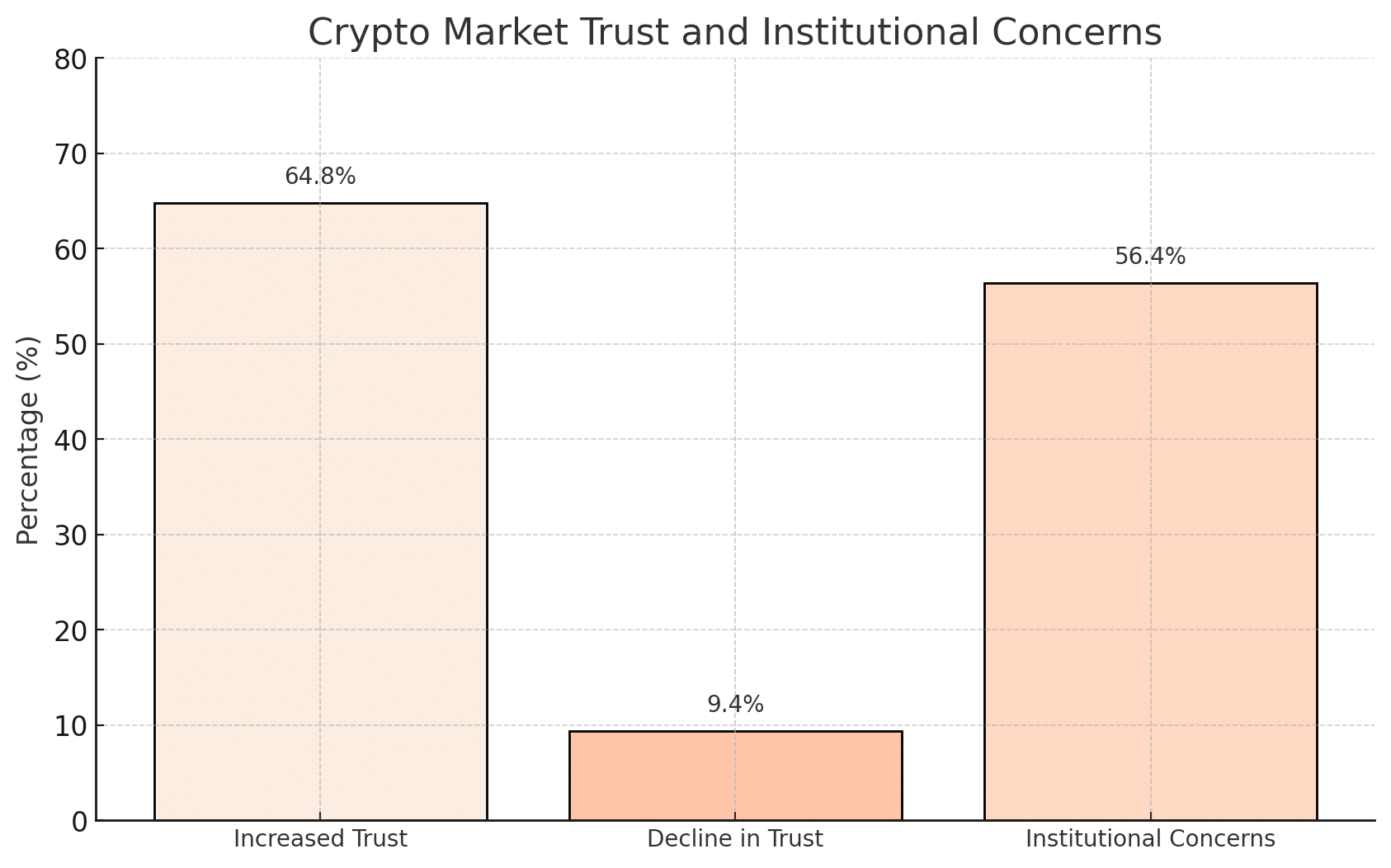

Crypto market trust and institutional concerns

Market perceptions have been significantly reshaped due to the growing influence of institutions. A whopping 64.8% of those surveyed expressed that the presence of institutions noticeably increased their trust levels, largely because of improved legitimacy and stability. On the other hand, only a modest 9.4% indicated a decrease in trust.

Nevertheless, this transition hasn’t been free from apprehensions. In fact, about 56.4% of the surveyed individuals are concerned that the increasing institutional dominance in crypto might lead to it mirroring traditional finance, potentially undermining its core principle of decentralization.

