-

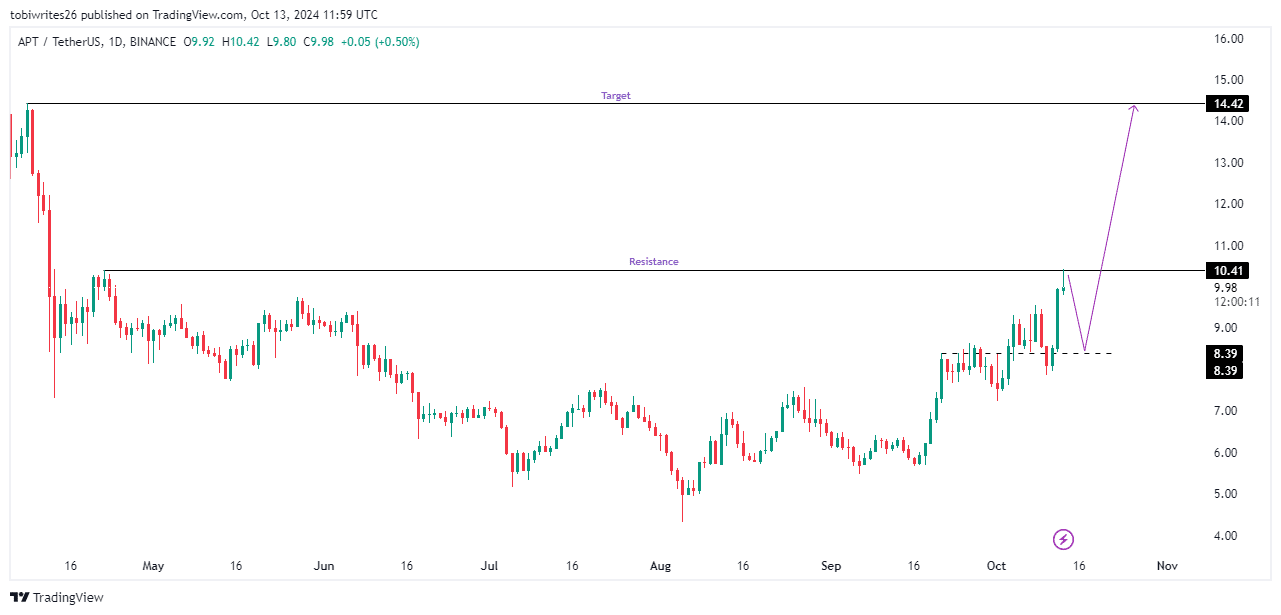

APT recently hit $10.41, a key level that could signal whether a short-term rally is on the horizon or if a downturn is more likely.

Several indicators suggest APT may pull back before making its way toward $14.42, a near-term target for the token.

After analyzing Aptos [APT] for quite some time now, I believe that we are witnessing a unique combination of factors at play here. The recent surge in price and trading volume suggests a strong underlying interest in the project, but the current technical indicators hint at a minor pullback before we can expect a potential rally toward $14.42.

Over the past month, Aptos (APT) has really shone, experiencing a significant increase of 63.30%. In just the last day, robust buying activity propelled its price up by 18.17%, bucking the trend of many altcoins that faced challenges in a turbulent market.

Although it has recently experienced growth, AMBCrypto’s assessment indicates that APT could experience another surge, further boosting its ongoing upward trend.

Short-term rally remains in play for Aptos

It seems likely that APT will carry on its upward trend following its trade beyond the $10.41 barrier, a point where it encountered substantial resistance from sellers.

Over the past day, the trading volume for APT has dramatically increased by about 174%, amounting to approximately $581 million. Furthermore, its market capitalization has also risen significantly by around 20.86%, now standing at a value of $5.17 billion.

To reach its immediate goal of $14.42, a key level with substantial trading activity, Aptos needs to surpass the resistance at $10.41 initially. In other words, it’s crucial for its trading volume to continue growing beyond that point.

If APT doesn’t manage to overcome this resistance, it might be expected to fall back towards the $8.39 support area, possibly regaining strength there to continue its uptrend.

According to AMBCrypto’s examination of the current market signals, it seems probable that the price of APT may soon dip after reaching its current heights.

