-

The monthly active users and transactions on the Tron network hit a peak last month amid the launch of SunPump.

However, daily activity slowed down and started weighing on TRX’s price performance.

As a seasoned researcher who has been tracking crypto markets for years, I’ve seen my fair share of market fluctuations and trends. The surge in Tron network activity following the launch of SunPump was indeed impressive, with the monthly active users and transactions hitting an all-time high. However, the subsequent slowdown in daily activity and the decline in dApp volumes has been a bit concerning.

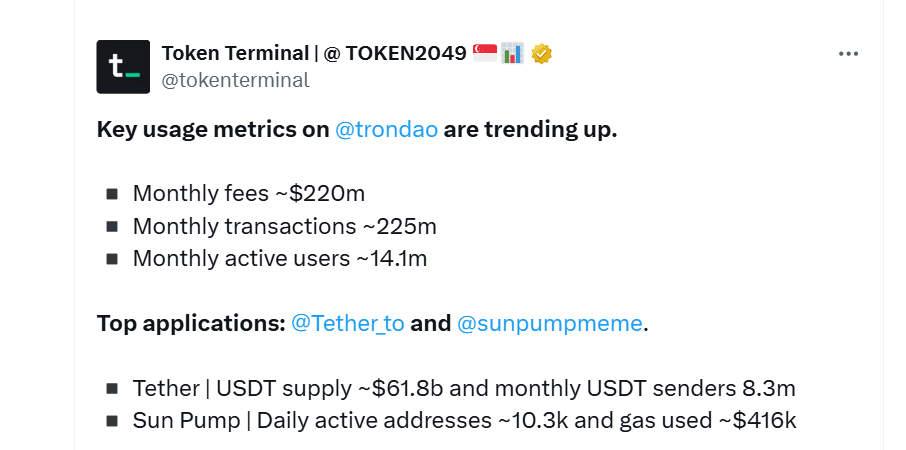

Following the recent launch of the SunPump memecoin platform last month, there was a significant increase in activity on the Tron blockchain. According to TokenTerminal, transaction fees, transaction volume, and active users on the Tron network all saw a spike soon after the launch.

USDT supply on Tron also contributed to this growth, as it has jumped from $48 billion at the beginning of the year to $68.9 billion. Tron now controls more than half of USDT’s $118 billion market capitalization.

