- Aptos’ 3.70 million daily transactions highlighted its growing ecosystem but faced social visibility challenges.

- Technical indicators showed mixed signals, with bearish trends and oversold conditions creating uncertainty.

As a seasoned researcher with years of experience in analyzing blockchain projects, I must admit that Aptos [APT] has certainly piqued my interest. With its impressive transaction volume and growing ecosystem, it’s clear that Aptos is making strides in the industry. However, as I dug deeper into their social dominance and development activity, I found myself scratching my head a bit.

A remarkable achievement for Aptos (APT)! Yesterday, it processed approximately 3.7 million transactions in a single day, maintaining an impressive average throughput of around 3700 transactions per second (TPS). The cost for these transactions was incredibly low, averaging just $0.00005.

I’m proud to report that this project has garnered significant momentum, with a Total Value Locked (TVL) exceeding one billion dollars and a market capitalization of approximately $5.35 billion. This growth is a testament to the trust and confidence the community has placed in us.

These impressive figures position Aptos among the top contenders in the blockchain industry.

As I analyze the current market situation, it appears that APT is currently trading at $8.99, representing a 6.58% drop compared to yesterday’s close. This decline could signal some challenges or obstacles that Aptos might need to navigate in the near future.

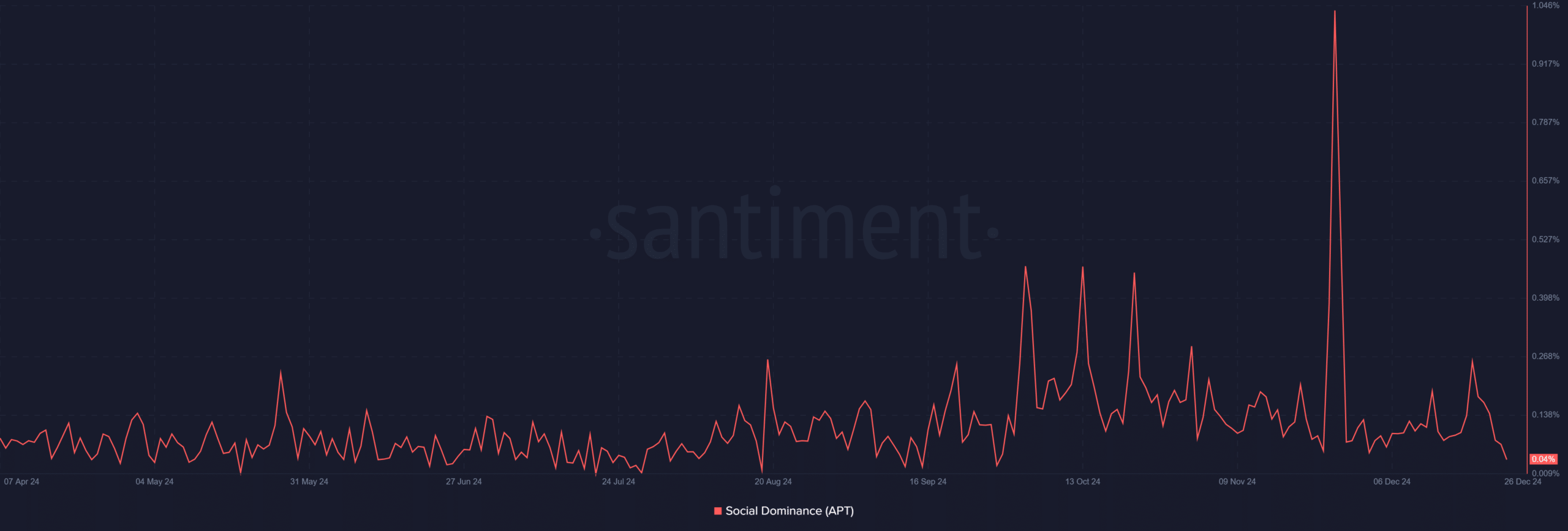

Social Dominance struggles despite ecosystem success

Despite its significant achievements, Aptos faces challenges in social engagement.

At the present moment, Social Dominance is barely registering at 0.04%, which is much lower than the higher readings seen intermittently throughout the year, including a temporary rise above 1% in November.

This indicates limited visibility and engagement across the broader crypto community. However, this challenge presents an opportunity for Aptos to ramp up its marketing and community-building initiatives.

