- MOVE crypto has gained by more than 12% in 24 hours after a surge in buying pressure.

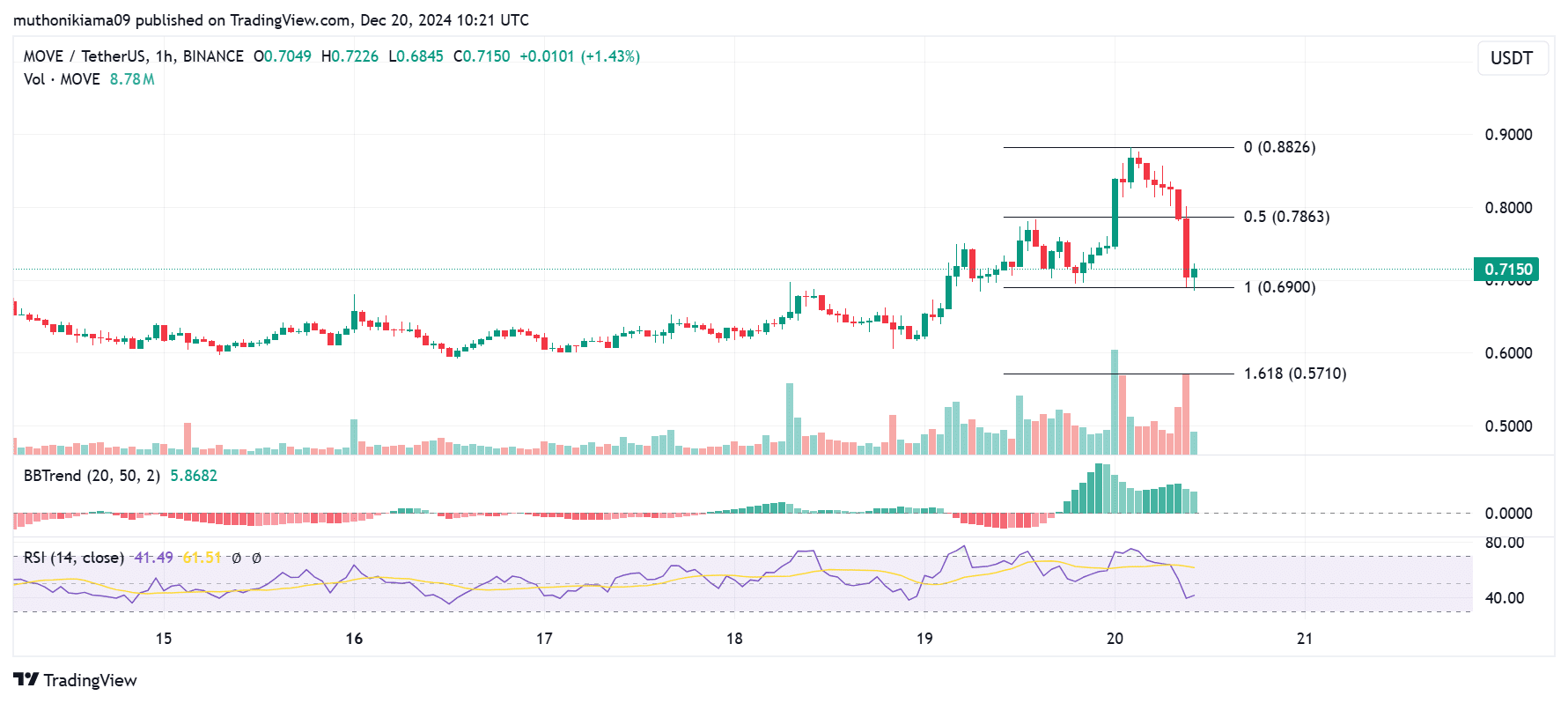

- The dropping RSI on the hourly chart suggests that traders who bought during the rally might be booking profits.

As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find myself intrigued by the recent surge in MOVE’s price. With more than 12% gained in just 24 hours, it’s hard not to be impressed! However, as we all know, every rise must have a fall – or at least a correction. The dropping RSI on the hourly chart hints that some traders who bought during the rally might be cashing out their profits.

After a significant increase of more than 12%, Movement [MOVE] has surpassed other sectors of the market in the past 24 hours. Currently, MOVE is being traded at $0.797, and there’s been a notable jump of 137% in trading volumes, according to CoinMarketCap.