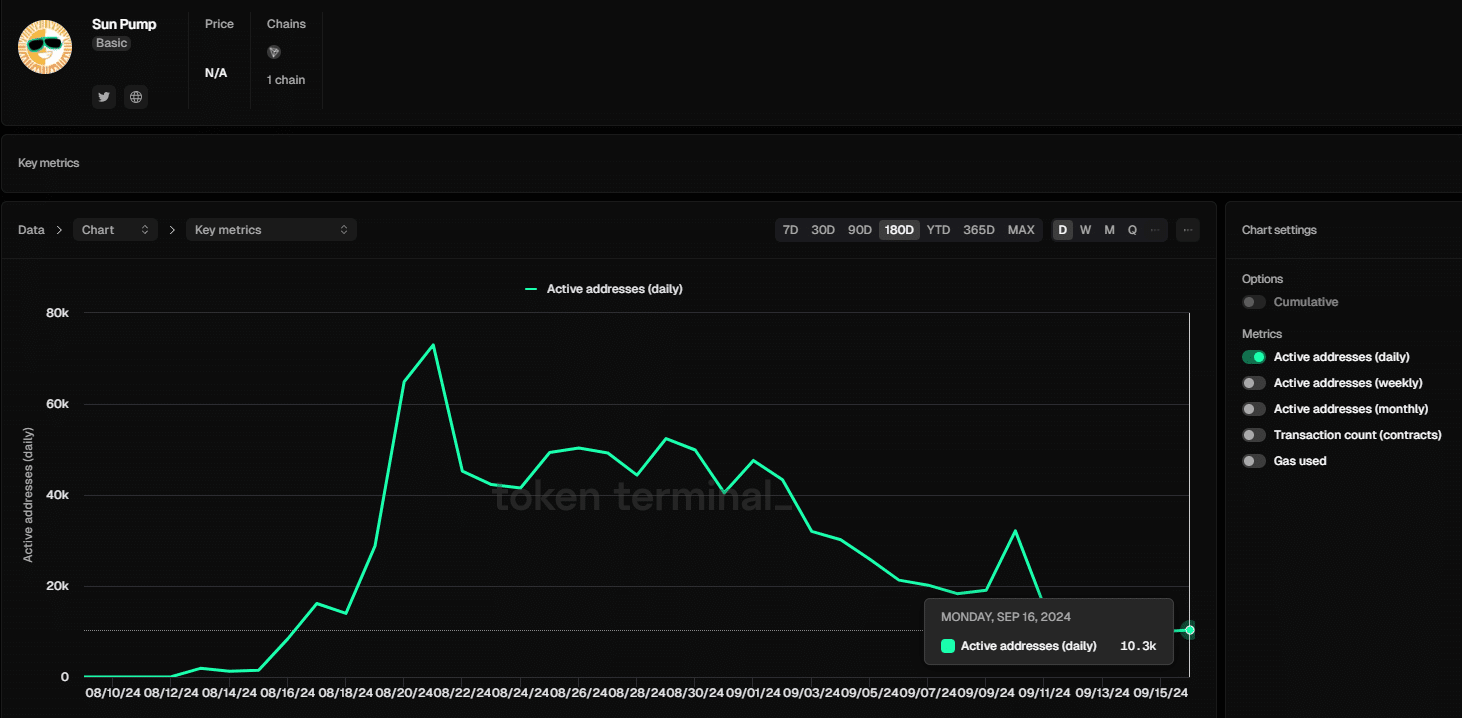

Regarding SunPump, its growth trend appears to be slowing down. The number of daily active users on this platform peaked at 73,000 in August but has since declined to approximately 10,300.

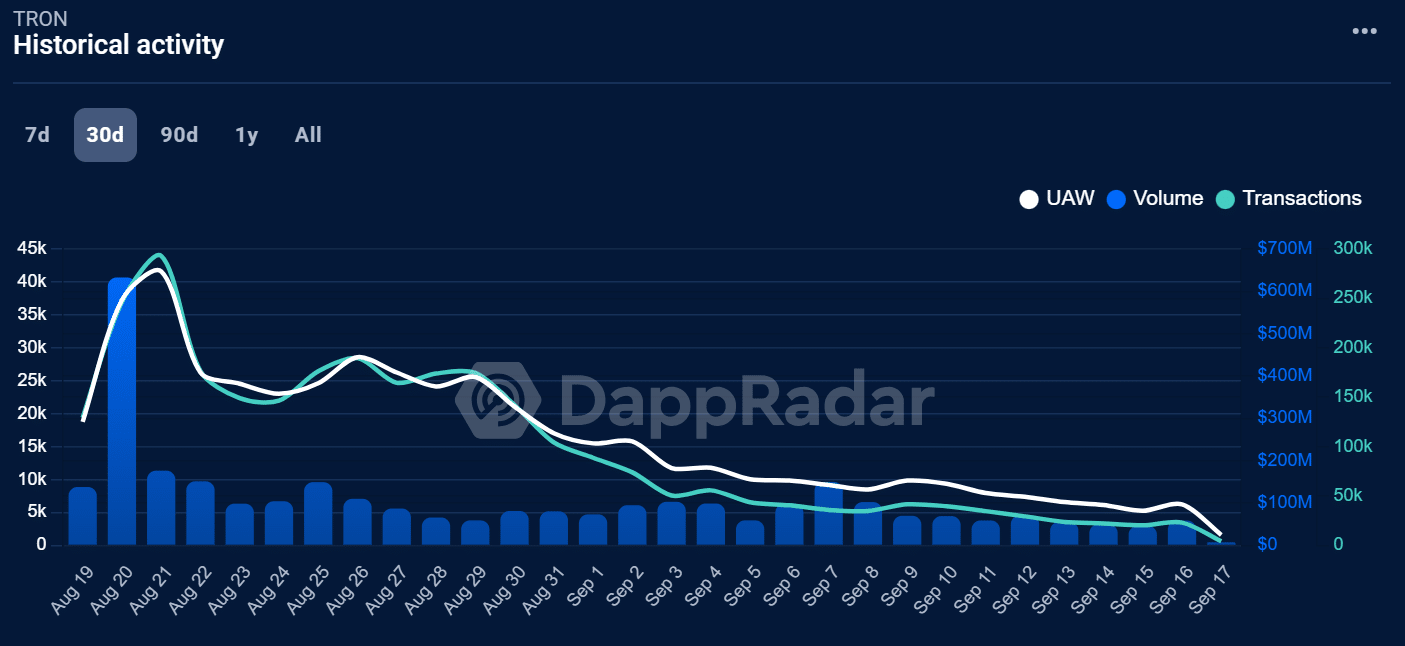

The decrease in activity within the decentralized applications, or dApps, can also be noticed alongside a reduction in the cooling network’s activity.

