-

APT has a strongly bullish outlook in the coming weeks.

The short-term bias was also bullish but BTC volatility could damage it.

As a seasoned analyst with over two decades of experience in the crypto market, I must say that the current outlook for Aptos [APT] is indeed bullish, at least in the short to medium term. The resilience it has shown in the face of market volatility and fear is quite commendable.

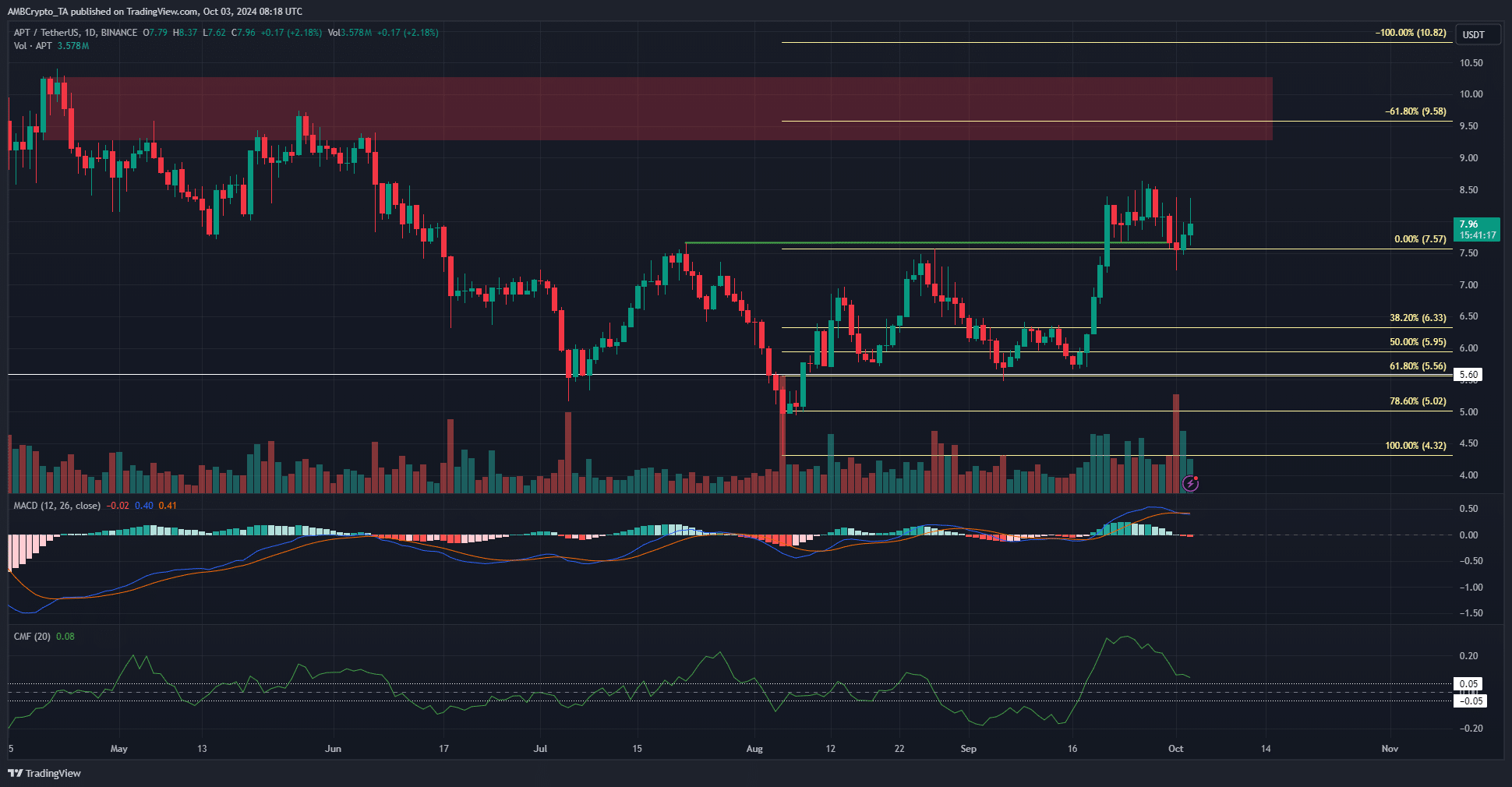

Aptos, represented by APT, exhibits a robust uptrend pattern on its weekly graph and has managed to sustain this positive trend even amidst the recent market turbulence and widespread fear. A surge beyond the $7.5 mark was followed by a temporary dip in line with broader market movements.

Yet, the higher timeframes did not signal a bearish trend was in progress. A drop below $7.23 would be the first sign of a bearish scenario. This drop did not seem likely based on the evidence at hand.

Aptos crypto retests August high as support

On October 1st, I experienced a significant daily decline of 1.56% in Aptos’ stock, yet the intraday fluctuations were exceptionally high. In fact, the trading activity on this day was reminiscent of the frenzied volume we saw on August 5th.

