- A prominent crypto analyst suggested that ETH could break out of a bullish pattern, potentially triggering a significant price surge.

- On-chain metrics tell a different story, with rising investor caution and increased selling activity casting doubt on a rally.

As a seasoned crypto investor with over a decade of experience navigating the volatile landscape of digital assets, I find myself torn between the bullish and bearish perspectives on Ethereum [ETH]. On one hand, I’m intrigued by Carl Runefelt’s technical analysis suggesting a potential breakout, but on the other hand, I can’t ignore the growing selling pressure from U.S investors as indicated by the Coinbase Premium Index and Exchange Netflow data.

Over the past month, Ethereum [ETH] delivered a notable 18.66% gain, but its upward trajectory has since slowed. Weekly performance showed a marginal 0.02% increase, while daily gains remain modest at 0.20%.

Based on my analysis, I find myself aligning with AMBCrypto’s perspective that Ethereum might be headed towards a correction rather than experiencing the bullish surge many anticipate. The current market indicators appear predominantly bearish, which raises concerns about a potential downturn in the near term.

Is Ethereum bullish enough to hit $3,400?

Based on Carl Runefelt’s chart interpretation, Ethereum (ETH) is currently trading beneath a downward resistance trendline – a configuration frequently suggesting an upcoming surge in its price.

As an analyst, I’m observing a distinct pattern that suggests Ethereum (ETH) might reach a potential high of around $3,420. This peak, being the culmination of the observed formation, represents an approximately 8.55% increase from its current standing.

Runefelt remarked,

“Ethereum needs to break above this descending resistance to regain bullish momentum.”

Still, closer examination reveals that opinions within the market are split, leaning towards the bears for now. There’s no strong agreement suggesting a surge past the current resistance point just at this moment.

Investors offload ETH, adding downward pressure on price

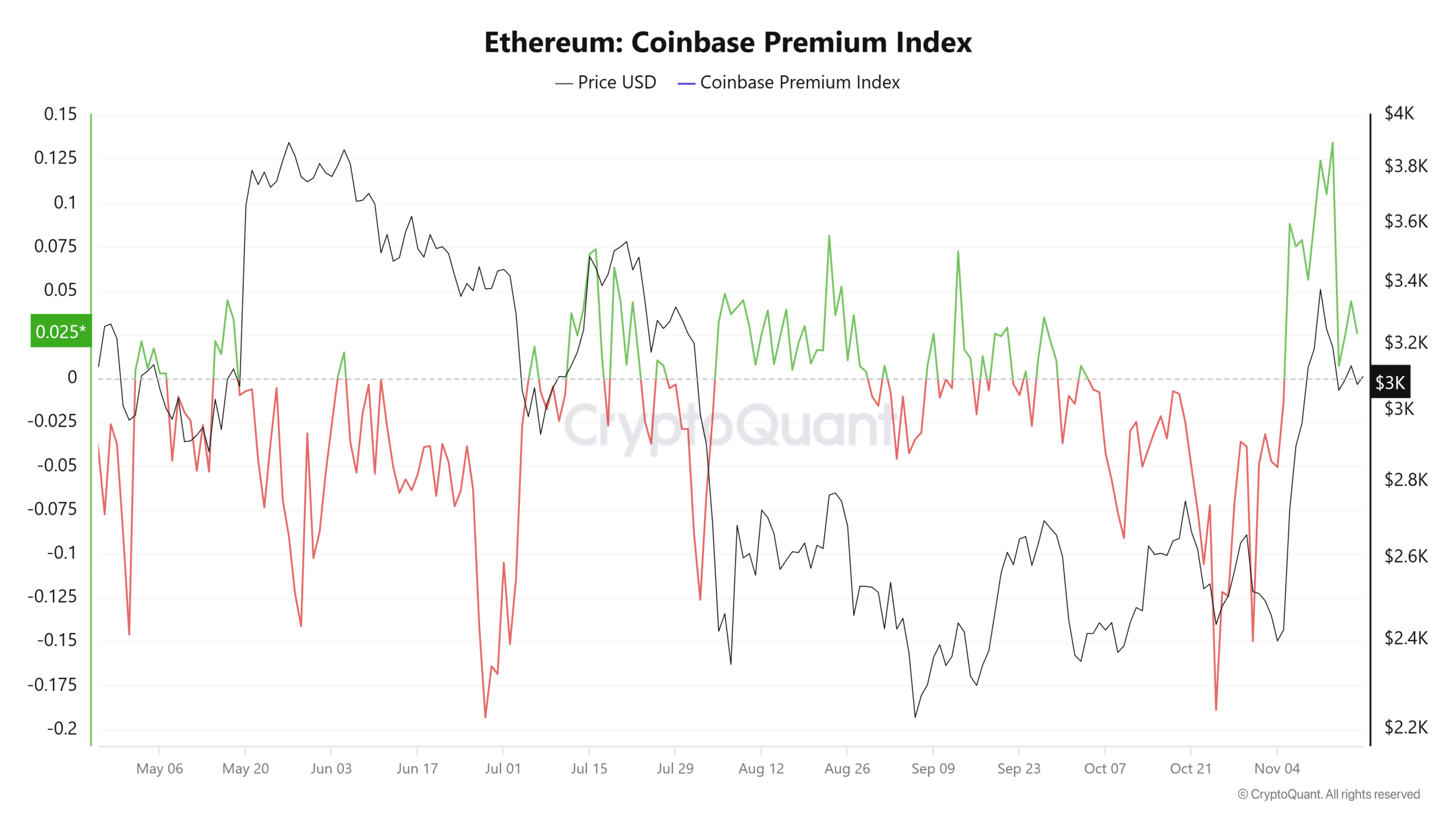

According to information from CryptoQuant, it seems that American investors are offloading their Ethereum (ETH) investments. This could indicate decreasing enthusiasm for the asset and potentially lower anticipation for a price surge.

