- INJ is testing key resistance at $21.26, with a sharp 340% surge in volume signaling strong buying interest.

- Open interest is up 9.43%, indicating bullish sentiment, but failure to break resistance could trigger a pullback.

As a seasoned crypto investor with battle scars from more than a few market cycles, I must admit that the current scenario surrounding Injective [INJ] has caught my attention. The token is poised at a critical resistance point near $21.26, and if history has taught me anything, it’s to never underestimate the power of bullish momentum building up at key levels like this one.

Currently, Injective is approaching a significant resistance level around $21.26, potentially setting up for a breakout that could push it beyond $24. At the moment of writing, the token is being traded at $21.83, representing a 6.54% increase over the past 24 hours.

The significant rise, coupled with a notable spike in activity, hints at a potential accumulation of positive sentiment. Can Injective sustain this trend and overcome the barriers of resistance?

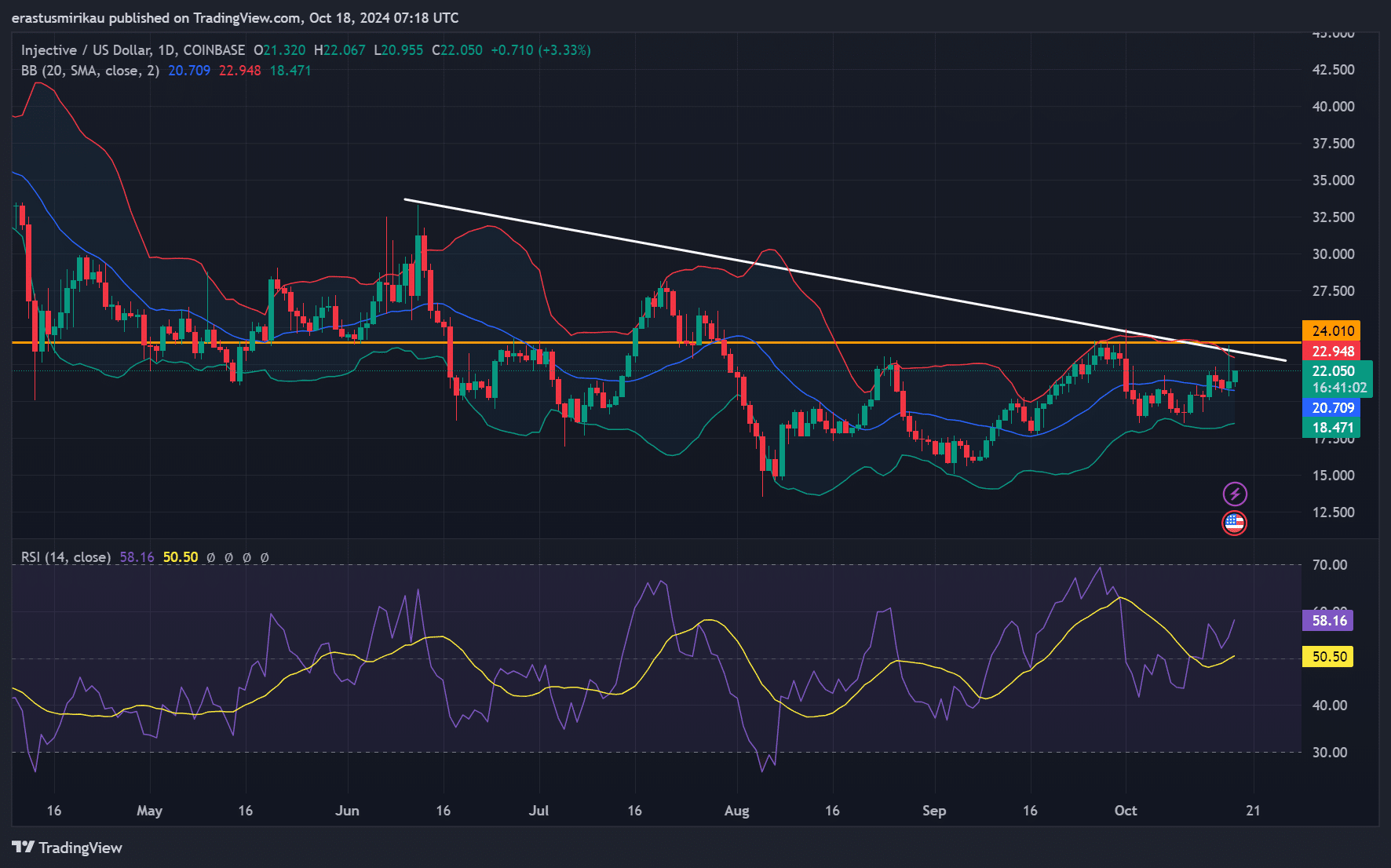

INJ chart analysis: Can bulls push through resistance?

