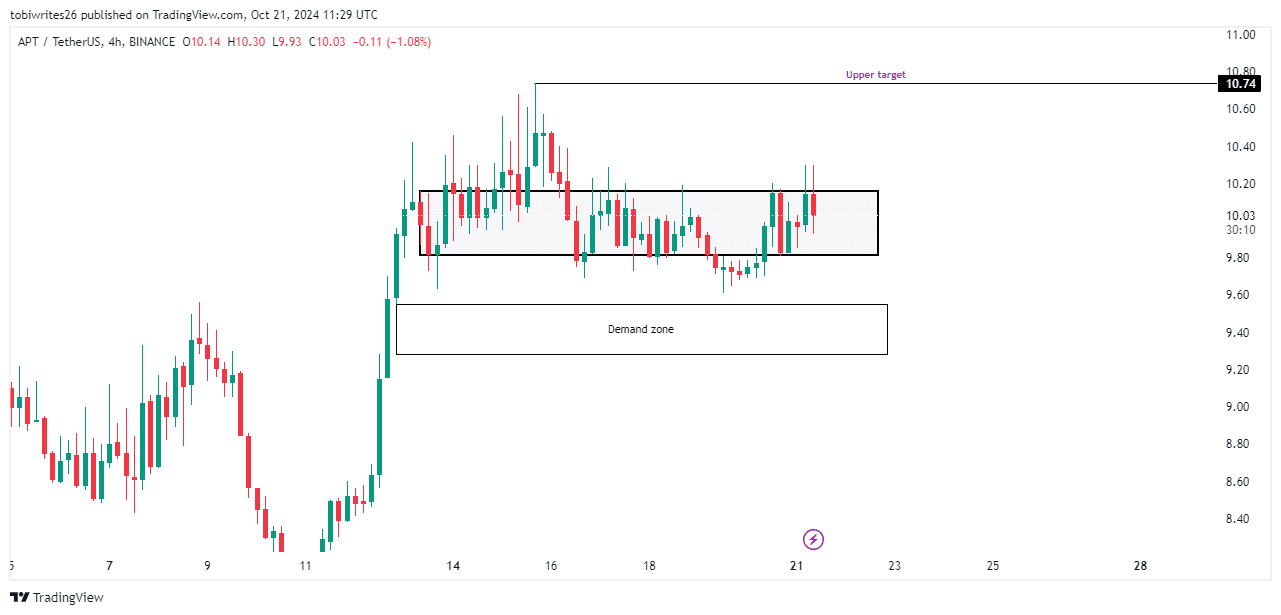

- Since 13th October, APT has been trading within a range.

- Given recent market activity, a move to the upside seems likely.

As a seasoned researcher who has navigated through numerous market fluctuations and trends, I find myself optimistic about the near future of APT. After closely observing its consolidation phase since October 13th, I believe we might be on the cusp of an upswing. The slight uptick in the last 24 hours could very well be a precursor to a more significant rally.

Despite a strong 29.61% increase over the past month, APT (Aptos) has been unable to maintain its initial excitement. Over the past week, the asset has declined by 1.91%, but showed a small 0.25% growth in the last day.

Might this minor increase grow further, leading us upward? AMBCrypto’s examination provides valuable predictions about what we can expect.

What does the consolidation phase mean for APT?

Since October 13th, APT’s behavior suggests it’s in a holding pattern. This is due to the market treating it as a neutral asset, with its value oscillating between a floor price of $9.81 (a point where buyers are willing to step in) and a ceiling at $10.61 (a level where sellers are comfortable selling).

Despite appearing impartial, such a stage frequently indicates a buildup period, where market players are purchasing APT in expectation of an upward price surge.

Should the anticipated rise occur, APT might ascend to reach the pattern’s maximum at around $10.74. Conversely, if it doesn’t, there’s a possibility that it could slide into a less active price range in search of support for a possible recovery.

Current technical indicators are showing signs that support the likelihood of an upward move.

