- Aptos readies for faster expansion of its DeFi segment now that it has embraced USDT natively.

- APT price demonstrates robust demand at key Fibonacci level. Why the next few weeks might be extremely bullish.

As a seasoned crypto investor with battle-scarred fingers from navigating through the crypto market’s wild rollercoaster rides, I can confidently say that the recent developments in Aptos [APT] have caught my attention like never before. The network’s strategic move to integrate USDT natively is a game-changer that could potentially catapult Aptos into the big leagues of DeFi.

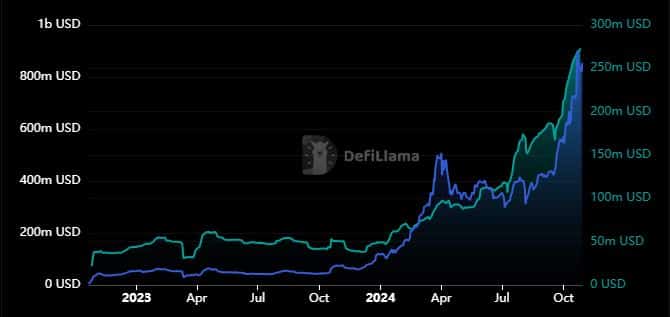

On the 22nd of October, I observed a brief spike in Aptos [APT] Total Value Locked (TVL), surpassing the $900 million mark for the first time. Interestingly, this brought us quite close to the elusive $1 billion TVL milestone. Yet, it seems this could shift rather swiftly based on the network’s recent announcement.

Aptos has officially unveiled that the United States Dollar Tether (USDT) stablecoin will now be integrated into its primary network. This move is a key step towards increasing Aptos’ participation in international transactions on a broader scale.

Introducing USDT to the Aptos system could potentially yield several advantages, including fueling Decentralized Finance (DeFi) expansion and drawing in more users. These benefits might also stimulate the total value locked (TVL) growth of Aptos. Notably, this TVL has been consistently increasing and is nearing the $1 billion threshold.

At the moment I’m penning this, the value locked within the Aptos ecosystem stands at approximately $855.43 million. Interestingly, it surpassed the $900 million mark merely a week ago, hinting at its potential growth. The presence of USDT in the Aptos ecosystem could potentially push the Total Value Locked (TVL) over the $1 billion threshold.

The value of Aptos’ stablecoin market cap demonstrated strong growth even before the USDT integration, climbing from just under $50 million at the start of 2024 to a record peak of $273.36 million more recently. Analysts predict that this upward trend in Aptos stablecoin market cap may continue and reach even higher levels.

APT price action recap

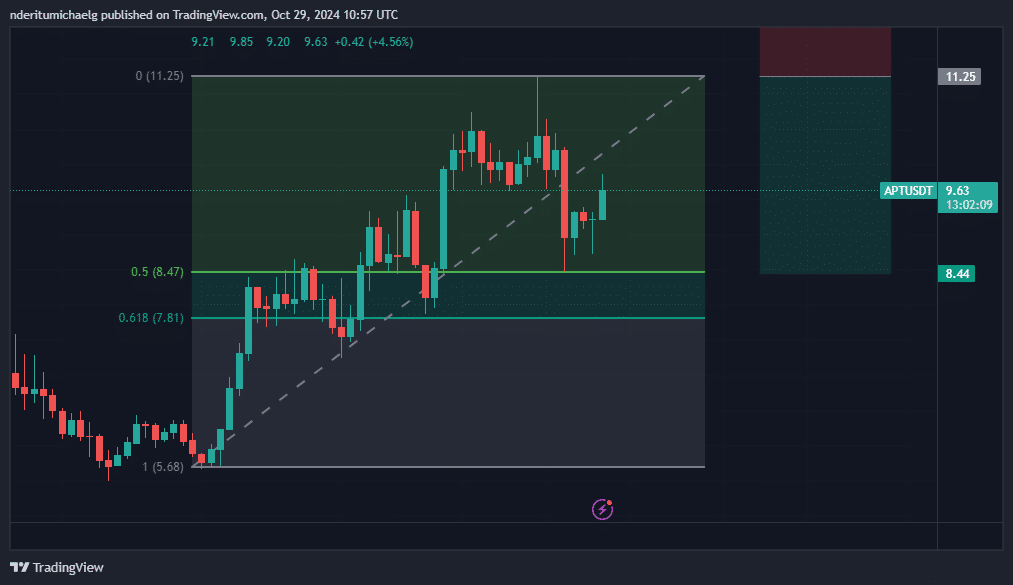

Last week, APT decreased by 25% from its highest point of $11.24 for the week. On October 25th (Friday), it hit a low of $8. Since then, there’s been a buildup or accumulation in its value.

At the moment, APT was priced at $9.66, representing a 13% bounce back from its lowest point on Friday. This surge suggests a robust resurgence of substantial demand.

According to Fibonacci retracement analysis, a potential downward correction might take place between approximately $7.81 and $8.47. This prediction is derived from the start of the upward trend in September/October until the recent peak last week. After briefly touching the upper boundary, the price showed a quick reversal, signaling the resurgence of bullish energy.

Read Aptos’ [APT] Price Prediction 2024–2025

After a temporary dip, the APT bulls picked up pace again when the price fell slightly below its 50% Relative Strength Index (RSI) threshold. This event underscored the fact that the strong trend from the past four weeks remained active.

It’s worth mentioning that the long-term trend has been shaping up as a cup and handle pattern. This indicates a potential significant surge in the near future, particularly if the broader market environment becomes highly favorable or extremely bullish.

Read More

2024-10-29 21:43