MOVE’s upward trajectory has propelled its market value beyond $1.79 billion, making it the 61st largest cryptocurrency in terms of market capitalization.

One significant factor fueling MOVE’s upward movement was an increase in purchasing activity from short-term investors aiming to cash in on the rally. Yet, it seems that the volume of these purchases has decreased on shorter trading intervals. If the selling volume picks up, this decrease could lead to a downward trend for MOVE.

At the current moment, the Relative Strength Index (RSI) stood at 41, approaching overbought territory. This might indicate an impending brief reversal in the upward trend. However, it also signifies that traders who bought into the upward momentum may be starting to offload their positions.

Even though there’s increased selling pressure, the Green Bollinger Band Trend Indicator suggests that the bulls are still in control. Should buyers return to the market, they might drive the price upward again, potentially reaching the significant resistance level of $0.882.

If the downward trend continues without buyers intervening, the price of MOVE might fall to a significant support point at approximately $0.57, which aligns with the 1.618 Fibonacci ratio.

Analyzing derivatives data

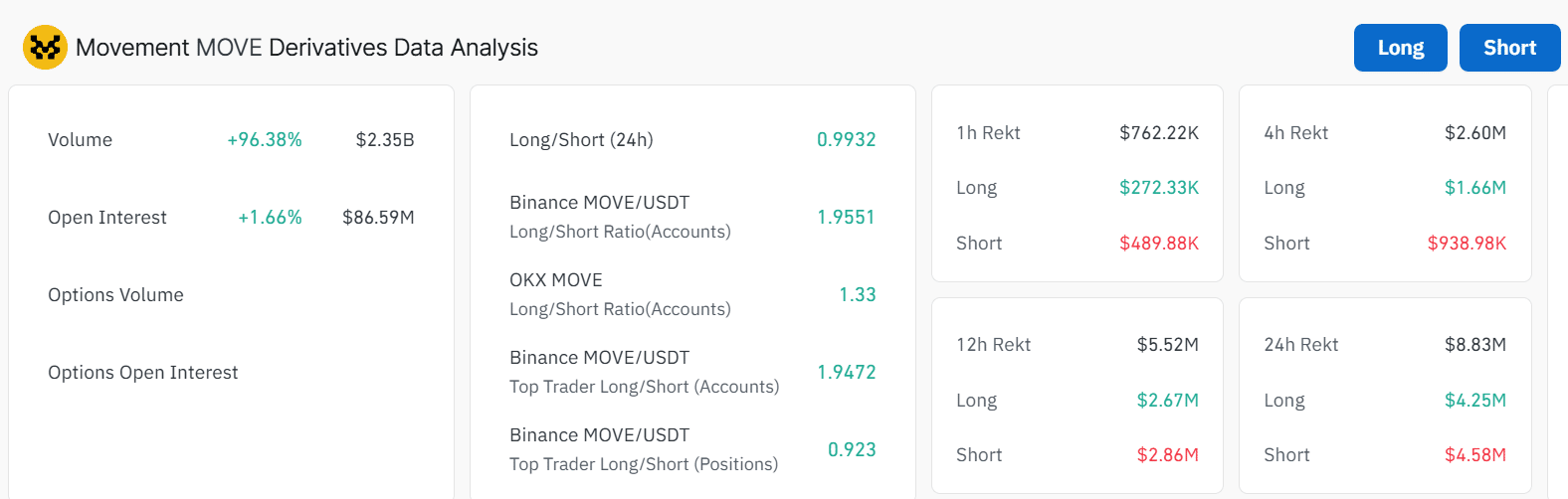

Examining the data from the derivatives market related to MOVE cryptocurrency reveals an increase in speculative actions, which might amplify its price fluctuations.

Over the past day, the value of the token’s open interest has risen to a staggering $86 million, marking a slight increase of 1.6%. Simultaneously, trading volumes in the derivatives market have skyrocketed by an impressive 96%, reaching a substantial $2.35 billion.

Dramatic fluctuations in prices have resulted in a significant increase in the closure of both buy and sell positions, totaling over $8 million within a day.

As a crypto investor, I’m noticing that the long/short ratio stands at 0.99, suggesting a fairly neutral market sentiment where short positions hold a slight edge. This balanced scenario potentially reduces the risk of either a short or long squeeze, leading to decreased market volatility.