Market Behavior: Liquidity Gains vs. Manipulation Risks

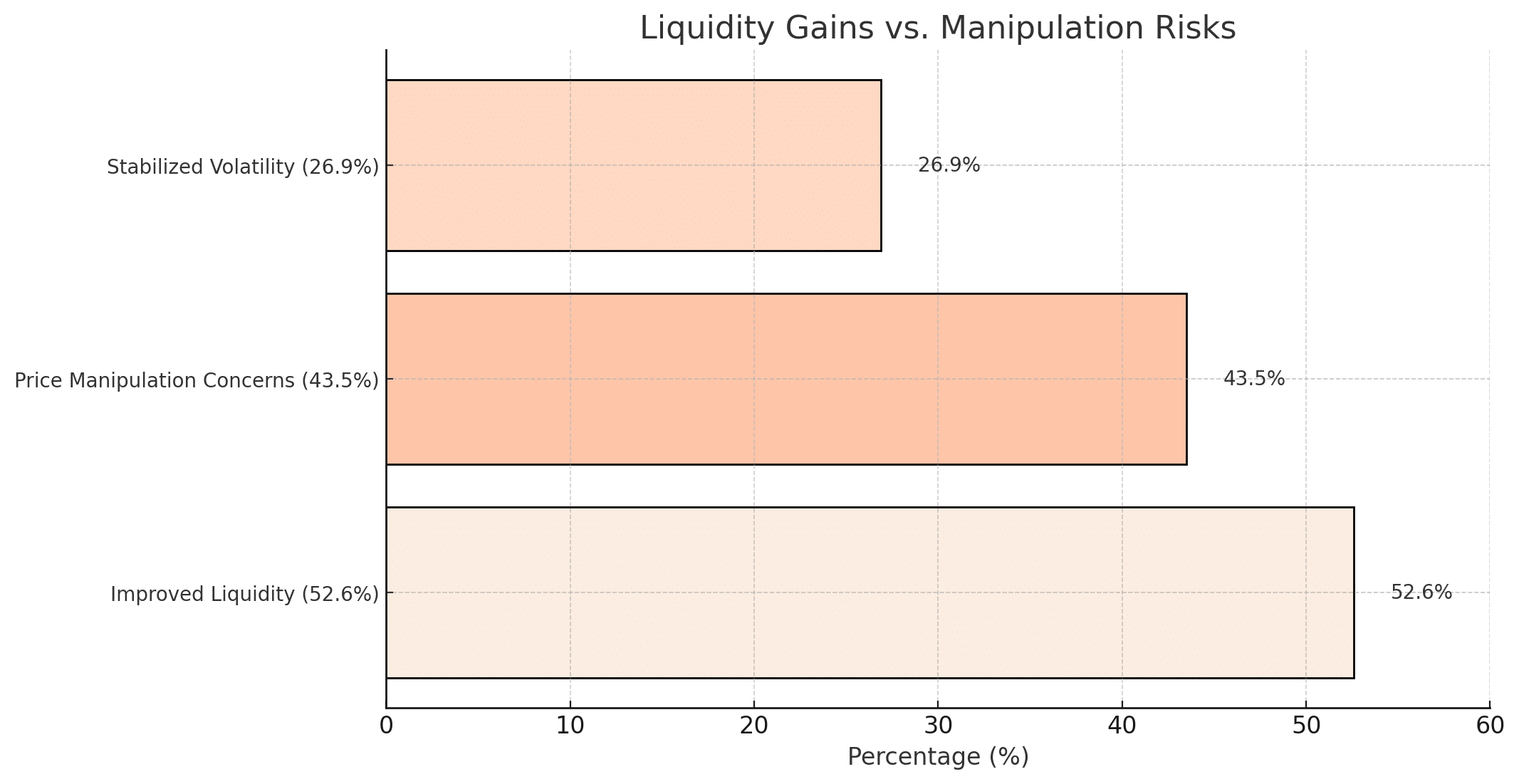

Liquidity gains vs. manipulation risks

Respondents highlighted significant changes in market behavior due to institutional involvement:

- 52.6% reported improved liquidity, citing smoother trades and deeper markets.

- 43.5% raised alarms over price manipulation, pointing to large-scale trades that create unfair advantages.

- A noteworthy 26.9% observed stabilized volatility, reflecting the calming effect of institutional capital on extreme price swings.

Retail Investors: Resilience Amidst Challenges

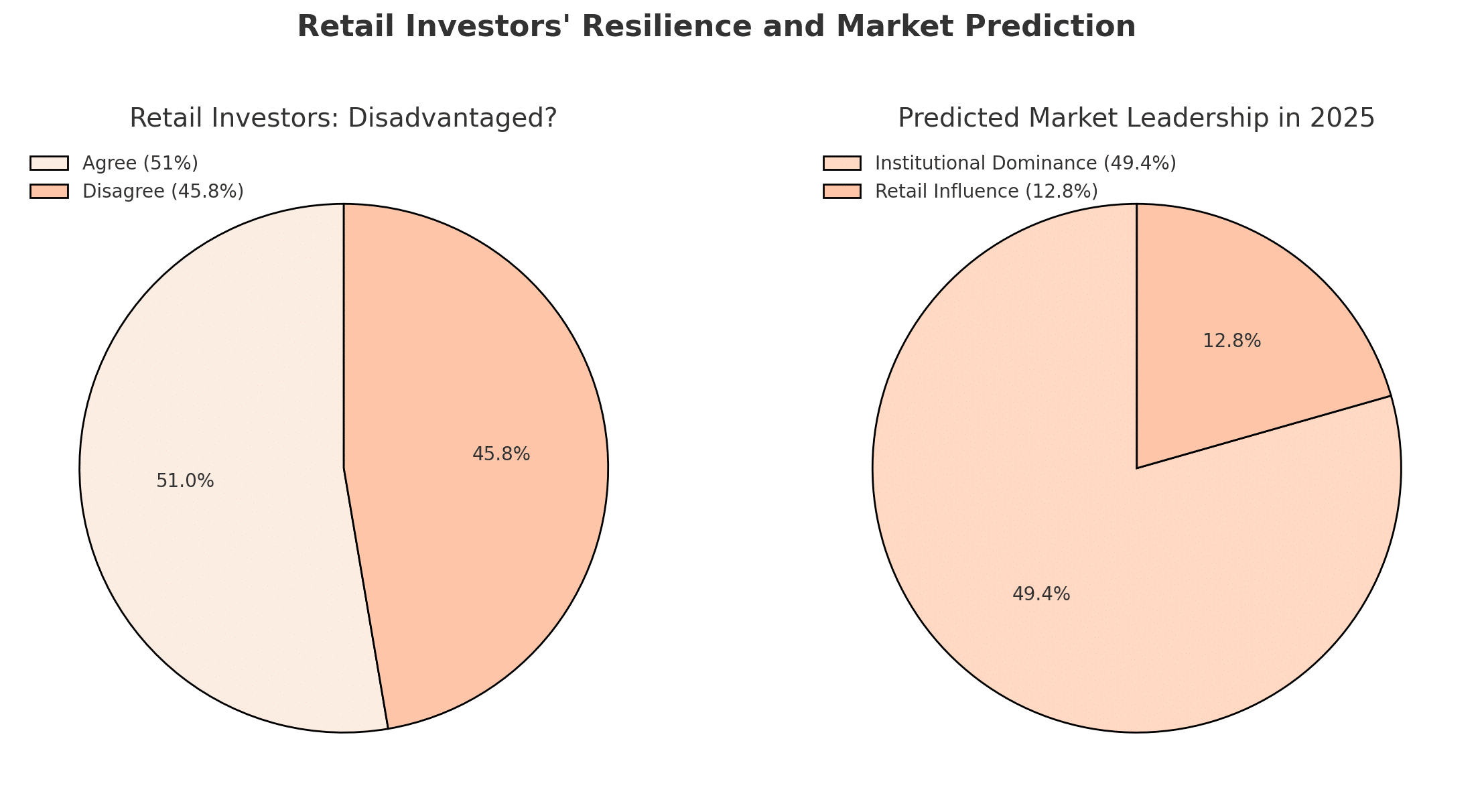

Retail investors’ resilience and market prediction

The survey revealed a mixed outlook on retail investors’ future:

- 51% of respondents agreed that institutional strategies disadvantage retail traders, citing unequal access to market-moving data and resources.

- However, 45.8% disagreed with the notion that retail is being forced out, emphasizing the enduring presence of retail participants in shaping market dynamics.

In 2025, when asked about leadership, approximately 49.4% of respondents anticipated that institutions would continue to hold sway, whereas only around 12.8% believed that retail investors would reclaim their influence.

