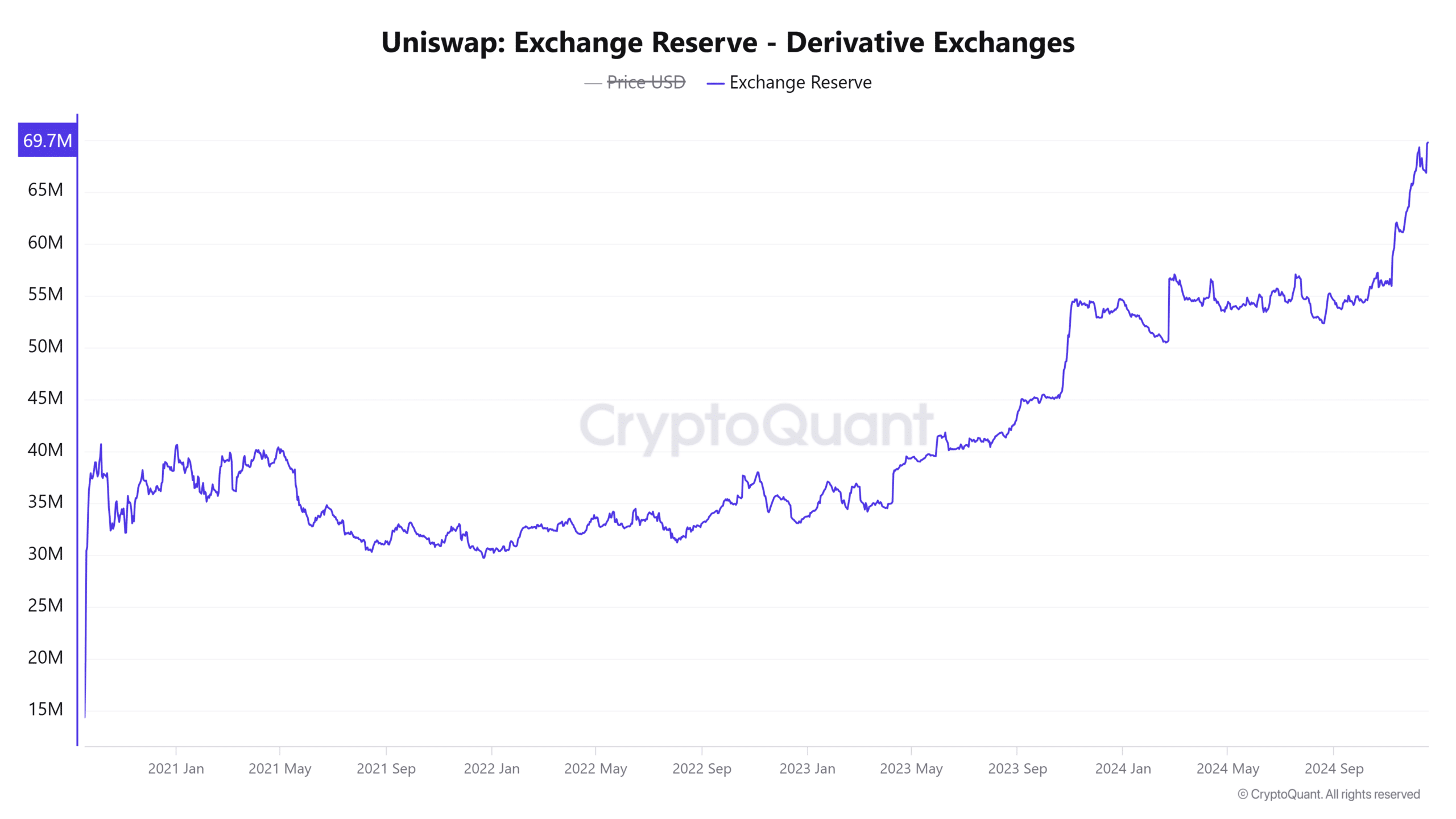

- Uniswap reserves on derivative exchanges have reached a record high of 69M tokens.

