-

Blast stole the show as it was ranked #1 in terms of growth last month

ARB’s price hiked by 8%, while OP fell by more than 10% in just 30 days

As a researcher with a background in blockchain technology and crypto markets, I find the recent performance of Layer-2 solutions, particularly Optimism (OP) and Arbitrum (ARB), to be quite intriguing. Based on the available data and trends, it seems that both projects have been making impressive strides in terms of growth and adoption.

Over the past few months, there has been a significant rise in the adoption of Layer-2 solutions, leading to a decrease in Ethereum‘s network congestion. A recent report also focused on the May performances of major Layer-2 platforms. With their recent progress, it is essential to closely examine their accomplishments.

Which L2 is leading?

As a researcher studying the current trends in the crypto market, I’ve recently come across an analysis by Coin98 that sheds light on the top-performing Layer 2 (L2) platforms. According to this data, Optimism (OP), Base, and Arbitrum (ARB) are among the leading contenders with a significant number of total addresses. Specifically, at the time of this writing, they boast 144 million, 75 million, and 28 million addresses, respectively.

During most of May, Optimism and Arbitrum dominated the daily new address count. However, towards the end of the month, Base experienced significant surge, with approximately 742,000 new addresses created on the 31st of May. On the other hand, Blast demonstrated the greatest increase rate, rising by nearly 39%.

In contrast, Arbitrum topped the list in May with over 6.4 million new wallet addresses created.

In the realm of L2 solutions, ARB and OP held the crown due to their expansive network growth. However, when it comes to user activity or transactions, opBNB reigned supreme based on Coin98’s recent disclosure.

Intriguingly, Blast claimed victory in May with a significant surge of 71% in transactions. Meanwhile, opBNB continued to lead the pack with the highest number of transactions per second last month. Regarding DeFi’s top performers, ARB, Blast, and Base stood out by experiencing substantial growth in their Total Value Locked (TVL).

ARB vs OP

Last month, a number of second-language assets (L2s) showed strong performance. Among them, ARB and OP stood out with particularly impressive results. Consequently, examining their price trends could be a valuable exploration.

As an analyst, I’d rephrase that as follows: Last month, the value of ARB experienced a significant increase of over 8%. At the current moment, its stock price is sitting at $1.11 and boasts a market capitalization exceeding $3.2 billion.

As a researcher, I’ve found that Opponent (OP) coins have been the leading players in the market recently. However, their price has taken a hit, dropping by more than 10% as reported by CoinMarketCap within the last month. At present, OP is being traded at $2.45 and boasts a market capitalization of over $2.6 billion.

Read Optimism’s [OP] Price Prediction 2024-25

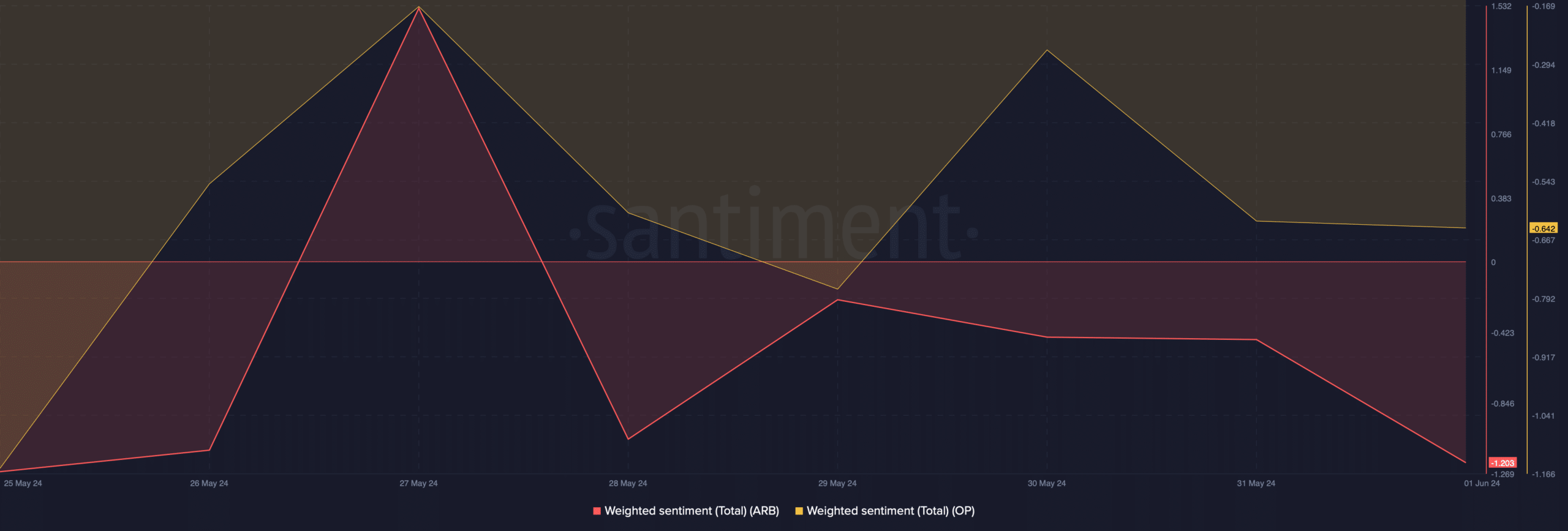

Despite a promising upward trend for ARB and OP in market charts, the prevailing sentiment towards these tokens remained predominantly negative based on weighted analysis. This indicates that bearish attitudes continued to hold significant influence within their respective markets.

Read More

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Paige DeSorbo’s Sassy Message: A Clear Shade at Craig Conover?

- Fifty Shades Feud: What Really Happened Between Dakota Johnson and Jamie Dornan?

- The Heartbreaking Reason Teen Mom’s Tyler and Catelynn Gave Up Their Daughter

- Lady Gaga’s ‘Edge of Glory’ Hair Revival: Back to Her Iconic Roots

2024-06-03 03:03