- API3 approaches key resistance at $2.20, with technical indicators suggesting a potential breakout toward $4.00.

- On-chain metrics show mixed signals, but open interest surge and bullish RSI indicate continued market interest.

As a seasoned crypto investor with battle scars from the wild West of decentralized finance, I must admit that my eyes have been drawn to API3 lately. With its recent 20% surge and an impending breakout at $2.20, it’s hard not to get excited about the potential gains.

In the last day, API3 experienced a noteworthy increase of 20%, currently trading at $2.07 per unit. At this moment, the market seems to be moving towards a more optimistic outlook. This sudden rise has left some questioning if the upward trend will persist or if a downturn might be imminent instead.

With API3 reaching crucial resistance points and various technical indicators suggesting a positive trend, traders are eagerly seeking insights about its potential future direction. Let’s delve into the price behavior and on-chain statistics to determine API3’s possible next steps.

Is API3 ready to break through resistance?

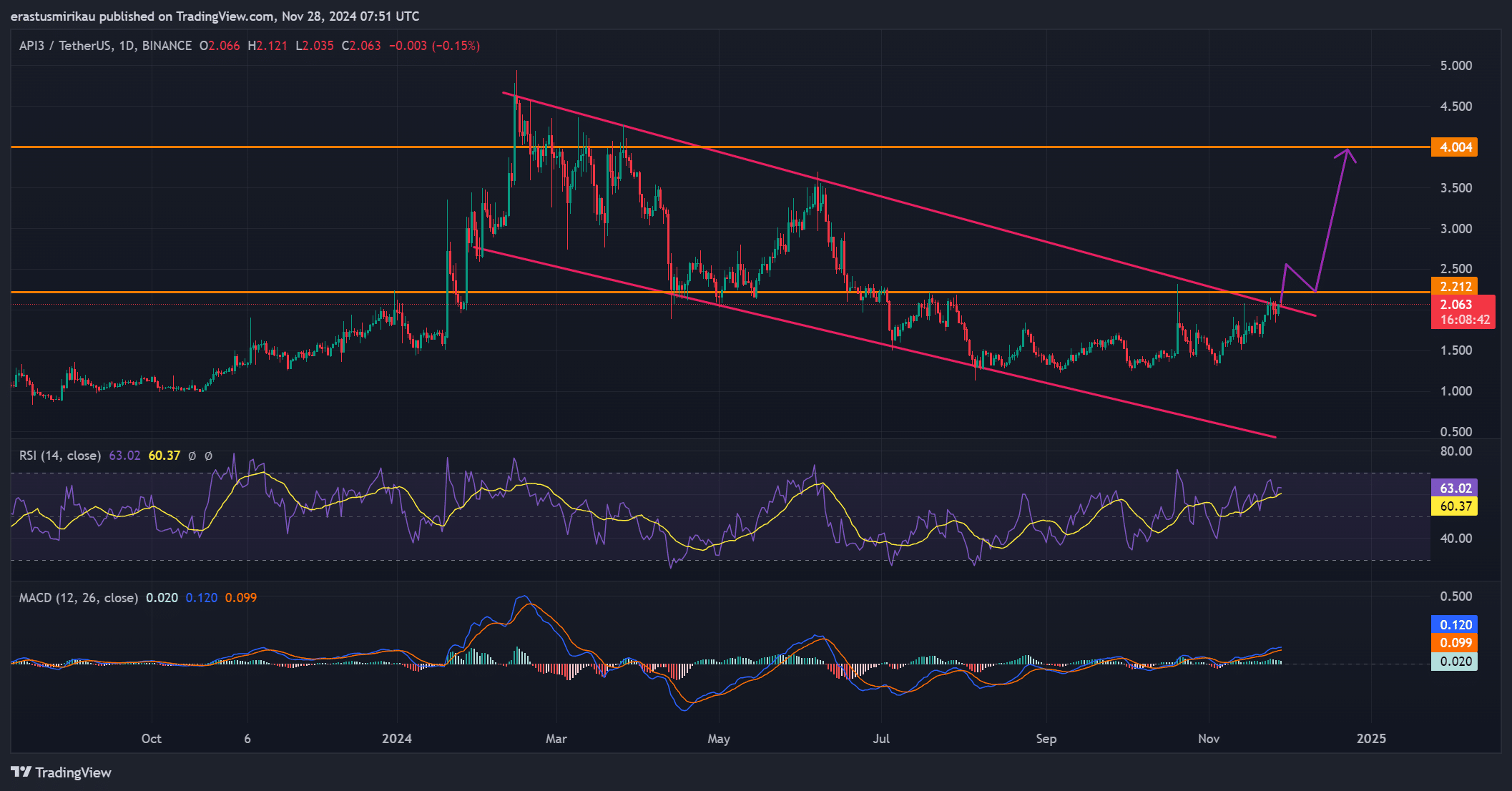

At present, API3’s trading activity falls within the confines of an ascending wedge, a chart formation frequently followed by a significant price surge. This digital token is edging closer to a notable resistance point at around $2.20, a level that has previously served as a barrier.

