-

Celestia rallied by more than 12% on 4th October outperforming most coins across the crypto market.

TIA has formed a bullish continuation pattern on the daily chart but trading volumes are needed to support a breakout.

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I find myself intrigued by Celestia’s [TIA] performance on 4th October. The 12% rally outperforming most coins across the crypto market is indeed impressive, but it raises some interesting questions about its sustainability.

On October 4th, Bitcoin (BTC) and the overall cryptocurrency market experienced a slight rebound, which could be due to a “buy-the-rumor” situation as traders speculated about the forthcoming US jobs data release. Notably, Celestia (TIA) spearheaded this recovery, surging by 12% over the past day and trading at $5.19 at the time of publishing.

Although there have been some positive advancements lately, TIA experienced a 20% decrease over the past week. With growing optimism towards TIA, will it continue its upward momentum, or might heavy sellers cause a price reversal?

Celestia’s bullish pattern

On the daily chart, Celestia appears to be following a cup-and-handle pattern, often indicative of a bullish trend and an upcoming price increase.

To maintain this trend, an increase in purchase transactions is required. The spike in the volume graph indicates a boost in buying activity, with it now outweighing the selling activity, as indicated by the change of the histogram bars to green.

In simpler terms, a clear indication for buying the stock will occur once the Relative Strength Index (RSI) surpasses its signal line. At present, the RSI trendline is pointing upwards; however, we haven’t seen enough bullish power yet to ensure additional price increases.

A similar outlook is also seen in the Chaikin Money Flow (CMF), which has a negative value of -0.04. This indicator shows that selling pressure is higher than buying pressure. A crossover to the positive side could support a breakout from this pattern.

Should the optimistic prediction prove true, we can expect TIA‘s value to potentially rise by approximately 35% from its current price, reaching a resistance level around $6.92. A bullish breakthrough at this level would pave the way for a more pronounced upward trajectory in the future.

