-

Bernstein analysts have revised the 2025 BTC target from $150K to $200K

However, short-term rally could be derailed by slow network growth, per Fidelity executive.

As a seasoned crypto investor with a keen interest in the fundamentals of the market, I find both the recent analysis from Jurrien Timmer at Fidelity and the revised BTC price target by Bernstein analysts noteworthy.

Bitcoin‘s price has found it challenging to surpass the all-time peak of $73,700 reached in mid-March, approximately three months ago. Notably, Jurrien Timmer, Fidelity’s director of global macro, attributes this to recent network congestion issues.

Penning his analysis on X (formerly Twitter), Timmer noted,

In recent months, the expansion of Bitcoin’s network has decelerated, yet its value in the marketplace has persisted in rising. From my perspective, this disparity between price increase and adoption may be the reason behind Bitcoin’s momentary pause on its journey towards potential record-breaking prices.

Bitcoin network activity declined after March

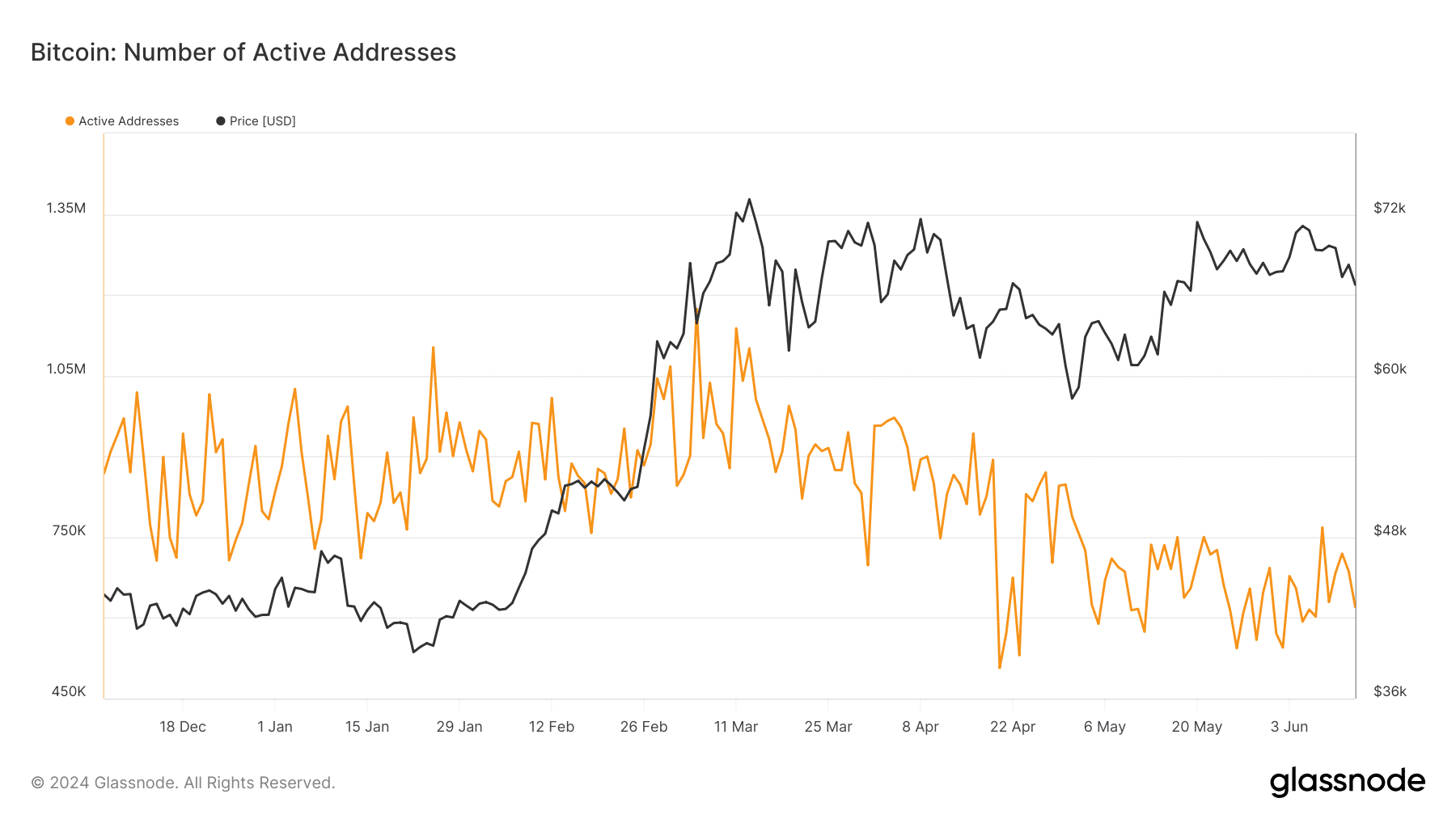

AMBCrypto’s analysis of the active addresses of the Bitcoin network supported Timmer’s assertion.

The number of active addresses on the network reached a high of 1.1 million during the first week of March, right before reaching its all-time high (ATH). However, this figure has since decreased to 620K as of the present moment, indicating a significant drop in network activity during the second quarter.

