-

Aptos showed strong bullish momentum with whale activity driving price action

Positive funding rates and short liquidations continue to support APT’s uptrend

As a seasoned crypto investor with a knack for reading between the lines of market trends and whale movements, I find Aptos’ [APT] recent performance intriguing. The strong bullish momentum, driven by whales, is reminiscent of the early days of Bitcoin when whales would orchestrate significant price swings.

Lately, APT (Aptos) is grabbing headlines due to its shifting prices, suggesting a robust surge in its cryptocurrency sector. The token exhibits characteristics of a rising market, sparking interest among short-term speculators and long-term investors equally.

The real question remains – Can APT continue its upward climb, or will the market correct itself?

APT price action – Is a breakout imminent?

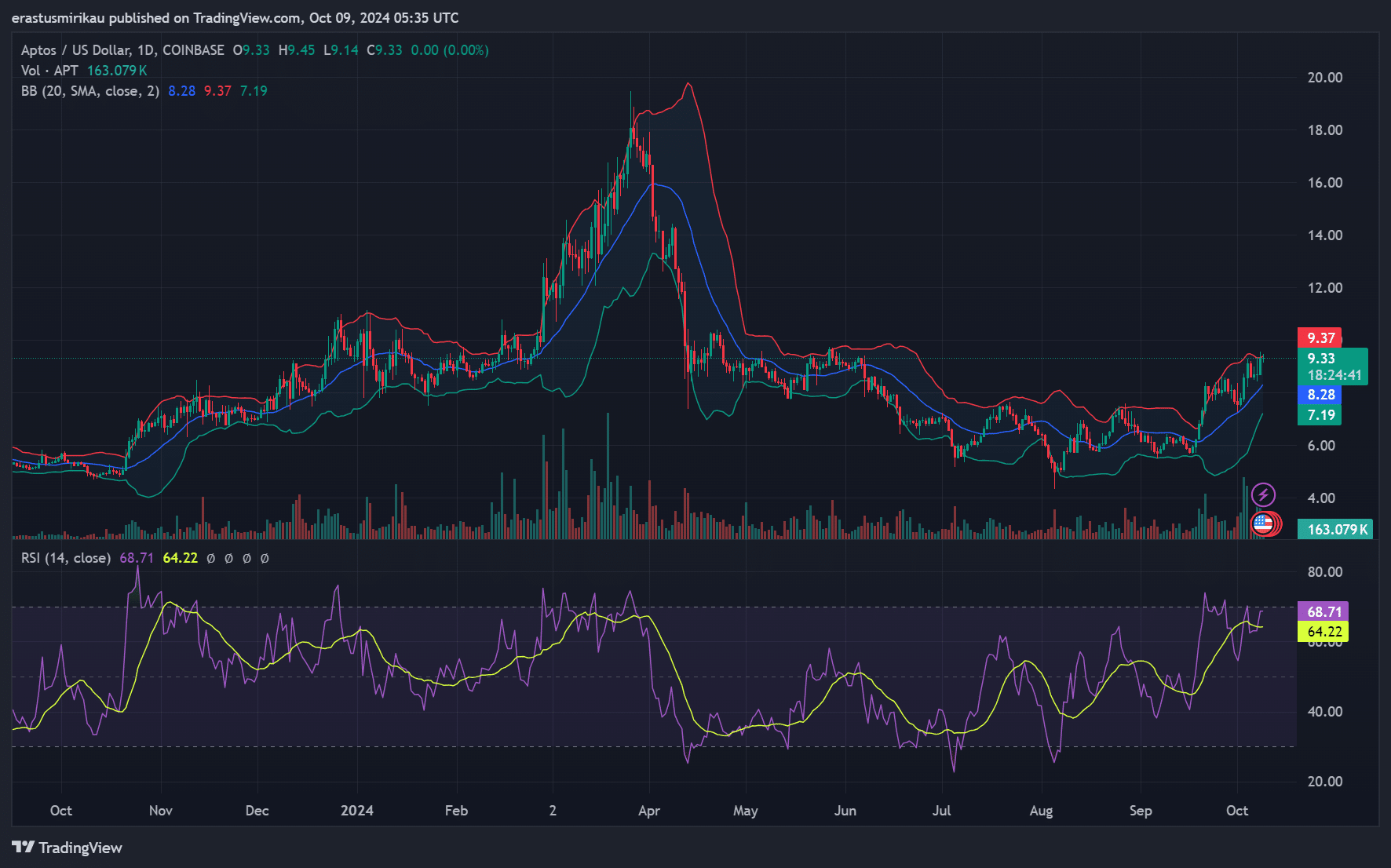

Currently, shares of Aptos are being exchanged for around $9.32, marking a 4.78% increase in the previous 24-hour period. Over the last several days, APT has been on an upward trend on the price graph, reaching as high as $9.45 at times.

Yet, the Relative Strength Index (RSI) currently stands at 64.22, suggesting that the token could be nearing an overbought state.

