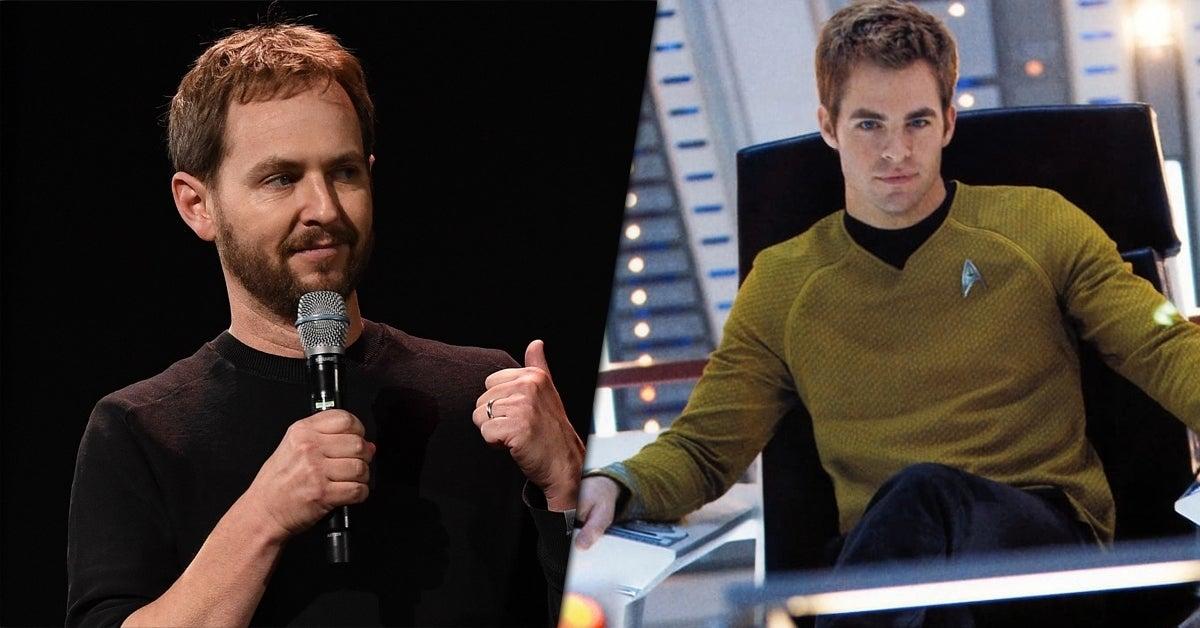

Fantastic Four Director Addresses Abandoned Star Trek Film (Could It Still Happen?)

In an interview with Variety, Shakman disclosed that in the spring of 2022, he held talks with Marvel Studios regarding the Fantastic Four, even though sets were constructed and a crew was hired for Star Trek 4. However, by the summer of 2022, there seemed to be a significant shift. The sets were dismantled, the crew was dismissed, and most notably, the story underwent a major transformation. Despite his reluctance to elaborate on what Star Trek 4 would have been about, he merely said, “The core concept, I believe, still holds true. I truly hope they get the opportunity to make that film.