If API3 surpasses its current level, it might indicate a bullish trend continuing towards approximately $4.00. This pattern implies that API3 may experience additional growth in the near future, as long as it successfully overcomes the resistance at around $2.20.

For API3’s Relative Strength Index (RSI), the value stands at 63.42, which implies that the token hasn’t quite reached the point of being overbought. This signals potential for further growth in its price, but traders need to exercise caution since the token is approaching overbought levels.

Furthermore, the Moving Average Convergence Divergence (MACD) has just experienced a bullish intersection, which is typically an indication of growing momentum. This trend lines up with the notion that we might see additional growth, particularly if the price surpasses $2.20 in its upward movement.

Is the price diverging from network growth?

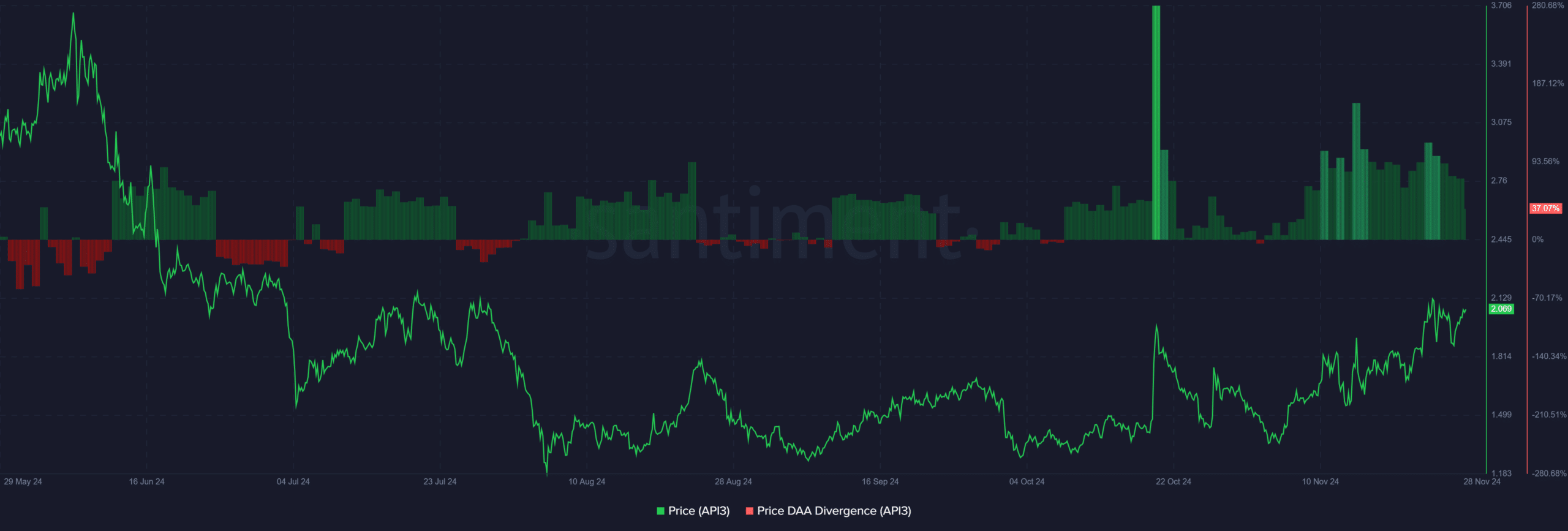

API3’s Daily Active Addresses (DAA) at 37.09% are demonstrating a significant discrepancy compared to the ongoing price trends. This disparity hints that the token’s price increase might be surpassing the expansion of its network, potentially suggesting an overextension situation.

