- Spot traders appear to be preparing for a potential rally, reducing the available supply of APT on exchanges.

- Derivative traders are taking a bearish stance — many are selling or placing short positions.

As a seasoned researcher with over two decades of experience in the cryptocurrency market, I have seen countless bull and bear cycles that have shaped my understanding of market dynamics. In the case of Aptos [APT], the current situation presents an interesting conundrum: spot traders are hoarding the asset while derivative traders remain bearish.

In spite of the prevailing negative market feelings, Aptos (APT) has shown remarkable growth over the last few weeks. For the past month alone, this asset has experienced a significant increase of 24.34%, and its weekly gains amount to an impressive 12.76%.

Currently, spot traders were leading the market, contributing to APT experiencing a small day-over-day growth of 1.08%.

On the other hand, it’s unclear how long this rally will last. The crucial point is whether the positive trend can hold up against the negative influence coming from the derivatives market.

Spot traders seize control of bullish momentum

The significant advancements seen in APT lately are primarily due to the active positions of market traders who have adopted a positive outlook, often referred to as going long or ‘buy’ positions.

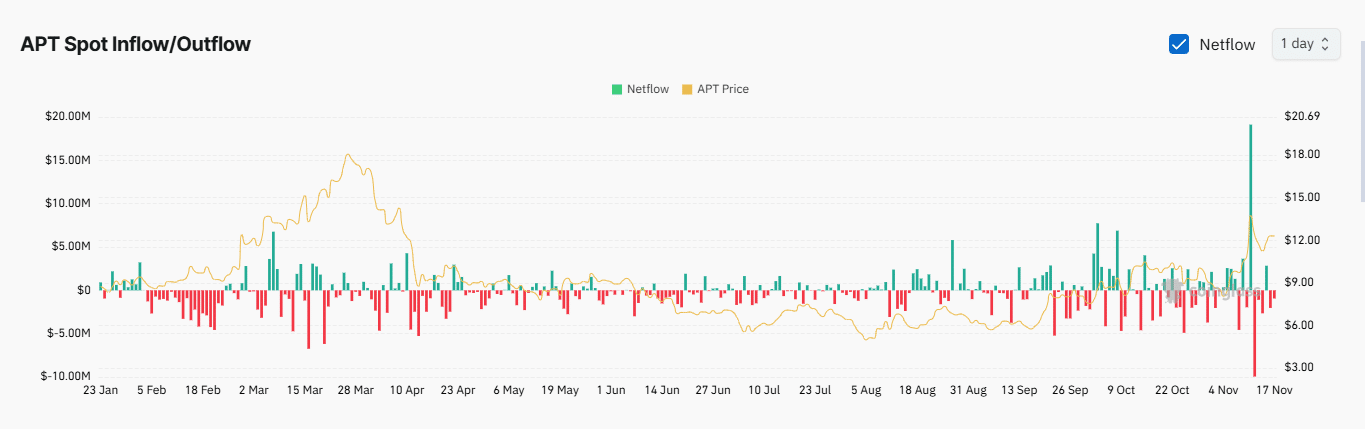

The data from the Exchange Netflow, which monitors the movement of Advanced Persistent Threats (APT) on cryptocurrency exchanges, displayed negative figures for two successive days.

On November 16th and 17th, approximately $2.03 million and $938,670 were taken out from exchanges in APT. This action hints at a change in the trading community’s overall feeling or attitude.

A negative exchange netflow usually means that a larger amount of assets is transferring from exchange wallets to personal wallets, which could be an indication of long-term storage or accumulation.

As a crypto investor, I’ve noticed that reducing the amount of cryptocurrency available for trading on exchanges has a squeezing effect on the supply, which frequently leads to an increase in market demand and subsequent price rise due to the scarcity.