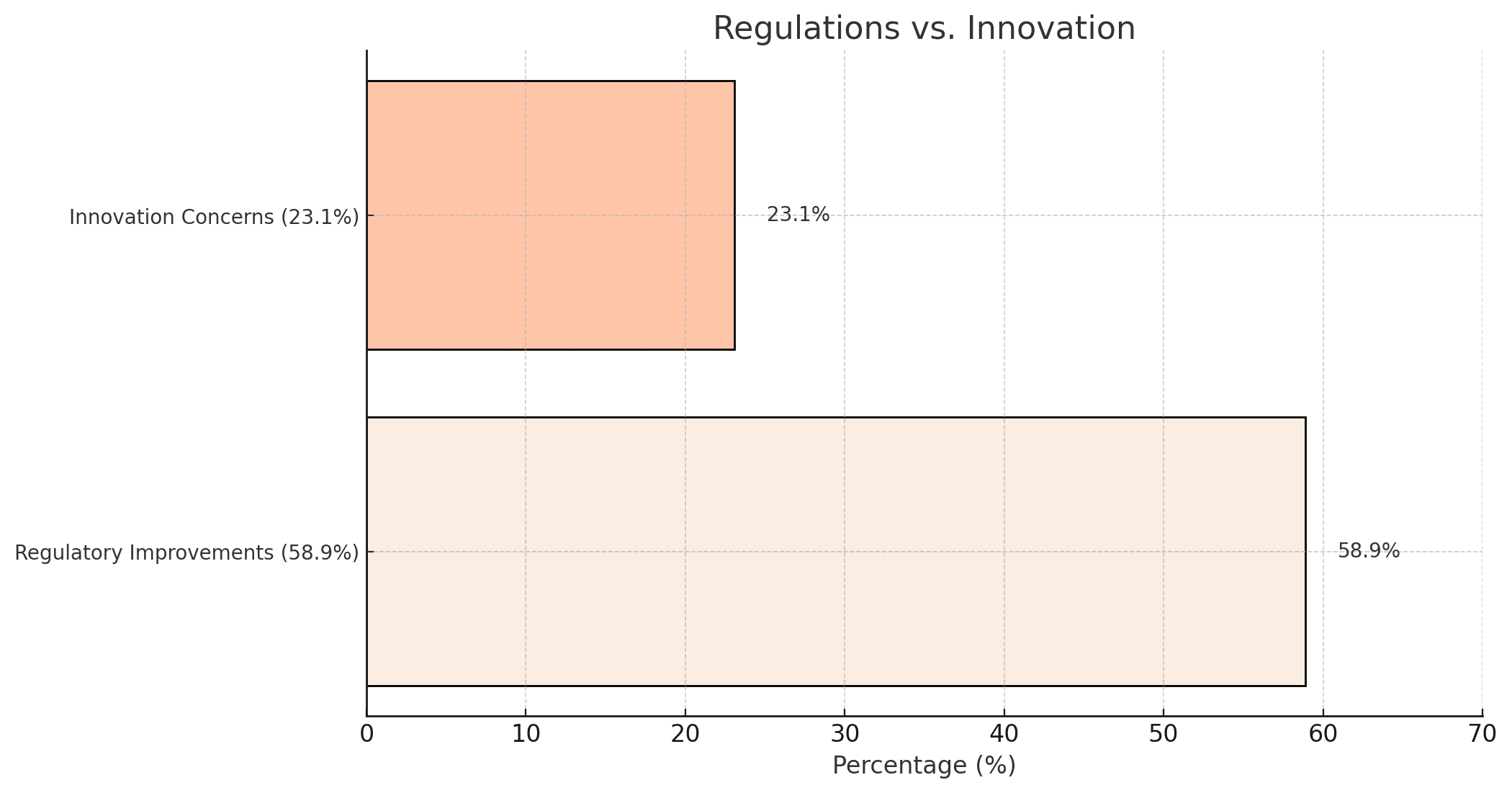

Regulations vs. Innovation: A Double-Edged Sword

Regulations vs. innovation

Institutions are viewed as both enablers and potential barriers:

- 58.9% of respondents believed institutions would drive regulatory improvements, creating a safer and more stable crypto market.

- Conversely, 23.1% expressed concerns that institutional dominance might stifle innovation, prioritizing profitability over decentralization.

A recent survey by AMBCrypto underscores the increasing impact of institutional investors in the crypto market, demonstrating their capacity to provide reliability and volume while sparking debates about decentralization and impartiality. As 2025 nears, the interplay between institutional and individual influence will play a crucial role in shaping the course of digital currencies.

Ethereum’s December Journey: Price Moves, Upgrades, and Future Outlook

Ethereum’s path in December 2024 demonstrated its versatility and ingenuity, fueled by key performance indicators, increased staking, and advancements within its ecosystem. As a pillar of the cryptocurrency market, Ethereum played a crucial role in propelling both decentralized finance (DeFi) and NFTs forward, while readying itself for significant future updates.

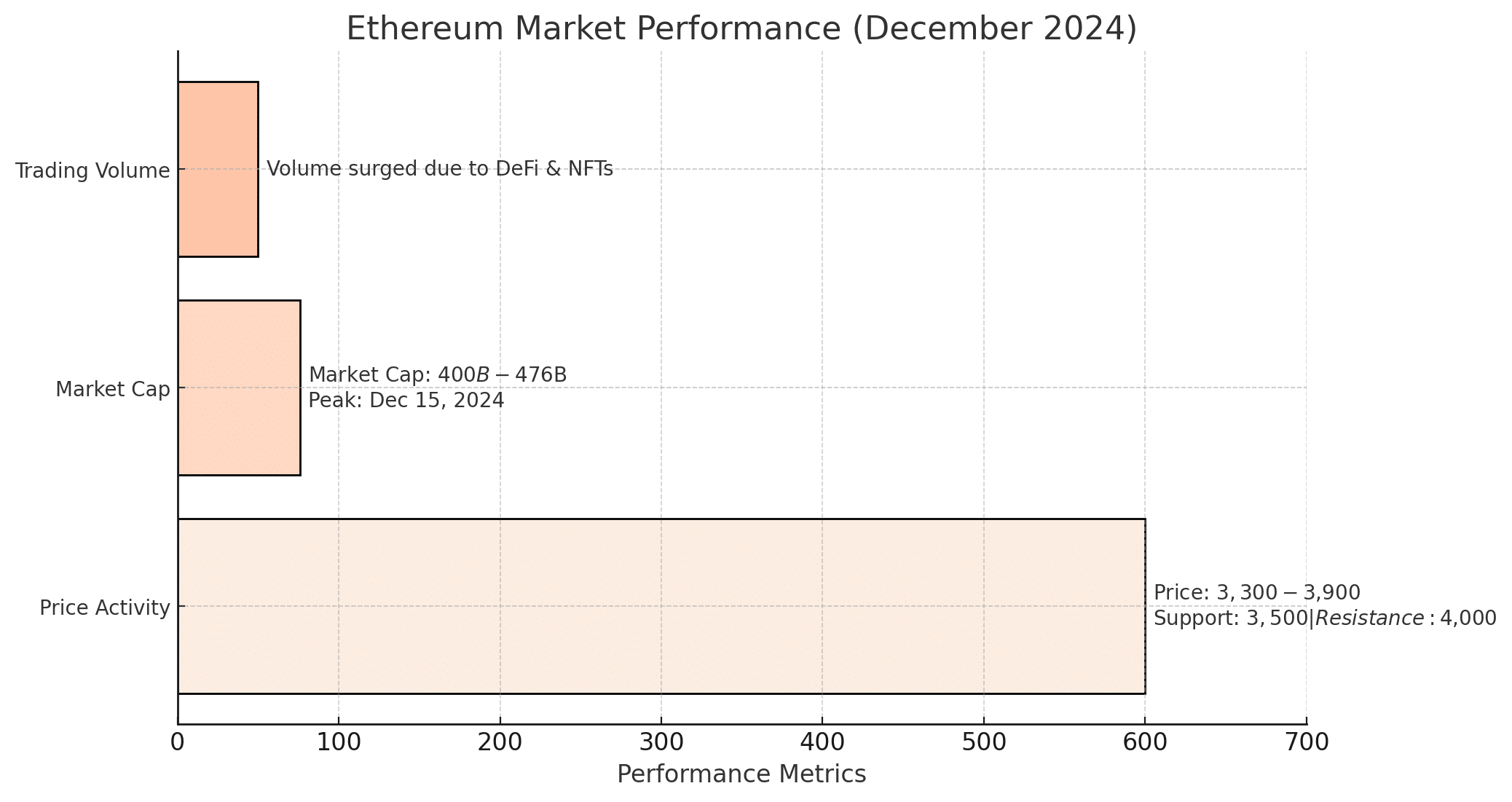

Market Performance

Ethereum’s market performance in December 2024

- Price Activity: Ethereum’s price fluctuated between $3,300 and $3,900 during December 2024, showcasing resilience amidst broader market volatility. Analysts identified $3,500 as a critical support level, with $4,000 acting as a resistance zone, though the price briefly approached the resistance level mid-month.

