- Aptos price action shows promise for higher prices.

- The blockchain’s TVL, transaction counts and speed witness growth.

As a seasoned analyst with over a decade of experience in the crypto market, I have witnessed numerous bull and bear cycles. From my vantage point, Aptos [APT] presents a compelling investment opportunity. The price action, while showing a downward trend since April, seems to be hinting at a potential reversal, as indicated by the weakening of the bearish trend during the fourth touch of the descending trendline.

Since April, the cryptocurrency APT [APT] has been showing a continuous decline, and its price fluctuations have been aligning with a falling trendline since May. On the daily chart for APT/USDT, this trendline has been tested on four separate occasions, each time resulting in a rejection of further advancements.

Yet, on the fourth attempt, the price failed to dip below its previous low, suggesting that the downward trend may be losing strength.

Furthermore, there appears to be a head and shoulders chart formation, which often indicates a potential price change if the neckline is breached and maintained above.

To establish the $4.30 as a lower boundary for the ongoing cycle, the price needs to shatter and sustain its position above the $7.50 mark.

Reaching this milestone might pave the way for a possible increase, potentially surpassing or even reaching $10, by the close of this year or in early 2025, according to various indicators we’ve observed.

Aptos adoption and TVL

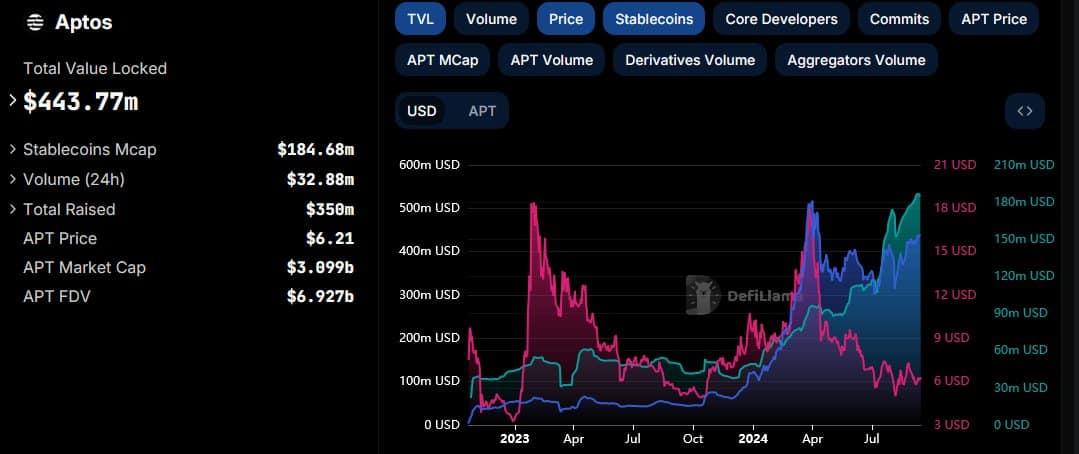

In terms of usage, data from Aptos shows a steadily increasing acceptance level. Currently, the Total Value Locked (TVL) within Aptos stands at approximately $439 million, positioning it as the 18th most popular overall and 6th among non-EVM chain networks.

As a keen analyst, I find myself impressed by the rapid ascent of Aptos in the TVL rankings, which it managed to achieve just this year when it launched its mainnet. This swift climb underscores a robust market entrance for Aptos.

Even though prices have been fluctuating, the Total Value Locked (TVL) on the platform remains consistent. This indicates a strong flow of assets within the system and growing confidence from users.

Furthermore, the market capitalization of stablecoins on Aptos has grown, indicating a growing trend of adoption and trust.

Daily active users and transactions

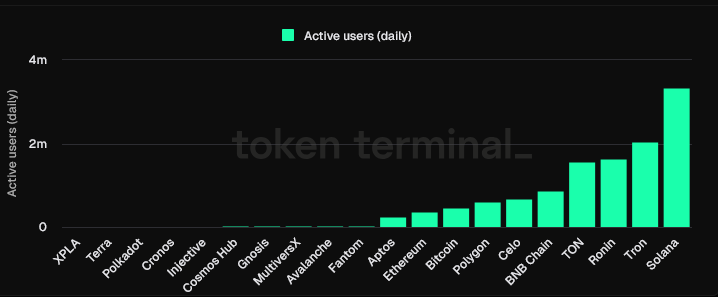

Aptos consistently thrives within the realm of layer-1 blockchains. In the last 18 months, we’ve seen a gradual uptick in active users, exceeding 200,000 on a daily basis.

This notable statistic positions it as the 13th most active blockchain, both in terms of layer-1 and layer-2 networks. According to Aptos Explorer, it consistently handles about a million daily user transactions on average.

As a researcher, I find that deciphering transactions can indeed be intricate; however, the substantial number of daily active users clearly indicates a vibrant level of engagement within this network.

Transaction speed and scalability

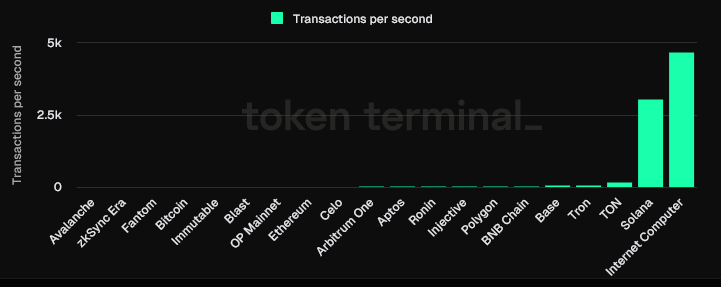

As a crypto investor, I’ve been impressed by Aptos’ swift transaction processing capabilities. On average, it manages around 25 transactions per second (TPS), but that figure skyrockets! Over the past 30 days, it has even reached astounding heights of up to 12,000 TPS.

The system has proven its ability to handle large amounts of data as it set new records for transaction volume. Back in May, it managed close to 100 million transactions within a 24-hour period.

Over four days, it handled 325 million transactions, maintaining over 2,000 TPS for more than 24 hours, with peaks nearing 5,000 TPS.

This performance highlights Aptos’s capability to handle high transaction volumes efficiently.

Read Aptos’ [APT] Price Prediction 2024-25

Aptos demonstrates a promising outlook for increased valuations, backed by its robust adoption statistics, substantial user engagement, and ability to scale effectively.

With the cost getting close to crucial resistance points and an increase in adoption, APT might experience notable growth, suggesting it as a promising prospect for investment in the coming days.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-09-16 06:16