-

Aptos’s stablecoin marketcap and TVL soared to new historic highs

Assessing the level of network activity and its potential impact is important to gauge APT’s price action

As a researcher with years of experience delving into the intricacies of blockchain networks, I must say that Aptos has certainly caught my attention this week. The network’s achievements are nothing short of impressive, and it’s hard not to be drawn in by its meteoric rise.

⚠️ Market Meltdown? EUR/USD Braces for Trump Tariff Fallout!

Explosive analysis shows why EUR/USD could face extreme moves ahead!

View Urgent ForecastThis week, Aptos emerged as one of the standout blockchain networks, showcasing impressive performance and utility. If you haven’t been following closely, this network reached new record highs on several occasions throughout the week.

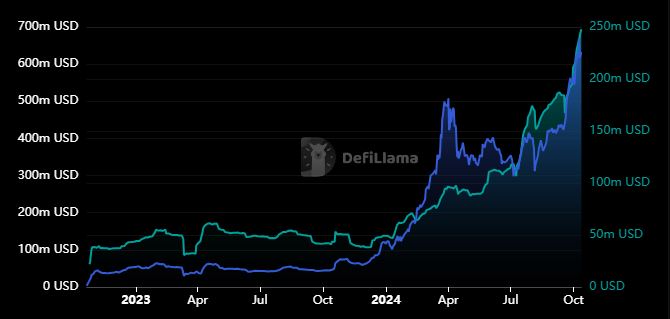

Based on DeFiLlama’s data, the highest amount of value ever locked within the Aptos network reached a peak of $668.42 million on October 9th – an all-time high for TVL (Total Value Locked). Remarkably, in just the past year, the TVL of this network has skyrocketed by more than 4700%.

Currently, it seems that the TVL (Total Value Locked) has taken on an exponential trend, noticeably after June; however, this isn’t the only metric experiencing new records. In fact, Aptos’s stablecoin market capitalization also peaked at approximately $247.97 million within the past 24 hours.

The combination of these accomplishments emphasizes the current strength of the Aptos network. A strong stablecoin and Total Value Locked (TVL) growth often go hand in hand with increased utility and user base growth. It’s no wonder, then, that the number of daily active addresses on Aptos has seen a substantial increase over the past few months.

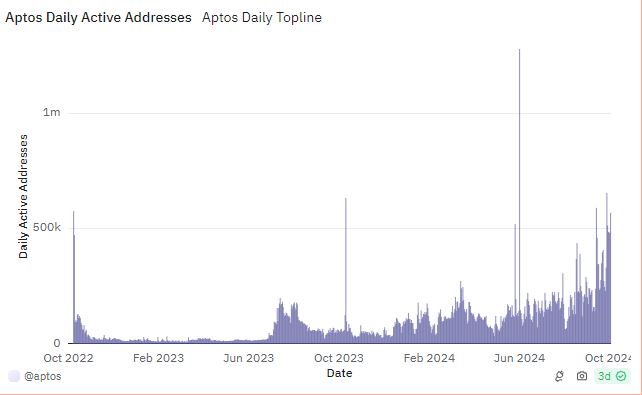

At the beginning of 2024, Aptos saw fewer than 100,000 active addresses on average each day. But as per Dune Analytics, recently, there have been days where the number of daily active addresses surpassed 500,000.

The hike in daily active addresses confirms that the Aptos network has been seeing more usage, especially from around June. But, what about the potential impact on APT’s demand?

Aptos recent growth underscores APT strength

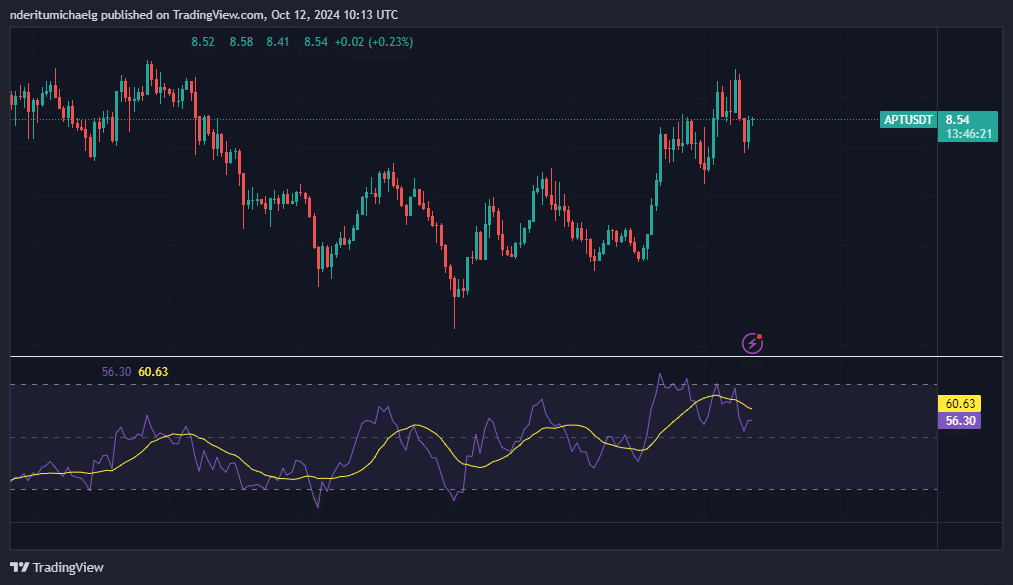

The recent surge in APT could be indicative of its strong internal transactional activity within the network. In the opening week of October, APT experienced a rise, further expanding upon its achievements from September. Interestingly, this upward trend coincided with many leading cryptocurrencies facing resistance due to market sell-offs.

In the initial eight days of October, APT saw an increase of 30%. It reached a high of $9.56, but currently, at the time of pressing, its value stands at $8.54. Nevertheless, APT has maintained a positive trend, showing signs of bullish energy.

The increasing use of the Aptos network appears to be driving interest in APT. It’s important to note that even with this strong performance, APT is currently being traded at a 55% reduction compared to its 2024 peak value.

An increase in network performance and significant achievements on the network could foster a more optimistic outlook among investors. Since increased activity on the Aptos network might suggest greater potential for the native coin, this influx of positive perception is likely to occur.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-10-12 22:15