MOVE’s liquidation heatmap shows THIS

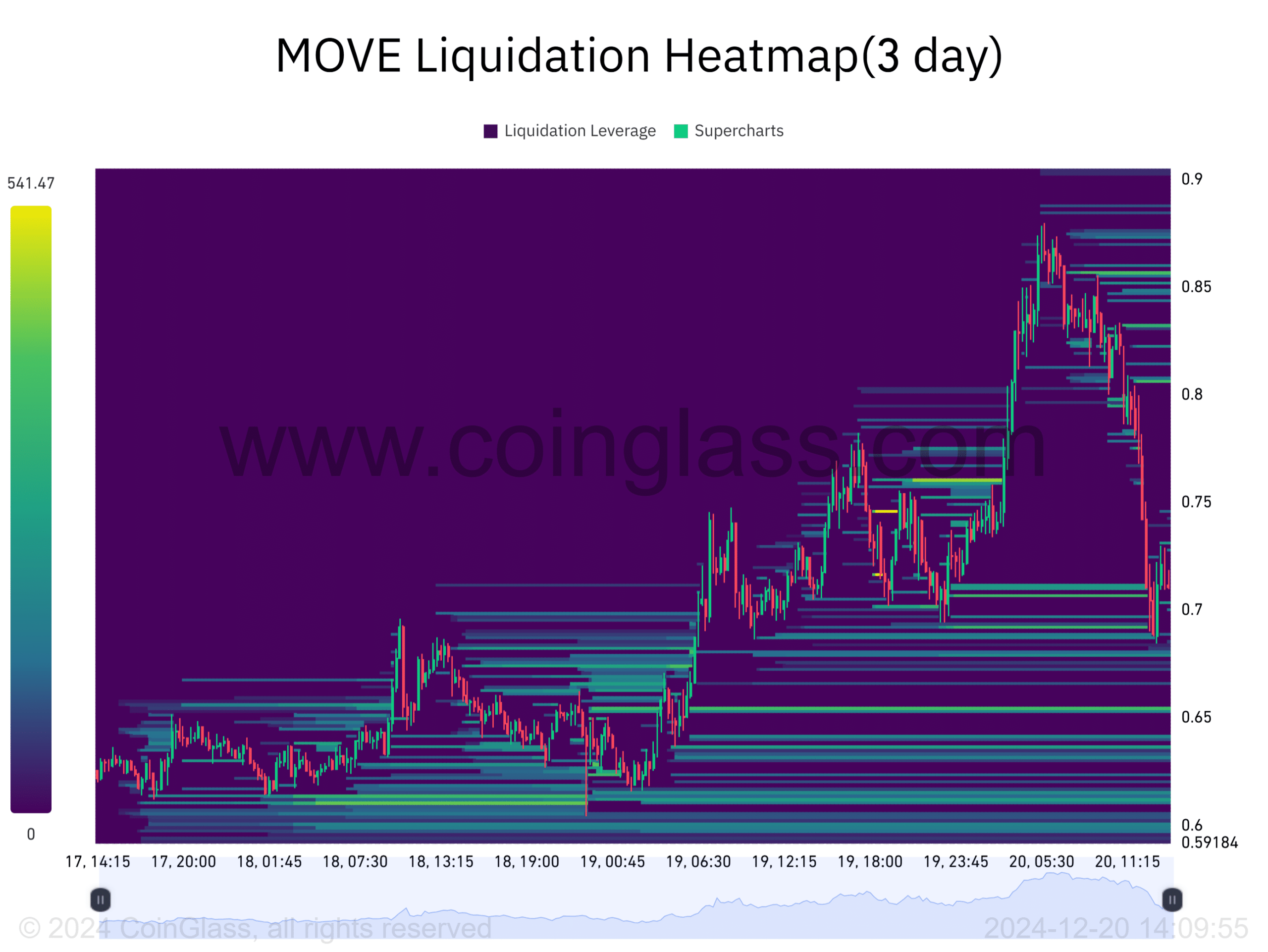

The 3-day analysis of MOVE crypto’s liquidation map reveals that the upward trend led to a chain reaction of short position liquidations. With these positions being closed out, the upward momentum was intensified as a result of compulsory purchasing.

Is your portfolio green? Check the Movement Profit Calculator

Conversely, there exist groups of sellers below the current price level who might drive MOVE downward. Two key levels to keep an eye on for traders are at $0.65 and $0.67.

As an analyst, observing the current market scenario, if MOVE were to dip down to those particular levels, the subsequent liquidation of long positions might amplify the selling pressure, thereby reinforcing the downward trend.

Read More

2024-12-21 02:15