- Bitcoin’s miner activity demonstrated a surge in unrealized profits, indicating bullish optimism

- A few key bullish signals could help dictate how BTC does on the price charts

Analyzing the behavior of miners within the Bitcoin system is crucial since shifts in their activities can yield valuable market information. By examining miner data accumulated over the past few months, we can gain a tentative understanding of the current mood and faith in the market.

Indeed, a recent study conducted by CryptoQuant in April 2024 showed a significant decrease in Bitcoin miners sending their coins to exchanges. This trend implies that miners are keeping more Bitcoin, potentially planning to sell it at a profit when prices rise further.

At the current moment, it appears that the total profits and losses yet to be realized by Bitcoin miners remain positive according to recent analysis. This suggests that these miners continue to hold onto their unrealized gains, thus exerting little influence on the selling pressure within the market.

Are Bitcoin miners still anticipating profits?

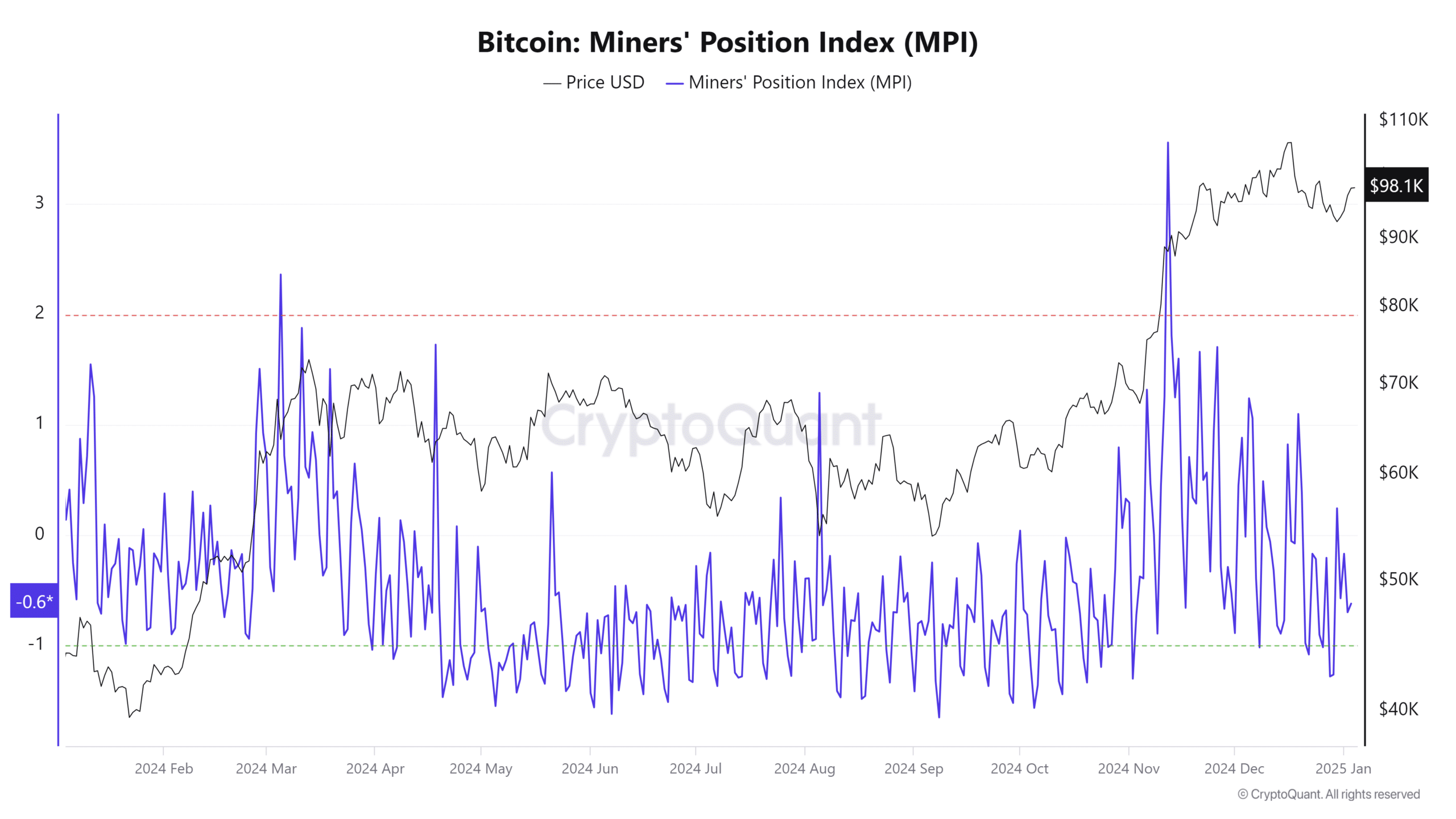

Previously mentioned findings appeared consistent with the Miner Position Index (MPI). Essentially, when the MPI is high, it suggests that miners are moving more Bitcoin, a situation that frequently corresponds to increased selling pressure.

The highest point this metric reached was on November 12, which was only a few weeks prior to when the price hit its all-time high.

Bitcoin miners’ intense selling pressure peaked as indicated by the MPI (Miner Position Index), but since then, there’s been a substantial drop, with it ending December close to its lowest point. This suggests that the rate of miner sell-offs has significantly slowed down.

