-

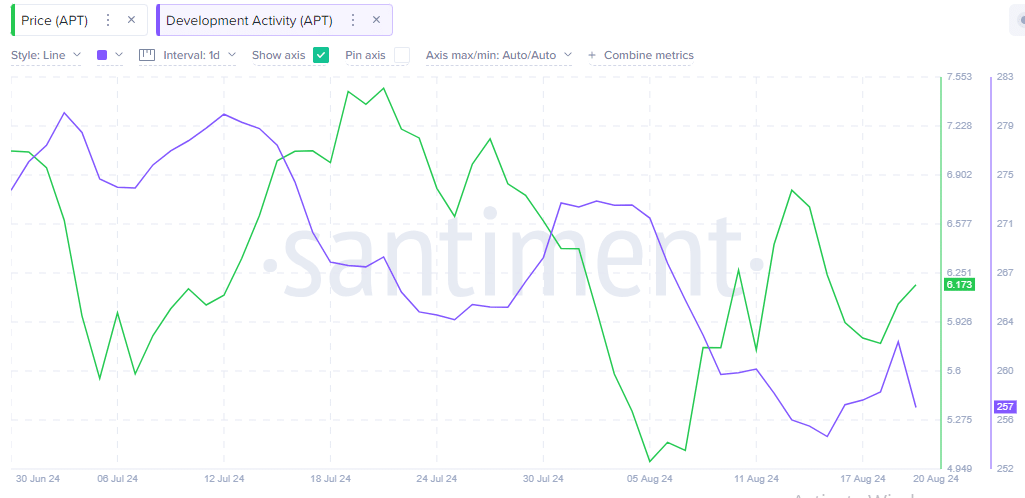

Development activity for APT has waned as its price surged, sounding alarms across the market.

Analysis indicates that APT is currently at a crossroads, pending a definitive trend emergence.

As a seasoned analyst with years of experience navigating the volatile cryptocurrency market, I find myself standing at the crossroads with Aptos [APT]. The recent surge in price offers a glimmer of hope amidst the dwindling development activity and bearish sentiment that has gripped the market.

Following several difficult days, Aptos (APT) appears to be making progress towards healing, with a 5.48% surge that momentarily eases the market’s strain.

Nevertheless, the question persists: Is this recovery sustainable, or just a temporary respite for fatigued sellers before another possible price drop occurs? AMBCrypto delves deeper into this topic.

The bears are knocking

In simpler terms, when there’s less progress being made in a market (indicating bears are in control), it means that the asset’s price may not accurately reflect its value, which can lead to an imbalance that usually requires adjustment or correction.

As a crypto investor, I’m saying that the current price (the green line) could potentially realign itself with the ongoing development activity (the blue line). Alternatively, the pace of development could pick up to correspond with the price fluctuations.

In contrast to the current situation, it’s more probable that we’ll see a reversal in price. A comparable pattern on July 16th occurred where the price climbed while development activity declined initially, but later fell, adjusting to the reduced development activity.

