-

Solana to lead Real World Assets (RWA) tokenization.

Sol has surged by 7.33% in 7 days as market sentiment shift.

As a researcher with over a decade of experience in the financial markets, I have seen my fair share of market volatility and trends. The recent surge in Solana (SOL) is quite intriguing given its tumultuous few months. While I am not one to make hasty predictions, the increasing adoption of Solana for Real-world Asset (RWA) tokenization has piqued my interest.

Over the past few months, Solana (SOL), currently ranked fifth in terms of cryptocurrency market capitalization, has faced some challenging times. Yet, with the crypto market trying to bounce back following the Federal Reserve’s interest rate reductions, Solana has also shown remarkable signs of recovery on its price graphs.

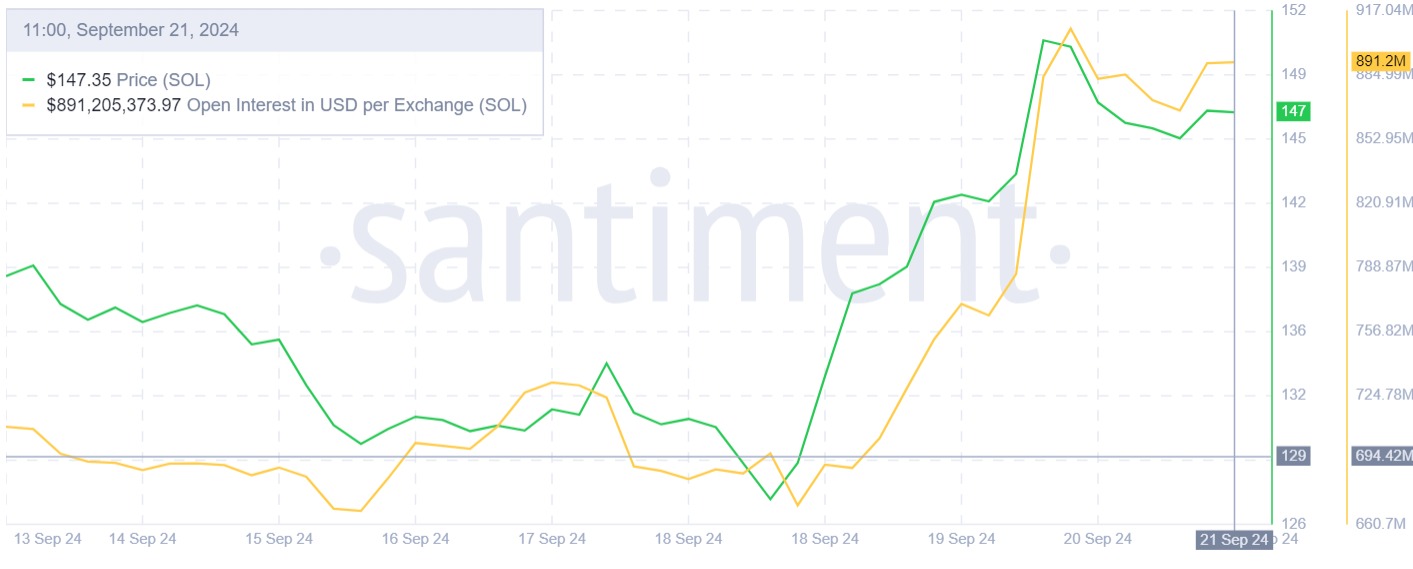

Currently, at the moment, SOL is being traded at $147 following a 7.33% surge over the last seven days. Despite September witnessing Solana reaching a local minimum of $120, the past week has contributed to the altcoin bouncing back from all monthly losses and climbing by 3.03% on monthly price charts.

Despite facing tough times recently, Solana’s robustness is often credited to the widespread adoption of its blockchain technology, particularly in the area of Real-World Asset (RWA) tokenization. This growing adoption has led major players to foresee Solana as a potential frontrunner in RWA tokenization for the future.

Solana to lead in assets tokenization

As per Anthony Scaramucci, renowned crypto advocate and founder of SkyBridge Capital, it appears that Solana could spearhead the tokenization of RWA (Real-World Assets). Scaramucci emphasizes that asset tokenization is pivotal in the modernization and smoother functioning of international financial structures.

He posited that financial markets use $7 billion annually on transaction verification. Thus, according to his claim, the adoption of asset tokenization will eliminate the need for intermediaries thus reducing unwanted friction in transactions.