- Market Capitalization: Ethereum’s market capitalization surpassed $400 billion during December, peaking at approximately $476 billion on December 15, 2024, securing its position as the second-largest cryptocurrency by market cap.

- Trading Volume: Trading volumes increased significantly in December, driven by heightened investor interest in DeFi projects and NFT marketplaces built on Ethereum. This reflected strong market engagement.

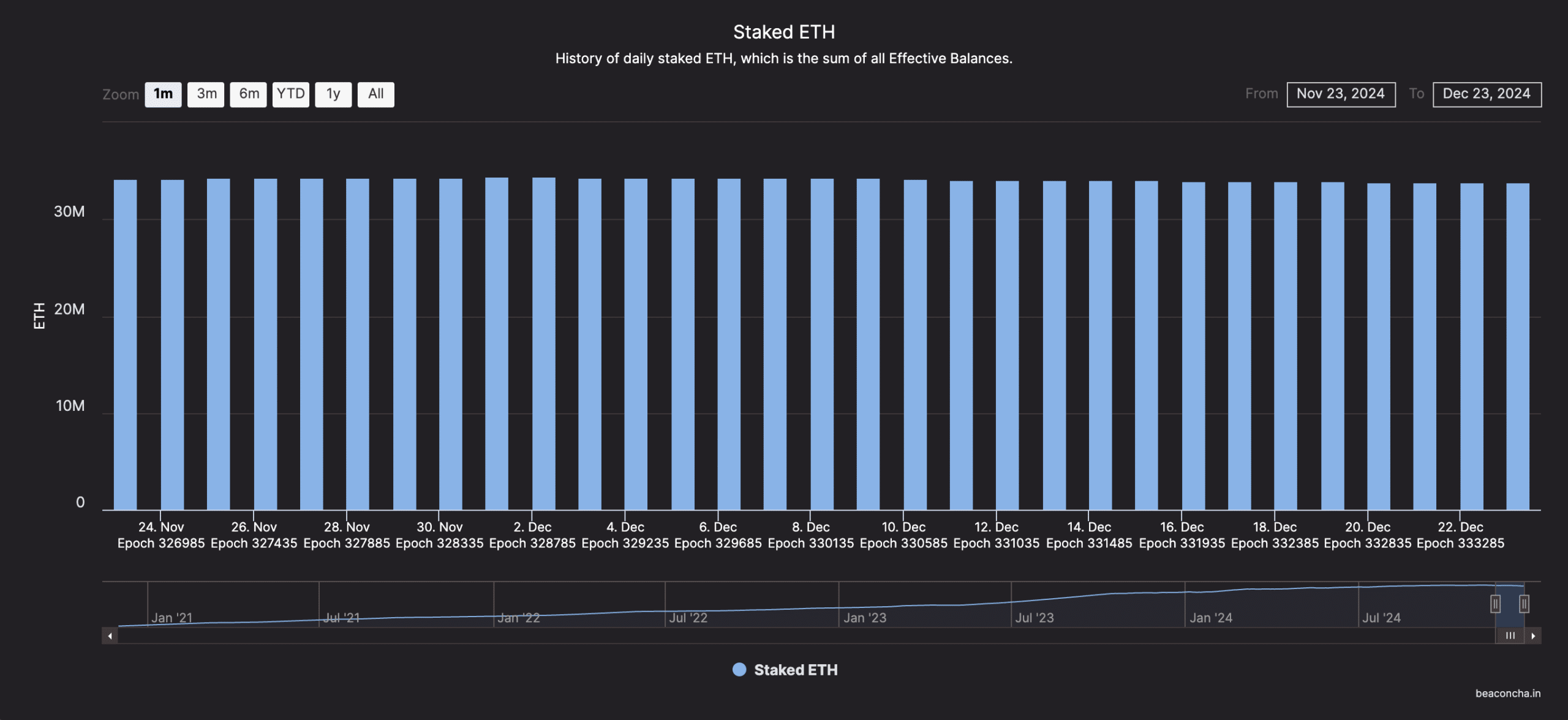

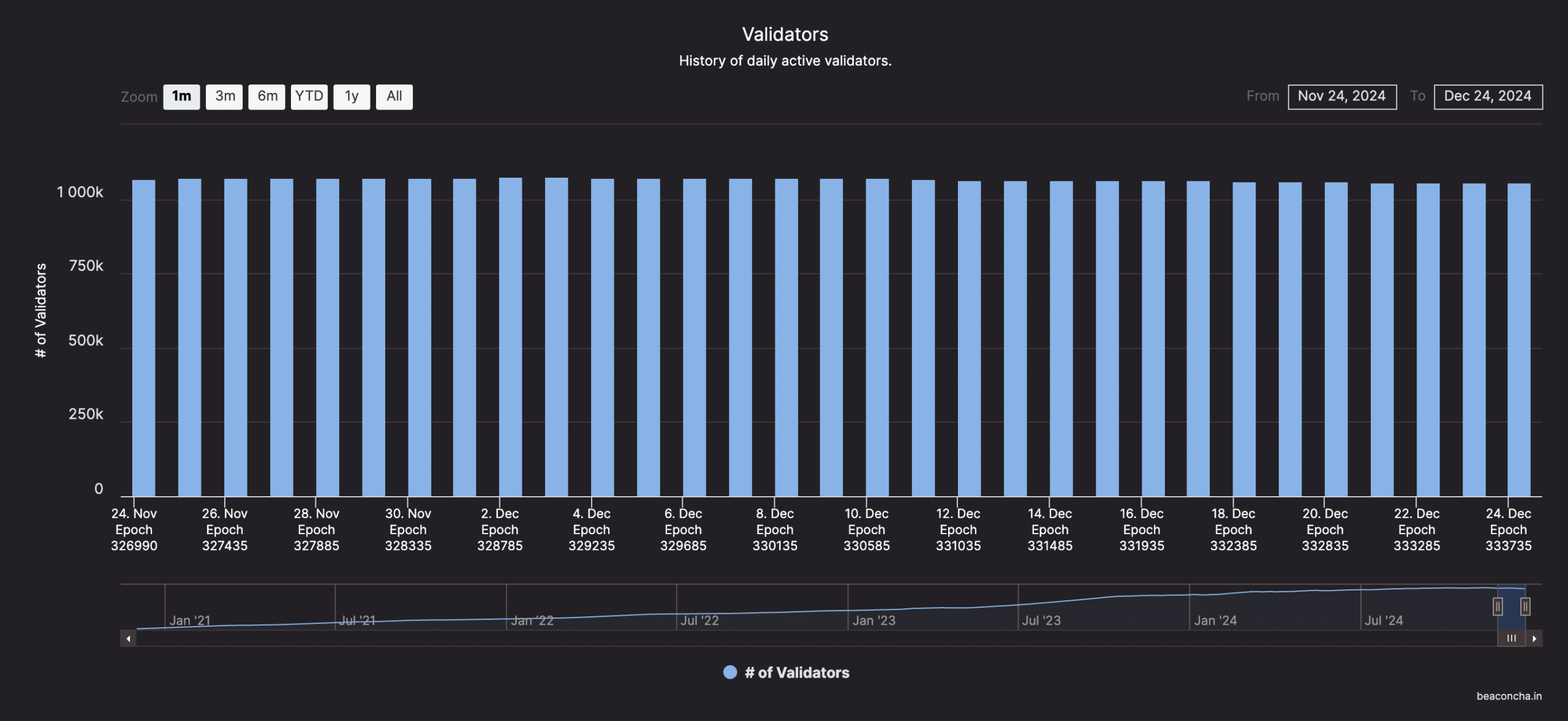

Staking Activity: Strengthening the Network

- Staked ETH Milestone: December 2024 saw staked ETH surpass 34.7 million, maintaining this level throughout the month. This milestone represents approximately 28.3% of Ethereum’s circulating supply, reflecting growing confidence in Ethereum’s proof-of-stake (PoS) consensus mechanism and its staking rewards program.

- Validator Growth: The network added approximately 10,000 new validators in December 2024, bringing the total count to over 1,100,000 validators. This consistent growth underscores Ethereum’s strengthened network security and commitment to decentralization.

Key Technological Developments

- Final Preparations for the Pectra Upgrade: Ethereum developers finalized testing for the Pectra upgrade, set to launch in early 2025. The upgrade introduces scalability features such as proto-danksharding to optimize data storage and reduce gas fees. Additionally, enhancements in gas fee efficiency aim to significantly improve network throughput, reflecting Ethereum’s focus on scalability and affordability.

- Layer-2 Expansion: Layer-2 platforms like Arbitrum and Optimism continued to see substantial adoption, contributing significantly to Ethereum’s ecosystem in December. Notably, Coinbase’s Base network emerged as a leading Layer-2 platform, surpassing competitors in Total Value Locked (TVL). These Layer-2 platforms played a pivotal role in alleviating congestion and reducing transaction costs, accounting for a significant portion of Ethereum’s total transaction volume.

- EIP-7512 Proposal: Discussions around EIP-7512, targeting more efficient data storage for smart contracts, were not publicly prominent in December 2024. While the proposal may exist in early stages, it did not emerge as a focal point of Ethereum’s roadmap during this period.

Ecosystem Highlights

DeFi Growth

- Total Value Locked (TVL): The total TVL in DeFi reached approximately $133.88 billion in December 2024, marking a 150% increase from the beginning of the year.

