- Toncoin recently rebounded from a key support level near $4.6, breaking out of a descending channel.

- Derivatives data indicated strong bullish sentiment with high trading volume and open interest.

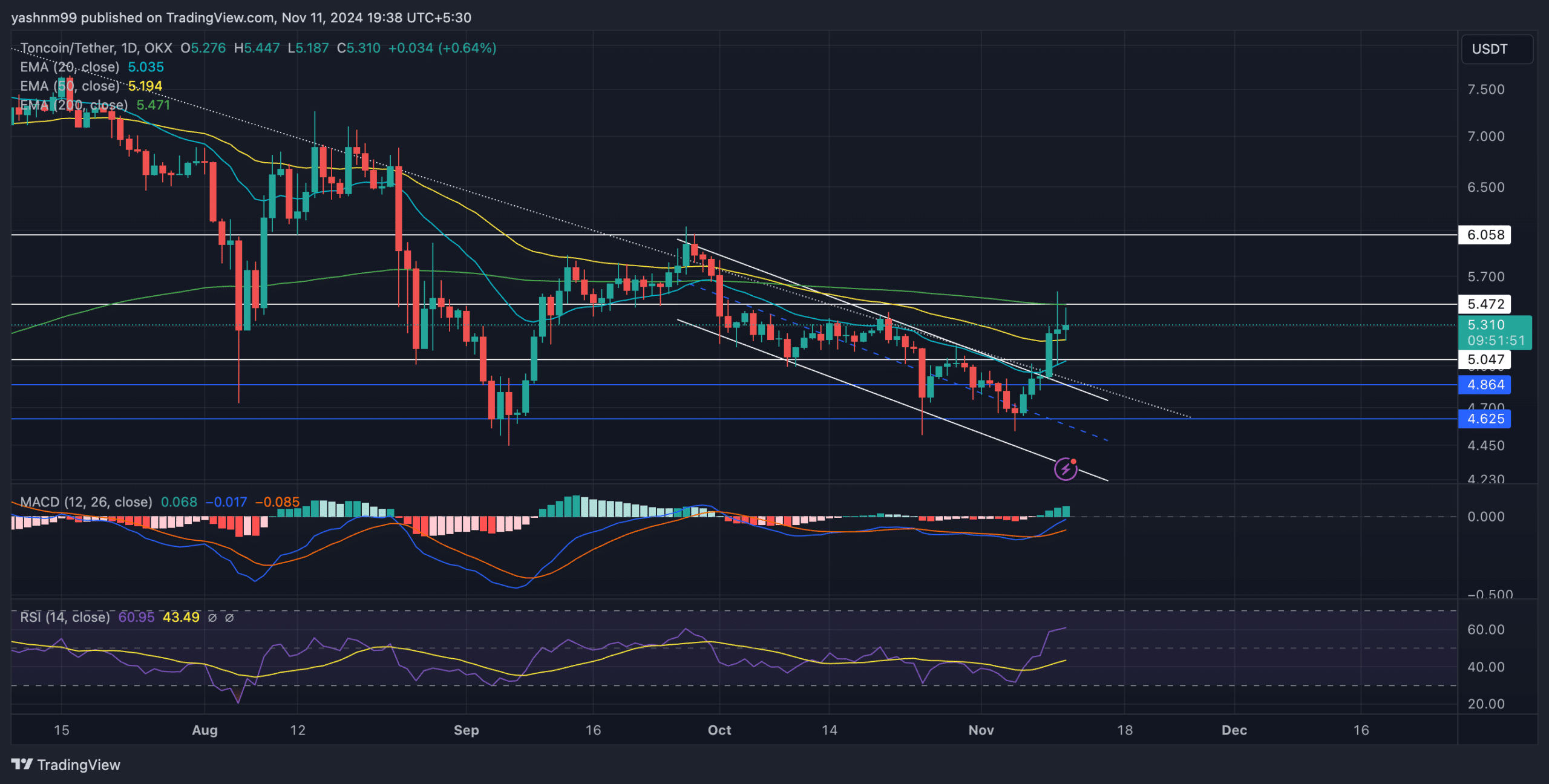

As a seasoned analyst with over two decades of trading experience under my belt, I find Toncoin’s [TON] recent performance particularly intriguing. The coin has managed to break free from its descending channel and rebound from a critical support level at $4.6 – a move that’s been long-awaited by many in the cryptosphere.

In simpler terms, after hitting a significant low of approximately $4.6, Toncoin [TON] has seen a robust recovery. This critical support level has played a vital role in the past few months, enabling bulls to defend it and prevent a more severe price drop.

Over the recent meetings, TON managed to escape from a downward channel trend, surging above both its 20-day and 50-day moving averages at $5.03 and $5.19. This upward trajectory suggests growing buying activity in the TON market, providing bulls with a minor advantage for the short term.

Toncoin was up 17% in the past week

Currently, when this is being written, Token (TON) is being traded at approximately $5.28. This price point comes after breaking through the upper boundary of its trend channel. Notably, the 200-day Exponential Moving Average (EMA) is situated at around $5.47, serving as a significant barrier for further growth.

Reaching a decisive peak beyond the current level might stimulate a continued bullish surge, possibly leading us to challenge the $6.05 resistance area. If Cosmos (TON) successfully overpowers this barrier, we may observe a prolonged upward trend, with $6.5 as the next potential milestone.

If the price doesn’t manage to surpass its 200-day Exponential Moving Average (EMA), there might be a dip in sight, possibly testing the support at around $5.04, which is provided by the 50-day EMA. This level could serve as a springboard for price action, offering traders a chance to profit from the short-term market fluctuations that may follow.

In simpler terms, the MACD (Moving Average Convergence Divergence) graph showed a bullish sign as the MACD line moved up and crossed over the signal line, indicating a potential increase in price. But, it’s best to hold off on buying until both these lines finish above the zero line in the coming short-to-medium period.

In simpler terms, the Relative Strength Index (RSI) was at 60, indicating an increase in bullish power. If it goes beyond 70, it might suggest the market is overheated, so traders need to watch for possible price stabilization near the present resistance level.

Derivatives data revealed THIS

Toncoin’s derivatives data demonstrated a strong bullish outlook, as volume spiked by 26.26% to hit $25.46 million. Additionally, Open Interest experienced a significant increase of 22.00%, suggesting that traders are maintaining their positions during the current bullish trend.

It’s worth noting that even though Open Interest increased, the overall long/short balance leaned towards short positions with a value of 0.6787. However, this trend flipped for top traders on Binance and OKX, where the ratio was significantly bullish at 2.864 and 3.0486 respectively.

Keep an eye on TON’s price fluctuations around the $5.47 mark, as crossing above the 200-day moving average could signal a bullish surge, potentially causing more increases. But if it can’t break through this resistance, there might be a retreat towards the $4.86 to $5 range instead.

Additionally, it’s crucial to take into account both Bitcoin‘s price trend and the overall market mood when deciding to buy.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-11-12 12:07