- Runes on Bitcoin’s blockchain can save traders from massive losses in the coming months.

- Staking on the Ethereum blockchain is on the rise, raising concerns about its future as “money.”

As a researcher with a background in cryptocurrencies and blockchain technology, I have closely followed the market trends and developments throughout April 2024. Based on my analysis of various reports and data sources, I believe that Bitcoin’s recent decline might be a sign of undervaluation, but there are also potential factors that could drive its price north.

Prior to the anticipated FOMC meeting in May 2024, I noticed a substantial decrease in the crypto market. Bitcoin specifically dipped down to $56,494 – a price last recorded on 28 February 2024. The prevailing market sentiment shifted towards apprehension as investors prepared their portfolios for the likelihood of no interest rate reductions.

As a Bitcoin analyst, I’ve observed that the MVRV Ratio (7-day) for Bitcoin has dropped to a level of -8.099% at present. This means that on average, Bitcoin holders are underwater with their investments. In simpler terms, the current market value no longer covers the cost basis for most BTC purchases. It is an indication that the market value has significantly decreased compared to the prices at which many investors initially bought Bitcoin.

The report from AMBCrypto’s market analysis for April suggests that Bitcoin may decline in most trading sessions during May, potentially indicating a lack of value or faith in the cryptocurrency.

The report highlights three key factors (BTCFi, Options ETF, and Solana) that may cause Bitcoin’s upward trend to change direction. Investments in Bitcoin through ETFs will have a more significant influence on price than the expectation of a federal interest rate cut or geopolitical tensions.

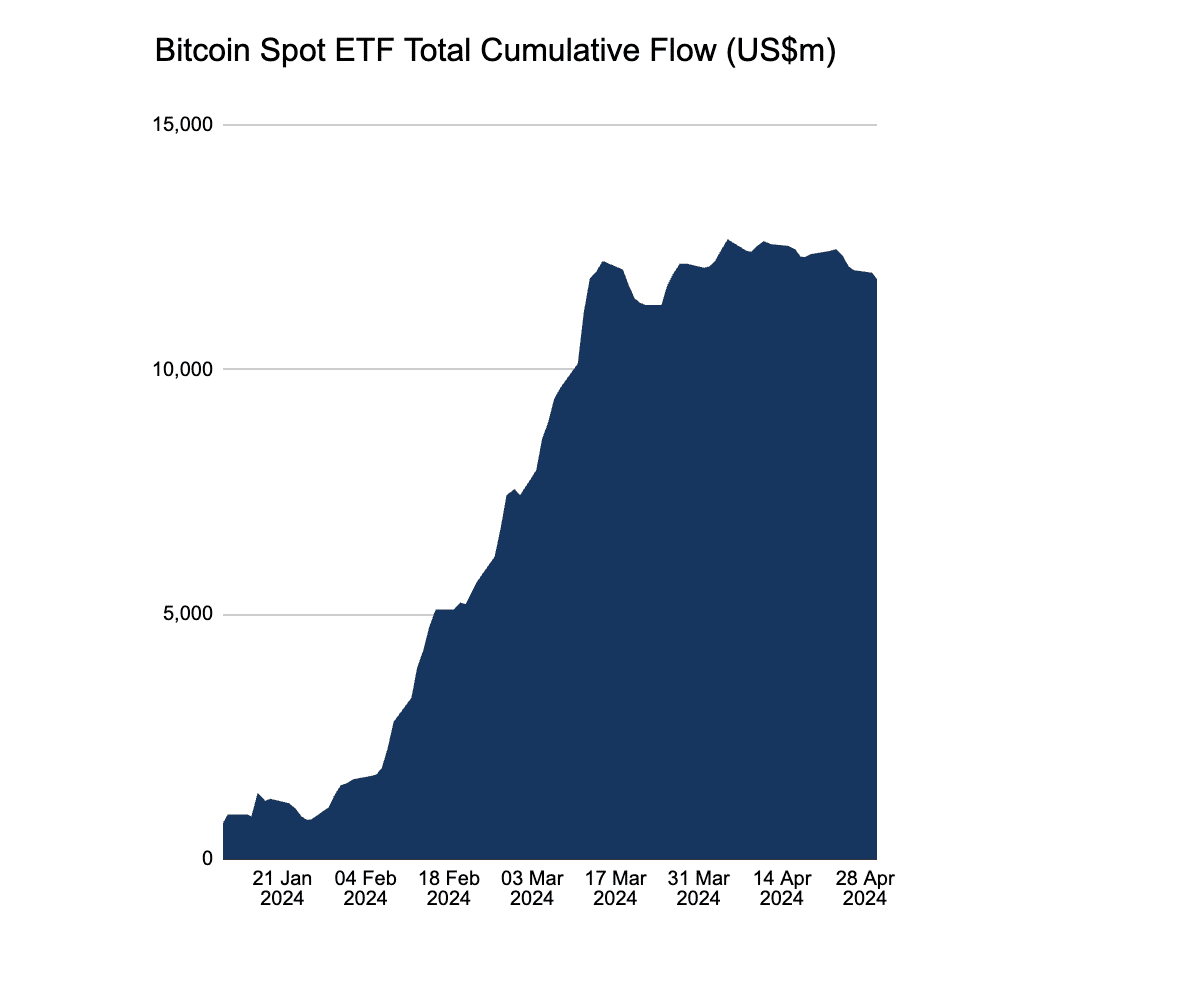

Starting from April 24, there have been more withdrawals than deposits for Bitcoin ETFs. On April 30, a notable withdrawal amounting to $161 million was recorded – The largest among the past three business days.

As an analyst, I’d like to highlight a fascinating discovery from AMBCrypto’s report. It appears that several institutions have applied for Bitcoin ETF approval this month. If these applications are successful in May, we could witness a substantial surge in demand. Consequently, the price of Bitcoin might experience a notable uptrend.

Bitcoin’s savior – Runes

The increasing adoption of Decentralized Finance (DeFi) on the Bitcoin blockchain may help traders avoid substantial losses as market volatility heightens in the near future, according to AMBCrypto’s comprehensive analysis.

Interestingly, the 7-day moving average of Bitcoin’s market cap to transaction fee ratio fell below that of Ethereum. It highlighted a huge surge in activity on the Bitcoin network since the launch of the Runes protocol. Basically, this ratio indicates how much money is flowing into a cryptocurrency relative to the transaction fees being paid.

Altcoins’ performance in April

As a crypto investor, I’ve noticed that the prices of various cryptocurrencies mirrored Bitcoin’s movements in April. The volatile month saw significant fluctuations in most altcoins. The broader market took a hit due to escalating geopolitical tensions and inflation worries. However, some sectors continued to shine, such as gaming tokens.

According to AMBCrypto’s latest findings, Solana has been making significant strides in the DeFi market, leading to a potential challenge for Ethereum’s dominance. At the same time, an Ethereum ETF is yet to receive SEC approval, while there’s a growing trend towards staking on the Ethereum blockchain. These developments have sparked debates about Ethereum’s role as a “money maker” in the future.

Take a look at AMBCrypto’s Market Analysis – April 2024 Edition

Explore the market trends, valuable data, and unique insights from April to better understand and anticipate the market fluctuations in May.

The report delves deep into key topics like –

- Rising popularity of DeFi on Bitcoin

- America’s love for memecoins

- Fall in USDT’s dominance

- Solana’s TVL masterstroke

- NFT market’s recovery

- Market forecast for May

You can also download the full report here.

Read More

2024-05-01 18:48