-

XRP’s Open Interest dropped by 2.5% in the last 24 hours, indicating lower interest from investors

There is a high possibility that XRP could fall by nearly 15%

As a seasoned analyst with over a decade of experience in the financial markets, I have seen my fair share of market swings and trends. The recent drop in XRP‘s open interest by 2.5% within 24 hours is a clear red flag for me. With whales offloading a significant amount of tokens worth $26.8 million, it’s safe to say that the selling pressure on XRP is mounting.

Recently, the mood within the cryptocurrency sector has undergone a significant shift. After showing signs of recovery for some time, the past few days have witnessed a downturn in the market. In fact, in just the last 24 hours, the broader crypto-market has experienced a drop of more than 3%.

In addition, it’s worth noting that large XRP holders, often referred to as ‘whales’, have been transferring substantial quantities of their tokens to centralized exchange platforms.

Whales offload $26.8 million of tokens

Yesterday, the blockchain monitoring service, Whale Alert, disclosed on its platform that large investors, or “whales,” transferred approximately 46.92 million XRP tokens valued at around $26.80 million within the past day. (Previously, this information was shared on Twitter.)

Instead, the large token transfer took place across two distinct operations. A first transaction saw a whale moving 26.72 million tokens towards Bitstamp, whereas another 20.2 million tokens were moved to Bitso in a separate transaction.

XRP price-performance analysis

As expected, this massive token dump on exchanges has created a lot of selling pressure.

As we speak, XRP was approximately $0.56 in value due to a 2.4% decrease over the past day. At the same time, the trading volume decreased by 15%, suggesting less involvement from traders and investors.

All the bearish signs

Additionally, XRP’s Open Interest also flashed bearish signals as the same dropped by 2.5%.

Indeed, based on data from CryptoQuant, a company specializing in on-chain analysis, there’s been a 2% increase in exchange deposit addresses over the past day. This uptick in deposits might suggest that investors are transferring their assets to exchanges, which could potentially lead to increased selling pressure.

