- APT is at a pivotal junction, with this support level likely to determine whether the asset trends upward or continues its decline.

- On-chain metrics reveal an aggressive sell-off from market participants, while broader indicators point to sustained selling pressure among traders.

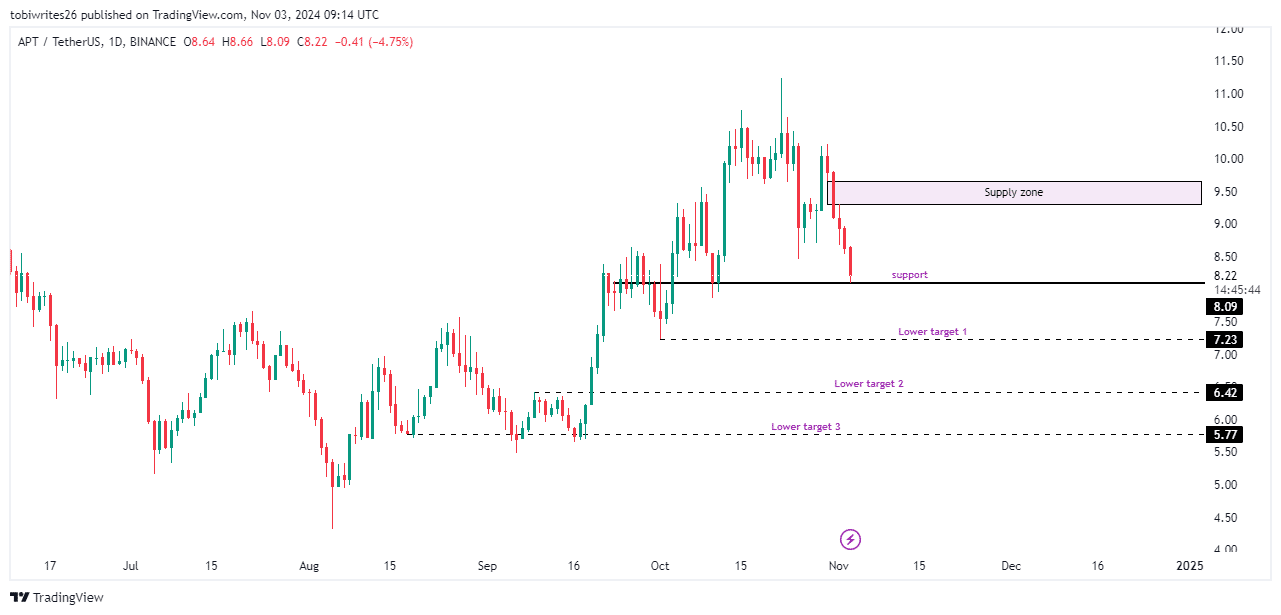

As a seasoned analyst with years of experience navigating the volatile cryptocurrency market, I find myself cautiously bearish on Aptos [APT] at this juncture. The current support level at $8.09 is a critical one, and its ability to hold will likely determine the asset’s trajectory in the coming days.

Over the last 24-hour period, Aptos (APT) has experienced a substantial decline of about 6.61%. As per the statistics from CoinMarketCap, this places APT among the day’s most affected cryptocurrencies.

Over the last seven days, APT’s market performance has followed a negative pattern, characterized by frequent sales and a drop of approximately 10.05%.

At this crucial juncture, APT might either rebound from its recent setbacks or continue its descending trend. AMBCrypto’s examination offers valuable perspectives on possible outcomes for the asset.

Can the support level hold for APT?

The current situation with APT shows a crucial juncture on its graph, which may influence whether it recovers or falls more. Significantly, the critical support point lies around $8.09.

Generally speaking, a support level is expected to draw sufficient buying interest to initiate a price increase, but it’s not always certain. A rebound from this point might push the price towards an adjacent area of high supply before experiencing a decrease.

Should APT not sustain its current price, a potential new low might be reached at around $7.23. If the market’s enthusiasm continues to wane, this decline could further push the price towards $6.42, with the possibility of falling even lower to $6.04 under such circumstances.

