- Amid the ongoing price correction, whales and institutions have moved Bitcoin worth hundreds of millions

- A crypto whale bought the dip, adding 550 BTC worth $38.68 million

As a seasoned crypto investor with a few battle scars to show for it, I’ve learned to read between the lines when it comes to market movements. The recent price correction of Bitcoin, although unsettling at first glance, is actually a positive sign for the long term. It’s like a breath of fresh air after a heavy rain, preparing the ground for new growth.

Following a substantial surge, it’s important to note that Bitcoin (BTC), the global leader among cryptocurrencies in terms of market capitalization, experienced a significant price drop after reaching new heights from October 26-29. The digital currency saw an impressive 11% increase in value earlier in this period, drawing considerable interest. Unfortunately, this bullish trend didn’t persist.

Will Bitcoin’s price correction continue?

Currently, it’s important for investors and traders to realize that a temporary price drop following a significant increase (rally) is actually a good sign for the future. This is because such corrections can potentially lay the groundwork for a strong price increase in the long run.

Consequently, this price adjustment might not have surprised some market observers. With this recent adjustment in mind, some large investors (whales) and institutions have even transferred assets valued in the hundreds of millions.

Whales’ and institutions’ recent action

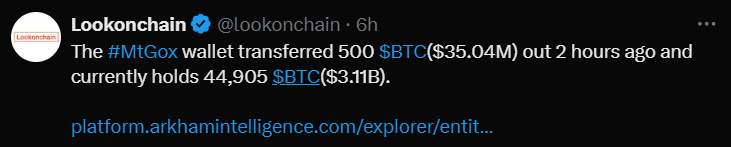

As reported by Lookonchain, a transaction tracker that uses blockchain technology, around the Asian trading session’s morning hours, a wallet associated with Mt. Gox (approximately holding 45,000 BTC or about $3.11 billion), moved approximately 500 BTC, equivalent to around $35.04 million.

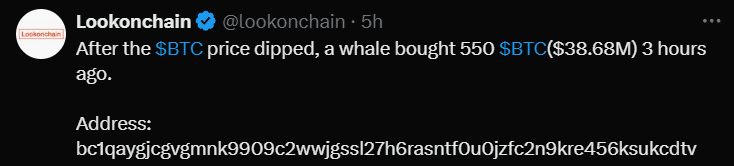

Furthermore, another whale stepped in during the decline, purchasing 550 BTC valued at approximately $38.68 million when the price dipped to a vital support level.

Bitcoin technical analysis and key level

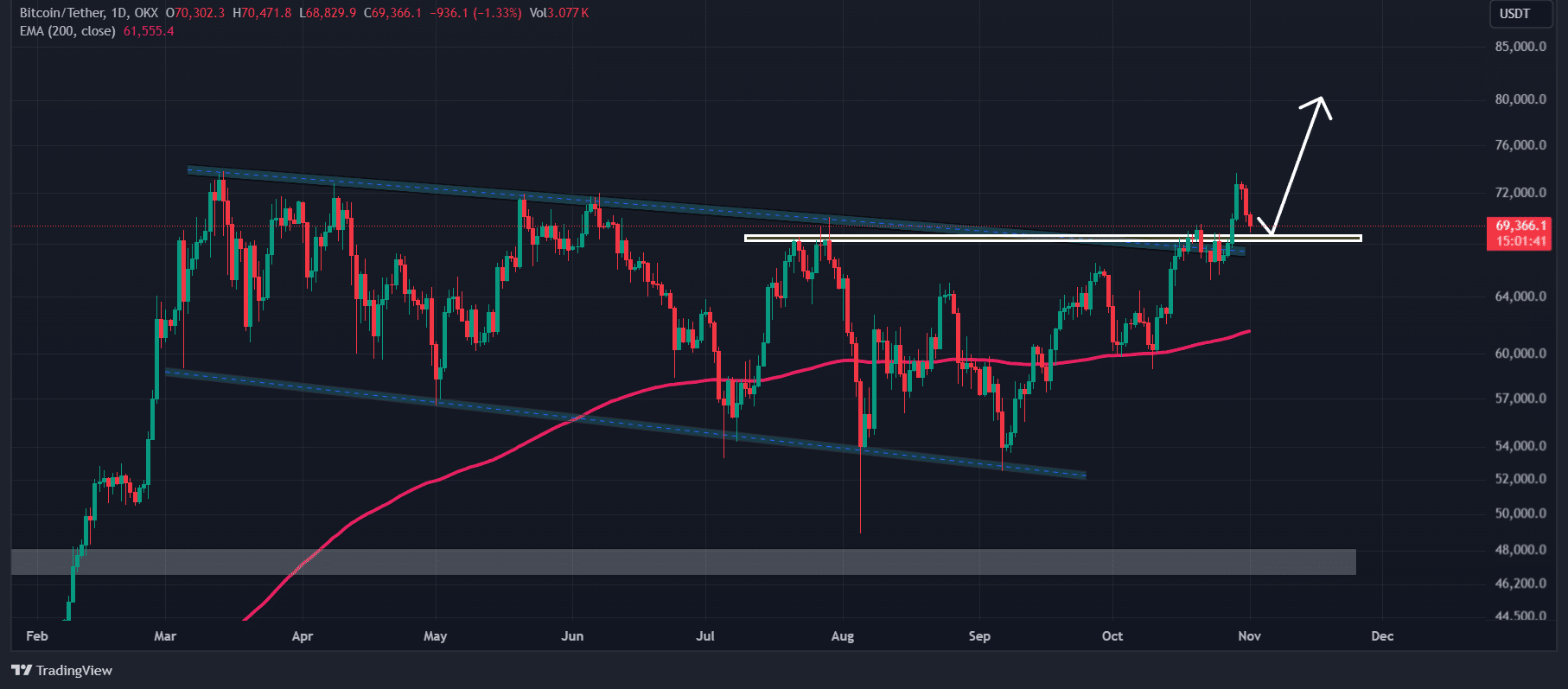

Based on AMBCrypto’s technical assessment, Bitcoin currently seems to be testing the potential resistance level of around $69,235, which was previously a point of breakdown during the declining price pattern.

Given its current trend and past performance, if Bitcoin maintains its current level, there’s a high probability it might experience a substantial increase in the near future. However, should it fail to hold this level, this upward movement could potentially be seen as a false breakout.

Currently, when I’m writing this, Bitcoin was transacting above its 200 Exponential Moving Average (EMA), suggesting that the asset’s trend is moving upward. On the other hand, its Relative Strength Index (RSI) hinted at a possible price surge ahead, since it remained in a neutral zone, neither showing signs of undervaluation nor overvaluation.

Bullish on-chain metrics

The optimistic viewpoint for Bitcoin was reinforced by its network statistics. As reported by the on-chain analysis company Coinglass, at the current moment, Bitcoin’s Long/Short ratio stood at 1.09, suggesting a robust bullish feeling among investors, implying they are more likely to buy than sell.

Additionally, Open Interest surged by 17% – A sign of growing interest in the asset among traders.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-01 16:07