-

ARB holders anticipated a breakout, with a potential 182.72% price surge from current levels.

Despite declining activity, ARB’s $2.47 billion TVL suggested strong DeFi performance amid price uncertainty.

As a seasoned crypto investor with a knack for spotting potential breakouts and a soft spot for Arbitrum [ARB], I find myself both excited and apprehensive at this critical juncture. The technical analysis suggests a bullish reversal is imminent, with a projected price surge of 182.72% if the token manages to breach its current resistance level. However, recent price action has been less favorable, with a decline in the last 24 hours and seven days.

At the moment of writing, I find myself observing Arbitrum [ARB] at a pivotal trading point. Some analysts are hinting that if this breakout materializes, it might trigger a substantial price uptick.

For quite some time now, this particular token has been moving along a downward trending path (or channel), repeatedly encountering resistance when it reaches the upper boundary and finding support each time it drops to the lower limit.

Currently, as I’m typing, the price of ARB was near the top limit of its trend channel, suggesting a potential shift in upward momentum if it surpasses this crucial threshold, indicating a possible bullish turnaround.

Based on a recent study, there’s a possibility that the price of ARB might surge up to around $1.50 if it manages to break through its current level. This estimate represents an anticipated growth of about 182.72% from its current value of $0.5082.

While the token pushes against its potential limit, traders are keeping a close eye on its upcoming action, hoping it will instigate a substantial surge.

Decline in ARB price and trading activity

Although there was a possibility of an increase, the latest trends with ARB have not been particularly advantageous. In fact, ARB experienced a decrease of 5.07% within the last 24 hours and a 1.11% drop over the past week.

Currently, the circulating supply of ARB tokens totals approximately 3.5 billion, which translates to a market capitalization of about $1.77 billion at the present moment.

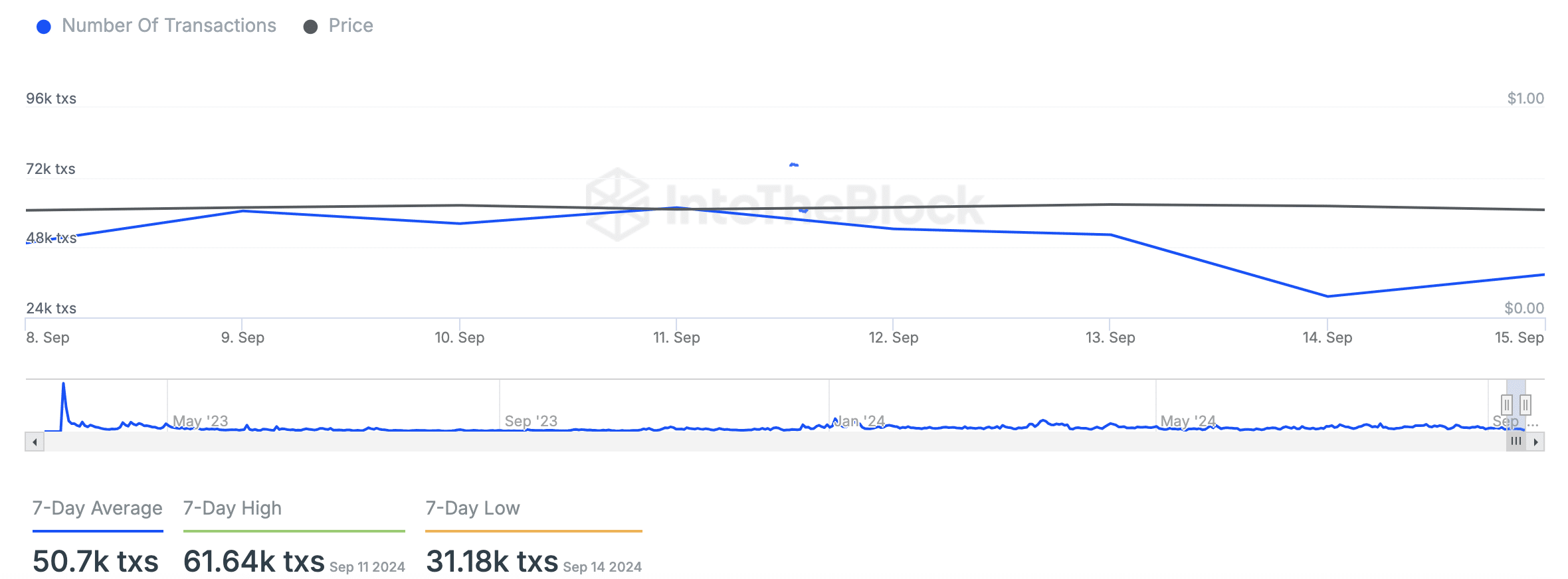

At the same time as prices falling, there’s been a decrease in on-chain activity for ARB. The data indicates that the daily transaction volume for ARB has been decreasing, currently averaging around 50,700 transactions over the past week.

