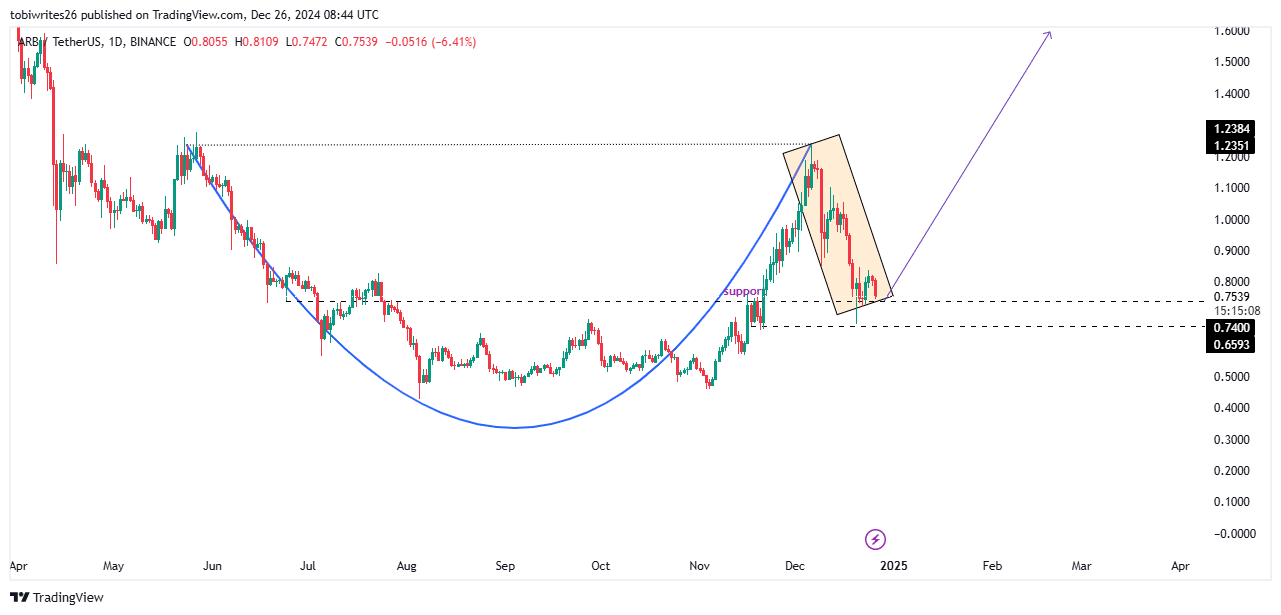

- At press time, ARB seemed to be trading within a cup and handle pattern – A bullish signal that often precedes a significant upswing

- Rally depends on ARB entering a major demand zone, and whales could play a role in driving this move

As an analyst with years of experience in the crypto market, I have seen my fair share of bull and bear runs. The current situation with ARB seems to be a mix of both, but there’s a silver lining – a potential bullish breakout is forming in the form of a cup and handle pattern.

As a researcher observing the ARB market, I’ve noticed a downward trend in its performance recently. Instead of maintaining its bullish momentum, the altcoin has been declining steadily on the charts for the past month. In fact, over this period, it has experienced a drop of 14.28%. This negative trajectory seems to persist not only throughout the last week but also during the last 24 hours.

In the near future, a dip might be seen in ARB’s performance. However, it’s possible that this downturn is temporary, and ARB could bounce back quickly, continuing its upward momentum and potentially yielding greater profits.

Bullish pattern forms for ARB

In simpler terms, the financial asset represented by ARB is currently moving in a bullish cup and handle pattern, as demonstrated on the graph with distinct lines. Generally, this kind of pattern indicates an impending rise in the value of the asset, particularly over the short term.

For ARB, the expected rally could push the price to at least $1.5 once the pattern fully develops.

Prior to the rally commencing, ARB might continue to decrease in value, aiming for a demand region that offers enough impetus between approximately $0.74 and $0.659. Once it reaches this point, the asset should then begin an upward trend.