Although it doesn’t directly signal an imminent change, it serves as a warning for traders to keep vigilant for indications suggesting a potential slowdown or pause.

On-chain metrics: Are the signals bullish or bearish?

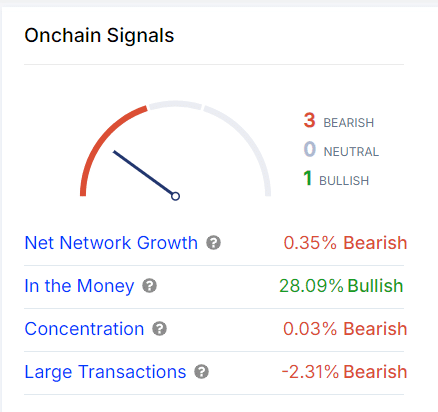

As a crypto investor, I’m closely watching API3’s performance, and the on-chain signals are giving me a mixed outlook. The decrease in network growth by -0.35% seems to hint at a slight bearish trend in network activity. Yet, the “In the Money” metric stands firm at 28.09%, signaling that a substantial portion of the market is currently profitable. This dichotomy keeps me intrigued and cautiously optimistic about API3’s future potential.

From my perspective as an analyst, while the overall concentration remains neutral at a slight 0.03% bearish tilt, a significant drop of -2.31% in large transactions might suggest a note of caution. However, it’s important to remember that these signals are mixed. Nevertheless, the predominant trend in on-chain data still leans slightly towards a bullish outlook.

Open interest surge: What does it mean for API3?

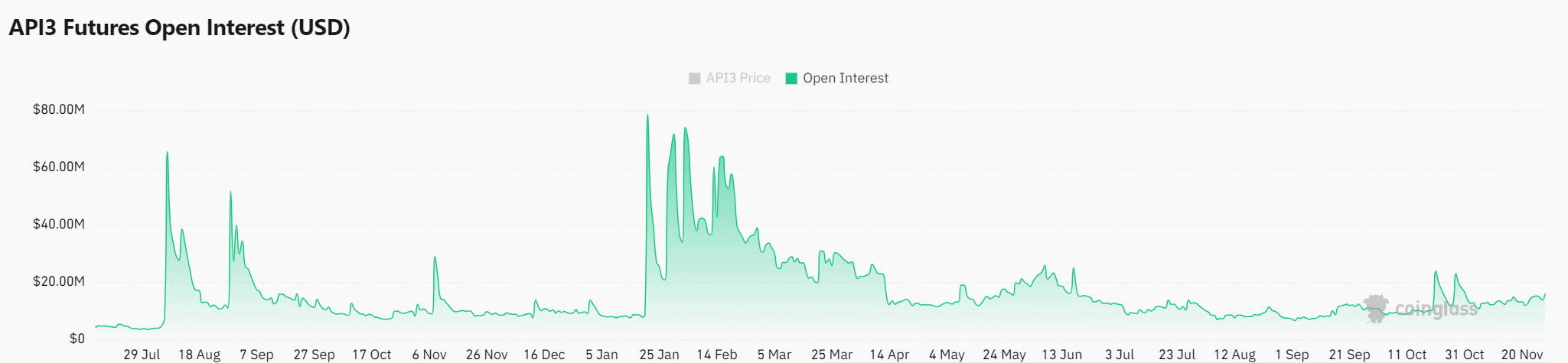

The open interest of API3 has experienced a considerable jump, moving up from 13.76% to approximately 16.23 million. This spike indicates a heightened curiosity towards API3, implying that traders might be readying themselves for further market fluctuations.

An increase in open interest often indicates that investors foresee ongoing market turbulence, a situation favorable to the near-term price fluctuations of API3.

Read API3 [API3] Price Prediction 2023-24

Is API3 set for a breakout or a pullback?

API3’s impressive 20% increase over the last day hints at further gains ahead, as it approaches the potential resistance level of $2.20. Technical analysis points towards continued growth, while the spike in open interest suggests a positive outlook among investors.

Nevertheless, the discrepancy between DAA’s stance and mixed on-chain signals indicates that vigilance is necessary. In essence, if API3 manages to surpass $2.20, it might aim for $4.00 in the short term. However, traders should remain attentive for any hints of a reversal.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-11-28 14:32