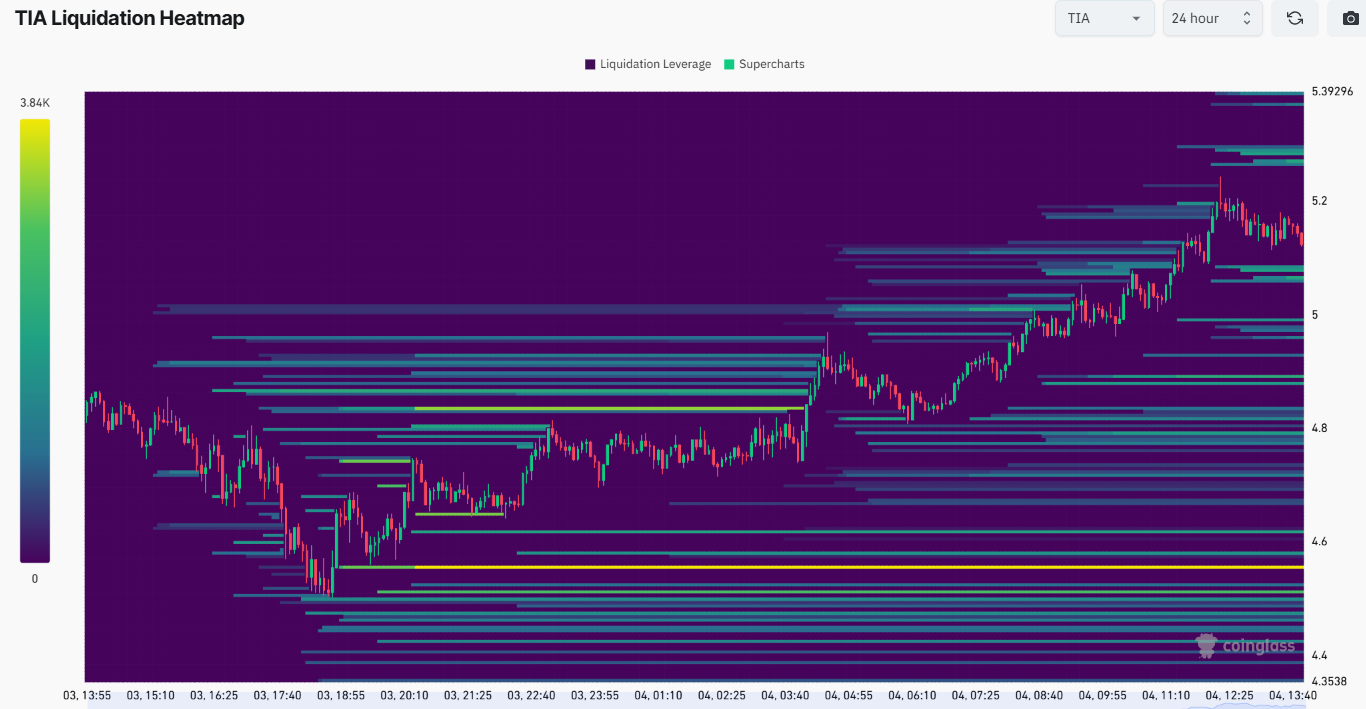

Analyzing liquidation data

Celestia’s liquidation heatmap shows that there are significantly more short positions than long positions on TIA. This data suggests that more traders are betting on further price drops, which shows strong bearish sentiment.

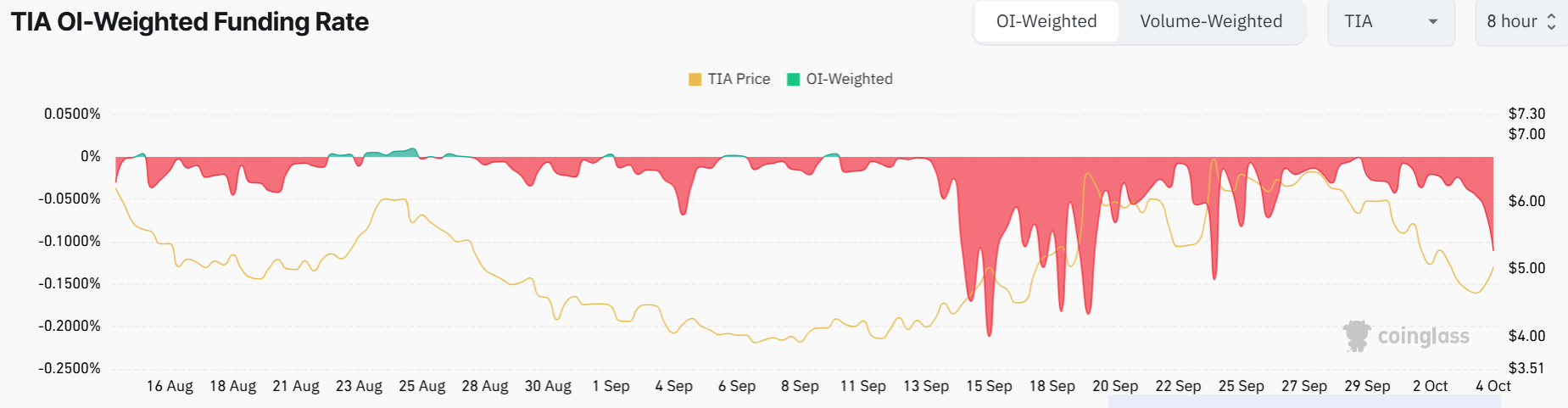

An examination of the funding rates provides additional support for the bearish argument. Since early September, TIA‘s funding rates have generally been negative, indicating that traders are hesitant about TIA’s continued price increase.

If interest rates continue to stay below zero for an extended period, it might lead to reduced prices unless the general market outlook significantly improves.

Moreover, as reported by Coinglass, open interest surpassed $200 million at the moment of publication. This indicates that investors holding short positions on TIA continue to keep their stakes, even amidst the current price upturn.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-10-05 03:35