-

ADA’s price saw some consolidation at $0.341 following the ASI token integration and DeFi activity

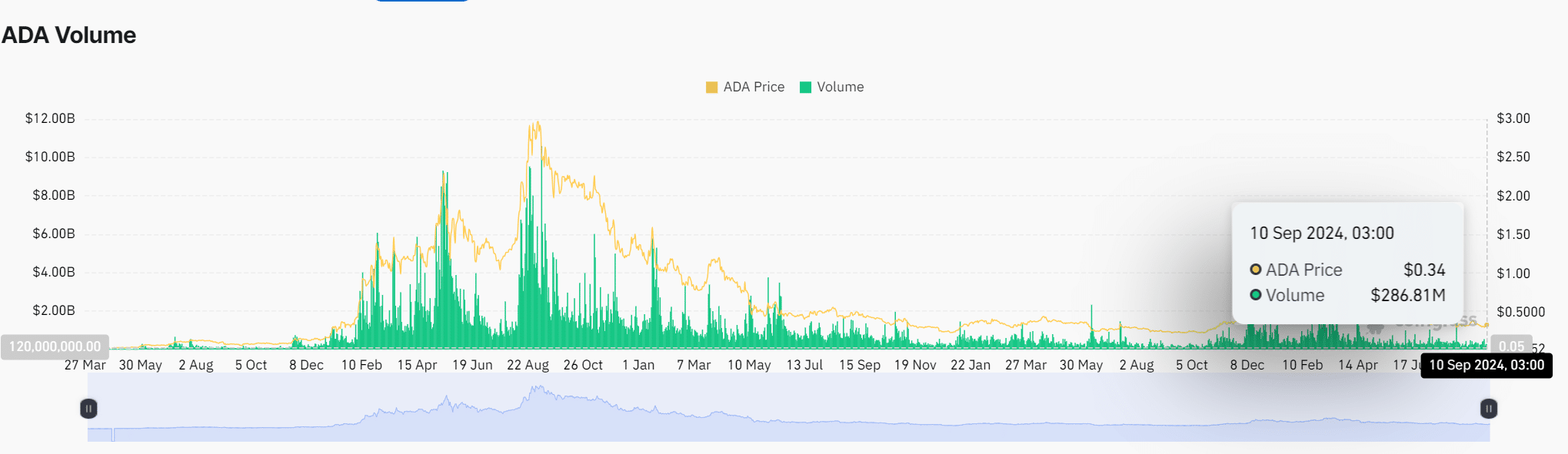

On-chain activity has been rising too, with transaction volume at $286.81M

As a seasoned researcher who has witnessed numerous market cycles and trends, I find myself intrigued by the recent developments surrounding Cardano [ADA]. The ASI token integration and increased DeFi activity have certainly stirred interest, but the 0.49% drop in price over the last 24 hours suggests that caution is warranted before making any bullish predictions.

After integrating the ASI token onto its blockchain, Cardano [ADA] has experienced a resurgence of interest. This development, coupled with increased activity within Decentralized Finance (DeFi), has once again brought focus to the network. However, in the past 24 hours, despite these encouraging advancements, ADA’s price dipped by 0.49%. Currently, its value stands at $0.3429.

Though there seem to be hints of possible expansion, the current market signals advise us to exercise care when forecasting optimistic long-term predictions.

