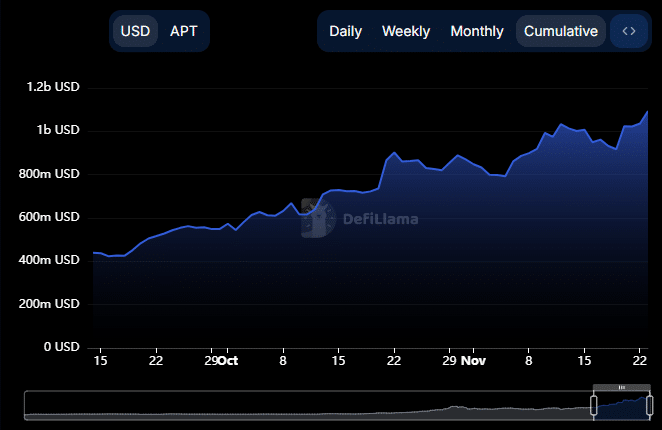

- Aptos’ Total Value Locked (TVL) recently hit a lifetime high of $1.09 billion, signaling increased adoption and investor confidence.

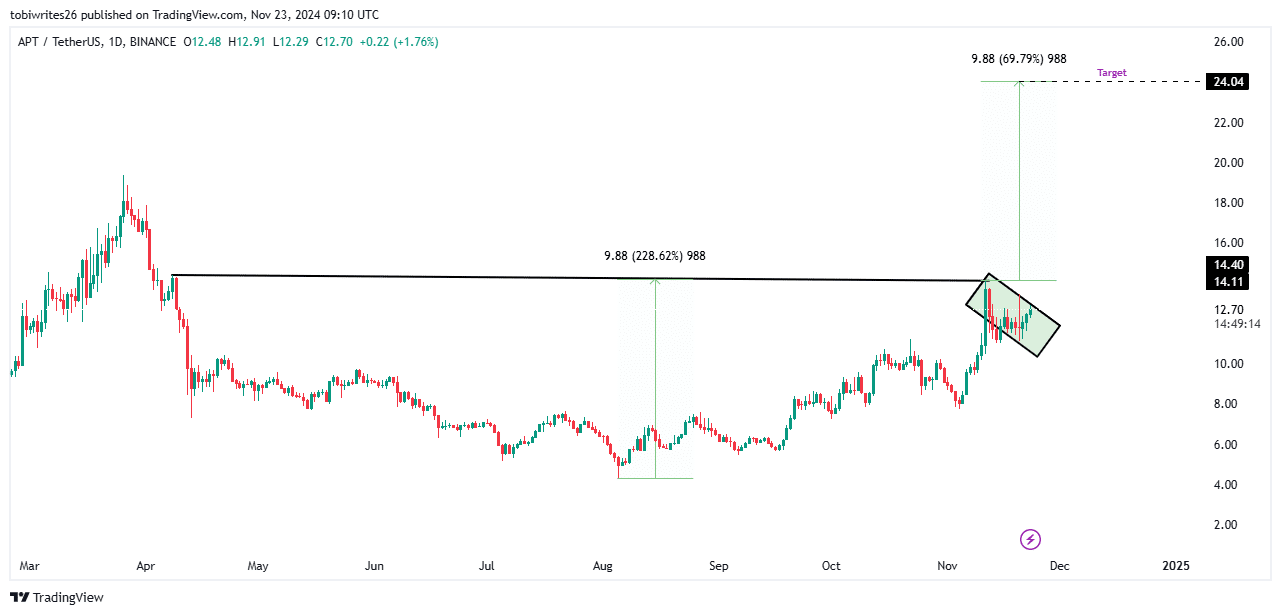

- APT has formed a cup and handle pattern—a reliable technical indicator of potential upward momentum.

As a seasoned analyst with over a decade of experience in the dynamic world of cryptocurrencies, I must say, the current bullish momentum surrounding APT is nothing short of intriguing. The recent surge in Total Value Locked (TVL) to an all-time high of $1.097 billion is a testament to growing market strength and investor confidence—a trend that has been my bread and butter for years.

While Aptos’ [APT] monthly performance showed a modest 26.58% gain, momentum seemed to be building.