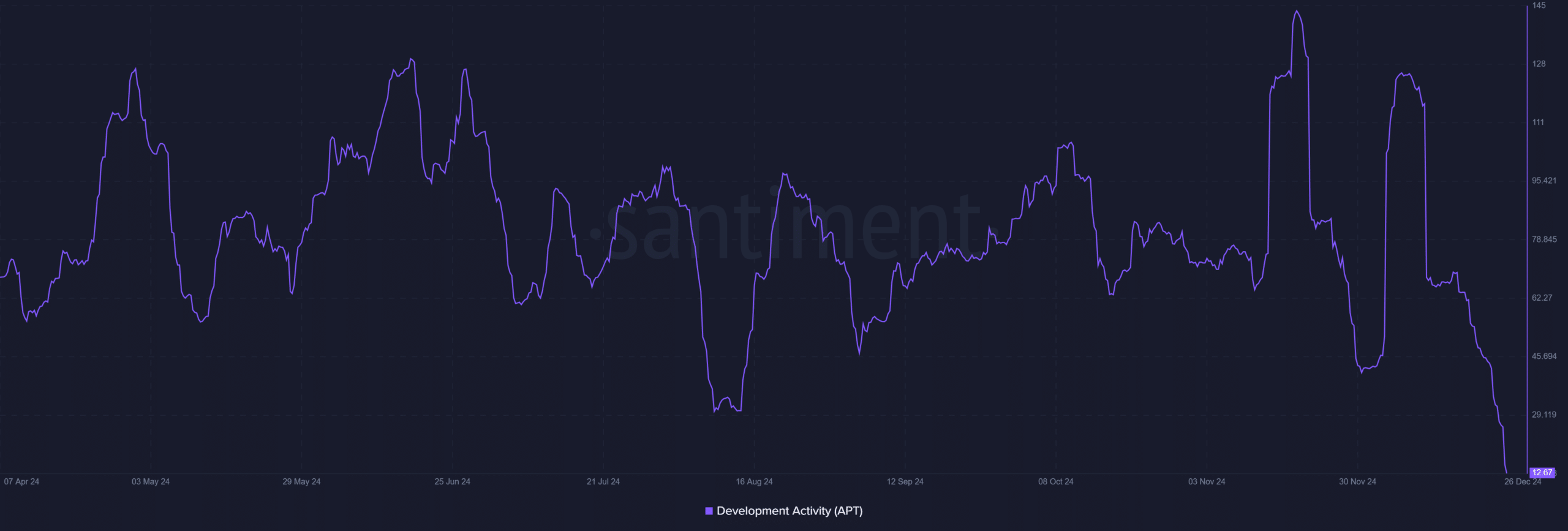

Development activity drops to concerning lows

Activity related to development in Aptos has noticeably decreased, dipping to only 12.67 as of late, which is significantly lower than the peak of 95 earlier in the year. This decrease stirs worries regarding the speed at which new ideas are being introduced and the expansion of the ecosystem.

Consequently, it’s crucial to prioritize our development endeavors to keep current developers engaged and entice fresh project proposals.

Furthermore, regular updates and new features could solidify Aptos’ standing as a cutting-edge blockchain technology.

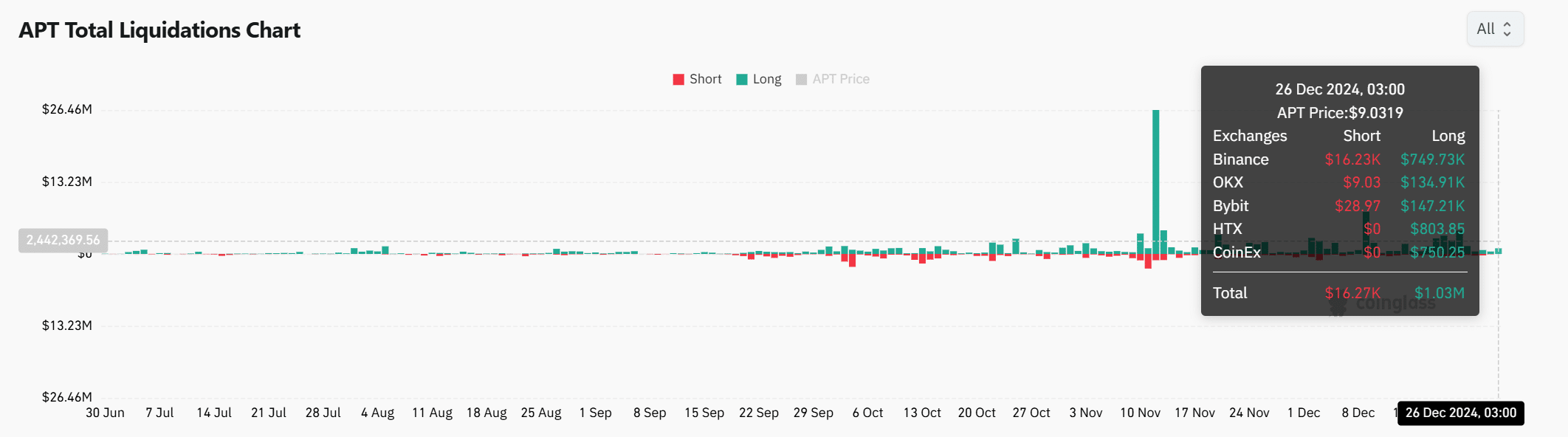

APT market liquidations highlight volatility

The latest clearing data suggests increasing apprehension in the Aptos market, as approximately $1.03 million worth of long positions have been liquidated, predominantly on the Binance platform.

As an analyst, I’m observing a prevailing trend towards liquidation, which underscores a cautious approach among investors regarding Aptos, as it hovers around crucial support zones.

On the other hand, this market activity suggests a high level of instability that shrewd traders might capitalize on for possible profits.

