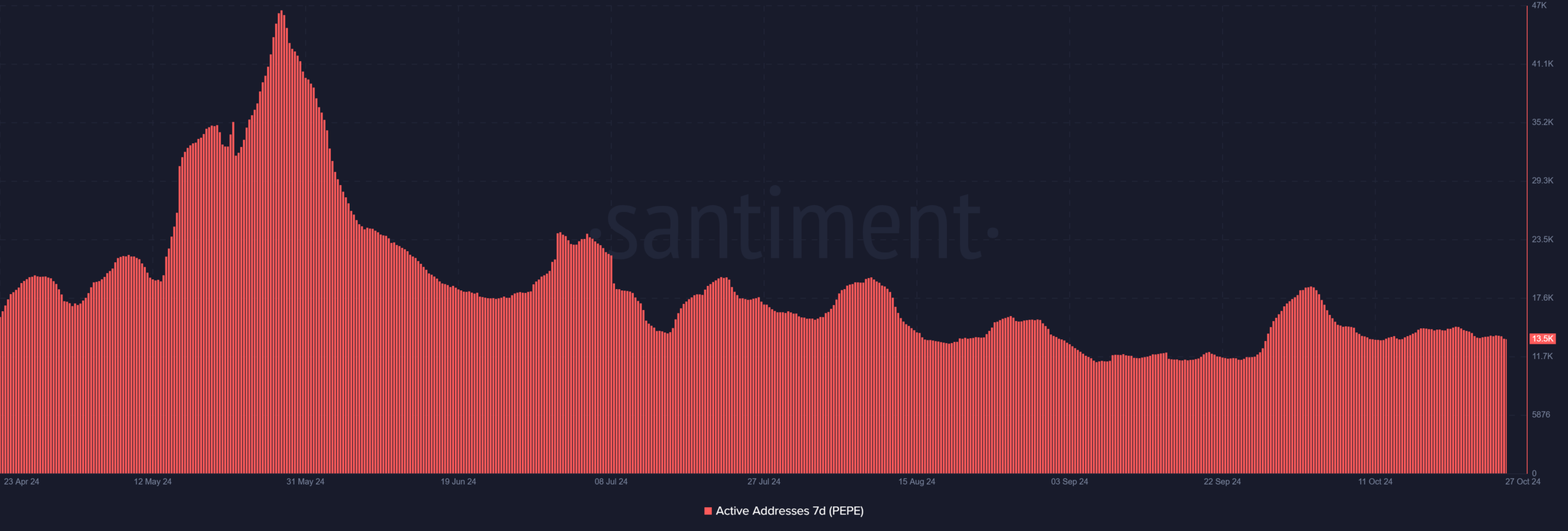

- Pepe’s active addresses have declined to around 13.5k.