- Ethereum’s Market Share: Ethereum has historically maintained a dominant position in the DeFi space. However, the rise of alternative platforms has introduced significant competition.

NFT Resilience

- Market Share: Ethereum continued to lead the NFT market, accounting for a substantial portion of the total trading volume. In early December, Ethereum-based NFTs had a weekly sales volume of $92 million, indicating robust activity.

- Utility-Based NFTs: There has been a growing interest in utility-based NFTs, particularly in sectors like gaming and the metaverse.

Looking Ahead to 2025

- Scalability Goals: The Pectra upgrade is expected to revolutionize Ethereum’s scalability and user experience, addressing longstanding challenges like high gas fees.

- DeFi and Staking: Ethereum’s dominance in DeFi and its growing staking ecosystem position it as a cornerstone of blockchain innovation for institutional and retail investors alike.

- Interoperability and Innovation: Developers aim to advance Ethereum’s interoperability with other blockchains, ensuring it remains the foundation for multi-chain ecosystems.

In the month of December 2024, Ethereum solidified its position as a pioneer in blockchain innovation. The network saw unprecedented levels of staking and continued activity in DeFi (Decentralized Finance) and NFTs (Non-Fungible Tokens). This demonstrated the robustness and adaptability within Ethereum’s ecosystem. As it prepares for significant updates in 2025, the outlook for Ethereum remains optimistic, matching its impressive December performance.

XRP Shines Bright: December’s Altcoin Superstar

In the December of 2024, XRP emerged as a top-tier altcoin, largely due to substantial advancements and market trends. The introduction of Ripple’s stablecoin, RLUSD, and positive regulatory updates played a crucial role in boosting XRP’s status during this timeframe.

Key Developments and Achievements

- Launch of RLUSD Stablecoin: Ripple announced the launch of RLUSD, a USD-backed stablecoin, on December 17, 2024. This development is expected to enhance Ripple’s payment solutions by providing a stable digital asset for transactions.

- Regulatory Approval: The New York Department of Financial Services (NYDFS) approved RLUSD, marking a significant regulatory milestone for Ripple and potentially increasing confidence among institutional investors.

