- Saylor plans to make MicroStrategy a Bitcoin bank.

- MSTR rallied and hit an ATH after the revelation.

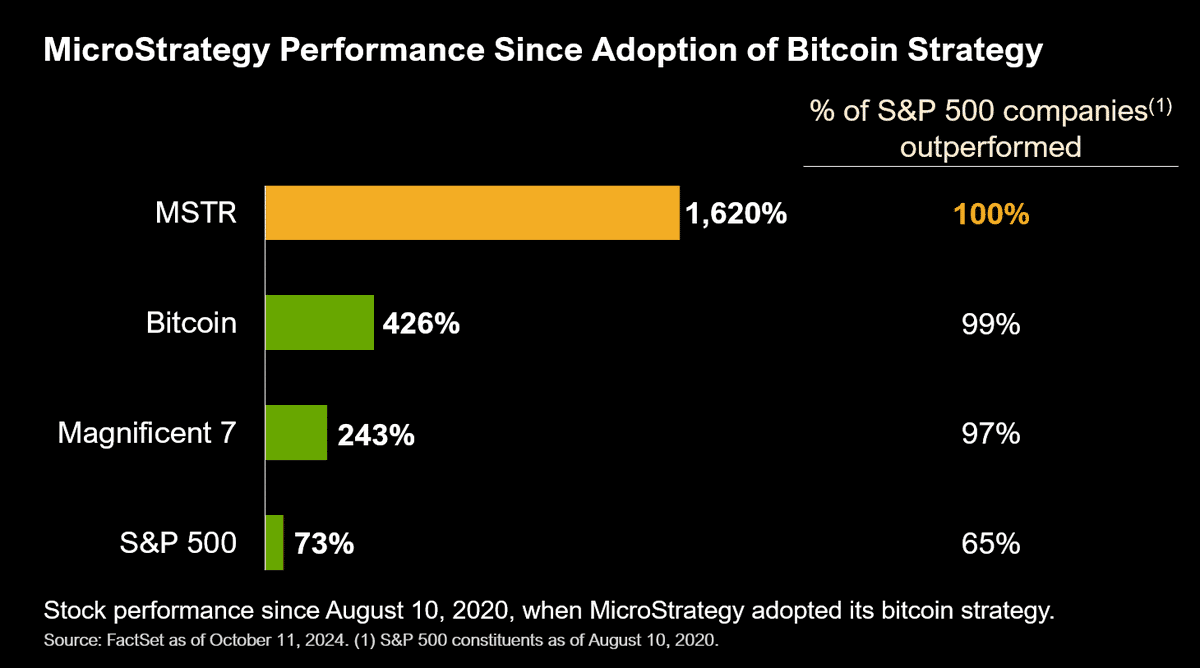

As a seasoned crypto investor with over a decade of experience in this wild and unpredictable market, I must admit that MicroStrategy’s ambitious plan to transform itself into a Bitcoin bank has caught my attention. The stock’s all-time high (ATH) is a testament to the faith investors have in Michael Saylor’s vision.

🛑 Trump Tariffs vs. Euro: The Fight of the Decade?

Discover how the EUR/USD pair could react to unprecedented pressure!

View Urgent ForecastThe MicroStrategy’s MSTR shares reached a new peak following the disclosure that their ambition is to transform into a billion-dollar Bitcoin (BTC) financial institution.

Michael Saylor, the founder of MicroStrategy, shared with Bernstein analysts that his company aims to reach a staggering $1 trillion market value, positioning itself as the world’s leading Bitcoin banking institution.

This could be facilitated, in part, by its swift amassing of the globe’s most substantial asset, as analysts forecasted a stock price goal of $290.