The chart clearly shows Injective approaching key downtrend resistance. Price has hovered around the $21.26 level but has struggled to break higher.

As an analyst, I see that the Relative Strength Index (RSI) currently stands at 58.16. This suggests there’s potential for the market to continue its upward momentum without yet reaching overbought levels.

Moreover, important resistance points can be found at $22.94 and $24.01. If the bulls manage to break through these levels, it will signal a positive trend.

If we don’t manage to reverse the current trend, there might be a pullback. The support level is around $20.42, and if sellers take over, there could be a drop towards $19.32 as well.

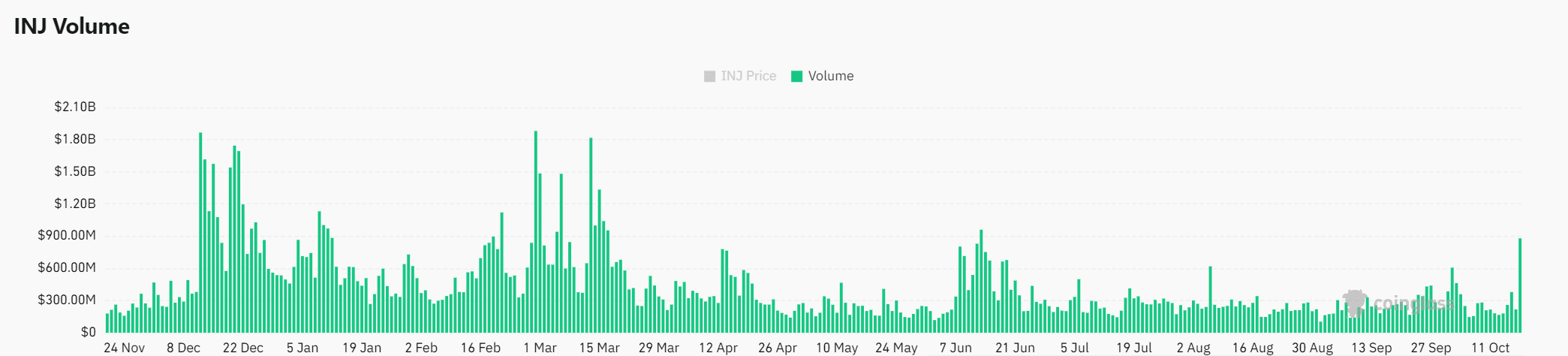

Volume surge: A precursor to a breakout?

One significant development for Injective involves a massive 340.88% increase in trading volume, amounting to approximately $917.65 million within the past 24 hours.

Generally speaking, when the trading volume suddenly increases at certain resistance points, it often suggests an increase in buyers’ activity. This heightened activity could be a sign that the bulls are entering the market, potentially preparing for a potential price breakthrough.

If the volume starts to decrease without pushing the price beyond resistance, this might be a sign of market exhaustion. Therefore, traders need to monitor the volume patterns during the upcoming hours to determine if this rise will continue to push prices higher or could potentially trigger a reversal.