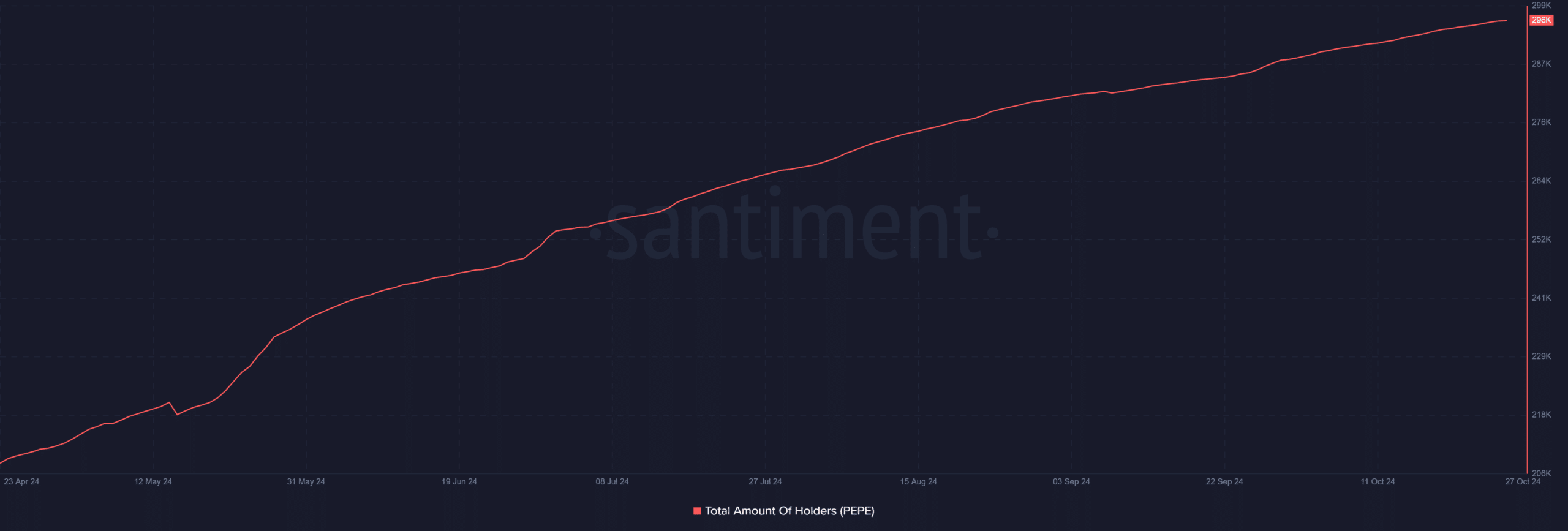

- Despite price challenges and reduced activity, its holder base has grown steadily to nearly 296k.

As a seasoned researcher who has witnessed the rise and fall of countless digital assets, I find myself both intrigued and concerned by the current state of PEPE [PEPE]. On one hand, its growing holder base suggests that there’s a dedicated community of believers who see potential in this memecoin. However, on the other hand, the declining active addresses and price weakness paint a different picture.

After making a splashy entrance, PEPE has experienced an exhilarating ride, attracting significant trading activity and capturing the attention of investors. Lately, though, signs indicate that its pace might be slowing down due to a string of hurdles it’s encountering, with one major issue being reduced user interaction.

On the bright side, an increasing number of owners indicates that the asset has managed to maintain a loyal investor community.

Pepe’s price weakness reflects cautious sentiment

As a crypto investor, I’ve noticed that PEPE’s price has been on a steady decline lately, currently trading around 0.000000900 at this moment. The Relative Strength Index (RSI) stands at 43.80, suggesting that the token is slightly below the neutral line, implying that sellers hold a slight advantage in the market.

From the analysis, it appears that although the cost isn’t excessively low (oversold), there’s not much demand to boost its value. For a change in direction, this memecoin must recapture investors’ trust and conquer significant resistance thresholds.

Otherwise, it risks slipping further if sellers maintain control.

The calm trading activity indicates a sense of caution amongst investors. While it used to have significant price surges, some traders seem to be holding back, potentially because of general market uncertainties or changes in the meme token market dynamics.

If the price remains under pressure, we may see further declines before PEPE finds strong support.

Pepe’s active addresses show declining user interest

On PEPE’s network, there’s been a significant decrease in the number of active addresses. Currently, it’s around 13,500, which is a substantial drop compared to the high points reached earlier this year.

Based on my years of experience in the digital world, I’ve noticed that a decrease in user interest can often be a red flag for the short-term success of any platform or meme, like PEPE. This trend has been observed in many projects I’ve worked with, and it’s always wise to pay attention to such signals when assessing the future of a project.

A smaller number of active addresses usually means less trading activity and reduced market fluidity, because fewer individuals are buying, selling, or interacting with the digital token.

A decrease in active users could suggest that the initial buzz surrounding it has waned, perhaps because investors are now looking for fresh opportunities in other meme-based cryptocurrencies. If there’s no increase in user interaction, this memecoin might find it challenging to recapture the market activity it once had.

Holder base growth reflects long-term confidence

Despite the declines in both price and engagement, one notable bright spot remains: PEPE’s holder count continues to climb steadily, now nearing 296k. This consistent growth indicates that a core group of investors is sticking with the asset, potentially in anticipation of a future recovery.

The growing number of token holders indicates that although its trading fervor may have subsided, there persists a level of long-term trust in the token.

Realistic or not, here’s PEPE market cap in BTC’s terms

The increasing number of PEPE holders indicates that the cryptocurrency could continue to show promise, particularly if overall market circumstances become more favorable.

At the moment, the absence of active involvement alongside weakening prices places PEPE at a crucial point, where it largely depends on its loyal supporters to preserve balance and tranquility.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-10-28 08:08