- BNB has broken through the key resistance at $634.85, signaling potential for further bullish movement.

- Technical indicators, rising open interest, and increased social volume suggest sustained momentum in the near term.

As an analyst with over two decades of experience in the crypto markets, I’ve seen my fair share of bull runs and bear markets. The recent breakout by Binance Coin [BNB] at $634.85 has certainly piqued my interest.

The digital currency Binance Coin (BNB) has made a significant advancement, surpassing its crucial barrier at approximately $634.85, suggesting the possible onset of a fresh upward price movement.

Currently, Binance Coin (BNB) is being traded at $653.79, marking a 5.79% increase over the past 24 hours. This surge has sparked curiosity among traders, leading them to ponder if this trend will continue and potentially propel the token towards even higher goals.

Looking at the positive signs from key technical indicators, everyone is eagerly watching if BNB can maintain its position above this significant threshold.

Price action analysis: Is the breakout sustainable?

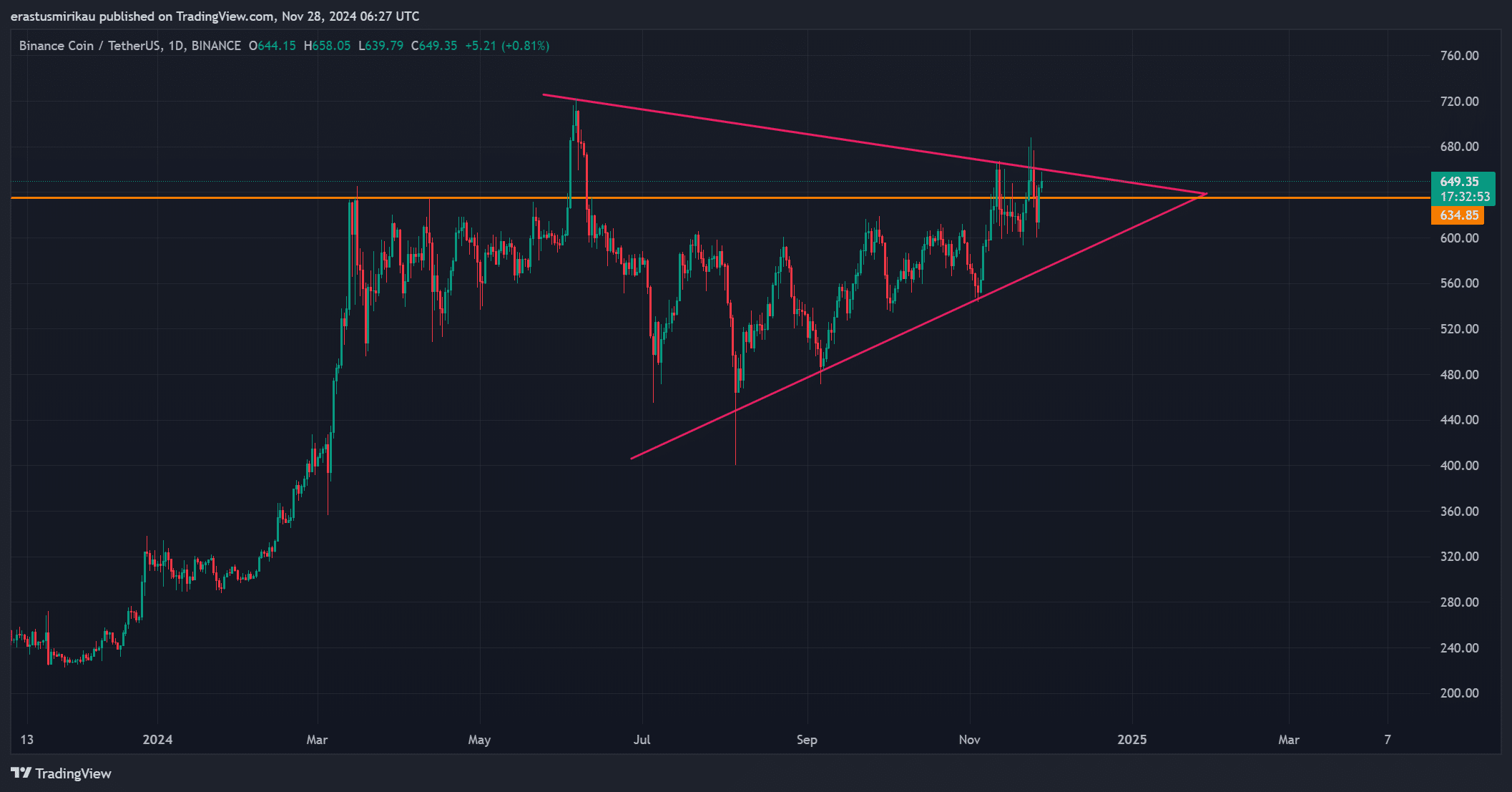

The latest movement in BNB’s pricing suggests a forceful escape from its symmetric triangle formation, a pattern that had limited the token’s price fluctuations for quite some time.

In simpler terms, when we see a symmetrical triangle forming with BNB’s price, it often suggests that the price is gathering strength before making a significant move. And interestingly, the price of BNB has recently broken through the crucial barrier of $634.85, indicating a possible breakout could be on the horizon.

At present, this stage shifts to reinforcement, which is essential for BNB’s potential to keep climbing. The key issue here is whether BNB can sustain this upward thrust and strive towards its subsequent resistance levels around $680 and $700, or if the price will encounter a pullback instead.

BNB technical indicators: What are the charts showing?