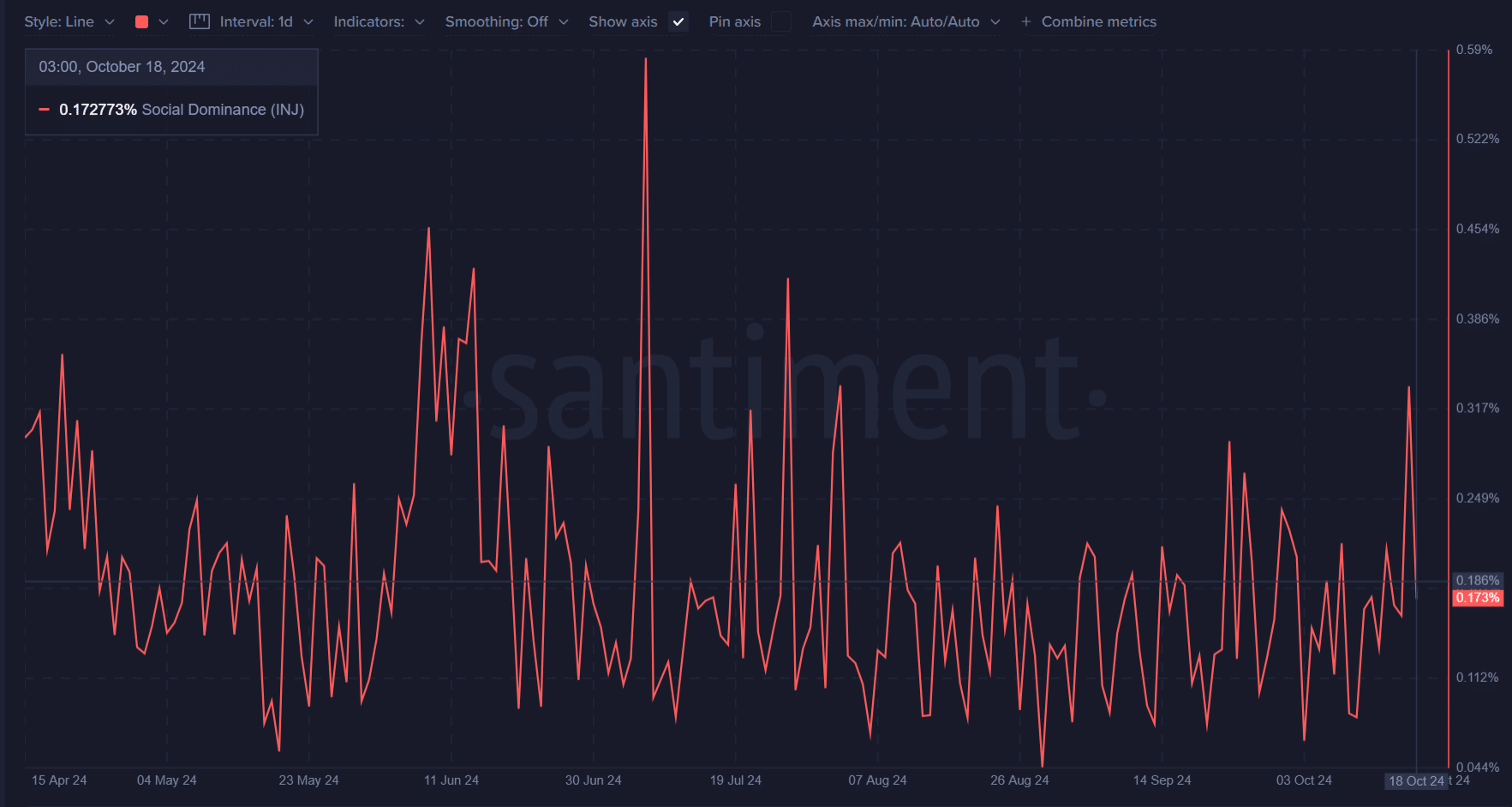

INJ social dominance: Will community interest sustain momentum?

Social dominance is another factor to consider. At 0.1727%, INJ’s social engagement remains active, though not at peak levels. This metric, which tracks community attention, often correlates with price movements.

However, to sustain upward momentum, community interest needs to stay elevated.

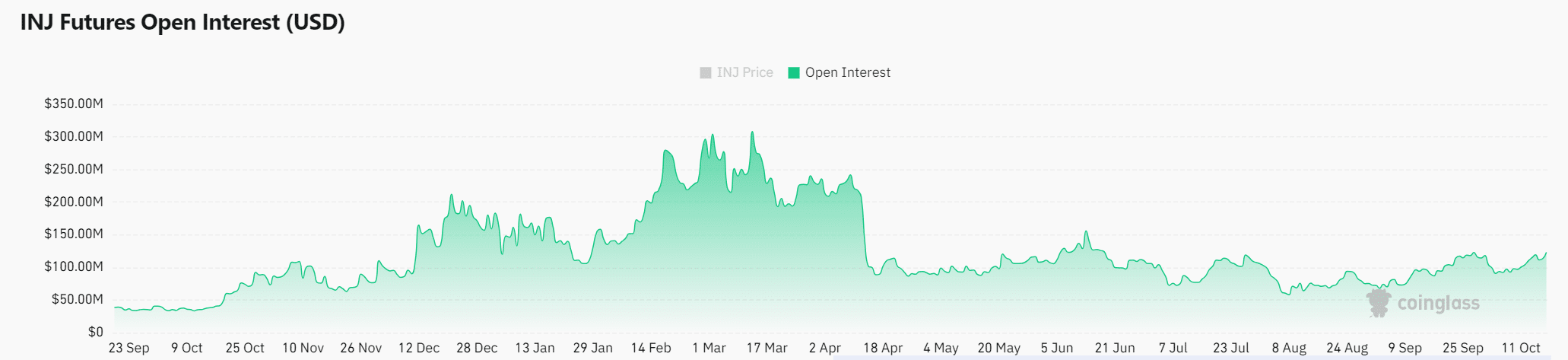

Open interest analysis: What are traders betting on?

The amount of outstanding contracts in the market has increased by 9.43%, suggesting that traders are taking on more positions. This increase in open interest, coupled with a rise in price, indicates that the market continues to be optimistic or “bullish.

If open interest increases but the price remains unchanged, this may suggest excessive leveraging. This situation could result in a sudden price decline when traders decide to close their positions.

Read Injective’s [INJ] Price Prediction 2024–2025

In summary, given the rising trading volume, optimistic investor sentiment indicated by open interests, and an engaged community, there’s a strong possibility that the price could exceed $24.

However, failure to clear this resistance could result in a pullback toward lower support levels.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Solo Leveling Arise Tawata Kanae Guide

2024-10-19 01:43