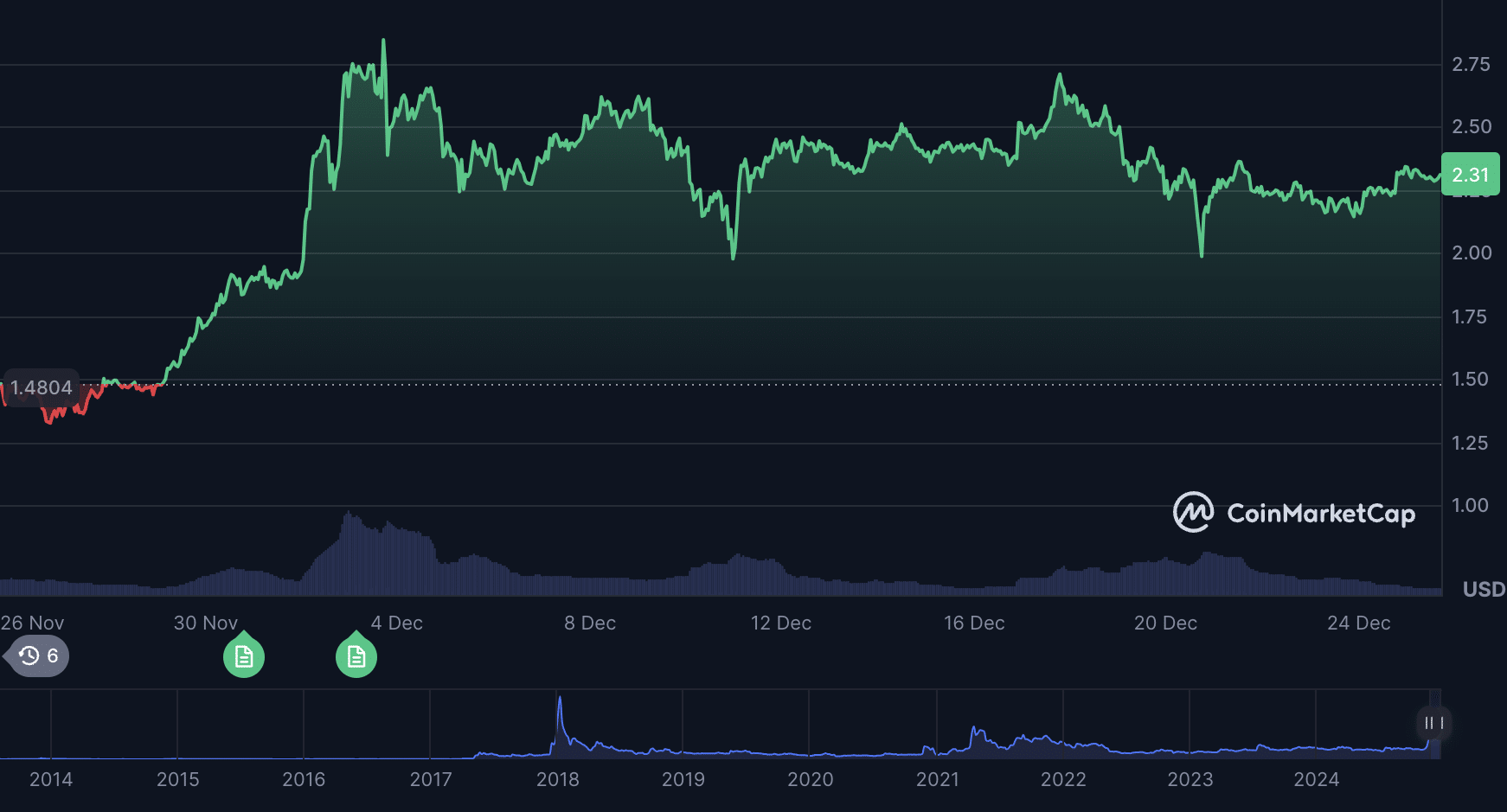

Market Performance

- Price Movements: XRP’s price experienced notable volatility in December 2024. It reached a high of approximately $2.89 on December 3 but later declined to around $2.19 by December 23, reflecting broader market trends and investor sentiment.

- Trading Volume: Following the RLUSD announcement, XRP’s trading volume surged, indicating increased market interest.

- Market Capitalization: XRP’s market capitalization fluctuated in line with its price movements, maintaining its position among the top cryptocurrencies by market cap.

Ecosystem Growth

- Institutional Interest: The approval and launch of RLUSD have the potential to attract institutional investors seeking compliant and stable digital assets for cross-border transactions.

- Global Adoption: Ripple’s initiatives, including the introduction of RLUSD, aim to expand its presence in various regions, with the Middle East and Asia-Pacific being strategic markets for Ripple.

2024 saw a crucial turning point for XRP, marked by the debut of RLUSD stablecoin and important regulatory endorsements. These advancements could boost XRP’s potential usefulness and market penetration within the digital payment sector. Yet, it is essential to remember that the cryptocurrency market can be unpredictable, so keeping up-to-date with the latest news and updates is crucial for investors.

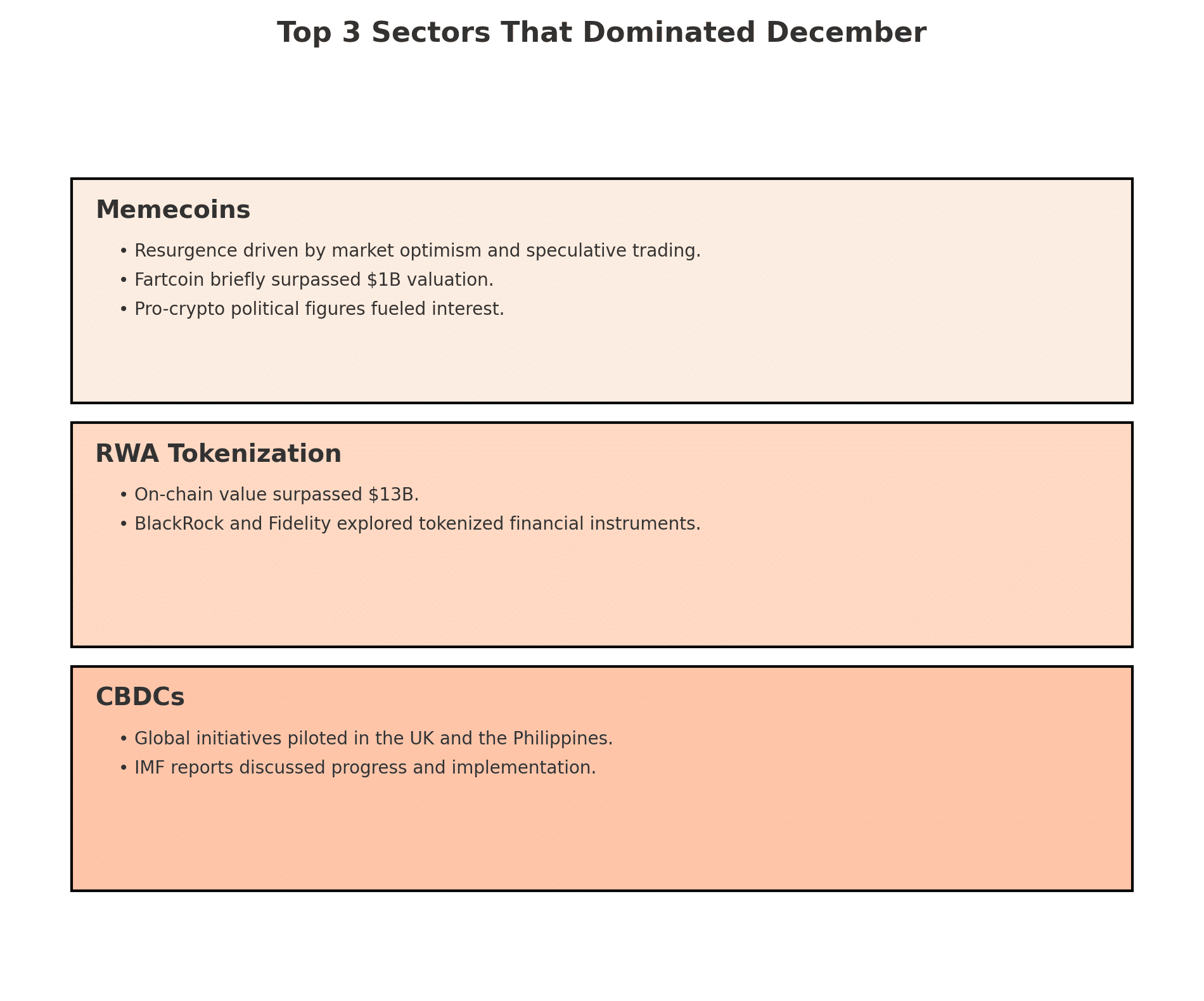

Crypto’s Power Players: Top 3 Sectors That Dominated December

Top 3 crypto sectors in December 2024

In December 2024, there were notable advancements across diverse areas within the cryptocurrency industry. Each sector made distinct contributions, collectively shaping the dynamic and ever-evolving world of digital assets.

Memecoins: Resurgence Amidst Market Optimism

In late 2024, meme coins saw a significant comeback, fueled primarily by growing investor excitement and speculative transactions.

Key Highlights

- Fartcoin’s Surge: Fartcoin, despite its humorous origin and lack of intrinsic value, saw its valuation briefly surpass $1 billion, reflecting the speculative fervor in the market.

- Market Dynamics: The election of pro-crypto political figures, such as Donald Trump, contributed to a favorable environment for memecoins, with investors seeking high-risk, high-reward opportunities.

Driving Factors

- Social Media Influence: Platforms like X (formerly Twitter) and Reddit played pivotal roles in amplifying memecoin trends, with viral posts and community-driven hype fueling investments.