APT on the edge as bearish pressure intensifies

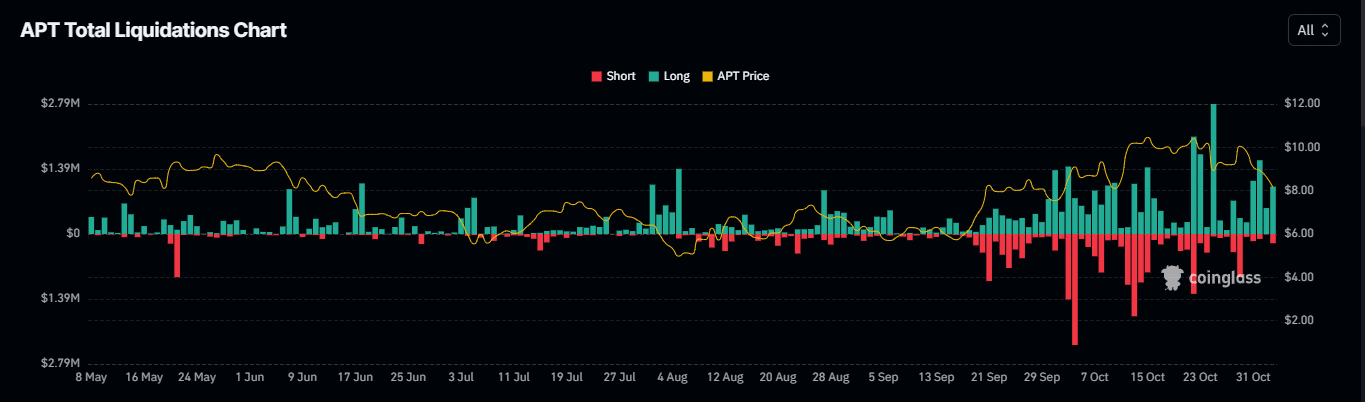

According to on-chain analysis provided by Coinglass, it appears that the token APT could be approaching a major drop due to an increased selling pressure that is causing its value to decrease significantly.

Market trend analysis using liquidation data, which measures investor sentiment by examining losses from both long and short trades, shows that there is currently a dominant negative or bearish outlook.

In the past day, the market has experienced approximately $1.65 million worth of trades being closed, or “liquidated.” Remarkably, around $1.45 million of these liquidations stemmed from long positions, implying that traders who anticipated a price increase were taken by surprise.

At the same time, small-scale selloffs totaled approximately $202,370, suggesting a strong influence from bearish forces.

As a crypto investor, I’ve noticed that the decreasing Open Interest in APT could be a sign of an impending price drop. After reaching a peak of $259.04 million on October 14, the Open Interest has since dropped to $168.96 million, suggesting that buying interest is dwindling.

The amount of open interest refers to the number of unresolved derivative contracts currently in the market. A significant decrease may indicate an increase in short positions, as traders are growing more optimistic about future price decreases for APT.

Demand for APT declines as Exchange Netflow rises

Currently, as I’m typing this, APT’s Exchange Netflow has grown significantly during the last 12 hours. This trend suggests a decrease in market confidence, which could be one reason for the recent drop in the asset’s value.

Read Aptos’ [APT] Price Prediction 2024–2025

Netflow, in this context, tracks the incoming and outgoing flow of a particular cryptocurrency on trading platforms. When Netflow shows a positive value, it typically means an increase in inflow, which could indicate a possible rise in supply, potentially leading to a decrease in price as more tokens become available for purchase.

Instead, when Netflow is negative, it suggests outgoing flows are occurring, which is often seen as a bullish signal because the supply on exchanges is reducing. On the other hand, with APT’s positive Netflow, there might be more declines to come.

Read More

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- OM PREDICTION. OM cryptocurrency

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- 1923 Sets Up MASSIVE Yellowstone Crossover

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Leslie Bibb Reveals Shocking Truth About Sam Rockwell’s White Lotus Role!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-11-04 02:15