Buy orders in place for ARB

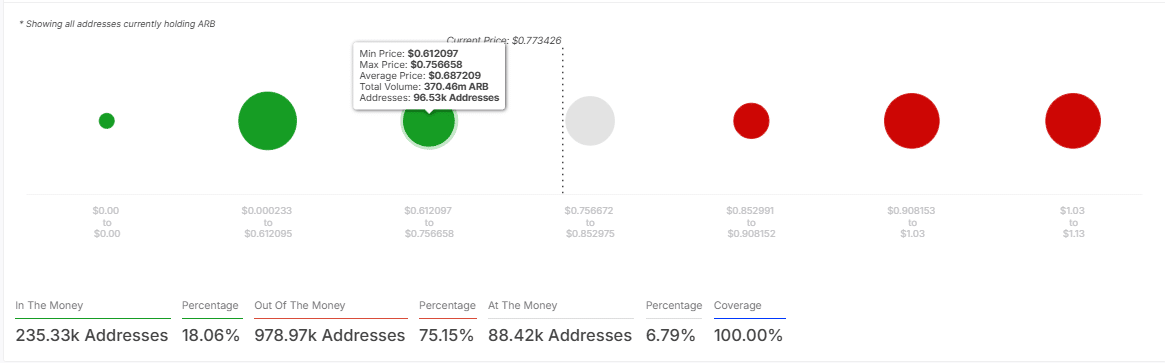

Based on AMBCrypto’s study, the potential demand indicated on the chart could cause Aave (ARB) to increase. As per the IOMAP, this demand area matches the “In the Money” area, where approximately 13,200 addresses hold around 320,000 ARB. This significant support level is likely to provide robust backing.

The IOMAP tool, which helps pinpoint important levels of potential buy and sell activity, shows how various addresses are distributed according to their profit or loss status. In this context, “In the Money” means those addresses where transactions resulted in a profit, while “Out of the Money” denotes addresses where transactions led to a loss.

When ARB reaches the “In-the-Money” area, it’s likely that the price will start increasing from thereon.

The Bull-to-Bear ratio, showing a comparison between optimistic and pessimistic large investors, indicated 39 bulls to 49 bears. This implies that the bearish whales might be influencing ARB’s decline, as they move it towards a potential demand area while waiting for more advantageous prices in line with increased buying activity, prior to re-entering.

Based on this sentiment, it’s possible that ARB’s drop might continue past the 5.06% decrease observed on a daily basis.

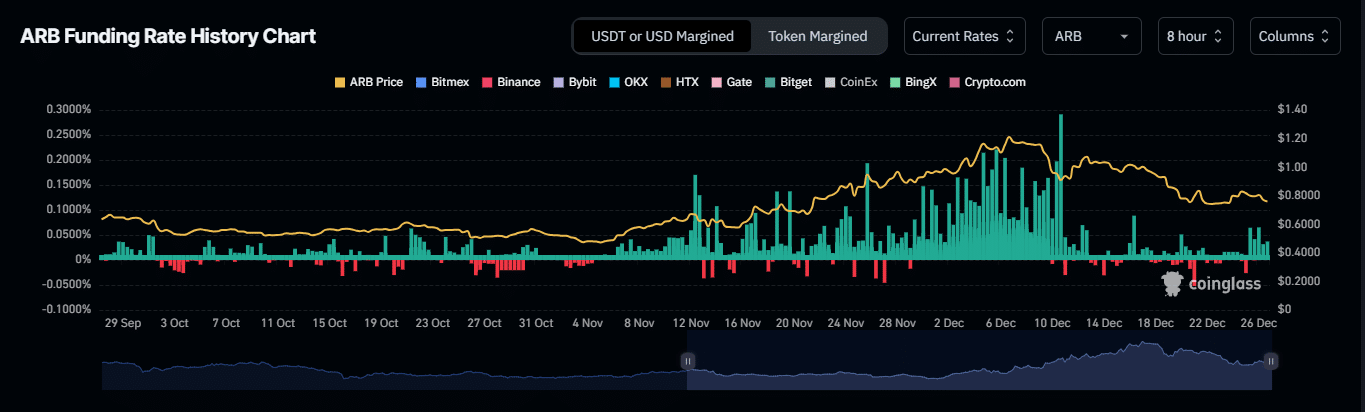

Derivative traders are entering the market

Based on data from Coinglass, the funding rate for ARB has increased recently. It reached 0.0097% within the past 24 hours, moving it into a positive range.

When a funding rate is favorable, it means long derivative traders – especially those utilizing leverage – have significant influence over the market, contributing to its overall price consistency.

Essentially, people’s outlook on ARB remains optimistic, and the recent dip might simply be a corrective step prior to another rise.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

2024-12-27 12:07