- Speculative Trading: The allure of quick profits attracted a surge of retail investors, despite the inherent risks associated with memecoins.

Real-World Asset (RWA) Tokenization: Bridging Traditional and Digital Finance

In December 2024, the pace of converting tangible assets into digital form picked up speed, opening up fresh possibilities for ease in trading and wider reach in conventional investment sectors.

Key Highlights

- Market Growth: The on-chain value of tokenized RWAs surpassed $13 billion, indicating a significant shift towards digitizing physical assets.

- Institutional Adoption: Major financial institutions, including BlackRock and Fidelity, explored tokenized financial instruments on blockchain, showcasing growing confidence in decentralized networks.

Driving Factors

- Enhanced Liquidity: Tokenization allows for fractional ownership, reducing entry barriers and increasing market participation.

- Regulatory Developments: Jurisdictions worldwide are reforming regulations to accommodate the tokenization of real-world assets, facilitating broader adoption.

Central Bank Digital Currencies (CBDCs): Institutional Adoption Accelerates

In December 2024, Central Banks were found delving deeper into the realm of digital currencies, aiming to bring about a modern transformation within their respective financial systems.

Key Highlights

- Global Initiatives: Central banks in various countries, including the UK and the Philippines, conducted research and pilot programs to assess the feasibility and implications of introducing CBDCs.

- Policy Discussions: International organizations, such as the International Monetary Fund (IMF), released reports discussing the progress and considerations for CBDC implementation.

Driving Factors

- Digital Economy Integration: CBDCs aim to provide a secure and efficient digital payment method, aligning with the increasing digitization of economies.

- Financial Inclusion: Central banks view CBDCs as a tool to enhance financial inclusion by providing access to digital financial services for unbanked populations.

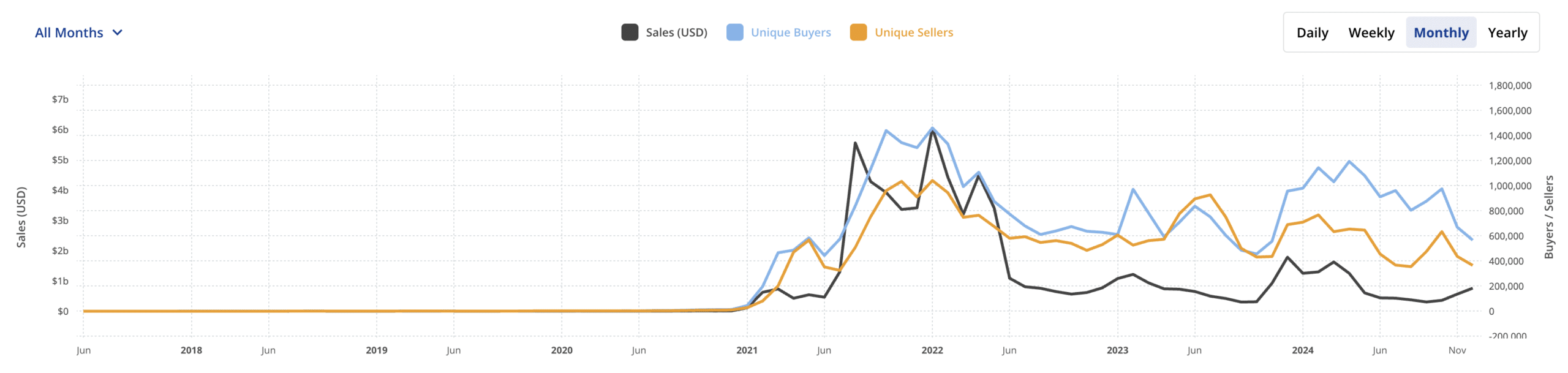

NFT Market Revival: Key Trends and Record Sales

In December 2024, the NFT market made a substantial comeback, marked by brisk trade activity, impressive collection standings, and high-priced single NFT transactions. This resurgence was driven by heightened seasonal demand and the introduction of fresh, cutting-edge projects.

Sales Volume

Total Market Activity

- The NFT market generated a sales volume of $757.57 million, reflecting a 34.8% increase compared to November 2024.

- Average sale prices rose to $185.73 per transaction, indicating an uptick in higher-value trades.

Blockchain Contributions

- Ethereum dominated NFT transactions, accounting for the majority of sales volume.

- Bitcoin NFTs (notably Uncategorized Ordinals) continued to grow, securing the second-largest share.

