-

Aptos TVL resumed its upward trajectory, but was overtaken by the network’s stablecoins market cap.

APT bounced back over 60% from local lows, but has room for more upside.

As a seasoned crypto analyst with years of experience in tracking and analyzing various blockchain projects, I have observed the intricacies of the market and the factors that drive growth for different protocols. In the case of Aptos and its native token APT, I’ve seen a noteworthy turnaround in recent weeks.

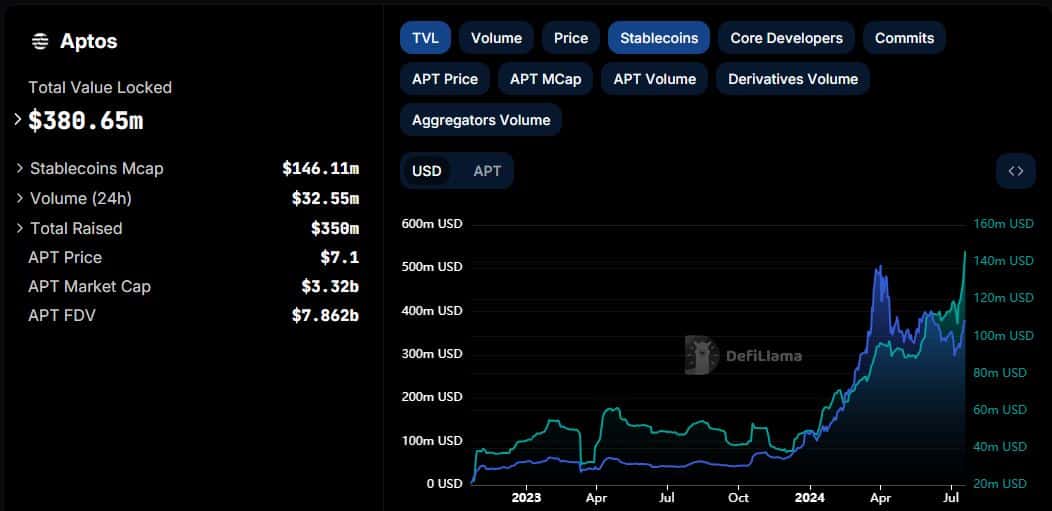

The total value secured by Aptos in its protocol, referred to as Total Value Locked (TVL), has significantly contributed to the project’s expansion. However, similar to numerous other crypto projects, there was a decline in TVL following April, which had previously shown signs of strong recovery during the first quarter of 2024.

The total value locked in Aptos experienced a deceleration from April to the initial week of July, declining from its peak of $429.66 million reached on April 1st. Approximately $124.04 million was taken out between April 1st and June 6th.

The market’s renewed faith has led to a notable increase in Total Value Locked (TVL) for Aptos, currently sitting at $380.65 million.

Stablecoins flip TVL: What it means for Aptos

The increase in Total Value Locked (TVL) in Aptos suggested that investors’ confidence in the market had returned, leading them to secure their funds within the protocol once more.

I’ve noticed an intriguing development while closely monitoring my crypto investments with AMBCrypto. Apart from the impressive Total Value Locked (TVL), there has been a remarkable increase in the usage of stablecoins on the Aptos network. At present, the market capitalization of these stablecoins stands at approximately $146.11 million. This represents a substantial gain of around $39.5 million over the past week.

The surge in value caused the market capitalization of Aptos stablecoins to surpass their total value locked (TVL), suggesting a higher degree of investor confidence, but the continued preference for keeping assets locked up could signal lingering caution.

Given the current market instability, it’s understandable that some prefer the flexibility of having easily accessible funds. This could potentially indicate a decrease in DeFi usage, but the optimistic trend provides a glimmer of hope.

Will APT maintain the bullish trajectory?

From a different perspective, the expansion of stablecoins and Total Value Locked (TVL) aligns with robust growth. Indicative of the market rebound witnessed over the past few days.

At the current moment, Aptos’ indigenous digital currency, APT, was priced at $7.01 following a robust surge of 27%, bouncing back from its previous depths.

At the current moment, APT was priced 63.9% lower than its highest year-to-date value, even with the recent market upturn. This underperformance primarily mirrors the broader market conditions.

Put simply, the price behavior of APT is influenced significantly by the broader market mood. Yet, it’s important to note that the stock remains relatively inexpensive when compared to its past peak prices.

Read Aptos’ [APT] Price Prediction 2024-25

The strongest resistance point for APT approaches slightly above the $10 mark. According to the MACD indicator, the bulls currently hold the upper hand in the market.

The Relative Strength Index (RSI) echoed this finding, implying further growth potential with a market cap of $3.27 billion for APT at that moment.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-07-20 07:03