Derivative traders remain aggressive

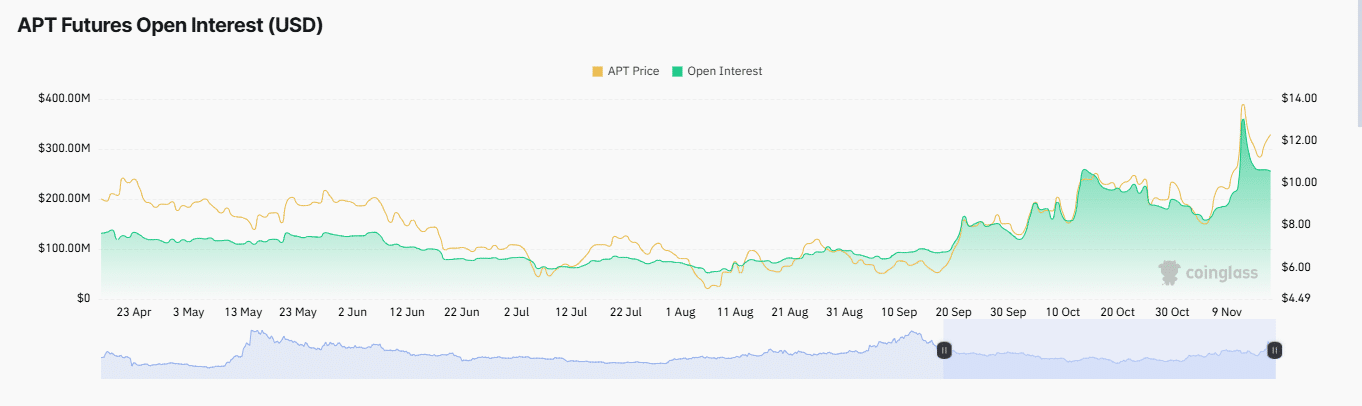

In simpler terms, derivative traders maintained their influence over the market by adopting a pessimistic approach, as various important indicators like Open Interest, Liquidations, and the Ratio of Long Positions to Short Positions suggested decreasing faith in an upward price trend.

Data from Coinglass revealed a significant drop in Open Interest, which fell by 8.03% to $255.58 million.

It showed that a majority of unresolved contracts are currently being influenced by short sellers, who have seized control over the market’s direction.

At the same time, large numbers of trades have been liquidated, totaling approximately $589,380 in value. This trend indicates that the market is moving contrary to traders’ expectations for a price increase, thereby intensifying the pessimistic outlook.

Furthermore, it’s worth noting that the Long-to-Short ratio stands at 0.8822, suggesting that there are more short traders than long traders currently in the market.

In simple terms, this imbalance adds extra stress to any upcoming positive trends, reducing the chance of a prolonged upward trend in the immediate future.

APT’s next move on the chart

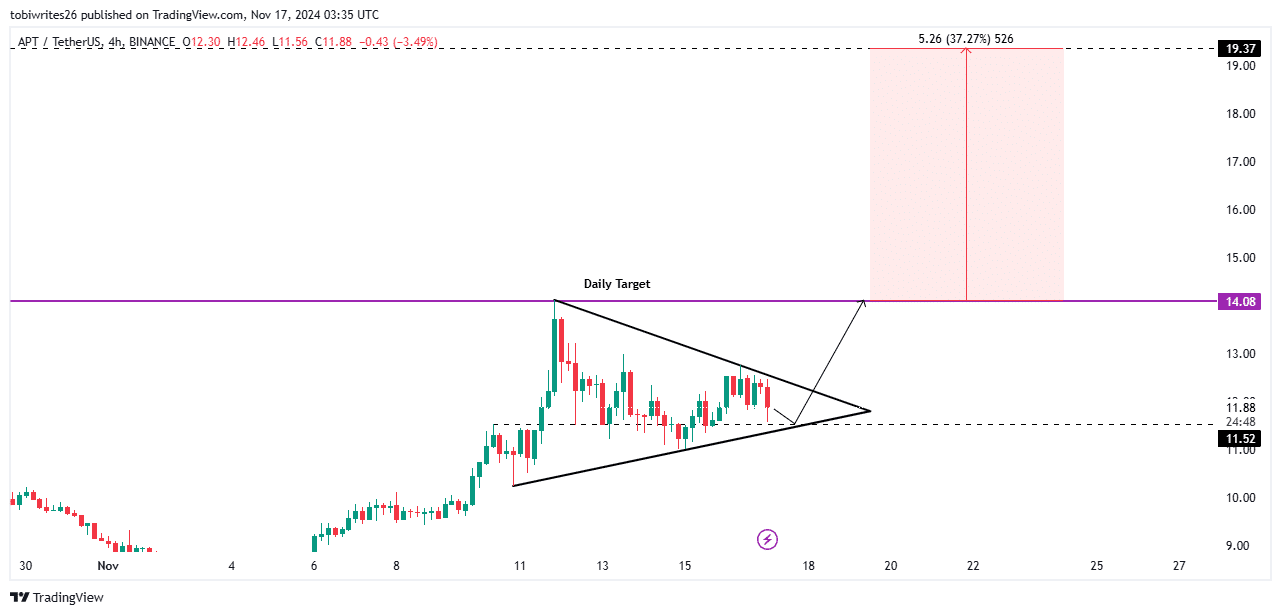

Based on the graph, APT was experiencing a consolidation period when the data was recorded. During this time, it was trading between a symmetrical triangle formation following its rebound from the $14.08 resistance level.

This repeated pattern typically signals an upcoming strong market surge, suggesting that the Asset Price Trend (APT) could be poised for a possible breakthrough.

To maintain an upward trend, APT might initially dip a bit to touch the $11.52 support again before bouncing back, or it may surge straight away from its present level towards the $14.08 resistance area.

Yet, the $14.08 level might face strong selling interest, possibly causing a brief dip or correction.

Read Aptos’ [APT] Price Prediction 2024–2025

Should the positive trend continue, there’s a possibility that APT may surpass its current threshold, potentially resulting in a forecasted increase of approximately 37.27% and setting a fresh monthly peak at around $19.37.

Considering these circumstances, it seems that spot traders are currently in a favorable position. If the negative on-chain indicators start to trend positively, their advantage could become even more pronounced.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-11-18 01:12