Market activity skewed in favor of the bulls

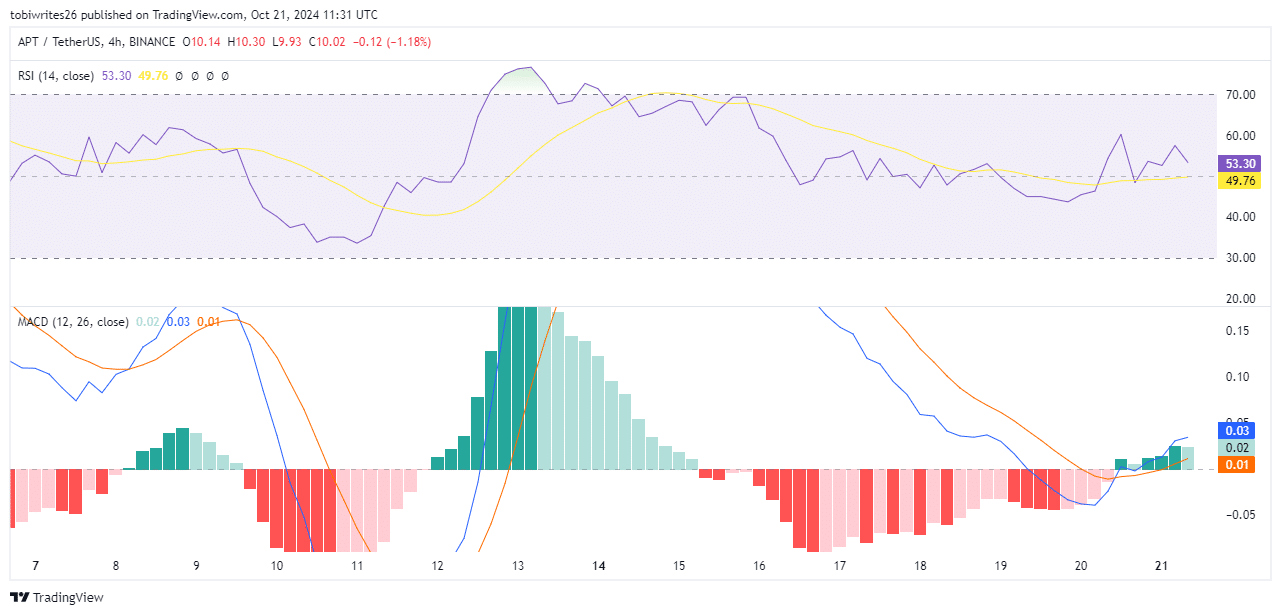

Based on the Moving Average Convergence Divergence (MACD), it appears that Asset Performance Tracker (APT) may see an upward trend. This prediction arises from the appearance of a Golden Cross pattern, which occurs when the short-term moving average crosses above the long-term moving average, and APT remains in a positive trading zone.

A “Golden Cross” happens when the blue Moving Average Convergence Divergence (MACD) line surpasses the orange signal line. This event often coincides with an increase in trading volume. What makes this a more reliable bullish sign is that the MACD line has already been in a positive region, indicating a favorable outlook for the asset.

Furthermore, at the present moment, the Relative Strength Index (RSI) – a tool that gauges the rate and direction of price movement – was indicating a bullish trend, with its value exceeding 50.

In simpler terms, it suggests that the price of APT might increase significantly, which could trigger a rise in the market, making conditions more favorable for buyers (bulls).

A drop before an upswing?

As per Coinglass, the Open Interest of APT saw a minor decrease in the past 24 hours, amounting to approximately 1.65%, leaving it at around $215.99 million.

Read Aptos’ [APT] Price Prediction 2024–2025

From my perspective as an analyst, it appears that the recent downtrend might be approaching its conclusion, potentially giving way to a substantial uptick. The recurring pattern, marked by a pullback prior to a surge, seems to be the prevailing trend here.

After this event, APT might start climbing towards the earlier mentioned price point of $10.74, possibly continuing to rise further.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-10-22 11:03