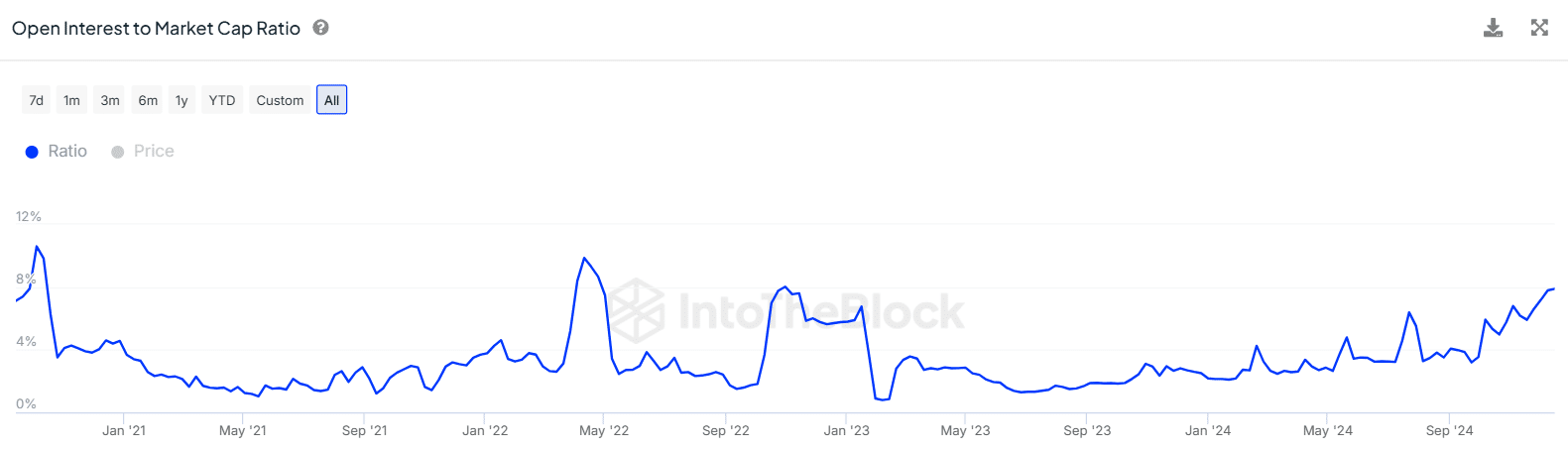

- UNI’s Open Interest to market cap ratio also shows that the market leverage is increasing.

As a seasoned analyst with years of experience in the cryptocurrency market, I find myself intrigued by the recent developments surrounding Uniswap [UNI]. The record high reserves of UNI tokens on derivative exchanges and the increasing Open Interest to market cap ratio are indicators that the market leverage is escalating.

Currently, Uniswap (UNI) is exchanging hands at $16.45, marking a 3% increase over the past 24 hours. Notably, UNI has been one of the top performing tokens this month, showing an impressive rise of over 78% in the last 30 days.

Uniswap’s uptrend has coincided with a recovery across the decentralized finance (DeFi) space.

As an analyst, I can share that according to data from DeFiLlama, the cumulative value of funds locked within the Decentralized Finance (DeFi) sector soared to an impressive $156 billion this week. This figure represents the highest point for TVL since early April 2022.

Apart from the surge in Decentralized Finance (DeFi) activities, it appears that a growing use of leveraged positions might be shaping Uniswap’s recent market movements.

Uniswap derivative exchange reserves hit record highs

Based on data from CryptoQuant, a significant amount of over 69 million UNI tokens are currently stored on derivatives trading platforms. This is the highest recorded level of such reserves ever since these platforms began operation.

An increase in these reserves indicates a surge in speculative interest towards UNI, potentially leading to fluctuations in the market.

