In simpler terms, while Ethereum [ETH] continues to be a key player in the Non-Fungible Token (NFT) discussion, current statistics show that its leading position may be shrinking somewhat.

The token called ApeCoin, represented by the symbol APE, which is connected to the non-fungible token (NFT) collection on Ethereum named Bored Ape Yacht Club (BAYC,) has seen a decrease in significance. This decline matches the recent drop in BAYC’s minimum sale price.

Ethereum NFT volume continues to slide down

In the past, NFTs (Non-Fungible Tokens) were largely connected to Ethereum due to the large number of related projects on this specific platform. Yet, the rise of new platforms has challenged Ethereum’s dominance in this area.

Lately, Bitcoin has surprised many by becoming a significant contender in the NFT market, even though it functions distinctly.

Over the past thirty days, according to an examination of trading data on CryptoSlam, Bitcoin has outpaced Ethereum in terms of NFT sales volume.

On Bitcoin’s network, the NFT (Non-Fungible Token) trading volume exceeded $455.59 million. In contrast, Ethereum’s NFT trading volume was around $291.15 million.

According to the data, Bitcoin-based collectibles hold the first, second, and third positions in terms of trading volume. On the other hand, Ethereum’s well-known collections such as Bored Ape Yacht Club (BAYC) occupy the sixth position instead.

A look at how BAYC has trended

The price trend analysis for Bored Ape Yacht Club (BAYC) on NFT Price Floor revealed a noticeable drop in the average selling price of these NFTs during the last several months.

Particularly, in April, there has been a noticeable drop in the floor price.

When I penned down this text, the minimum cost for the Ethereum NFT series was approximately 10.89 ETH. This minimum cost signifies the lowest bid for the collection, and the graph suggests a decrease of more than 67% in value over the past twelve months.

The drop in value for BAYC and similar Yuga Labs collections has significantly affected the price of ApeCoin, pushing it near its all-time low.

APE close to ATL

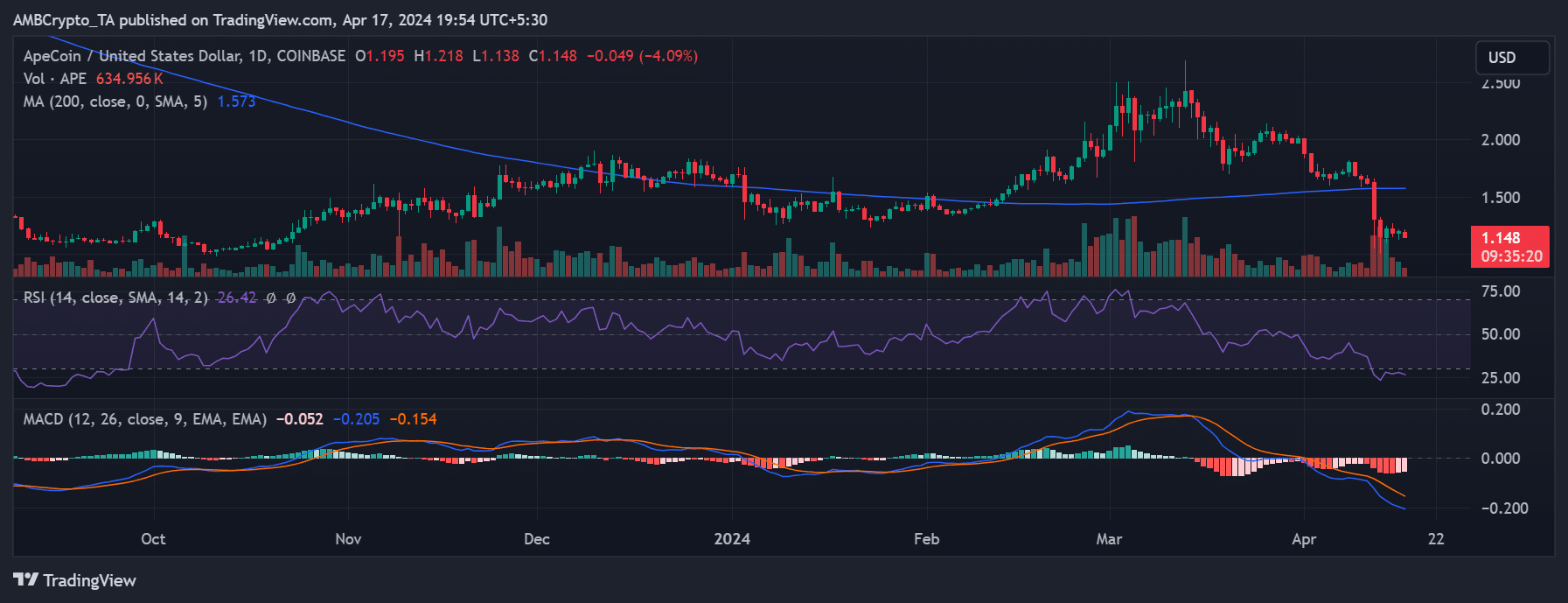

Based on the examination of ApeCoin’s trends, it appears that this coin serves as the de facto currency within Ethereum-based collection ecosystems, and the data suggests a downward trend. Using the Relative Strength Index (RSI), which is a common indicator in stock market analysis, we found that the condition of ApeCoin is oversold, meaning it may have been oversold in the market and could potentially experience a price increase in the near future.

Realistic or not, here’s APE market cap in BTC’s terms

When I penned this down, the Relative Strength Index (RSI) stood low, around 30, indicating a powerful downtrend and an oversold condition. Furthermore, the APE was hovering near $1.15, representing a drop of over 4%.

After examining the data more closely, it appeared that APE had reached its lowest point at approximately $1.01 in the past. Therefore, there was a possibility that the price could decrease even further and reach this level again.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2024-04-18 09:11