Per DappRadar, dApp volumes on Tron have decreased from $73M at the start of the month to $58M.

During that time frame, the total count of individual wallets actively engaged (UAWS) decreased significantly, dropping from approximately 15,000 to just 6,000. This implies a noticeable reduction in the number of people using the blockchain.

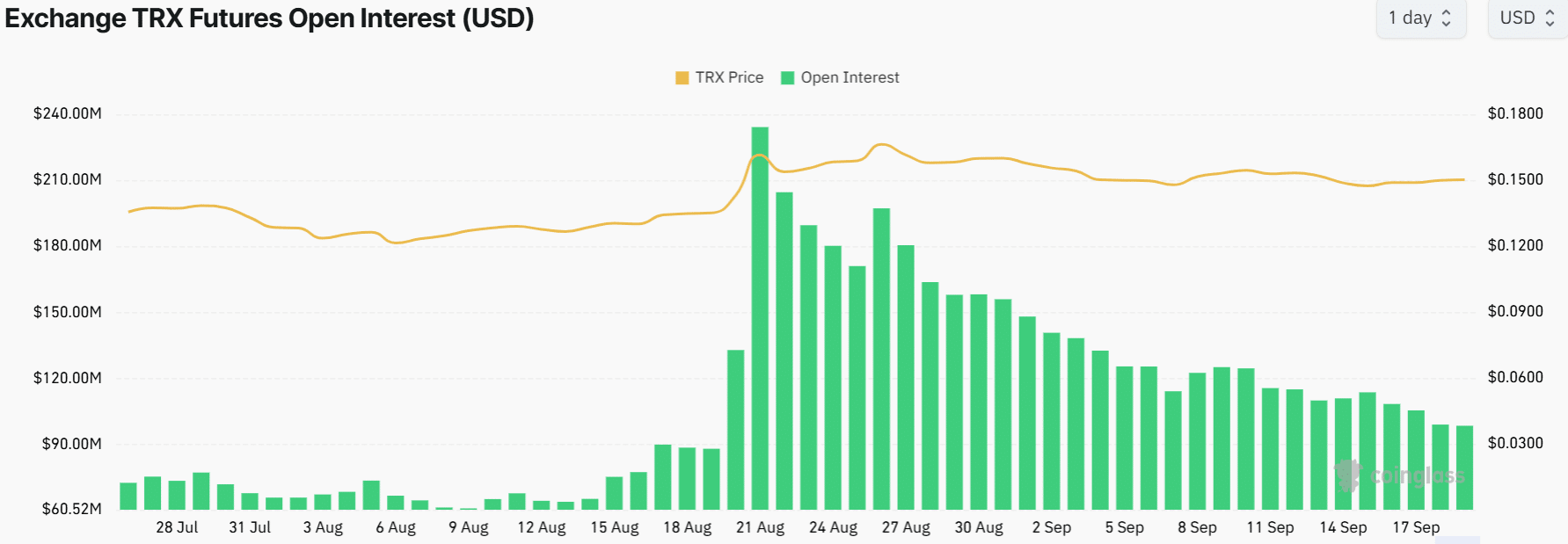

The decrease in network activity has prevented the TRX price from experiencing substantial increases, with downward pressure instead taking hold.