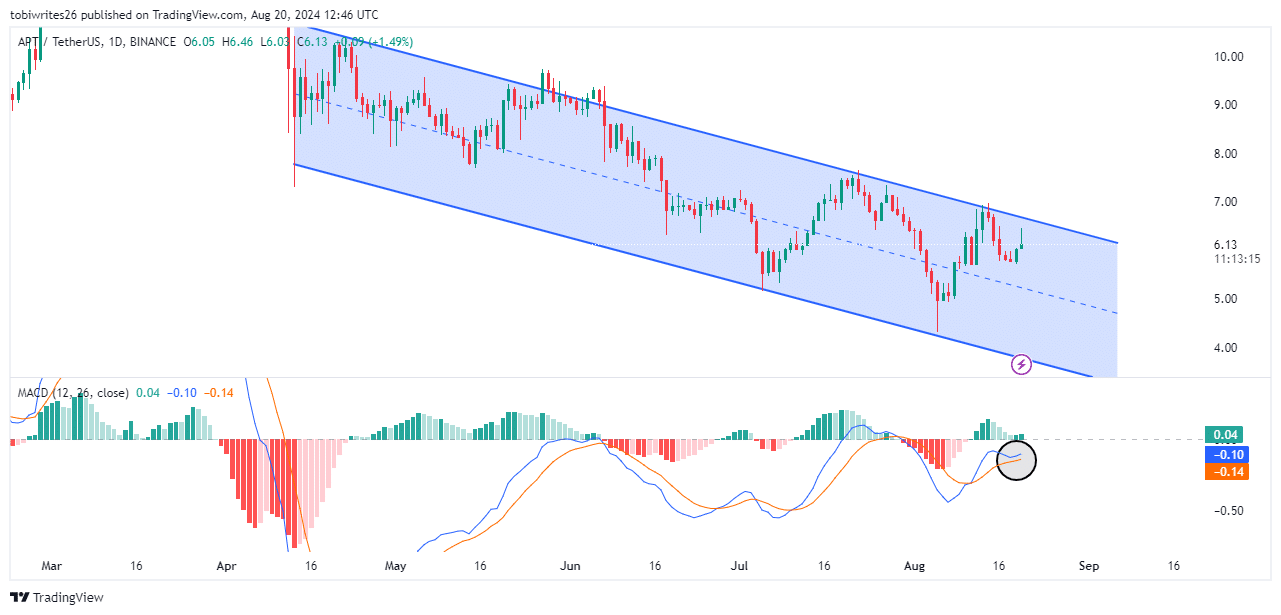

The downward move intensifies

APT is moving along a downward trending channel over the course of a month, offering conflicting indicators on the technical side. Within this channel, the price of an asset might surpass the upper limit, signaling a possible upward spike or drop below the lower limit, hinting at a potential price decrease.

Presently, the upper limit is serving as a barrier for further advancement; As APT bounced back from this point, it managed to generate some upward thrust, yet according to AMBCrypto’s assessment, this growth might not prove to be long-lasting.

In this study, we employed the Moving Average Convergence Divergence (MACD), an analytical tool based on the comparison of two moving averages of a stock’s price, to highlight its momentum.

When the MACD line (represented by blue) rises above the signal line (colored orange), it’s suggesting potential buying opportunities. Conversely, a crossing of the MACD line below the signal line signals selling opportunities.

At present, the MACD (Moving Average Convergence Divergence) line is situated within a region where it’s negative, and the volume is reducing. Soon, it might dip below the signal line. Considering that APT‘s current share price stands at $6.15, there’s a strong possibility of further price decreases.

Slight hope: APT remains bullish among retail investors

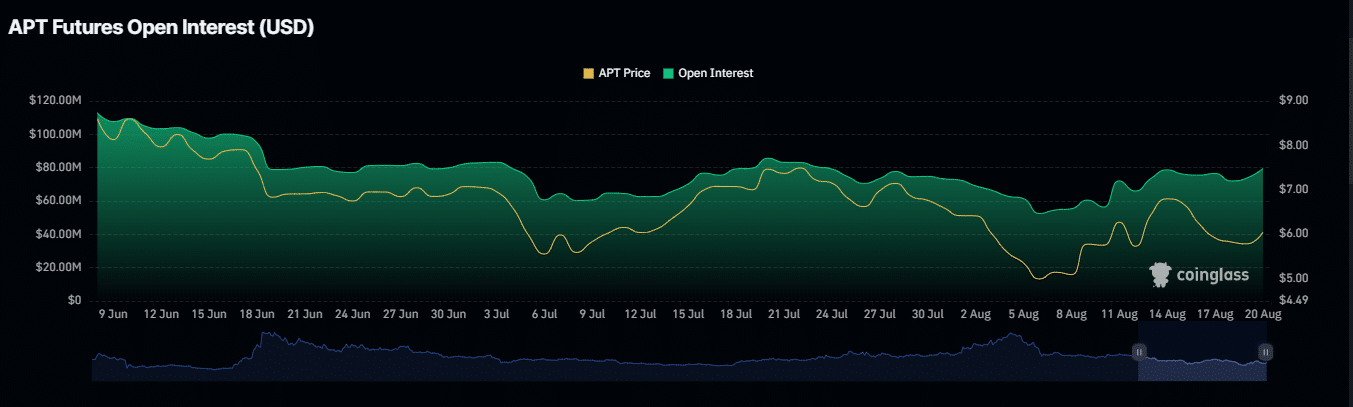

The count of pending derivative agreements such as options or futures, known as open interest, has noticeably increased since August 6, as reported by Coinglass, indicating a substantial level of market activity and involvement.

An uptick in open interest suggests that more traders are entering into new contract agreements while others are either settling or ending theirs. This trend implies a positive, or bullish, sentiment towards the asset APT.

Furthermore, the flow of Advanced Persistent Threats (APT) from exchanges has been decreasing over both the past day and week. This trend is often seen as a positive or bullish signal.

Read Aptos’ [APT] Price Prediction 2024-25

As an analyst, I’m observing a trend where market participants appear to be opting for storing their APT assets in wallets or offline storage solutions. This choice seems to indicate a strong belief in the asset’s prospective growth potential.

To summarize, even with some conflicting messages, it’s crucial to give the market enough time so that it can provide more defined signs of either purchasing or selling trends.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-08-21 12:08