The gap between the cost of Ethereum in USD on the American-centric exchange, Coinbase Pro, compared to its price in USDT on the worldwide exchange, Binance, is indicative of this pattern, as shown by the Coinbase Premium Index.

In April, the index stood at 0.1346 for ETH’s demand among U.S. investors, but it has significantly decreased to 0.0256 now. This decrease suggests a reduction in interest or demand for Ether by U.S. investors relative to global markets.

The drop in prices occurs at the same time as an increase in Exchange Netflow, indicating the transfer of Ethereum between exchanges is on the rise.

In simpler terms, a positive Netflow means more assets are flowing into exchanges for the purpose of selling, whereas a negative Netflow implies that investors are transferring their assets from exchanges to personal wallets for long-term storage.

For the last three days running, ETH’s trading platform Netflow has been on the rise, experiencing a substantial increase of 28,726.8 Ether within the past day. This significant influx has put downward pressure on ETH’s price trend, with further positive Netflow likely to maintain this direction.

Sellers take control as ETH struggles

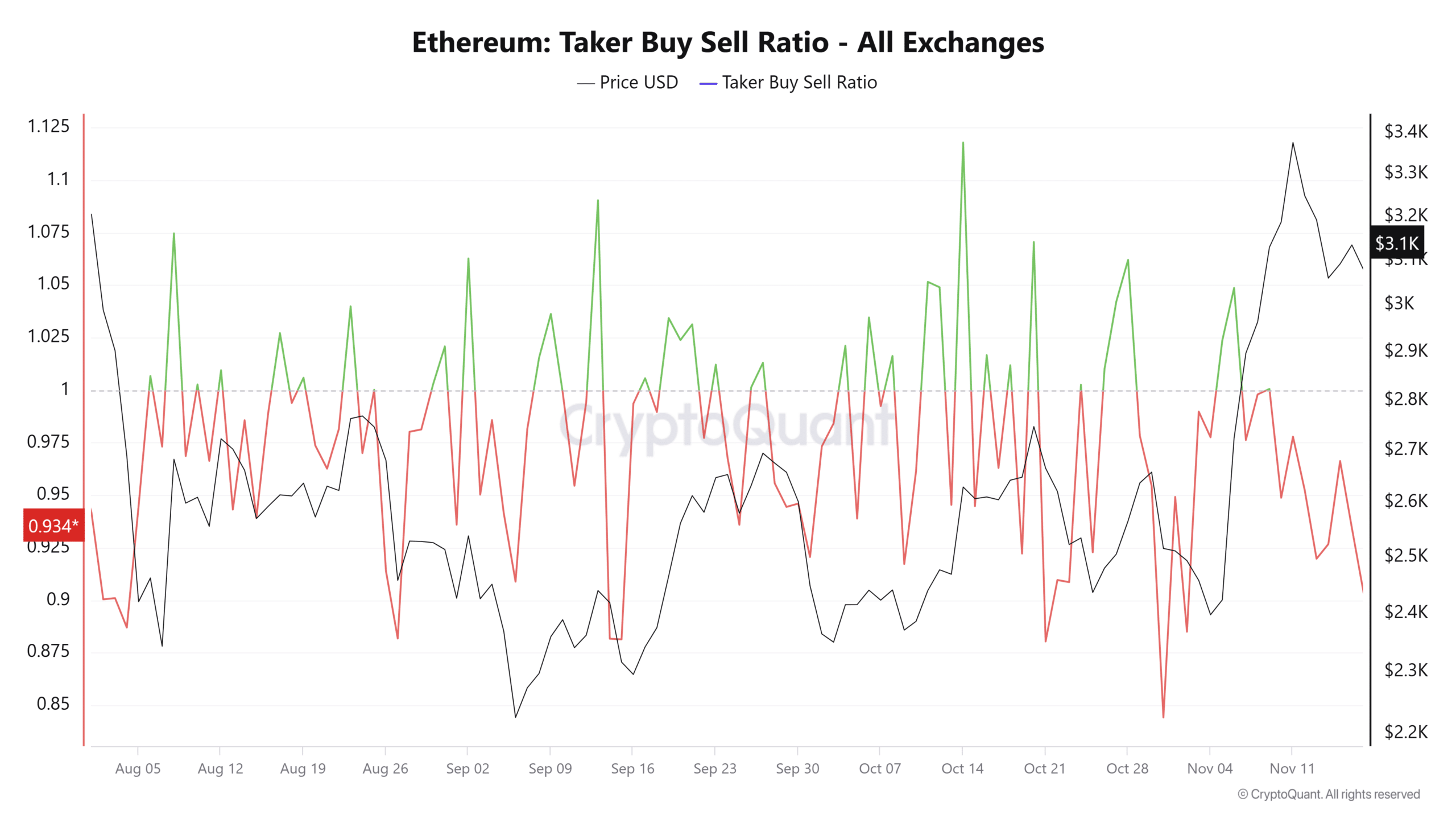

Examining the Balance of Power in the Taker Buy/Sell Ratio indicates that at present, it appears sellers are more influential in the market compared to buyers.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Currently, the ratio stands at 0.9033, which is less than the crucial level of 1. This suggests that there’s more selling activity compared to buying among Ethereum investors, as they are unloading their ETH more frequently.

As a researcher studying Ethereum’s market trends, if the bearish patterns seen across various indicators continue unabated, it appears unlikely that ETH will manage to surpass its resistance threshold. Instead, this resistance level might function as a price cap, potentially leading to additional decreases in ETH’s value due to its inability to sustain growth above this barrier.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-11-18 21:12