TRX Open Interest hits one-month low

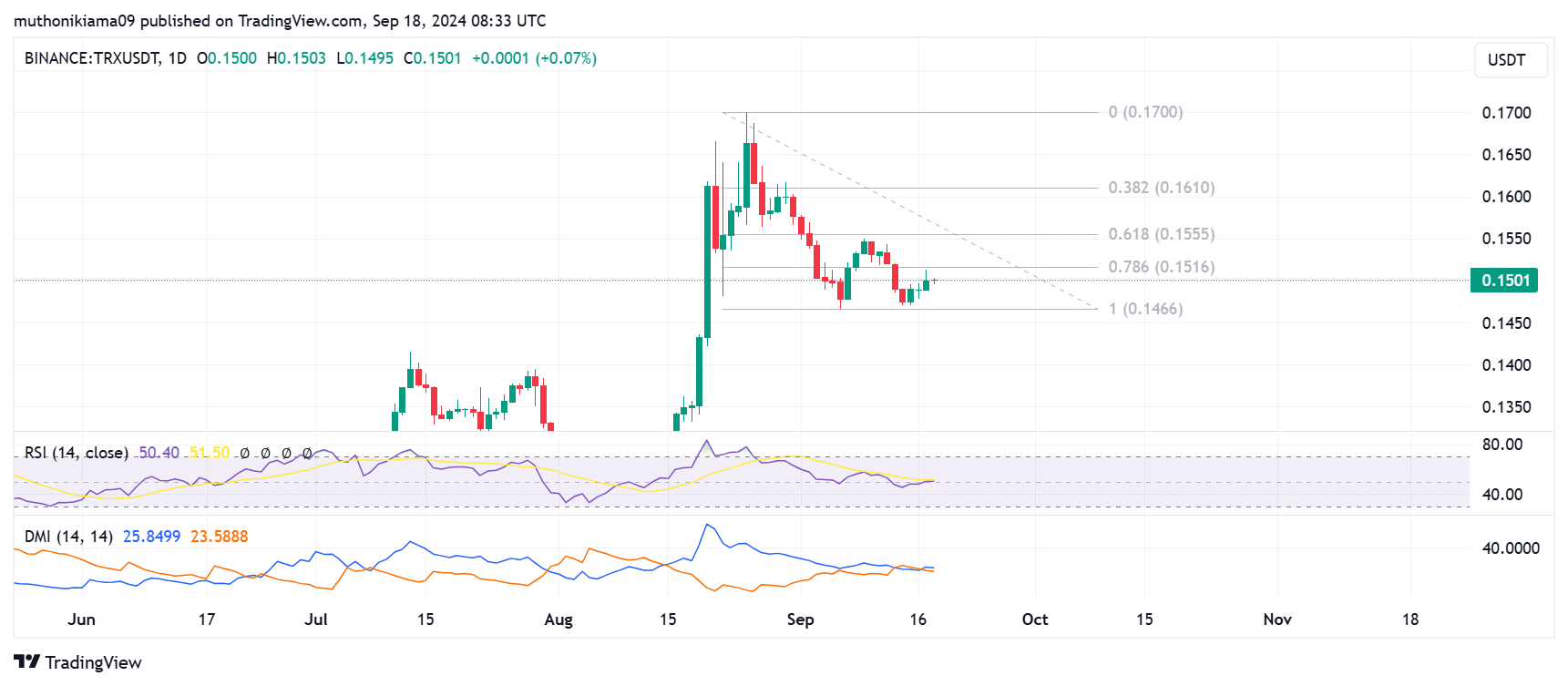

At the point of this writing, TRX was going for around $0.15, showing a relatively calm price movement. It fluctuated slightly between $0.149 and $0.51.

Data from Coinglass showed that Tron’s Open Interest has been on a downward trajectory since late August. This metric recently dropped to a one-month low.

As an analyst, I’m observing a decrease in Open Interest for TRX, which indicates that rather than initiating fresh trades, traders are primarily liquidating their current positions due to a lack of price movement.

The lack of movement with TRX can also be noticed in the Relative Strength Index (RSI), as it currently stands at a balanced point of 50.

Keep an eye on instances where the Relative Strength Index (RSI) line surges past the signaling line. This occurrence might suggest a buy signal and ignite a positive market trend.

In simpler terms, when the Positive Directional Movement (PDM) line surpassed the Negative Directional Movement (NDM) line in the Directional Movement Indicator (DMI), it indicates a bullish divergence. This pattern may signal that TRX is potentially starting an upward trend.

If purchasers take action, the potential profits could propel TRX towards the 0.382 Fibonacci resistance point. Previously, when TRX surpassed this resistance level, its value skyrocketed to a three-year peak of $0.17.

Read Tron’s [TRX] Price Prediction 2024–2025

It is important to note that 94% of TRX traders are In The Money per IntoTheBlock data.

If TRX persists in being weak, these traders could opt to sell to limit their losses, which may further intensify the downward trend for the cryptocurrency.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-09-18 16:08