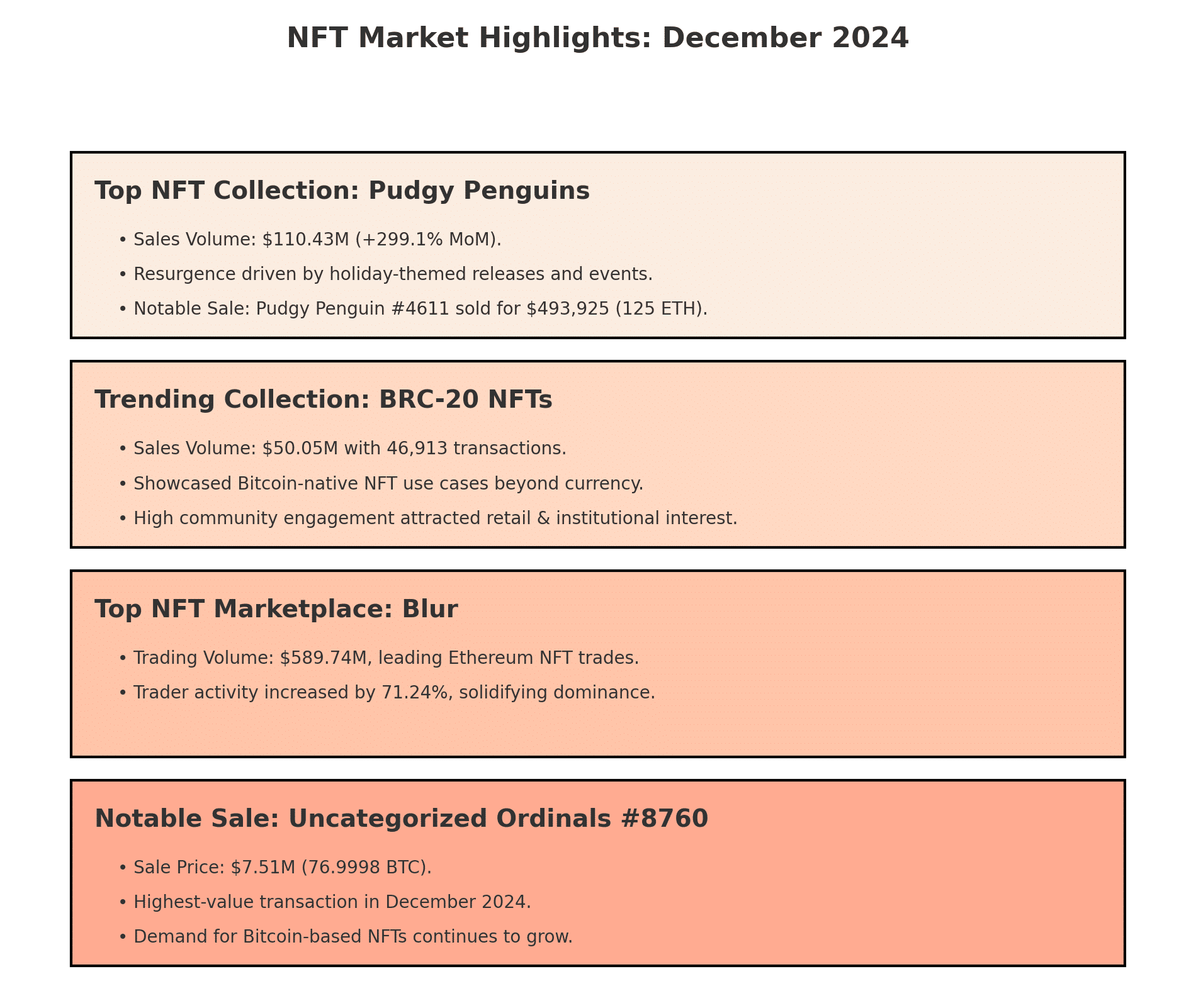

NFT market highlights in December 2024

Top NFT Collection: Pudgy Penguins

Sales Performance

- Pudgy Penguins emerged as the top NFT collection in December 2024, with a sales volume of $110.43 million, a staggering 299.1% increase from the previous month.

- This resurgence was driven by exclusive holiday-themed releases and community events that revitalized interest.

Notable Sale

- Pudgy Penguin #4611 was sold for $493,925 (125 ETH), marking one of the highest-value transactions for the collection.

Trending Collection: BRC-20 NFTs

Growth Metrics

- BRC-20 NFTs recorded a sales volume of $50.05 million, with 46,913 transactions in December 2024.

- This collection’s focus on Bitcoin-native NFTs showcased the expanding use cases for Bitcoin beyond currency.

Driving Factors

- High community engagement and unique tokenomics attracted both retail and institutional participants.

Top NFT Marketplace: Blur

- Market Leadership: Blur retained its position as the leading NFT marketplace in December 2024, facilitating the majority of Ethereum-based NFT trades with a trading volume of $589.74M. This reinforces its dominance in the Ethereum NFT ecosystem.

- User Activity: Trader activity on Blur increased by an impressive 71.24%, solidifying its role as the go-to platform for NFT enthusiasts.

Notable Sale: Uncategorized Ordinals #8760

Sale Details

- The most expensive NFT sale in December 2024 was Uncategorized Ordinals #8760, which sold for $7.51 million (76.9998 BTC).

- This sale highlighted the growing demand for Bitcoin-based NFTs, particularly within the Ordinals ecosystem.

2024 saw a robust resurgence in the Non-Fungible Token (NFT) market, with Pudgy Penguins heading the list of popular collections, BRC-20 NFTs garnering widespread interest, and Bitcoin-based Ordinals setting new sales records. As blockchain platforms proliferate, the NFT market is expected to maintain its growth trajectory well into 2025.

Crypto Predictions 2025: What Lies Ahead for the Industry

Scalability and Multi-Chain Ecosystems

- Layer-2 Solutions: Platforms like Arbitrum and Optimism have been instrumental in scaling Ethereum by processing transactions off-chain, reducing fees, and increasing speed. As of Q2 2024, Arbitrum led with a Total Value Locked (TVL) of $2.6 billion, followed by Base at $1.5 billion.

- Multi-Chain Ecosystems: Interoperability protocols such as Polkadot and Cosmos facilitate seamless interaction across blockchains, promoting a multi-chain ecosystem. These platforms enable different blockchains to communicate and share information, enhancing the overall efficiency and scalability of the crypto space.

DeFi Expansion Beyond Ethereum

- Alternative Platforms: While Ethereum remains dominant in DeFi, other platforms like BNB Chain, Avalanche, and Polygon are gaining traction, offering lower fees and faster transactions. This diversification allows users to choose platforms that best suit their needs, fostering innovation and competition in the DeFi space.

- Real-World Asset Tokenization: The tokenization of real-world assets, such as bonds and real estate, is expected to grow, attracting institutional investors and expanding DeFi’s utility. This process involves creating digital tokens that represent ownership of physical assets, making them more accessible and tradable on blockchain platforms.

NFT Market Evolution

- Utility-Driven NFTs: Non-fungible tokens (NFTs) with practical applications in gaming, metaverse platforms, and membership programs are anticipated to overshadow purely speculative trading. This shift towards utility-driven NFTs adds intrinsic value and functionality, enhancing user engagement and adoption.

- Emerging Platforms: Blockchains like Solana, Immutable X, and Polygon are challenging Ethereum’s dominance in the NFT sector, particularly in gaming-related assets, by offering lower fees and faster transaction times. This competition encourages innovation and provides users with diverse options for NFT creation and trading.

Central Bank Digital Currencies (CBDCs)

- Global Developments: Major economies, including the European Union and China, are advancing their CBDC initiatives, with pilot programs and potential rollouts influencing the broader crypto market. The interaction between decentralized cryptocurrencies and CBDCs will redefine the role of public and private blockchain systems, impacting monetary policy and financial stability.

Regulatory Developments

- Increased Clarity: Global regulatory frameworks are becoming more defined, encouraging institutional adoption of digital assets while posing challenges to privacy-focused projects. Regions like the European Union, through the Markets in Crypto-Assets (MiCA) regulation, are leading efforts to establish clear guidelines for the crypto industry.

- Emerging Markets: Countries in Latin America and Africa are experiencing increased crypto adoption, leveraging stablecoins for remittances and financial inclusion, providing alternatives to traditional banking systems.

Sustainability and Green Blockchain Initiatives

- Energy-Efficient Consensus Mechanisms: Blockchains utilizing Proof of Stake (PoS) or innovative mechanisms like Proof of Space and Time are attracting attention for their reduced environmental impact. Ethereum’s transition to PoS has significantly decreased its energy consumption, setting a precedent for sustainability in the industry.

- Carbon Credit Tokenization: The tokenization of carbon credits on blockchain platforms is emerging as a method to enhance transparency and efficiency in carbon markets, supporting global sustainability efforts.

AI and Blockchain Convergence

- Emerging Platforms: Projects like Fetch.ai and SingularityNET are at the forefront of integrating artificial intelligence with blockchain technology, enabling decentralized data sharing and smart contracts for automated decision-making. This convergence facilitates the development of intelligent decentralized applications (dApps) with enhanced capabilities.

Gaming and Metaverse Growth

- Blockchain Integration: The gaming industry is increasingly incorporating blockchain technology, with platforms like Immutable X, Polygon, and Gala Games leading the way. This integration enables features such as virtual asset ownership, Play-to-Earn (P2E) economies, and decentralized marketplaces, transforming the gaming experience.

References:

- ETF.com

- Glassnode

- beaconcha.in

- CryptoSlam

- DappRadar

- Santiment

- IntoTheBlock

- Farside Investors

- CryptoQuant

- CoinGecko

- CoinMarketCap

- Messari

- Coinglass

- TradingView

- Dune Analytics

- DeFiLlama

- NFTGo

- SEC Filings Database

- AMBCrypto’s Survey: Institutional players vs. retail investors: Who’s leading the market in 2024?

Read More

2024-12-25 17:02