In the past day, we’ve seen a significant 5.42% increase, which might signal the start of a prolonged upward trend. This spike is likely fueled by an increasing sense of positivity and goodwill in the market.

According to AMBCrypto’s analysis, crucial elements driving this trend have been identified, implying that Advance Persistent Threats (APT) might experience considerable profits in the near future based on their current path.

APT TVL reached a record $1.097 billion

New data from DeFiLlama shows that the Total Value Locked (TVL) for APT has reached an unprecedented peak of $1.097 billion, underscoring a burgeoning market power and rising faith among investors in this asset.

For those who might be new to this, TVL stands for Total Value Locked, which refers to the overall amount of assets (often cryptocurrencies) held within a particular protocol or platform. This metric is essential because it shows the level of liquidity within the platform and how widely adopted it is.

As a crypto investor, I’ve noticed that the all-time high Total Value Locked (TVL) of APT has been quite impressive, which typically indicates a robust bullish outlook. This is usually linked to enhanced liquidity and an uptick in active buying, suggesting increased market activity.

This increase in interest not only boosts APT’s attractiveness in the market, but it also suggests a possibility of increased pricing due to heightened demand and potential future growth.

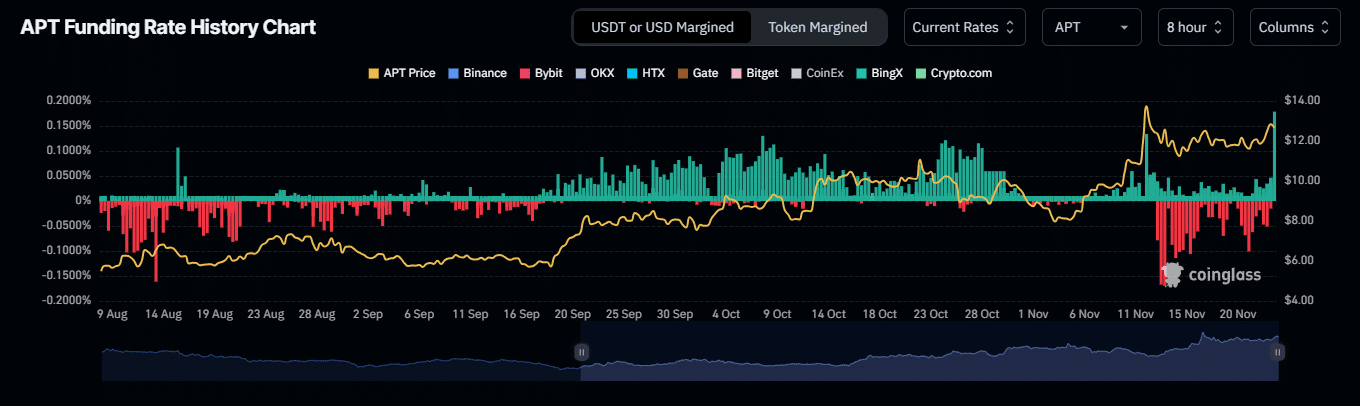

Bullish sentiment drives liquidity surge

As a researcher, I’ve recently observed an intriguing surge in liquidity inflow towards APT, which appears to be significantly influenced by the vigorous trading dynamics within the derivatives market.

The Funding Rate, which measures payments between long and short positions, has climbed to a yearly high of 0.0450%, reflecting strong bullish sentiment among traders.

As we speak, the Funding Rate indicates a trend where long traders are leading the market, maintaining positive price movements.

The Open Interest has experienced a significant jump, climbing up by 1.73% to reach approximately $279.77 million. This increase indicates an uptick in trader involvement and a sense of enthusiasm among them regarding the possible upward trend of APT.

A strong Funding Rate alongside significant Open Interest indicates that investors have faith in the asset’s continued upward trend, bolstering market confidence.

APT eyes $24

In the lead-up to a possible market surge, APT demonstrated robust technical indicators. Specifically, it was shaping like a ‘cup and handle’ pattern at the current moment, a configuration frequently linked to substantial price jumps.

Should the anticipated pattern unfold correctly, APT might witness an approximately 69.79% rise, potentially pushing its value up to around $24 – a significant level last touched during its initial week in October 2022.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-11-24 05:11