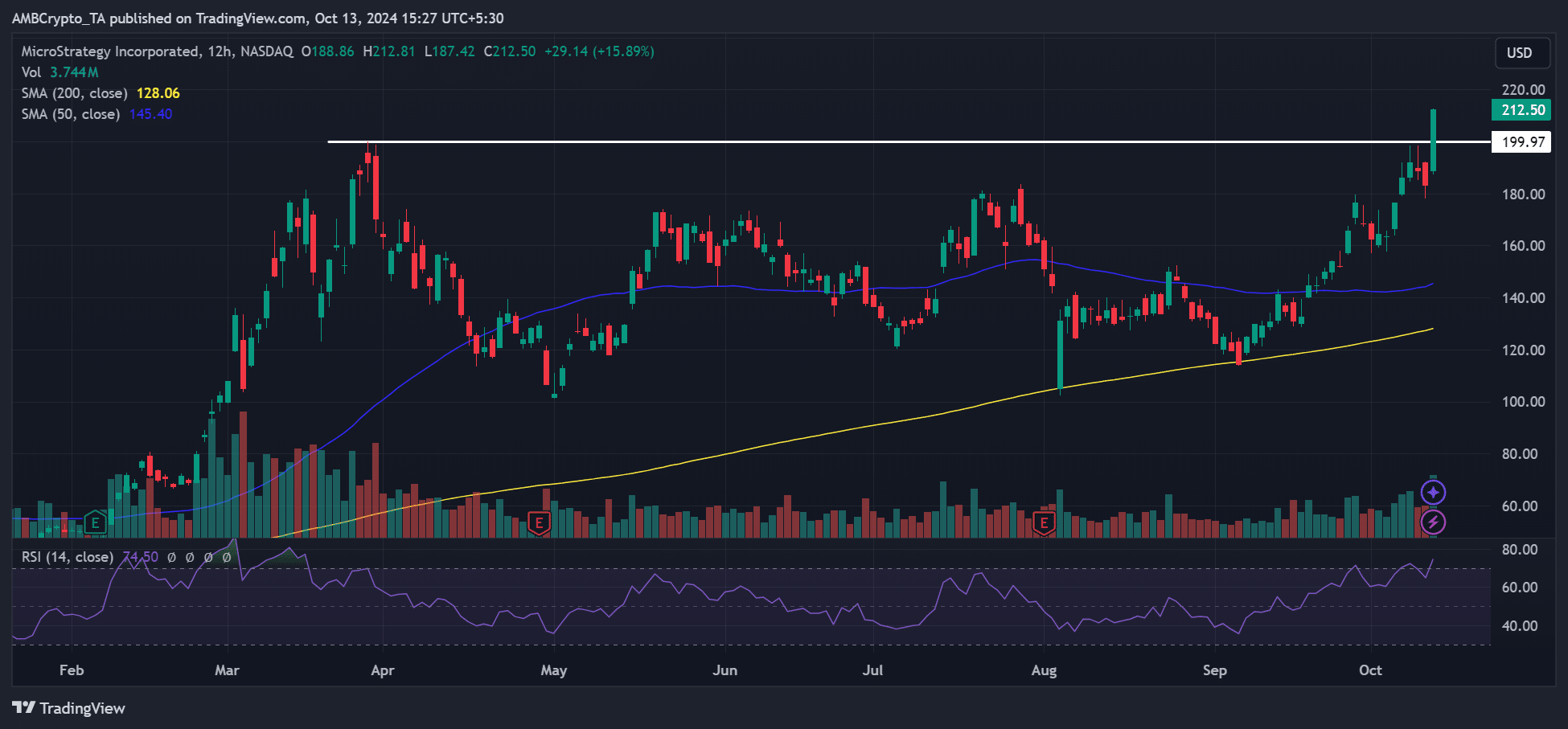

On October 11th, during intraday trading, MSTR reached an all-time peak of $212.50, marking a 15% rise and breaking through the previous resistance at $200.

Bitcoin bank end-game

In response to MSTR’s surge, Saylor pointed out that nothing outperformed Bitcoin quite like additional Bitcoin.

“The only thing better than #Bitcoin is more Bitcoin.”

As of the current news report, MicroStrategy owns approximately 252,220 Bitcoins, valued at around $15.8 billion according to Bitcoin Treasuries. In interviews, Michael Saylor, the company’s CEO, has not clarified whether MicroStrategy plans to sell its Bitcoin reserves or what their ultimate objective is.

But the end-game was made clear last week.