Current price movement

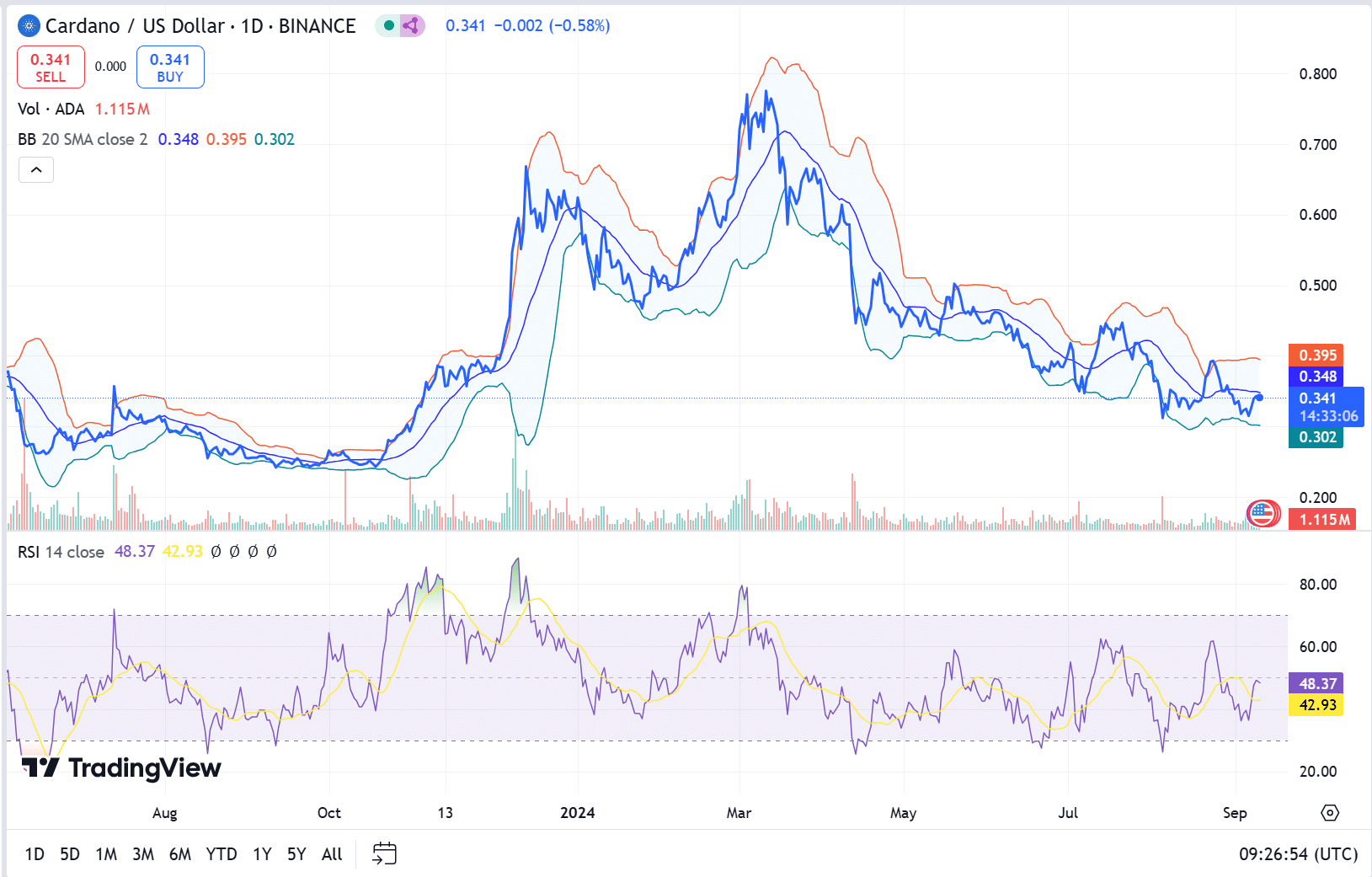

Over the past period, Cardano (ADA) has been holding steady within a compact price band between approximately $0.302 and $0.395. Traders are keeping a keen eye on the $0.395 barrier as potential resistance. The Bollinger Bands suggest a narrow trading range, often indicating an increase in volatility is imminent. If ADA manages to breach the $0.395 resistance level, it may signal the commencement of a more robust bullish trend, which investors have been anticipating eagerly.

As a crypto investor, I’ve been keeping a close eye on Cardano, and while its technical indicators show a bit of a mixed bag, there are still some promising signs. For one, the Relative Strength Index (RSI) is currently at 48.37, which indicates that the market is in a neutral zone. This means there’s potential for price growth, as it suggests neither overbought nor oversold conditions. It’s an exciting time to be invested in Cardano!

As a crypto investor, I’ve noticed that the trading volume of ADA dropped by approximately 3.16% over the past 24 hours, which has now brought the total volume to around $232 million. This decrease in activity might make it challenging for ADA to overcome the resistance at $0.395. To confirm a bullish breakout, we would require a more substantial increase in trading volume.