Regardless of the intimidating environment, the price managed to hold above $7.57 – a peak from August that served as a reference point for calculating Fibonacci retracement and extension levels. The 61.8% extension, roughly equaling $9.58, coincided neatly with a weekly bearish resistance zone around $10.

The 100% extension level was at $10.82, a resistance zone from December 2023. Swing traders will be targeting these levels in the coming months.

Overall, the market showed an upward trend in both daily and weekly patterns. However, a bearish cross-over occurred in the Moving Average Convergence Divergence (MACD), suggesting a temporary shift towards bearish short-term momentum. Despite this, the Chaikin Money Flow (CMF) plummeted significantly but remained above +0.05, hinting at substantial buying pressure that remains in place.

Shift in the Open Interest trends

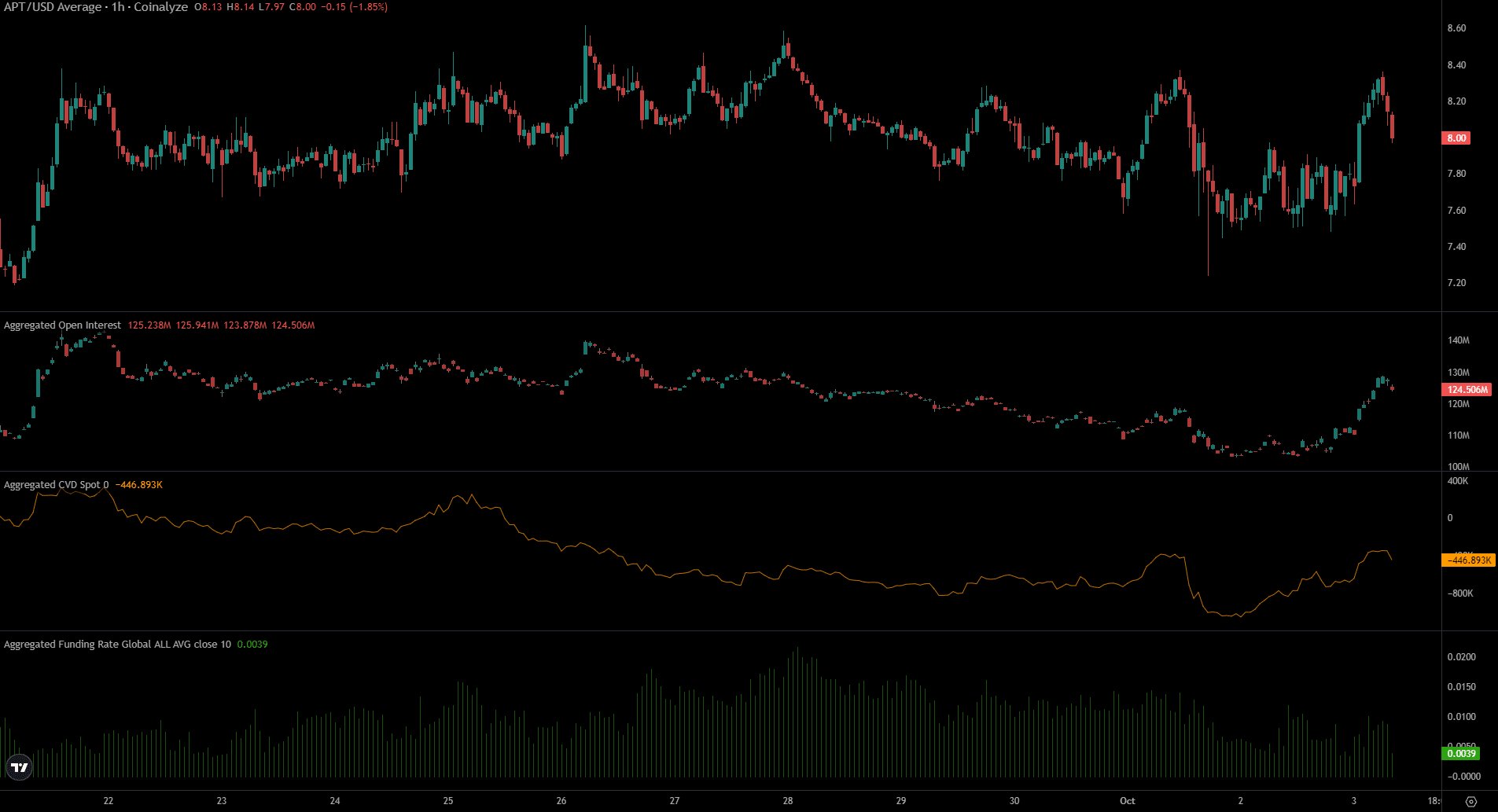

Over the past week, Open Interest was on a decline, but there’s been a significant shift in the last 24 hours. Instead of continuing its dip, the Open Interest surged from $104 million to reach $124 million. At the same time, APT experienced an uptick of 7.2%.

Is your portfolio green? Check the Aptos Profit Calculator

In the past few days, there’s been a consistent upward trend in the stock CVD, indicating optimism among investors about potential profits and further growth. This sentiment suggests that traders anticipate additional gains.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-04 01:11