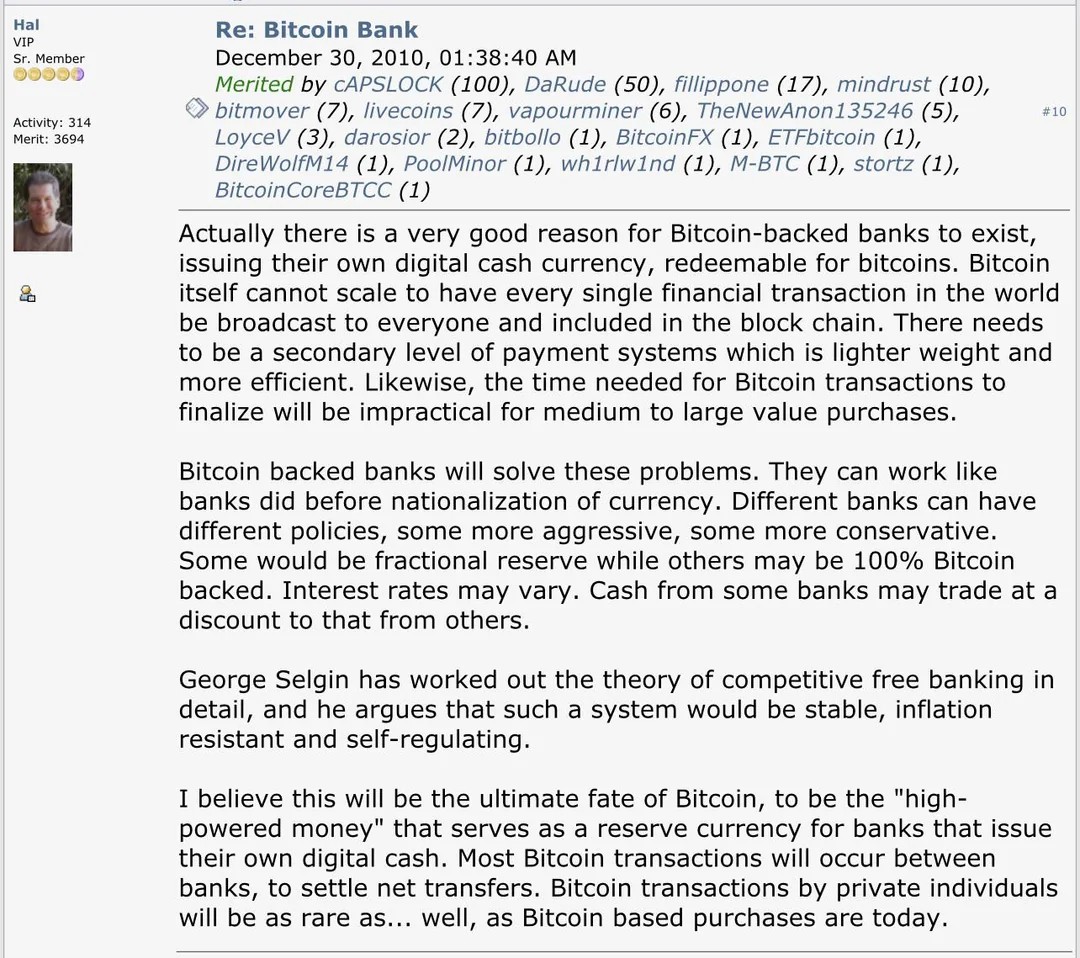

So, what’s a Bitcoin bank?

As a crypto investor, I’ve been intrigued by the idea that, much like traditional asset classes, Bitcoin could serve as the foundation for new financial structures, as proposed by Saylor. To put it simply, this means creating institutions specifically tailored to Bitcoin and its associated ecosystem. Interestingly, a part of the Bernstein report hints at this very concept.

Michael thinks that MSTR primarily focuses on developing various financial products tied to Bitcoin within categories like stocks, convertible bonds, fixed-income securities, and preferred shares.

Previously, Saylor predicted that Bitcoin might reach a value between $3 million and $49 million by the year 2045, growing as it becomes integrated within the global financial system.

Consequently, the executive anticipated it would be less complex to generate profits by developing Bitcoin (BTC) financial products such as bonds or shares compared to loaning out Bitcoin assets owned by MicroStrategy.

Back in 2010, I found myself pondering over an intriguing thought – a concept that had been previously proposed by Hal Finney, one of the pioneers within the Bitcoin network.

But some called for advanced self-custody technology to ensure such a system remains honest.

That said, some market pundits foresaw a strong BTC rally as a positive catalyst for MSTR’s value.

According to financial consultant Ben Franklin, based on MicroStrategy’s financial health and BTC appreciation, MSTR’s value could grow 6x-10x.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-10-14 03:03