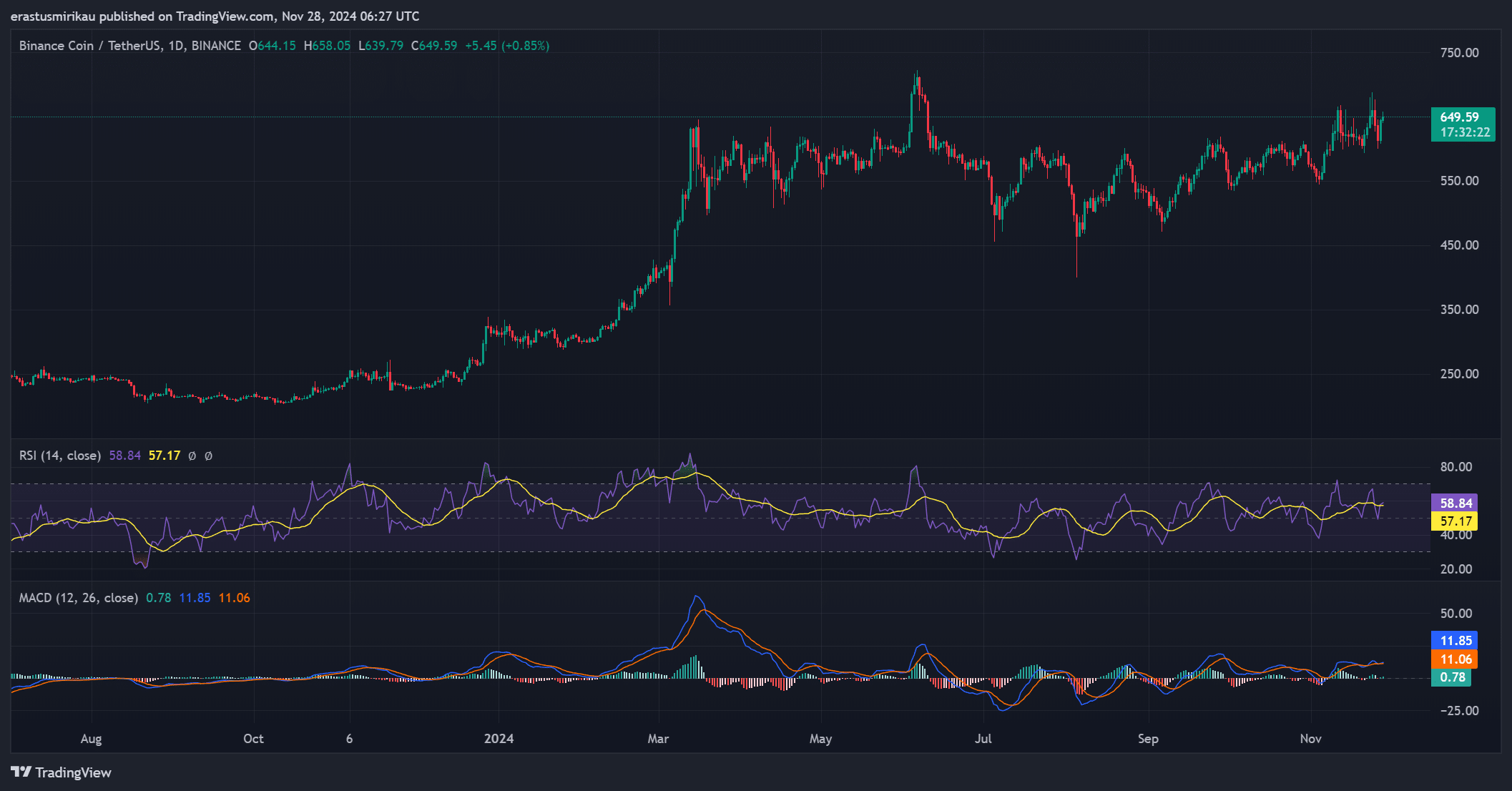

The BNB’s Relative Strength Index (RSI) currently stands at 58.84, signaling a somewhat bullish state without being overly so. This implies that there might be more potential for the asset to rise before it reaches the overbought level, which could potentially trigger a price decrease.

Furthermore, the MACD indicates a bullish signal, which strengthens the likelihood of ongoing price increases. This suggests that Binance Coin (BNB) appears to be in a beneficial position for further growth, provided it manages to uphold resistance above its breakout point.

Social volume: Is there growing interest?