Additionally, we’re seeing a discrepancy emerge between the cash market (spot) and the future contracts market (derivatives) because the cash market’s reserves are dwindling.

According to CryptoQuant, the reserves on the trading spots are currently near their lowest levels, suggesting a decrease in selling actions.

Should the derivatives market persist in increased action, it might lead to price fluctuations as a consequence of sudden unwindings.

Open Interest to market cap ratio hits two-year highs

Over the past day, Uniswap’s total value locked (TVL) has been steadily growing, currently sitting at approximately $326 million, marking a 3% surge from its previous level.

As an analyst, I’ve noticed a significant upward trend that has driven the Open Interest-to-Market Cap ratio up to 7.89%. This is the highest it’s been since last November of 2022.

A larger ratio suggests a higher level of market exposure for UNI, meaning it might be more susceptible to significant market adjustments or corrections if the actual price veers significantly from what derivative traders anticipate.

As a researcher, I’ve observed that, despite the uptick in speculative interest, the current ratio suggests traders remain somewhat cautious. This indicates they might be approaching their trades with a degree of prudence or restraint.

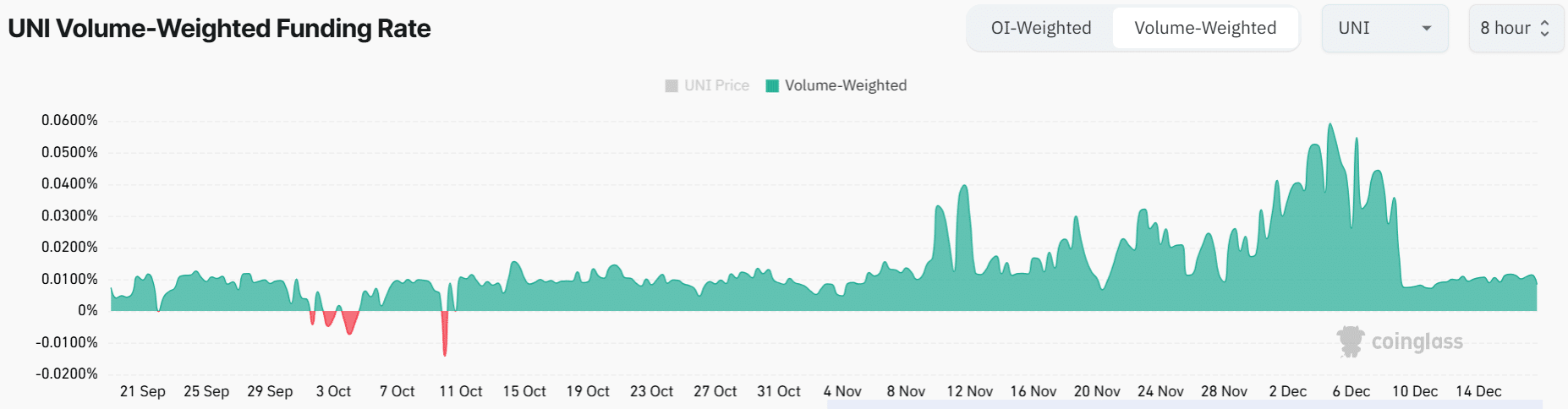

Uniswap Funding Rates show THIS

Investors who expect Uniswap’s growth to continue are showing a stronger sentiment compared to those predicting a price reversal, as suggested by the favorable Funding Rates.

Read Uniswap’s [UNI] Price Prediction 2024–2025

As reported by Coinglass, the Funding Rates for UNI have remained positive since October’s midpoint, suggesting that traders who hold long positions on this asset are prepared to pay a premium to keep their positions open.

Nevertheless, the Funding Rates at UNI have decreased from their peak levels this month, suggesting a decline in the demand for long positions despite the overall optimistic market sentiments.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-12-18 21:11