- Ethereum has lost 24% of its value in the past week, underperforming compared to other major cryptocurrencies.

- Analyst Duo Nine suggests Ethereum’s approach to scalability might be diminishing its token’s value and demand.

As a seasoned researcher with over a decade of experience in the crypto market, I have seen my fair share of bull runs and bear markets. The past week has been particularly challenging for Ethereum [ETH] investors, with the asset losing approximately 24% of its value compared to other major cryptocurrencies.

In terms of the leading ten cryptocurrencies ranked by market capitalization, Ethereum (ETH) experienced the steepest decline as of the current moment. Over the last week, its value dropped roughly 24%, more than other similar assets.

This decline has even extended to the asset’s past day performance which showed a drop of 3.9%.

Analyzing Ethereum’s decline

In the realm of cryptocurrency analysis, Duo Nine, a well-regarded figure, has issued a warning about Ethereum’s present course. He posits that there might be signs indicating a gradual decline for the platform, likening it to a slow demise.

Based on the analysis by Duo Nine, the relative underachievement of Ethereum, notably in comparison to Bitcoin and Solana, sparks significant doubts about its longevity or continued success.

“If Bitcoin and Solana are consistently beating Ethereum in performance, it’s worth pondering some significant concerns, according to Duo Nine, especially given the growing doubts among Ethereum supporters about its future potential.”

According to the analyst, one factor contributing to Ethereum’s difficulties is what he calls the “XLM effect” – a situation in which a network’s high efficiency and affordability does not lead to an increase in the token’s worth.

He explained,

“If your network is fast & cheap, there is no reason for your token to pump,”

Introducing Layer 2 systems such as Arbitrum significantly lowers transaction fees, a development that technically speaking is advantageous. However, this improvement could potentially have an adverse effect on Ethereum’s market value.

The reduced need for ETH as a gas token could diminish its relevance and value.