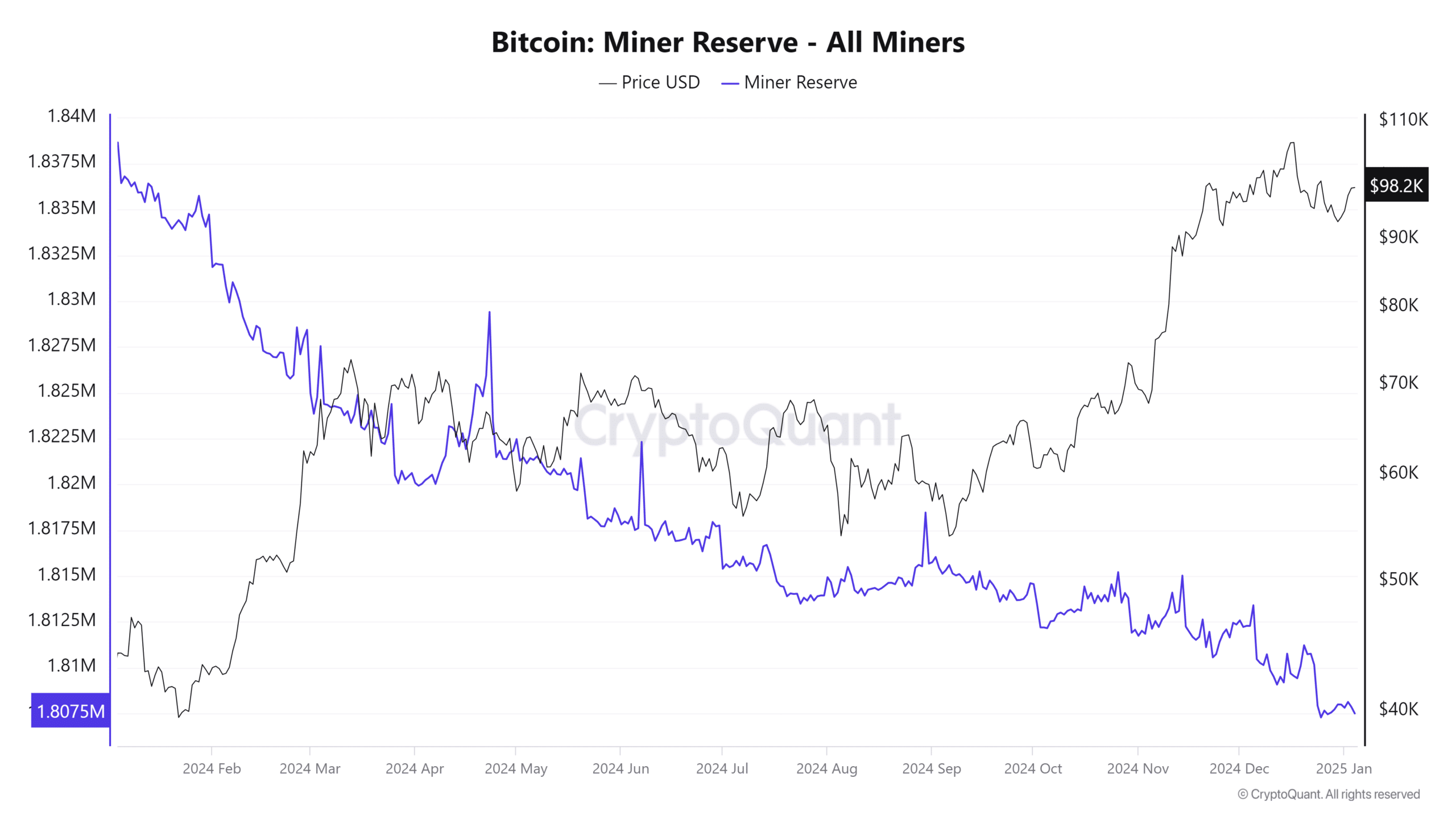

Even though this is the case, it’s worth noting that Bitcoin mining reserves have been decreasing and are approaching 12-month lows. At the time of observation, these reserves were around 1.807 million BTC, which is significantly lower than the 1.838 million BTC at the start of 2024.

As the mineral reserves continue to dwindle, it’s not surprising that miners are seizing opportunities to realize some earnings, particularly with prices on the rise. Given that they must pay for operational expenses using these very same resources, this outcome was indeed anticipated.

According to MPI, the pace at which Bitcoin is being sold off has slowed down significantly as the market experiences a downturn. This could imply that Bitcoin miners are accumulating their coins, hoping for a price surge in the year 2025.

Over time, we’ve seen an increase in mineral reserves, and another significant rise could lead to a new peak. It’s important to keep an eye on institutional demand as well, as it can serve as a crucial sign. Typically, ETFs are often at the center of robust demand trends.

ETF investments generally saw a decline during the latter half of December and began the first two days of 2025 negatively. However, on Friday, there was a significant reversal with approximately $908.1 million worth of ETFs being purchased. If this demand continues in the upcoming weeks, it could potentially lead to the price regaining the $100,000 mark.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2025-01-05 02:15