Technical analysis and key levels

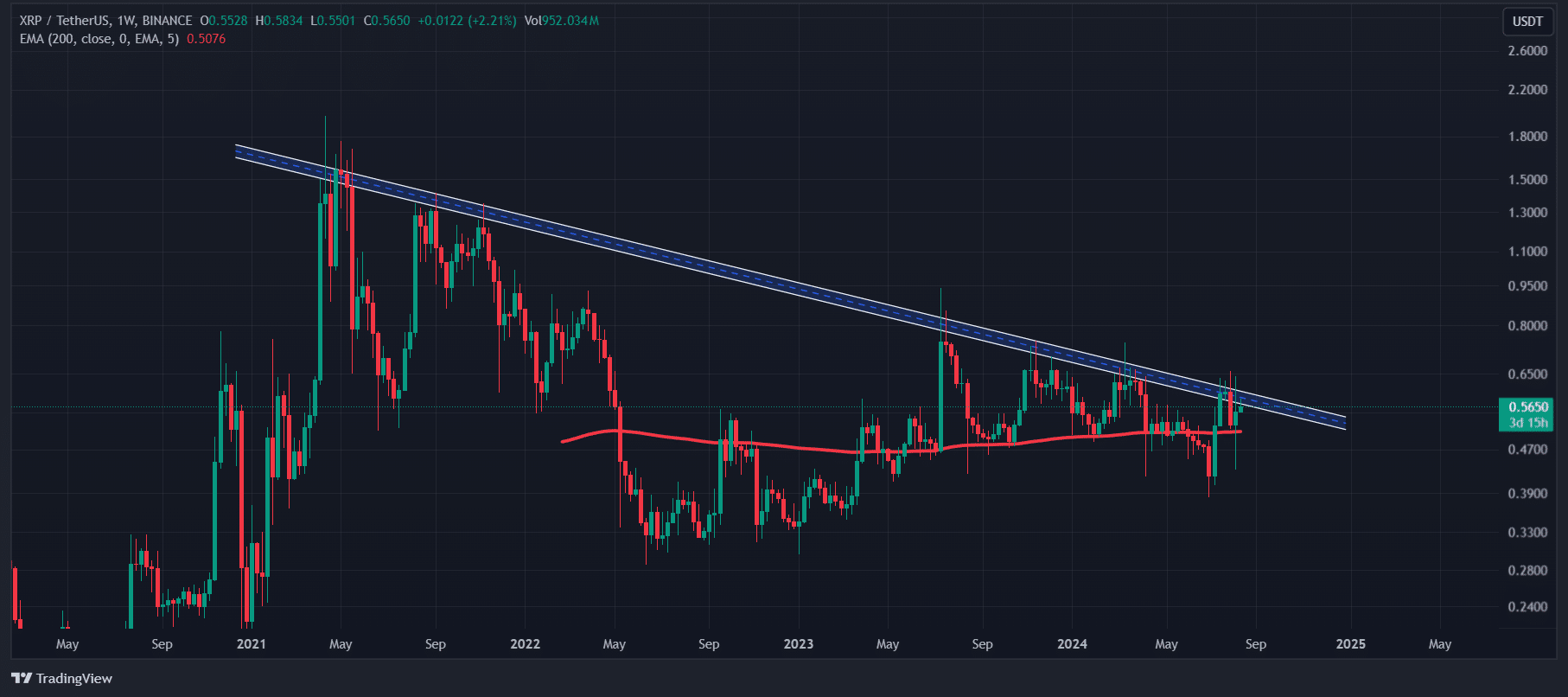

Currently, at the point of composition, XRP appears to be showing bearish signs. It initiated a downward trend following resistance from a descending trendline on the daily chart.

Starting from April 2021, the price line of XRP has intersected with this trendline no less than five times. On every occasion, this interaction was followed by a substantial decrease in its value as depicted on the price charts.

This time, there is a high possibility that XRP could fall by nearly 15% to the $0.48 level.

Major liquidation levels

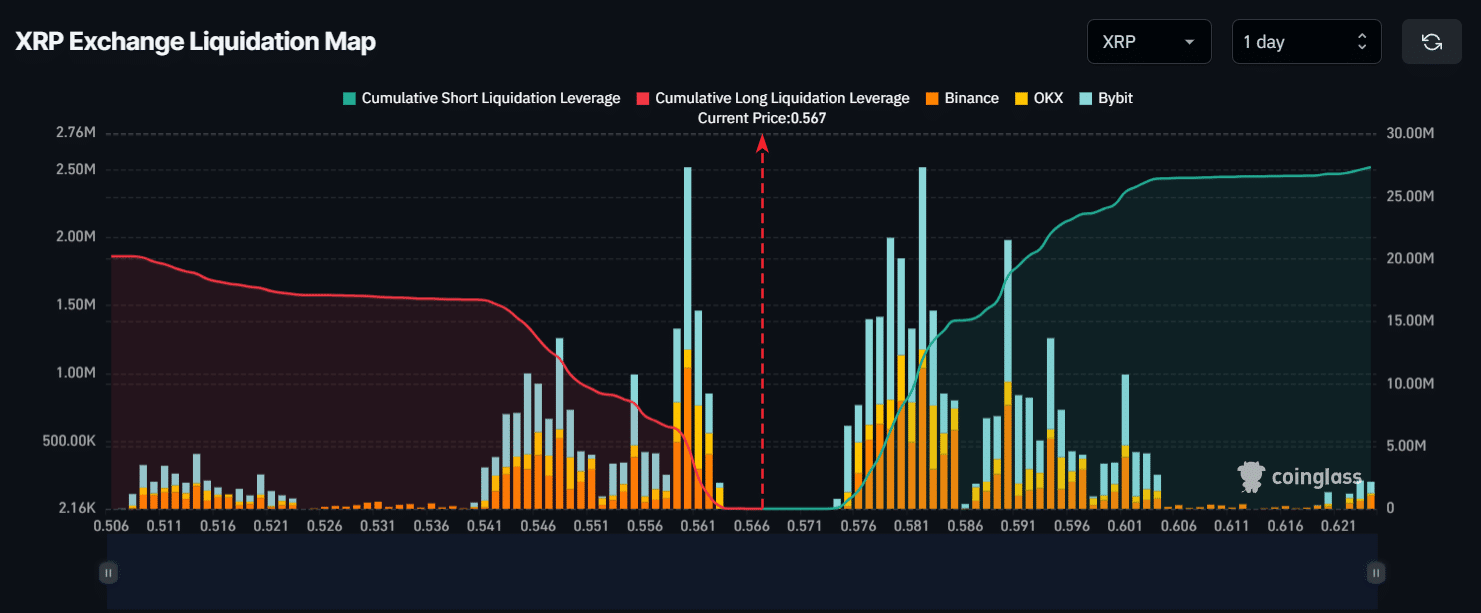

As I currently analyze XRP‘s market trends, key liquidation points can be found on both the lower and upper sides. On the lower end, they are close to approximately $0.56, while on the upper side, they stand at around $0.582.

If the outlook remains pessimistic and XRP drops to $0.56, around 5.03 million dollars’ worth of long positions may need to be closed.

If the sentiment changes and the price increases to $0.582, it would mean approximately $12 million in short positions being closed out or “covered”.

Read More

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Solana – Long or short? Here’s the position SOL traders are taking

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

2024-08-15 17:14