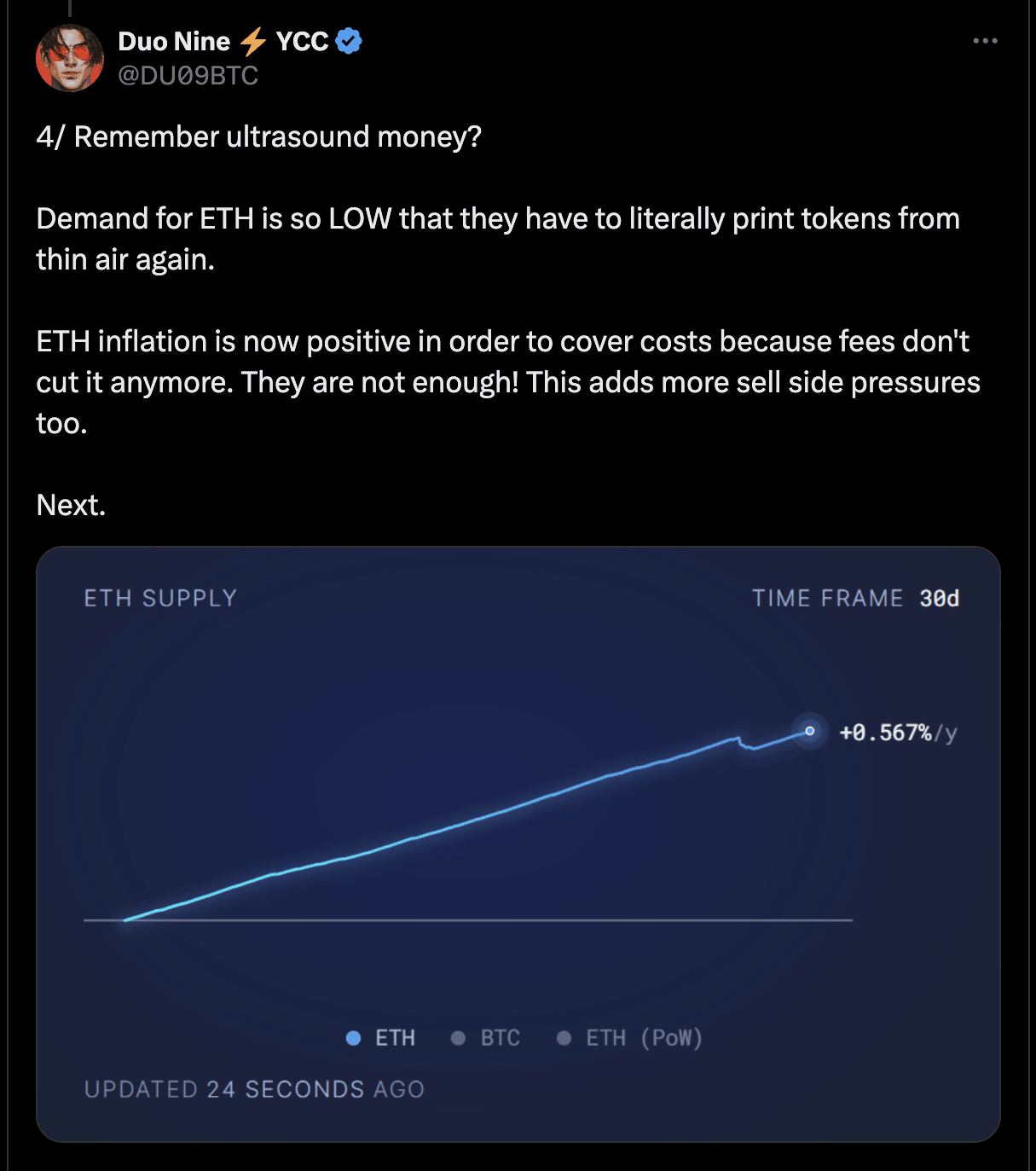

As a analyst, I’d like to add that Duo Nine has raised concerns about Ethereum’s economic structure, which currently results in an inflationary token supply. This is allegedly done to compensate for operational expenses that can’t be fully covered by transaction fees.

This, he argues, adds downward pressure on ETH’s price.

He asserts that the demand for ETH is so minimal that they are essentially creating more tokens out of nothing, indicating a high inflation rate as a negative indicator for the asset’s value.

He added,

I’ve been closely following the evolution of Ethereum for quite some time now, and I must admit that I was initially skeptical when Vitalik Buterin announced his plans to scale ETH via L2 solutions. However, I have to give credit where it’s due – the move has made transactions incredibly cheap and efficient.

The intense competition from Solana, as well as several other cryptocurrencies, adds complexity to Ethereum’s standing within the market.

Could it be that the reduction in fees by the expert was a questionable move, since ensuring enough demand to sustain the lower fees might prove difficult, potentially leading to decreased pressure on Ethereum’s value over time?

What does fundamentals suggest?

In the broader market, Ethereum’s metrics provide a mixed picture.