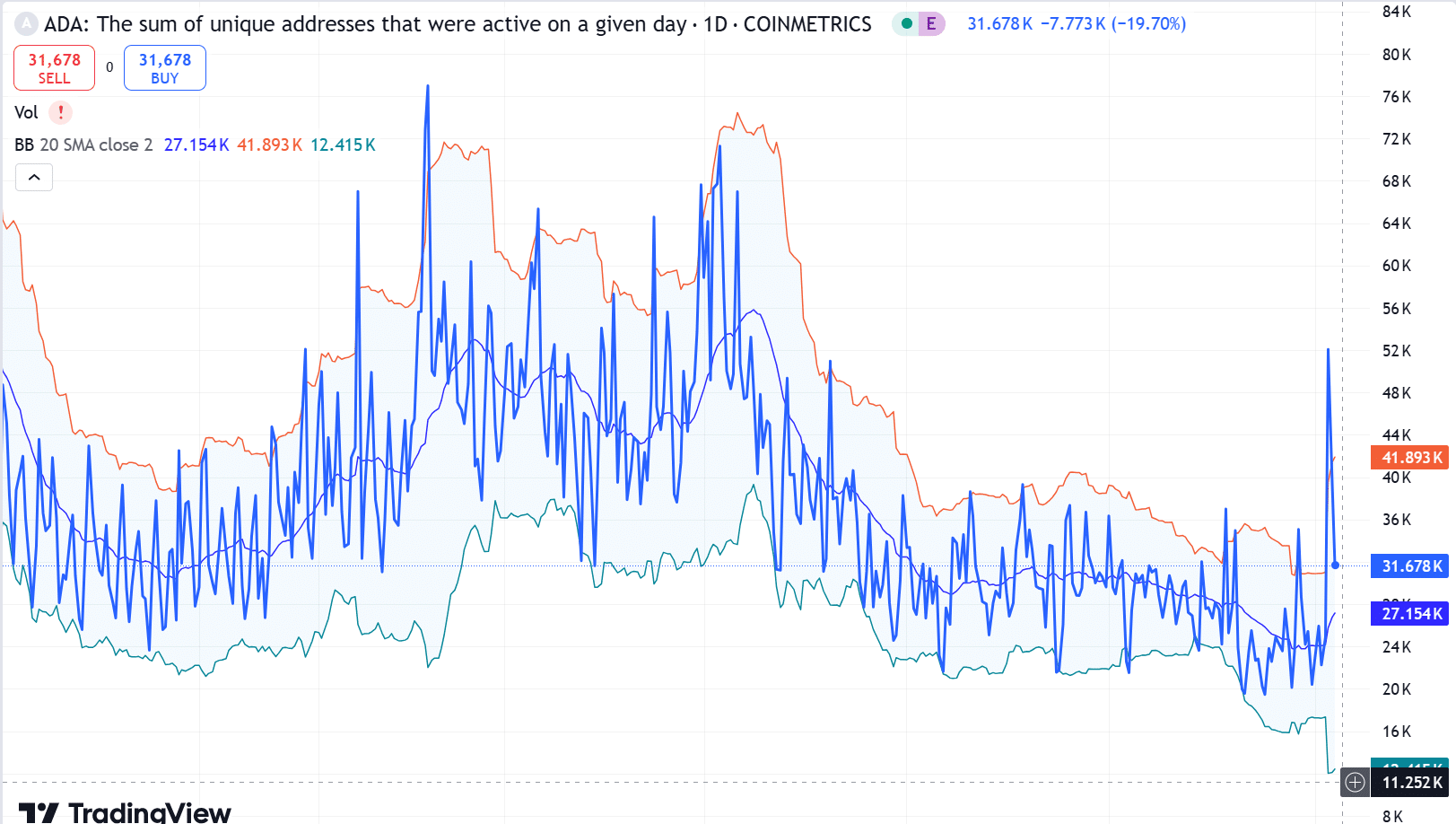

Active Addresses hit a 5-month high

Contrarily, the on-chain activity on Cardano presented some encouraging indicators from my perspective as an analyst. The count of active addresses spiked to reach a 5-month peak at 31,678, signaling a significant increase in network engagement post the ASI token deployment.

Furthermore, as reported by Coinglass, the value of transactions on the Cardano network surged to approximately $286.81 million – Indicating increased on-chain activity. This surge suggests that the Cardano network is being heavily used, which might foster upcoming price fluctuations.

The integration of ASI tokens on the Cardano network has reignited interest and boosted the number of active addresses. Yet, the drop in trading activity gives rise to questions about whether this newfound excitement will lead to lasting expansion.

An increase in ADA‘s trading and transaction activity is essential for it to move beyond its current phase of stability. Caution is advised among traders as they observe crucial price points and network activity to ascertain if a sustained bullish market is developing.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-09-10 23:35