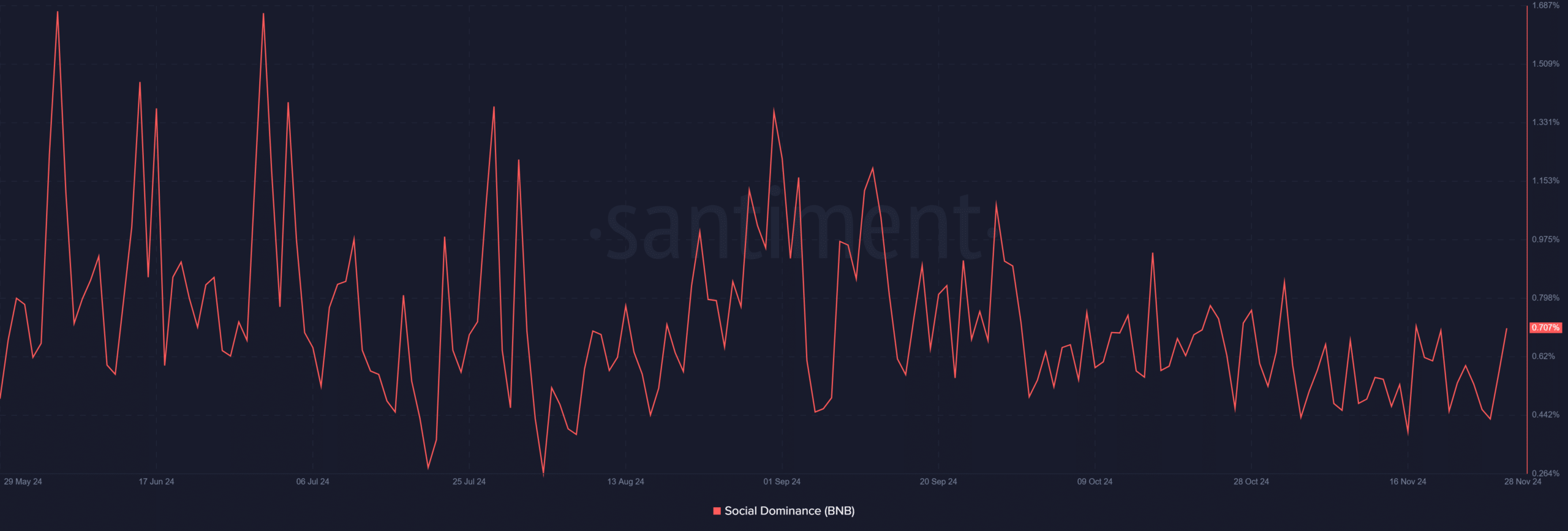

Over the last day, there’s been a small bump in social activity, rising from 0.565 to 0.707. While this rise might seem minor, it suggests a growing curiosity and participation related to the token.

As prices surge, there’s usually an increase in social buzz around trading and investing, implying that a growing number of people are paying attention to Binance Coin (BNB)’s current market behavior. If this pattern persists, it might serve as a catalyst for additional price increases in the near future.

Market sentiment: What does open interest tell us?

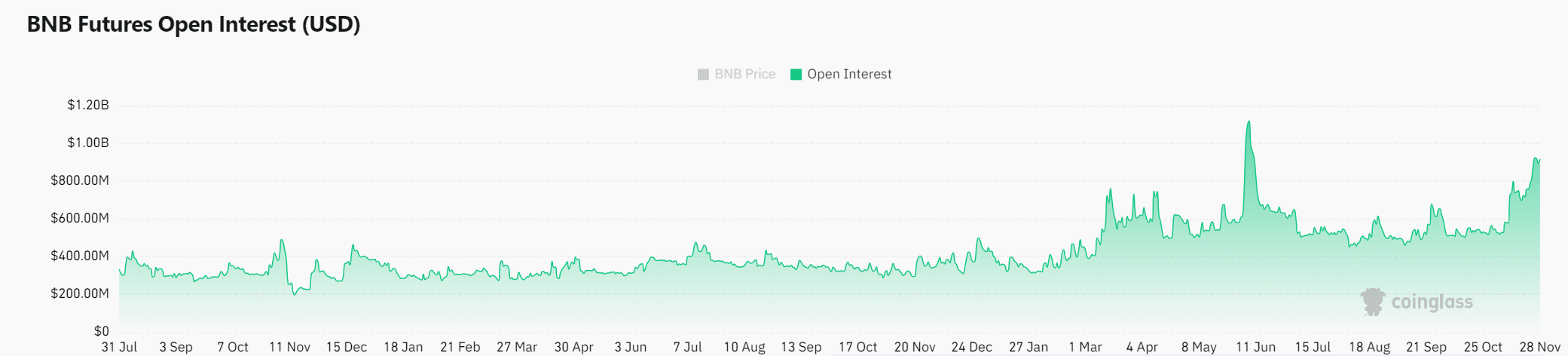

The substantial growth of 6.74% in open interest has brought it up to $973.10 million. This surge suggests that a higher number of traders are initiating trades, hinting at their expectation for ongoing price movement and boosting optimism towards BNB’s positive market trends.

An increase in open interest implies that traders anticipate further market fluctuations and are preparing to capitalize on possible profits by setting up their trades accordingly.

As a result, the optimistic market feeling suggests that BNB could continue to rise, provided it maintains its current breakout point.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

Conclusion: Is BNB set for further gains?

Breaking beyond $634.85 on BNB, bolstered by positive technical signs and a surge in open interest, hints at potential future growth. Additionally, an uptick in social chatter indicates growing market enthusiasm, which could lead to additional price rises.

It’s quite possible that BNB will continue its upward momentum in the short term. But it’s crucial for traders to stay vigilant, looking out for potential obstacles or dips as the value nears significant thresholds.

Read More

2024-11-29 03:03