Furthermore, the Bollinger Bands suggest increased price fluctuations, potentially leading to significant upward or downward movements. Consequently, it’s advisable for traders to keep a close eye on these levels since APT might breach the $9.45 resistance or experience a short-term correction.

APT whale activity and social dominance – A key driver?

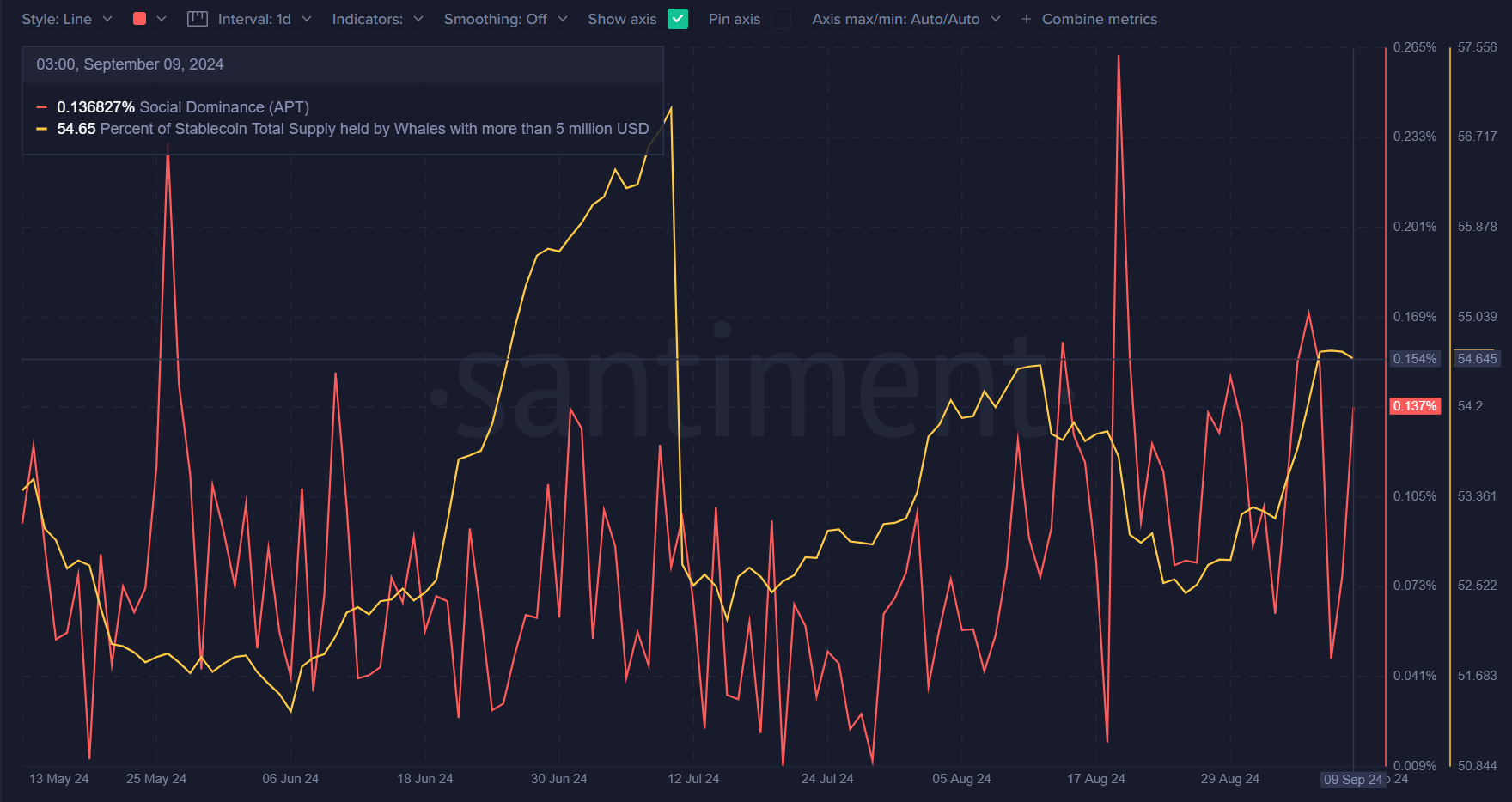

In Aptos, the role of whales continues to significantly influence its bullish trend. Currently, over half (54.65%) of the token’s total stablecoin reserve is in the possession of whales who own more than $5 million worth of tokens. This suggests that these large investors are primarily responsible for the price fluctuations observed at this moment.

In simpler terms, the level of social dominance was quite low at just 0.137%, implying that Aptos hasn’t yet gained significant widespread recognition in the market.

As a result, an increase in social dominance may strengthen the token’s tendency to rise in value.

Liquidation levels – Can bulls maintain control?