In the course of Aptos’ growth, ensuring a steady performance in terms of price will be essential for preserving the faith of investors.

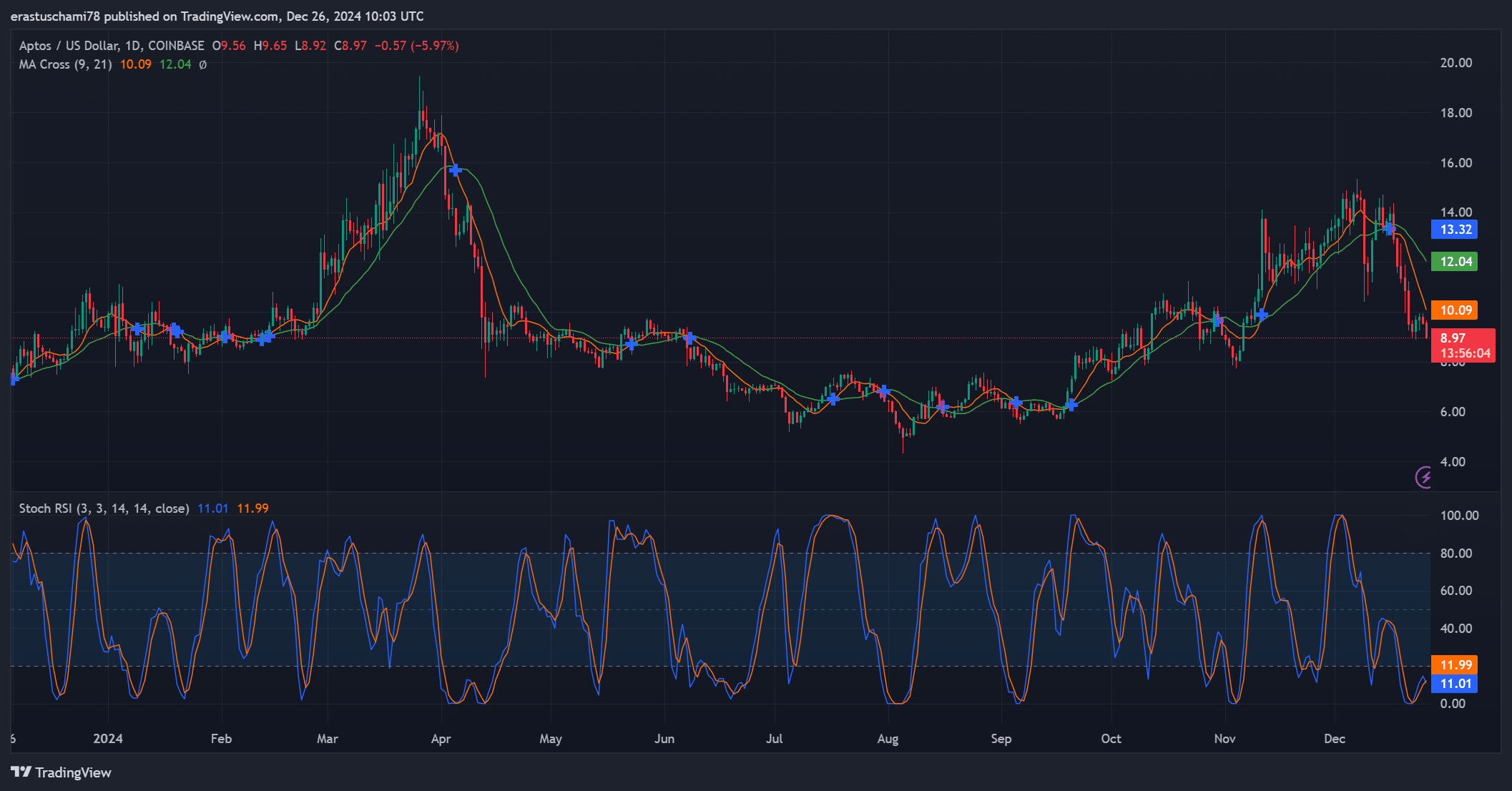

Technical indicators provide conflicting insights

From my perspective as a crypto investor, the technical forecast for APT is somewhat ambiguous, presenting both positive and negative indicators. The Stochastic RSI, a tool I often use, points towards oversold conditions at current levels, with readings of 11.01 and 11.99. This could potentially signal a rebound in the near future.

On the other hand, the arrangement of the Moving Averages shows a bearish trend, as the 9-day average line is located underneath the 21-day average line.

As a result, traders might choose to exercise caution, preferring to wait for more definite indications before taking bold actions.

Read Aptos’ [APT] Price Prediction 2024–2025

Conclusion: Can Aptos sustain its momentum?

It’s clear that APT has made significant strides in terms of transaction volume and overall ecosystem worth. Yet, to maintain this momentum, it’s essential to tackle challenges such as its limited social influence, decreasing project activity, and market instability.

Consequently, although Aptos seems promising, its lasting achievement relies heavily on continuous innovation, increased involvement within the community, and well-executed methods for price equilibrium.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-12-27 05:12