In the surge of tokens representing real-world assets, Scaramucci commended Solana for its significant contributions. He went on to say that Solana is expected to spearhead advancements in the realm of tokenized assets in the days to come.

Under Solana’s guidance, the process of asset trading becomes smoother and more efficient than existing methods due to the implementation of tokenization.

What it means for SOL

It’s clear that as more people adopt and utilize a network, it tends to contribute significantly to its value increase. Consequently, if the Solana blockchain becomes widely popular, you can expect the price of SOL to climb upwards.

According to Scaramucci’s forecast, the Solana blockchain is expected to continue growing, with recent market trends potentially leading to even more increases in the price of SOL.

Initiating my exploration, I’ve observed an encouraging upward trend in Sol’s performance as per AMBCrypto’s analysis, evident from its robust momentum on the weekly charts. This uptrend is clearly highlighted by the optimistic reading on the Directional Movement Index.

At 27.2, the positive value is positioned higher than the negative value at 21.3, indicating a consistent upward trend.

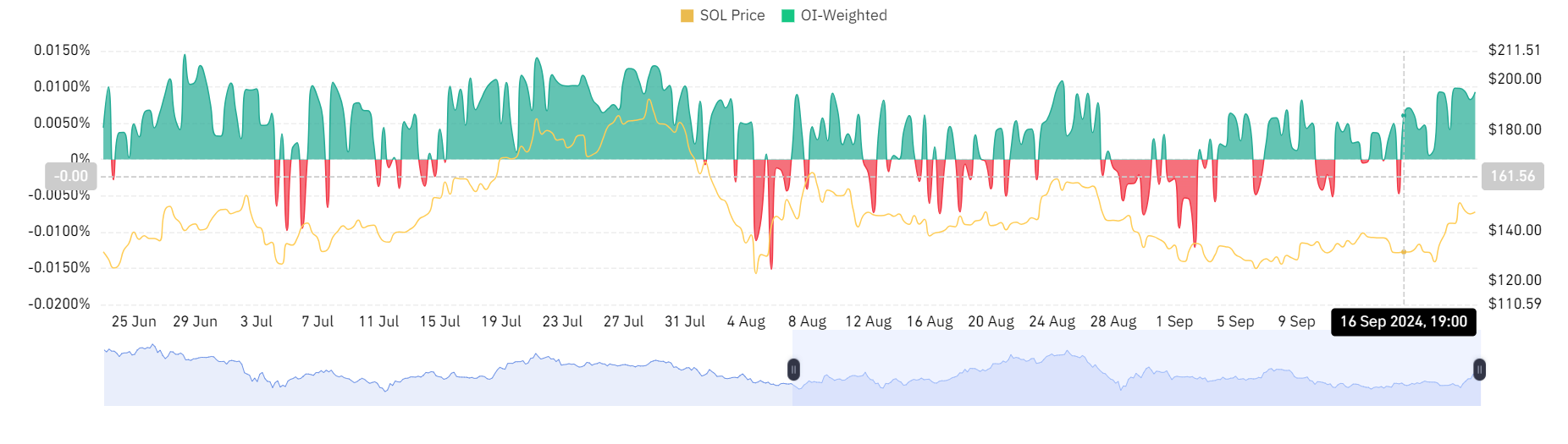

To add, the OI-weighted funding rate on Solana has been favorable for the past five days. This indicates an increasing interest in long positions, where long holders are compensating short sellers. This is considered a bullish indicator, suggesting optimism towards Solana’s future worth.

Similarly, this occurrence is also reinforced by a favorable funding rate collected by the exchange. This suggests that investors expect prices to increase and are prepared to pay more to maintain their positions.

Over the last seven days, the open interest for Solana on each exchange has been steadily rising. The open interest has grown significantly, moving from a minimum of $667 million to currently standing at $891.2 million.

Read Solana’s [SOL] Price Prediction 2024–2025

This suggests that fresh capital is flowing into the market, which signals an increase in investor engagement and optimism about future opportunities.

As a researcher, I find myself observing a situation where Sol seems to be fighting to regain its ground at elevated resistance levels. However, it’s evident that market sentiments have taken a turn, which could potentially lead to an attempt to surmount the challenging $162 resistance level. This obstinate barrier has so far thwarted two previous attempts.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- ANKR PREDICTION. ANKR cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- DOOM: The Dark Ages Debuts on Top of Weekly Retail UK Charts

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- LINK PREDICTION. LINK cryptocurrency

- K-Pop Idols

2024-09-22 00:08