In this timeframe, the busiest day for transactions was September 11 with a total of 61,640, whereas the least active day was September 14, with only 31,180 transactions.

Additionally, it’s worth noting that there has been a significant decrease in large transactions. Specifically, just 51 such transactions were made in the past 24 hours, a drop from a high of 110 on September 10th.

Although the level of activity has decreased, the price has still held steady at approximately $0.50, which has sparked speculation as to whether it might surge beyond its current state.

On-chain metrics show mixed signals

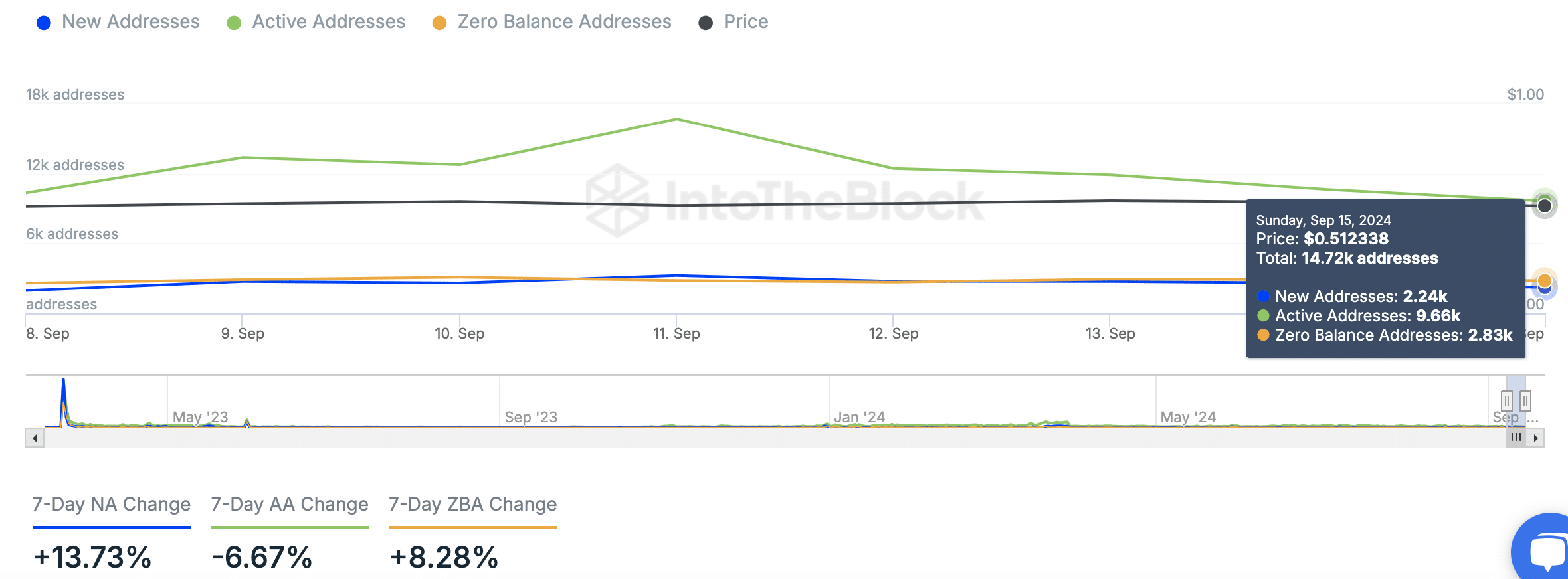

Recent data from IntoTheBlock highlighted both positive and negative trends in ARB’s on-chain metrics. The number of new addresses has increased by 13.73% over the past week, reaching 2.24k.

On the flip side, there’s been a decrease of about 6.67% in active addresses, dropping them to roughly 9,660. Conversely, the number of zero balance addresses has grown by 8.28%, suggesting an increase in dormant or inactive accounts.

Regardless of the specific metrics, the overall value locked within ARB remained strong, currently standing at approximately $2.47 billion according to DefiLlama at this moment in time.

On the platform, the total value of stablecoins was approximately $4.701 billion during the previous day. The fees generated amounted to around $11,118, while the revenue earned was approximately $9,417 over the same period.

Despite the impressive showing in the Decentralized Finance (DeFi) sector, ARB‘s price has not yet bounced back. However, if there’s a breakthrough, it could potentially trigger a price increase.

According to the latest findings by AMBCrypto, almost all ARB owners are presently sitting on a loss.

Read Arbitrum’s [ARB] Price Prediction 2024–2025

Over the past few months, the token’s value has been steadily decreasing, while the platform itself has thrived in terms of Total Value Locked (TVL) and market dominance within the Decentralized Finance (DeFi) sector.

The token’s decline has raised concerns among holders, especially as on-chain activity has slowed.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

2024-09-17 03:04