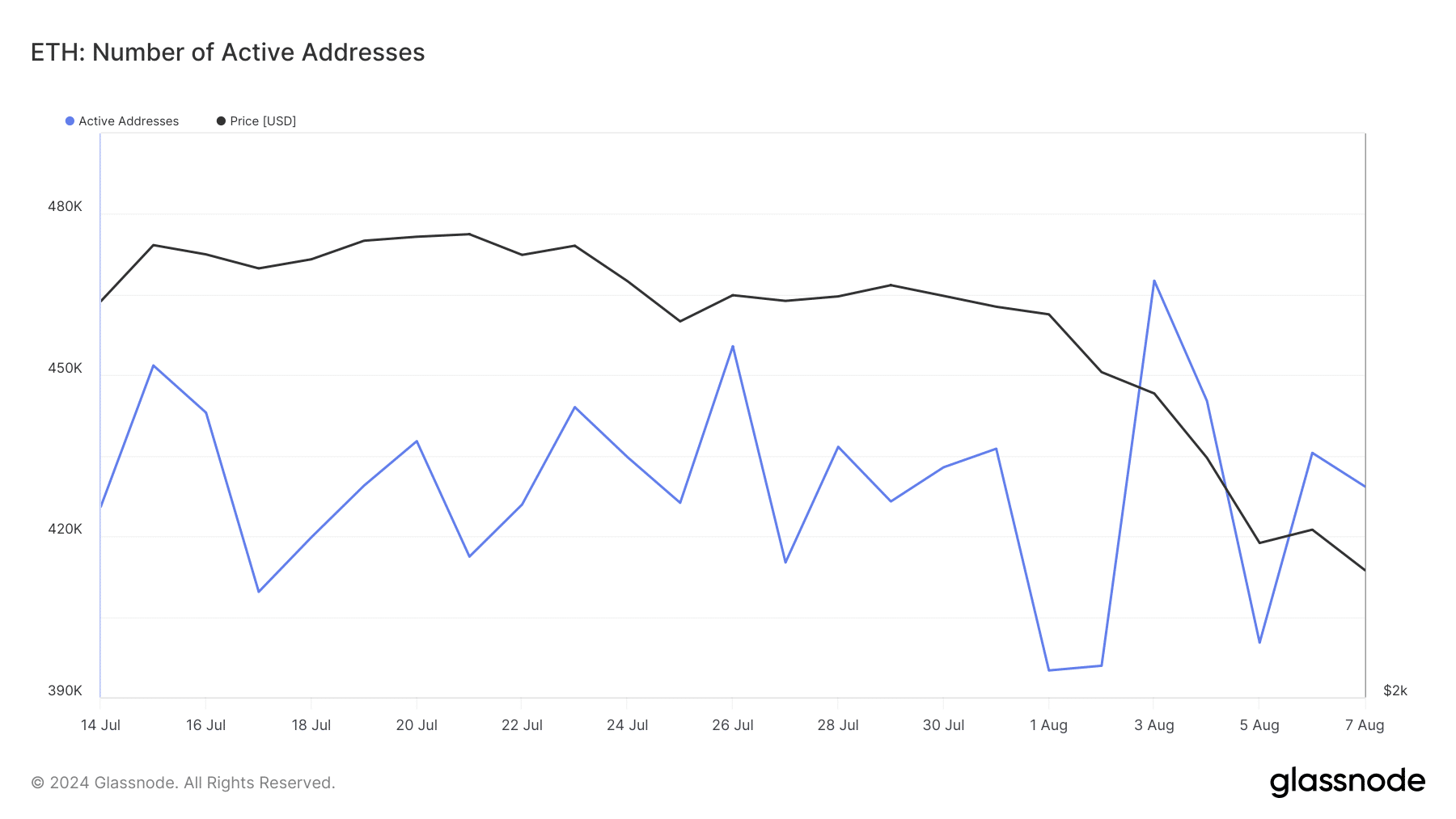

Over the past few weeks, there have been substantial changes in the number of active addresses. Following a notable rise that reached over 455,000 at the end of July, it climbed even higher to approximately 467,000 on August 3rd. However, it has since dropped back down to around 429,000, which is slightly higher than the 400,000 seen on August 5th.

The fluctuation in user activity implies that although the network is still being used, their trust or faith might be decreasing over time.

Read Ethereum’s [ETH] Price Prediction 2024-25

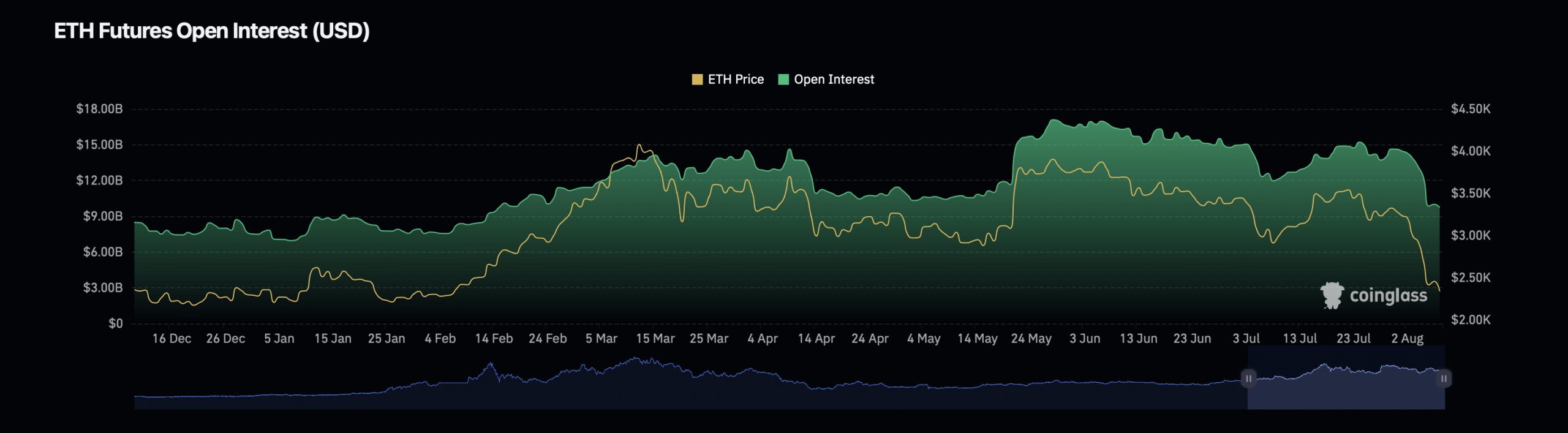

financially speaking, the open interest for Ethereum, indicating the combined unfilled derivative agreements such as futures and options, dropped by approximately 3.60% within a single day.

Instead, an increase of 3.96% was observed in the total value of these contracts due to open interest volume, implying a intricate dance of investment activities.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- BLUR PREDICTION. BLUR cryptocurrency

2024-08-08 21:12