A slight dip before the rally to $14.42 target

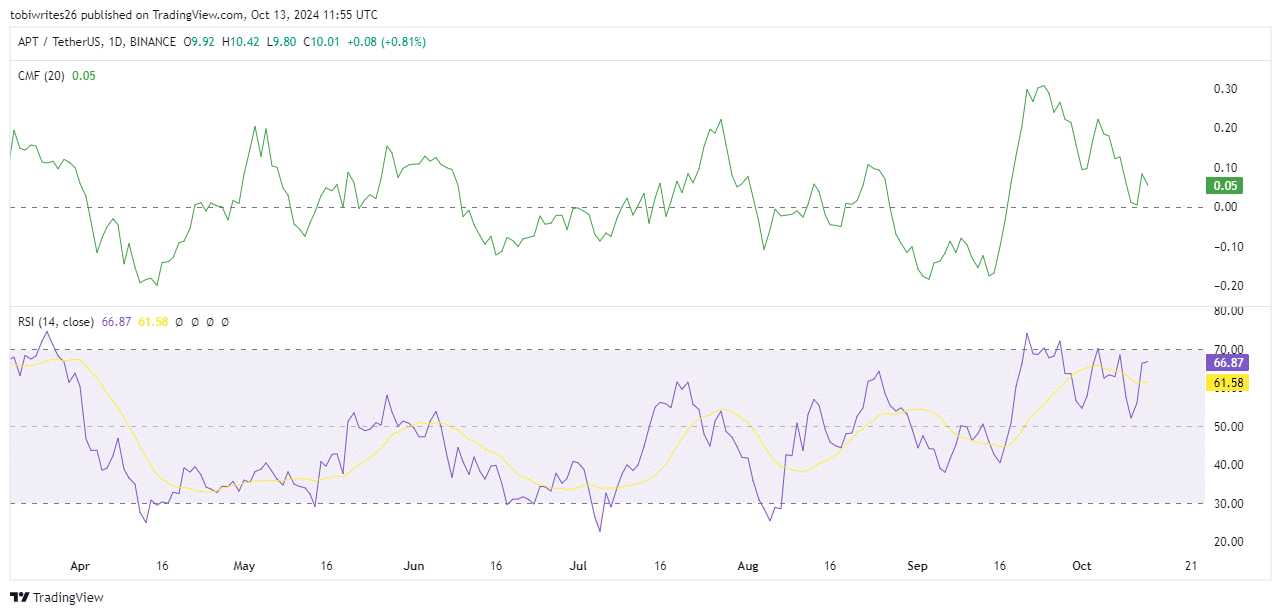

As an analyst, I’m predicting that my analysis on APT might encounter a brief dip before continuing its upward momentum towards the near-term objective of $14.42. This forecast is based on technical indicators like the Relative Strength Index (RSI) and Chaikin Money Flow (CMF).

The Capital Movement Facility (CMF), used to gauge liquidity movements for understanding market opinions, suggests a slight selling trend in the market, implying that certain investors are choosing to withdraw their funds.

In much the same vein, the Relative Strength Index (RSI) shows a minor dip, and the momentum is just tipping slightly negative. Should this pattern persist, it’s anticipated that APT‘s price will mirror this trend temporarily, experiencing a short-lived drop.

Nevertheless, even with these signs, the market continues to exhibit a generally optimistic outlook. The Chaikin Money Flow (CMF) and Relative Strength Index (RSI) are both still showing positive values, implying that the dominant direction is still climbing upwards.

According to AMBCrypto’s assessment, there are additional signs suggesting that the AppTech (APT) coin might continue in its bullish trend even after a predicted price correction.

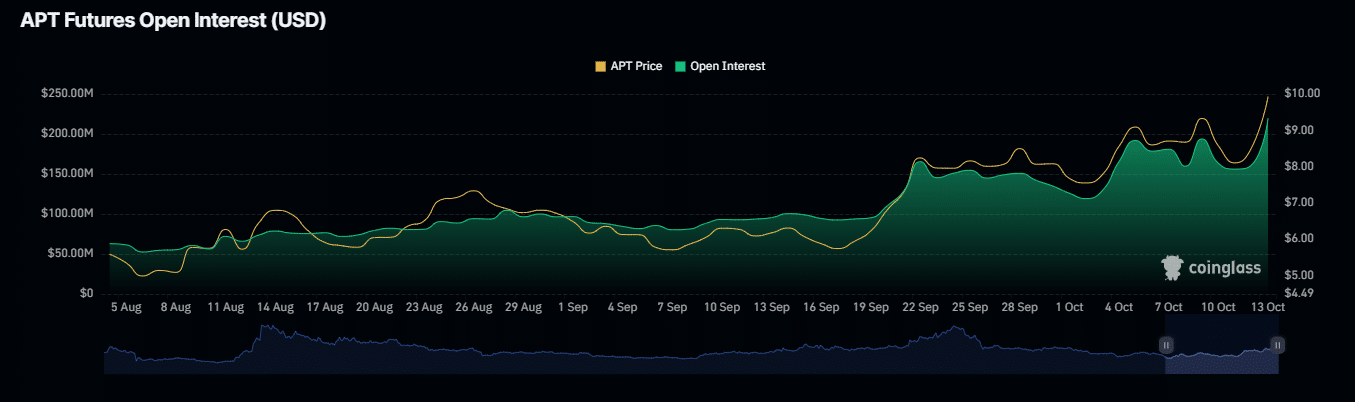

Rising open interest and funding rates signal Aptos rally

As I’m typing this, APT appears to be gaining traction as indicated by rising Open Interest (OI) and favorable Funding Rates. This puts APT in a strategic position for a possible upswing, further supporting its optimistic forecast.

The count of derivative contracts yet to be settled on the APT platform has experienced a substantial rise, indicating an uptick in open positions.

Read Aptos’ [APT] Price Prediction 2024-25

As an analyst, I’ve observed a significant increase in Open Interest (OI) according to Coinglass data, which has surged by approximately 61.13% to reach $264.74 million. This suggests that a larger number of long contracts are being initiated and existing ones are being sustained, indicating increased investor confidence and potentially bullish market sentiment in the asset I’m analyzing.

In a similar vein, the funding rate has risen significantly to 0.0148%, implying that traders holding long positions are compensating those in short positions to maintain equilibrium between futures and spot market prices. This situation strengthens the bullish outlook for the market.

Read More

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

2024-10-14 11:04