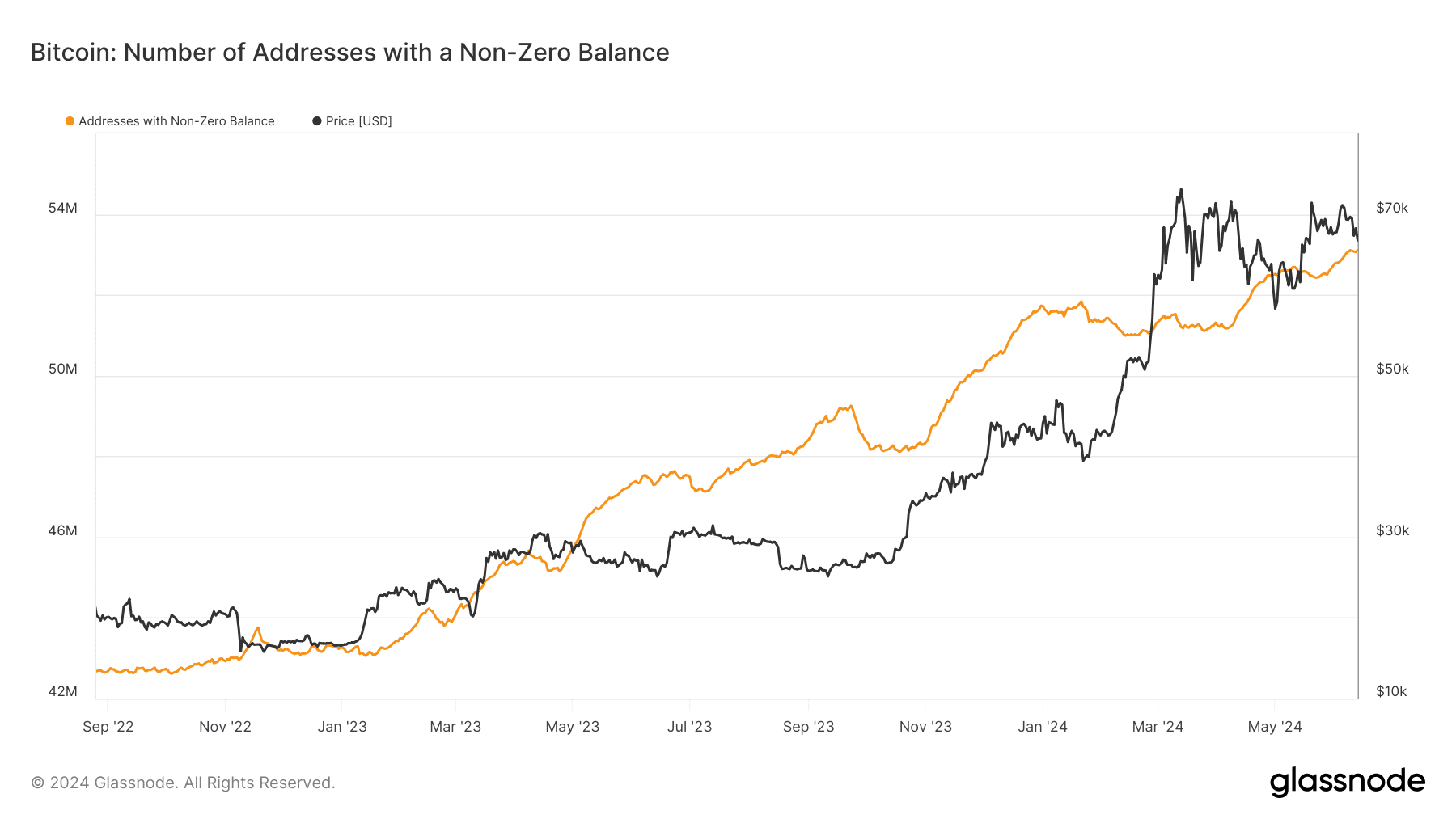

The executive used the existence of non-zero Bitcoin addresses as evidence to strengthen his argument that network expansion significantly influences Bitcoin’s market value.

The count of active Bitcoin addresses rose significantly during periods of network expansion, while it dwindled when the network’s activity took a downturn.

Intriguingly, over fifty million Bitcoin addresses holding a non-zero balance emerged during the last quarter of 2023, coinciding with escalated anticipation surrounding the US approval of a Bitcoin Spot Exchange Traded Fund (ETF).

Between January 2024 and the middle of the year, there was a growth of approximately 2 million new addresses on the metric, bringing the total from 51 million to 53 million.

In spite of the significant increase in non-zero Bitcoin addresses, according to Timmer’s assessment, the decline in overall network activity has been hindering Bitcoin’s anticipated rally. He further mentioned,

To maintain the current record-breaking heights, the network might need to pick up the pace once more. This potential acceleration could be fueled by the upcoming developments in the fiscal dominance hypothesis.

Bernstein: BTC to hit $200K by 2025

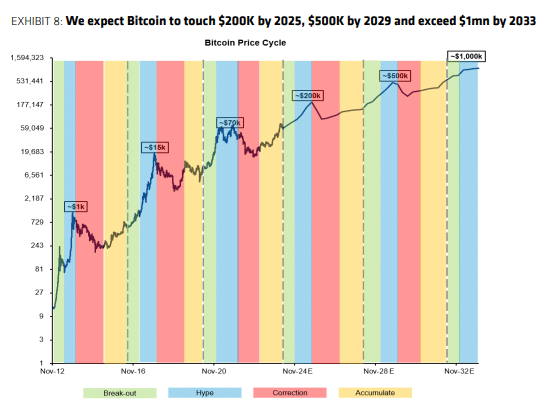

As a crypto investor, I’m always keeping an eye on market analysis and price predictions. Recently, Bernstein, a reputable brokerage and research firm, has updated their forecast for Bitcoin (BTC). Originally, they predicted a price target of $150,000 by the end of 2025. However, after further assessment, they’ve raised this estimate to an impressive $200,000. This means potential growth in value for those invested in Bitcoin, making it an even more exciting investment opportunity.

I, as an analyst, recently shared with our clients that ETF demand and Bitcoin’s supply dynamics have been pivotal factors influencing our market outlook.

Based on their calculations, it’s projected that the ETF’s total assets will increase from their present value of $60 billion to an anticipated $190 billion by the year 2025.

As such, they projected BTC could rally 2.8X from the current level to $200K by next year.

Based on our analysis, we anticipate that the price of bitcoin will surge during the 2024-27 market cycle, reaching a peak that is 1.5 times greater than its production cost. This would equate to a cycle high of approximately $200,000 (representing around a 2.8x increase from the current bitcoin price) by mid-2025.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-06-14 20:07