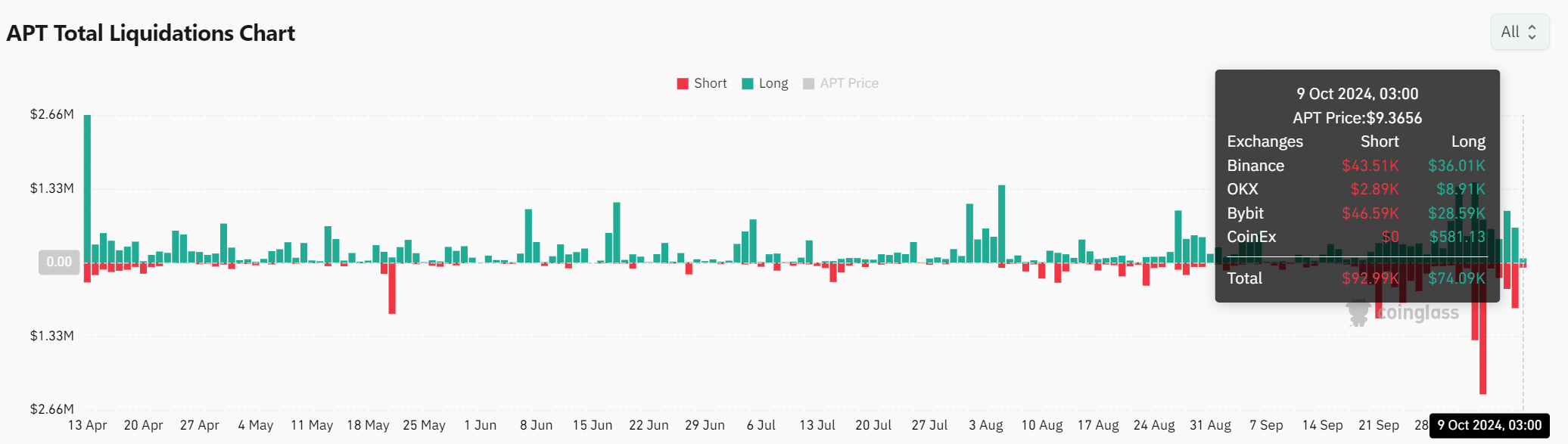

In the derivatives sector, recent data shows that bulls have been taking charge. As of now, long liquidations amount to approximately $74,090 while short liquidations stand at around $92,990. This indicates that those holding short positions are facing more pressure – a hint that bears may be finding it tough to hold onto their stakes.

As a crypto investor, I’m riding the wave as APT surges due to an increase in bullish sentiment caused by this round of short liquidations. Yet, it’s essential to remember that unexpected shifts in liquidation trends can influence the market, so I’ll keep my eyes open and stay vigilant.

APT funding rates – Is the market still bullish?

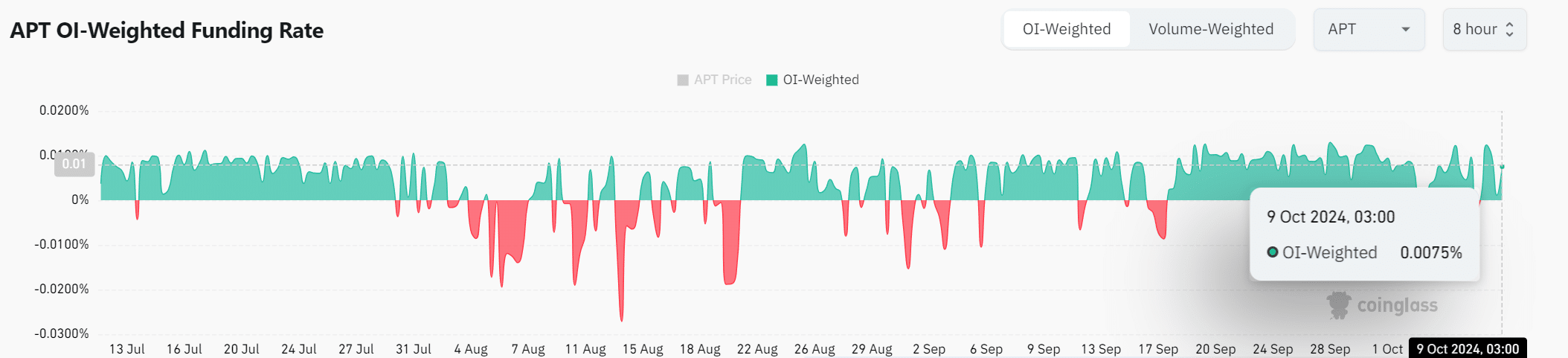

Ultimately, the funding rate for Aptos, calculated using the OI method, was positive at 0.0075% on October 9th. This suggests that traders continue to be ready to pay a premium to hold long positions, underscoring the persistent optimistic outlook in the market.

In essence, a notable adjustment in the funding rate might indicate a shift in investor sentiment, potentially leading to heightened market volatility.

Read Aptos’ [APT] Price Prediction 2024-25

Looking at current market trends, whale behavior, potential sell-offs, interest rates, and other factors, it seems that Aptos is poised to keep up its upward trajectory. Consequently, we can expect the price of APT to carry on rising, with $9.45 being a significant level of resistance that investors should be aware of.

Keep in mind that while trading, it’s wise to remain vigilant since changes in investor mood or significant actions by large investors (whales) might trigger a market adjustment or downturn.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-10-09 11:36